Interest On Refund Of Income Tax Calculator The Interest on income tax refund calculator answers the most common questions about tax refunds The Simple interest is charged at 0 5 and the period is

41 rowsWith our free online IRS Interest Calculator you are able to calculate how Understand how we charge interest on underpayments of tax and pay interest on overpayments of tax The IRS charges underpayment interest when you

Interest On Refund Of Income Tax Calculator

Interest On Refund Of Income Tax Calculator

https://i1.wp.com/moneysavvyliving.com/wp-content/uploads/2020/02/tax-refund-scaled.jpg?fit=2560%2C1707&ssl=1

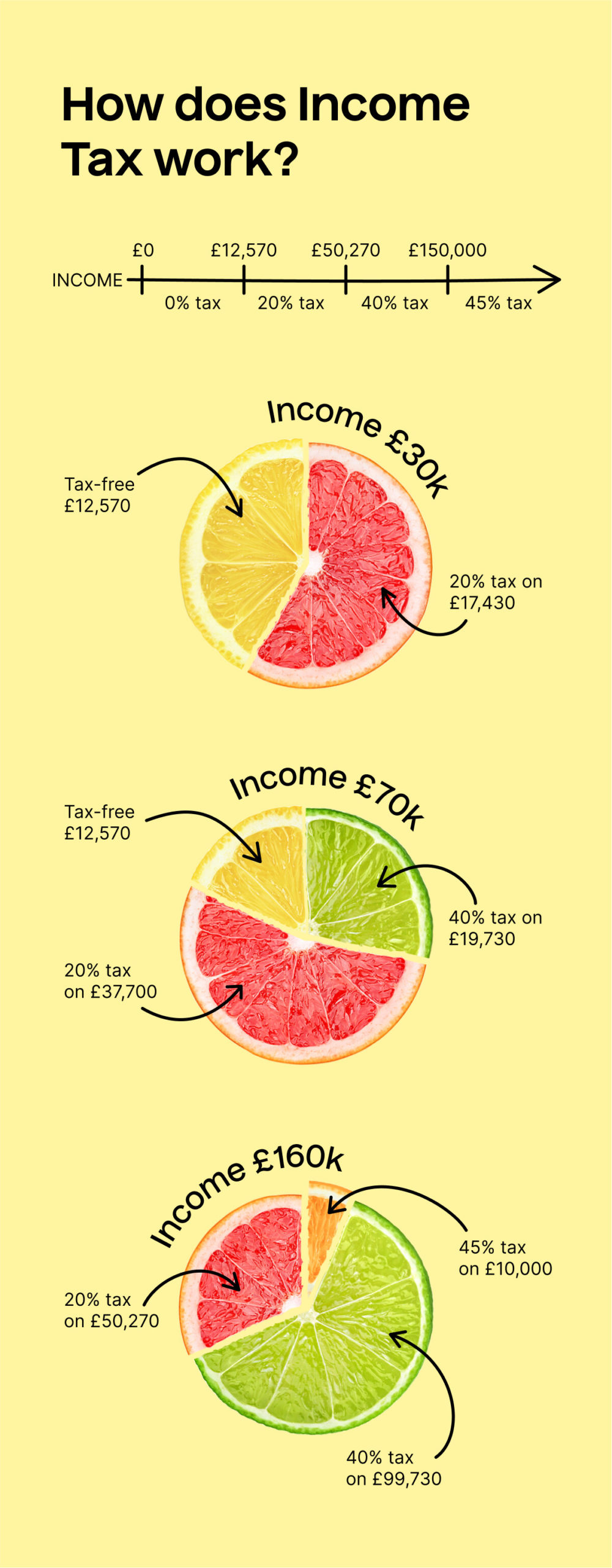

Income Tax Rates In The UK TaxScouts

https://taxscouts.com/wp-content/uploads/Infographic_How_does_income_tax_work-scaled.jpg

Section 194A Of Income Tax Act Sorting Tax

https://sortingtax.com/wp-content/uploads/2022/08/blogimg2.png

Free online income tax calculator to estimate U S federal tax refund or owed amount for both salary earners and independent contractors 1 Interest on Housing Loan Income from self occupied house property b Income from Let out Property 1 Annual Letable Value Rent Received or Receivable 2 Less

Understand how interest is calculated on income tax refunds as per section 244A 1 of the Income Tax Act Learn about the applicable rates and conditions When refund is of any advance tax paid or TDS or TCS The interest is payable at the rate of 0 5 percent per month or part of month from 1st April of

Download Interest On Refund Of Income Tax Calculator

More picture related to Interest On Refund Of Income Tax Calculator

Outer Plenty Precious Hmrc Income Tax Calculator Rotate Shop Beef

https://www.telegraph.co.uk/content/dam/tax/2019/03/13/take-home-pay_trans_NvBQzQNjv4BqgCXocDQF5kP7s3jSjli3eCH0-jRUT4rHK8EgtaGoQwQ.jpg

This Income Tax Calculator Shows What You Owe LHDN 2023 Updated

https://ringgitohringgit.com/wp-content/uploads/2022/02/income-tax-calculator-malaysia-kiracukai.my_-1024x677.jpg

Income Tax 20p Rate Will Form Part Of Review Guernsey Press

https://guernseypress.com/resizer/s4jAXy0imak1dcPMplbgeCoSUYM=/1200x0/cloudfront-us-east-1.images.arcpublishing.com/mna/ODNPXKST5ZGKTFV2BHWXRFB7VY.jpg

The Income and Tax Calculator service enables both registered and unregistered e Filing users to calculate tax as per the provisions of Income Tax Act Income tax rules Notifications etc by providing inputs with The IRS interest rate on unpaid taxes and tax refunds for individuals is 8 for the first three quarters of 2024 the rate is adjusted on a quarterly basis The IRS

If you haven t received your refund within 45 days of the tax deadline the IRS pays interest on your outstanding funds at the prevailing overpayment rate with Interest on income tax refund can be calculated using the interest on income tax refund calculator 244A available online As per section 244A of the Income Tax

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

https://i.ytimg.com/vi/B9P96APDSVw/maxresdefault.jpg

Canadian Income Tax Calculator Amazon ca Appstore For Android

https://images-na.ssl-images-amazon.com/images/I/61jomO1pjXL.png

https://instafiling.com/interest-on-income-tax-refund-calculator

The Interest on income tax refund calculator answers the most common questions about tax refunds The Simple interest is charged at 0 5 and the period is

https://goodcalculators.com/irs-interest-calculator

41 rowsWith our free online IRS Interest Calculator you are able to calculate how

Hecht Group Does Pennymac Pay Property Taxes

How To Calculate Your Tax Refund FREE In 5 Minutes Calculate Tax

What Is The Tax Liability On The Income Of Partners Of LLP S

Your Tax Refund Is The Key To Homeownership

Tax Refund 2019 Unexpected IRS Bills Burden Some Americans Budgets

Here s The Average IRS Tax Refund Amount By State GOBankingRates

Here s The Average IRS Tax Refund Amount By State GOBankingRates

RECOVERY REFUND OF INCOME TAX LECTURE 15 Deduction Of Tax From

Income Tax 20 Days Remaining MyCyprusTax

Extension Of Timelines For Filing Of Income tax Returns And Various

Interest On Refund Of Income Tax Calculator - The interest under section 234D is leviable at 0 5 per month or a part thereof on the amount of refund recoverable from the taxpayer The interest under this