Investment Tax Rebate Bangladesh What is the tax rebate As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now your tax rebate will be BDT 28 620

The new income tax act makes a few changes to the tax rebate calculations The most important among the changes is about eligible securities and their limits As Under the current provisions they are allowed to invest 25 or Tk1 50 000 on which they will get a rebate of 15 As such the amount of their rebate or tax credit will be Tk22 500 On the other hand the

Investment Tax Rebate Bangladesh

Investment Tax Rebate Bangladesh

https://i.ytimg.com/vi/IAs9ku69PyE/maxresdefault.jpg

Investment For Tax Rebate In Bangladesh

https://i.pinimg.com/originals/ab/bd/fd/abbdfdbd7d1bde572d822e1c573ff9e2.jpg

Investment Plan Rebate Under Income Tax Ordinance 1984 In Bangladesh

https://i.ytimg.com/vi/zeFzDcIi_qU/maxresdefault.jpg

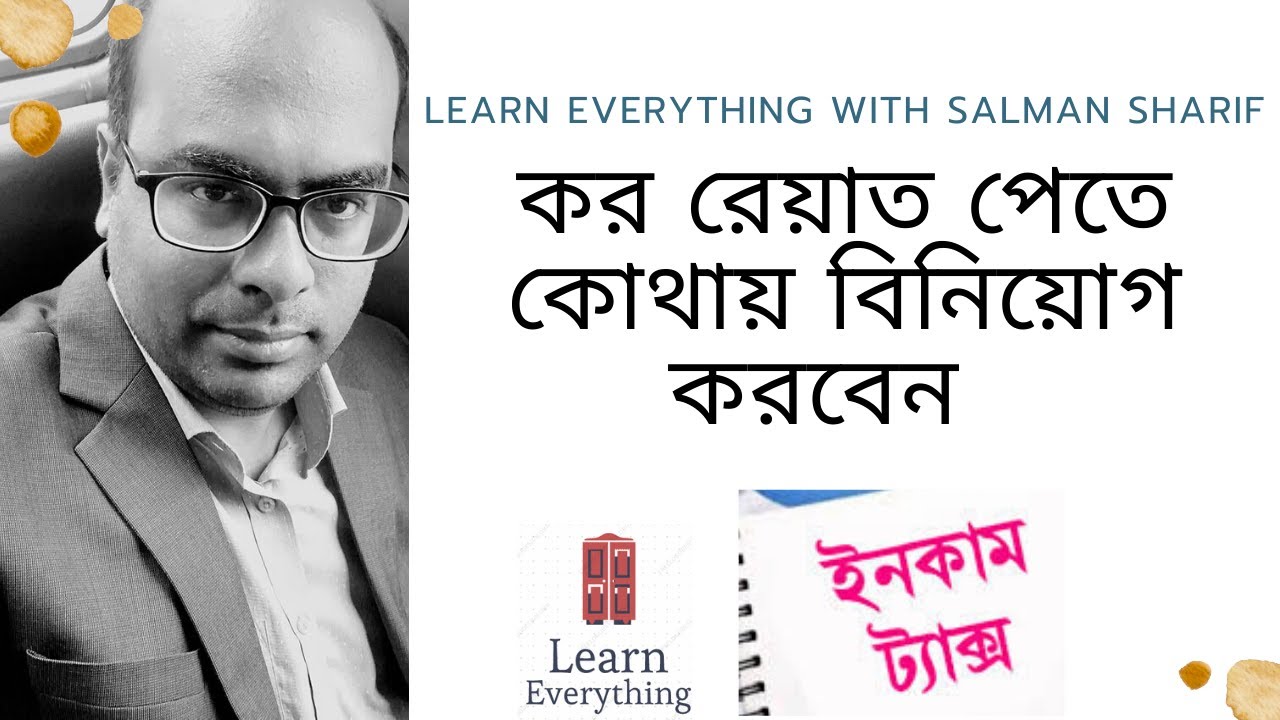

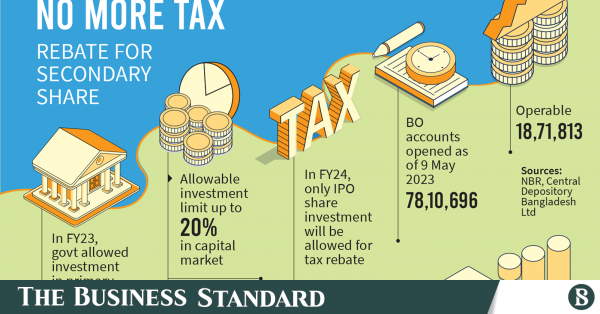

The highest annual tax rebate on investments in listed securities of the capital market will be reduced by one third or 33 per cent to Tk 1 million if the draft income tax act 2023 is Government has encouraged taxpayers to invest money and get tax rebate And therefore specified the areas where you could invest for tax rebate From this article we will know where to invest or donate

The tax rebate ranges from 10 15 of the allowable investment based on the income slab Tags Tax rebate reduce income tax tax burden tax eligible securities The new law proposed that investments up to Tk 5 lakh in any government securities units of mutual funds and exchange traded funds will get a tax rebate

Download Investment Tax Rebate Bangladesh

More picture related to Investment Tax Rebate Bangladesh

Senior Citizen Income Tax Calculation 2020 21 Excel Calculator

https://i.ytimg.com/vi/XQDCOVLK05g/maxresdefault.jpg

How To Calculate Tax Rebate In Income Tax Of Bangladesh

http://www.jasimrasel.com/wp-content/uploads/2017/08/Calculate-tax-rebate-1024x768.jpg

Law Proposes Cutting Tax Rebate By A Third For Investments In

https://tfe-bd.sgp1.cdn.digitaloceanspaces.com/posts/11189/dse-june-13.jpg

Though there are multiple avenues more than 20 that are an eligible investment for tax rebate 5 6 products National Savings Certificate NSC or The investment tax rebate for high income taxpayers in Bangladesh allows them to pay fewer taxes Investing in insurance plans with higher premiums also gives

The government has proposed a certain tax rebate for wealthy individual taxpayers in the new fiscal year starting in July Currently the minimum threshold for Savings Certificate It is secured as a government issued savings certificate You will also get the highest interest compared to other available investment areas in

Tax Rebate Lanka Bangla Asset Management Company Limited

https://lbamcl.com/tax-rebate/wp-content/uploads/2022/06/Untitled-1.png

Where To Invest For Tax Rebate In Bangladesh L Learn Everything L

https://i.ytimg.com/vi/dyGNwExk4TU/maxresdefault.jpg

https://www.jasimrasel.com/calculate-tax-reb…

What is the tax rebate As per section 44 2 b of the Income Tax Ordinance 1984 an individual taxpayer will get tax rebate at 15 on investment allowance Now your tax rebate will be BDT 28 620

https://www.edgeamc.com/public/blog/income-tax-act...

The new income tax act makes a few changes to the tax rebate calculations The most important among the changes is about eligible securities and their limits As

HMRC Paid My Tax Rebate Into Someone Else s Bank Account Consumer

Tax Rebate Lanka Bangla Asset Management Company Limited

Tax Rebate On Investment In Secondary Stock May Go The Business Standard

How Much Money Need To Invest For Tax Rebate In Bangladesh

Hmrc Tax Return Self Assessment Form PrintableRebateForm

Eight Moves To Make To Give Yourself A Larger Tax Refund Between 2 000

Eight Moves To Make To Give Yourself A Larger Tax Refund Between 2 000

Council Tax Rebate Fury As Millions Of Pensioners Missing Out On 150

Tax Incentive Removal Why The Proposal Raises Concern Over Long term

Right To A Tax Rebate For Whom Is It Available And How To Use It

Investment Tax Rebate Bangladesh - The tax rebate ranges from 10 15 of the allowable investment based on the income slab Tags Tax rebate reduce income tax tax burden tax eligible securities