Ireland Film Tax Rebate A producer company can use film relief as a credit against Corporation Tax CT If the relief is more than the tax due Revenue will pay the difference The amount of relief due

Ireland has a Tax Rebate available called the Section 481 Tax Credit which is a 32 rebate of qualified in country production spending There is also an additional 2 regional uplift for Films and TV series which bring all or some of their production to Ireland are able to apply to Irish Tax Authorities via an Irish based company for a tax refund delivering a percentage of costs

Ireland Film Tax Rebate

Ireland Film Tax Rebate

https://i.ytimg.com/vi/SrZ9i3SLV8U/maxresdefault.jpg

Sweden Film Tax Rebate Application Opens 2 May Film I V st EN

https://i0.wp.com/filmivast.com/wp-content/uploads/2023/04/Erik-Poppe-Utvandrarna-9800x600-1.jpg?fit=900%2C600&ssl=1

Why Is VA Giving A Tax Rebate YouTube

https://i.ytimg.com/vi/lmak_YmzQf4/maxresdefault.jpg

From January 1st 2015 Ireland s tax incentive Section 481 for film and television is enhanced creating a new payable tax credit programme The rate of tax relief has been significantly A new measure known as Sc al Uplift has been announced to provide for an increased rate of tax credit of up to 40 being an 8 uplift for Irish feature film productions

Section 481 is a tax credit incentivising film and TV animation and creative documentary production in Ireland administered by Ireland s Department of Culture and the Revenue SEC 481 32 TAX CREDIT The rate of tax credit is worth up to 32 of eligible Irish expenditure The payable tax credit is based on the cost of all cast and crew working in Ireland and all goods and services sourced in Ireland This

Download Ireland Film Tax Rebate

More picture related to Ireland Film Tax Rebate

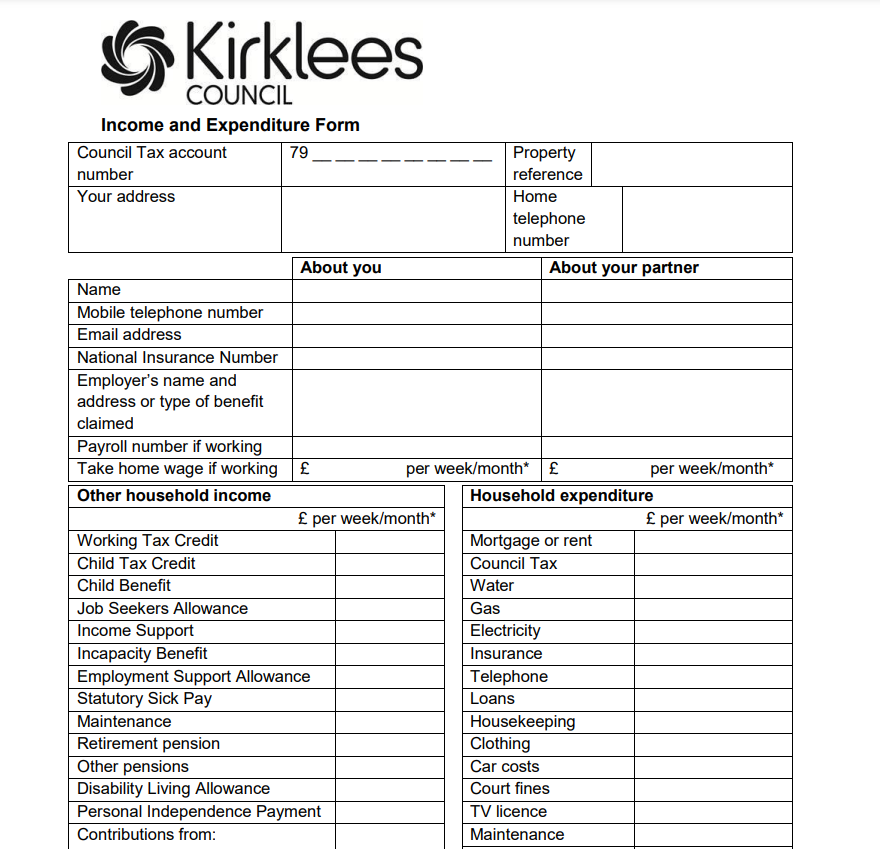

Council Tax Rebate Form Kirklees By Touch PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/10/Council-Tax-Rebate-Form-Kirklees.png

Ghanaian Activists Reject High Taxes On Menstrual Products In Struggle

https://peoplesdispatch.org/wp-content/uploads/2023/06/FxdkpgdWAAIhAU6.jpeg

One Time Minnesota Tax Rebate Payments Of Up To 1 300 Will Begin This

https://sdkcpa.com/wp-content/uploads/Tax-Rebate-081723.png

The rate of tax credit is worth up to 32 of eligible Irish expenditure Eligible expenditure criteria The payable tax credit is based on the cost of all cast and crew working in Ireland and all Section 481 of the Taxes Consolidation Act 1997 as amended Section 481 was introduced to promote the Irish film industry by encouraging investment in Irish made films which make a

The payable tax credit is based on the cost of all cast and crew working in Ireland and all goods and services sourced in Ireland This includes post production and or VFX The Irish government has boosted its support for the Irish film and TV industry in its 2024 budget with film and TV productions able to claim a 32 tax break on eligible

Canik Sept 22 Rebate Gun Rebates

https://gun-rebates.com/wp-content/uploads/2022/09/Canik-Sept-22-rebate.jpg

Proposal To Update Ailing Pa Rent Property Tax Rebate Program Would

https://whyy.org/wp-content/uploads/2023/05/property-tax-rebate-spotlight-pa-2023-05-04.png

https://www.revenue.ie › ... › film-relief › index.aspx

A producer company can use film relief as a credit against Corporation Tax CT If the relief is more than the tax due Revenue will pay the difference The amount of relief due

https://mbrellafilms.com › incentives › ireland

Ireland has a Tax Rebate available called the Section 481 Tax Credit which is a 32 rebate of qualified in country production spending There is also an additional 2 regional uplift for

Tax Rebate Payments Begin Republic Times News

Canik Sept 22 Rebate Gun Rebates

What Is Tax Rebate Searche

How To Increase The Chances Of Getting A Tax Refund CherishSisters

How To Get Your Tax Back Tax Refund Tax Return Tax Rebate

Difference Between Rebate And Relief Of Tax All Details Here

Difference Between Rebate And Relief Of Tax All Details Here

Disney Movie Poster For Fanum Tax On Craiyon

Tax Rebate Taxbuddi

Tax Rebate Today PDF

Ireland Film Tax Rebate - A new measure known as Sc al Uplift has been announced to provide for an increased rate of tax credit of up to 40 being an 8 uplift for Irish feature film productions