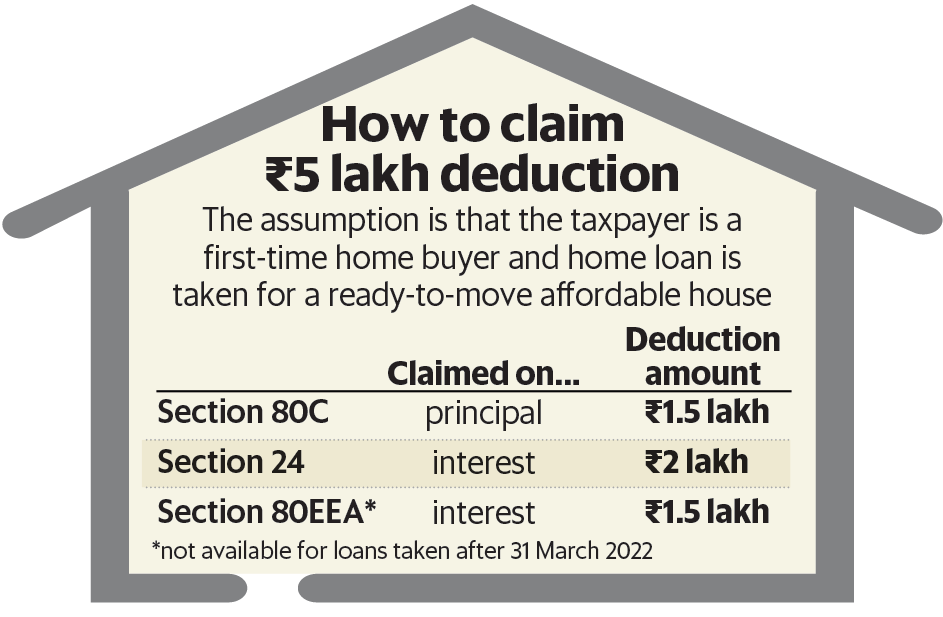

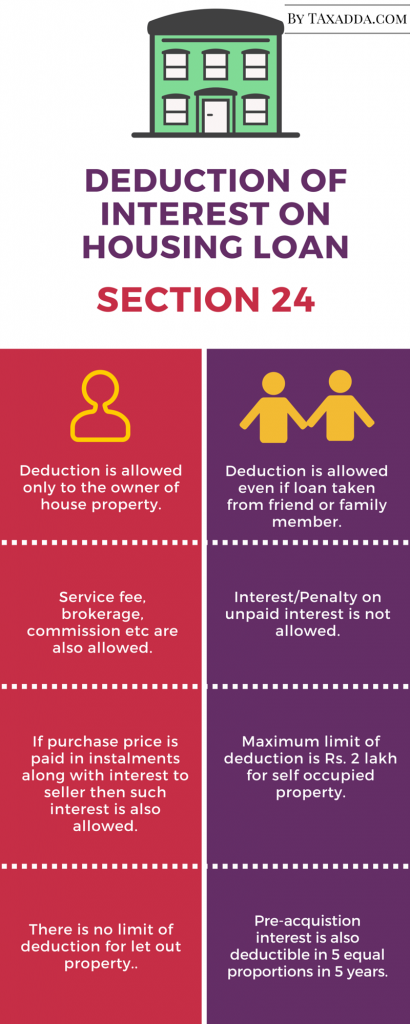

Interest Rebate On Housing Loan Under Section 24 The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

Income tax act provides deduction of interest paid on home loan under Section 24 Provides provision if any house is acquired constructed using borrowed capital Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution As per this section you can claim a deduction of up to Rs 50 000 per financial year

Interest Rebate On Housing Loan Under Section 24

Interest Rebate On Housing Loan Under Section 24

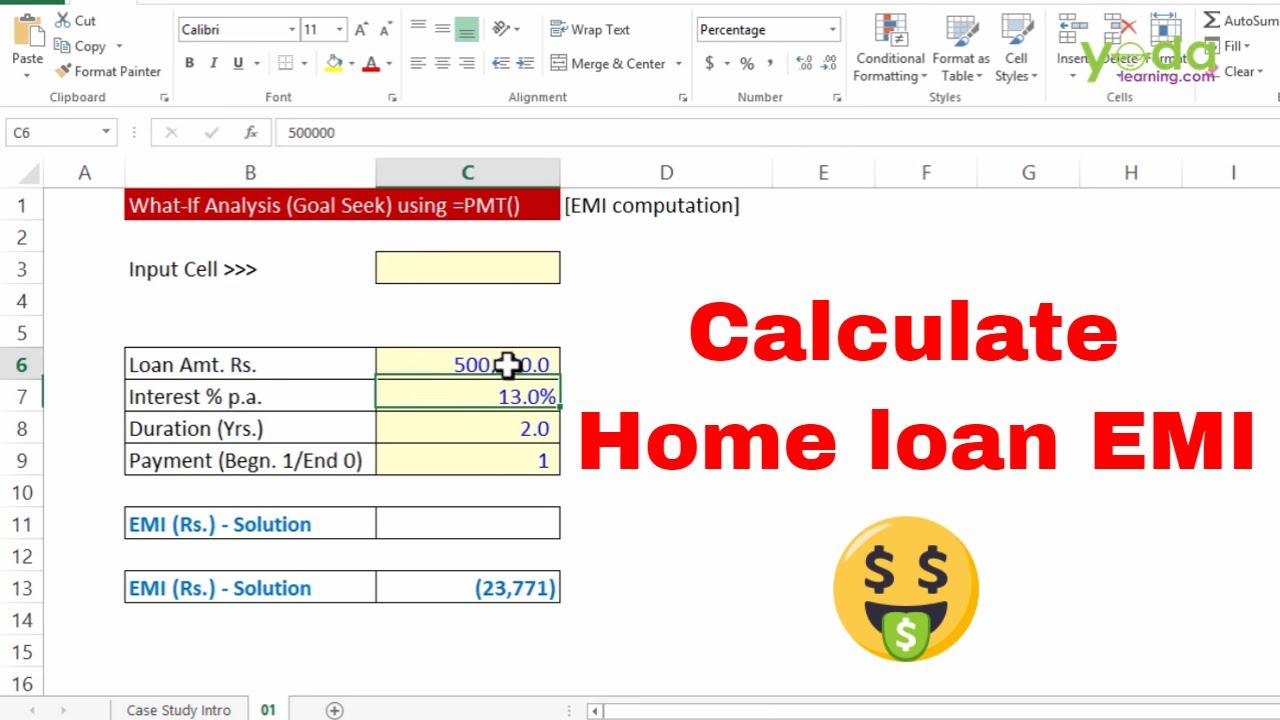

https://i.ytimg.com/vi/M-wUkSDKAfk/maxresdefault.jpg

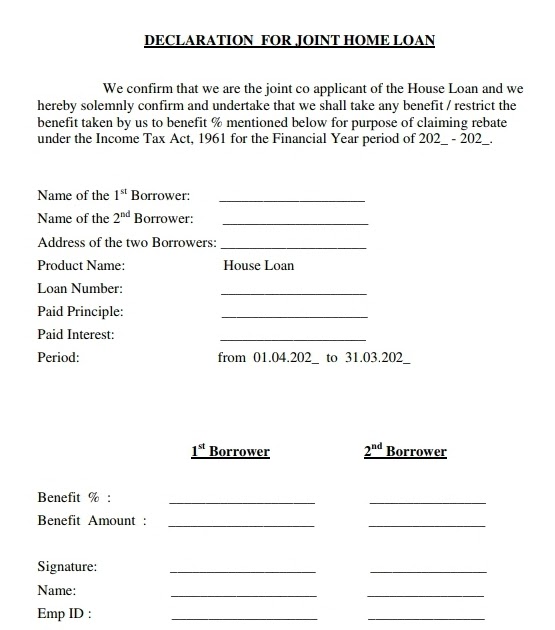

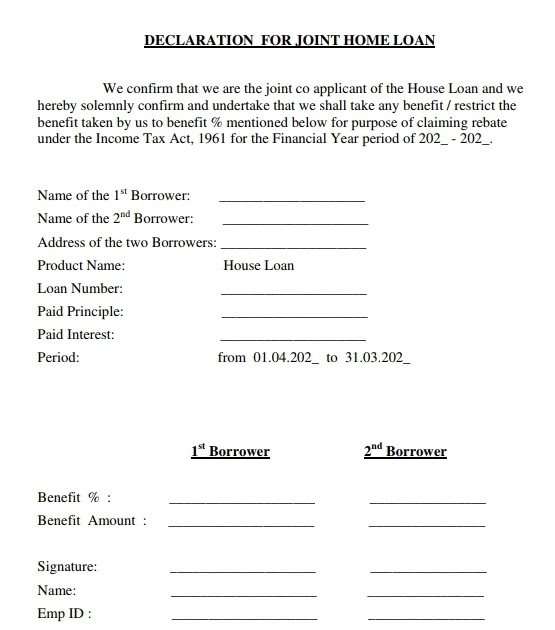

Joint Home Loan Declaration Form For Income Tax Savings And Non

https://lh3.googleusercontent.com/-m3Y3HavWnbc/YgqSD7tknxI/AAAAAAAAYdw/PRErS72JdeIE0B2a37gG1CvGAfWFlQvHwCNcBGAsYHQ/w1200-h630-p-k-no-nu/1644859917358770-0.png

How First time Home Buyers Can Get Up To 5 Lakh Tax Rebate Mint

https://images.livemint.com/img/2022/01/23/original/tax_1642957579591.png

Deductions for home loan interest repayment are offered under various sections of the income tax law Deductions under Section 24 B Available for Property construction property purchase Can be claimed for Self occupied rented deemed to be rented properties Overall the assessee is eligible to claim deduction of any interest payable on capital borrowed for acquisition and construction of house property upto maximum of INR 3 50 000 upto 2 00 000 in section 24 and upto 1 50 000 in section 80EEA provided specified conditions are fulfilled

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C and up to Rs 2 lakh on interest payment under Section 24 b If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C

Download Interest Rebate On Housing Loan Under Section 24

More picture related to Interest Rebate On Housing Loan Under Section 24

Section 24 Of Income Tax Act Deduction For Home Loan Interest

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/09/section-24-of-income-tax-act.jpg

Here Are 5 Benefits Of Taking A Home Loan

https://telugu.samayam.com/photo/msid-91905880,imgsize-28456/pic.jpg

Income Tax Benefits On Home Loan Loanfasttrack

https://www.loanfasttrack.com/blog/wp-content/uploads/2020/12/IncomeTaxBenfits-800x534.png

In India taxpayers can claim tax deductions on home loan interest under Section 24 b of the Income Tax Act This deduction is available for self occupied properties that are completed within five years and for which the loan was taken for acquisition or construction Section 24 of the Income Tax Act permits house owners deductions up to Rs 2 lakh for yearly interest on housing loans under section 24 If the loan money is used to build or buy a new home the borrower can deduct Rs 2 lakhs in pre EMI interest deduction under section 24

Currently homebuyers can claim an income tax deduction on the interest paid on their home loan under Section 24 b of the Income tax Act 1961 The maximum amount of deduction that can be claimed is Rs 2 lakh per financial year for a self occupied property Section 24 b of the Income Tax Act 1961 deals with deduction of interest from the GAV in order to arrive at the net asset value NAV Interest deduction treatment is different depending upon whether the house property is self occupied or it is let out

Interest Rebate On Interest On Loans

https://www.ariviyalpuram.com/wp-content/uploads/2020/10/Interest-rebate-on-interest-on-loans-2-1024x576.jpg

How To Calculate Interest On Housing Loan For Income Tax Haiper

https://i.ytimg.com/vi/qzW5XaLnrJM/maxresdefault.jpg

https://cleartax.in/s/home-loan-tax-benefit

The interest portion of the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24 From the assessment year 2018 19 onwards the maximum deduction for interest paid on self occupied house property is Rs 2 lakh

https://tax2win.in/guide/interest-deduction-on-rented-house-property

Income tax act provides deduction of interest paid on home loan under Section 24 Provides provision if any house is acquired constructed using borrowed capital

Best Guide On Interest On Housing Loan Section 24b TaxAdda

Interest Rebate On Interest On Loans

Joint Home Loan Declaration Form For Income Tax Savings And Non

Section 24 Of Income Tax Act House Property Deduction

Home Loans Top Tips To Close Your Loan Account Early As RBI Keeps Repo

Interest Rebate Program Feeder Associations Of Alberta Limited

Interest Rebate Program Feeder Associations Of Alberta Limited

How To Fill Housing Loan Interest And Principal In Income Tax Return

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Interest Rebate On Interest On Loans

Interest Rebate On Housing Loan Under Section 24 - To save income tax under Section 24 you are allowed to reduce the income by the amount of interest paid on Housing Loan to an extent in addition to certain conditions Here is the detailed guide on how to save taxes under section 24 of Income Tax Act