Irs Definition Of Education Expenses Verkko If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received

Verkko Expenses that you can deduct include Tuition books supplies lab fees and similar items Certain transportation and travel costs Other educational expenses such as Verkko 18 lokak 2023 nbsp 0183 32 Topic No 458 Educator Expense Deduction If you re an eligible educator you can deduct up to 300 600 if married filing jointly and both

Irs Definition Of Education Expenses

Irs Definition Of Education Expenses

https://fintoo.in/blog/wp-content/uploads/2020/06/img_5ed919b1dac5f.jpg

Understanding The IRS Definition Of Doing Business In The United States

https://uploads-ssl.webflow.com/6192bc360c457959f03f65a3/64a305724b78b8d713b47db4_irs-definition-doing-business-in-united-states-p-2000.jpeg

What Is A Plan Administrator IRS Definition Of A Plan Administrator

https://www.irs-taxid-numbers.com/wp-content/uploads/2022/05/130-ITNS-FAQ-ENTITY-NPO-What-is-a-Plan-Administrator-IRS-Definition-of-a-Plan-Administrator-v1.docx-scaled.jpg

Verkko Review the AOTC and Publication 519 U S Tax Guide for Aliens for details Tax credits deductions and savings plans can help taxpayers with their expenses for higher Verkko 15 kes 228 k 2023 nbsp 0183 32 To determine if you can claim the educational expense and if so where to claim it on your return review the rules for the Lifetime Learning Credit and

Verkko Adjusted Qualified Education Expenses Worksheet Form 8863 instructions 1 Total qualified education expenses paid for on behalf of the student in 2021 for the Verkko Understanding Taxes Education Credits Module 10 Education Credits Page 6 of 11 Differences Between the Two Credits The amount of the American Opportunity Credit

Download Irs Definition Of Education Expenses

More picture related to Irs Definition Of Education Expenses

/GettyImages-56043781-1a2cdb581d4d4f10801a93e0da9f2283.jpg)

Irs Definition Of Entertainment Expense

https://www.investopedia.com/thmb/02yQfZCecvaJoJk2_WS7rEMqfh8=/1500x1000/filters:fill(auto,1)/GettyImages-56043781-1a2cdb581d4d4f10801a93e0da9f2283.jpg

Claim Medical Expenses On Your Taxes Health For CA

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/04xx.jpeg

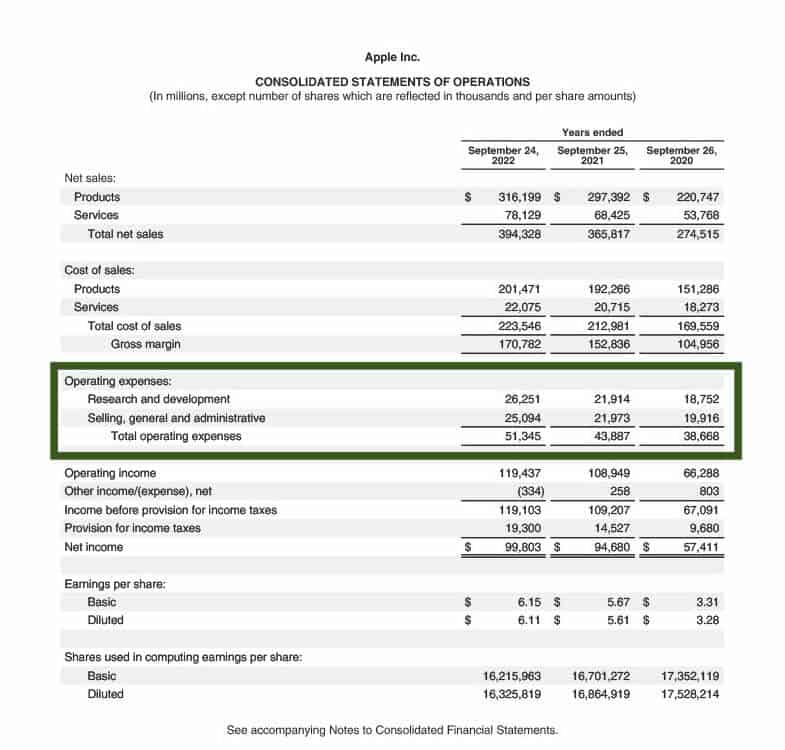

What Are Expenses Definition Types And Examples Forage

https://www.theforage.com/blog/wp-content/uploads/2023/02/apple-statement-of-ops-expenses1024_1.jpg

Verkko Qualified Education Expenses For purposes of the student loan interest deduction these expenses are the total costs of attending an eligible educational institution including Verkko 20 marrask 2022 nbsp 0183 32 A qualified higher education expense is any money paid by an individual for expenses required to attend a college university or other post

Verkko Juan s parents can claim the entire 4 000 education expenses toward the AOC Juan s gross income is 8 600 4 000 12 600 Since Juan s income in over the Verkko 4 tammik 2022 nbsp 0183 32 The American Opportunity Tax Credit AOTC is a partially refundable tax credit for college education where the student must attend at least half time The

What Are IRS Allowable Living Expenses Definition Classifications

https://www.sambrotman.com/hubfs/IRSLivingExpensesBlog.jpg#keepProtocol

5 Tips To Spread Mental Health Awareness Astroviz

https://www.astroviz.com/wp-content/uploads/2022/02/5-Tips-To-Spread-Mental-Health-Awareness2.jpg

https://www.irs.gov/publications/p970

Verkko If any tax free educational assistance for the qualified education expenses paid in 2022 or any refund of your qualified education expenses paid in 2022 is received

https://www.irs.gov/taxtopics/tc513

Verkko Expenses that you can deduct include Tuition books supplies lab fees and similar items Certain transportation and travel costs Other educational expenses such as

IRS Definition Of A Lease

What Are IRS Allowable Living Expenses Definition Classifications

Como Satisfazer A Defini o Do IRS De Um Dependente O B sico 2024

:max_bytes(150000):strip_icc()/TermDefinitions_AccuredExspense_recirc_3-2-ab4e70486db34a81bf9098e2b1da6407.jpg)

Accrued Expense What It Is With Examples And Pros And Cons Prepaid

Education Essay For Students 700 Words Essays Top 3

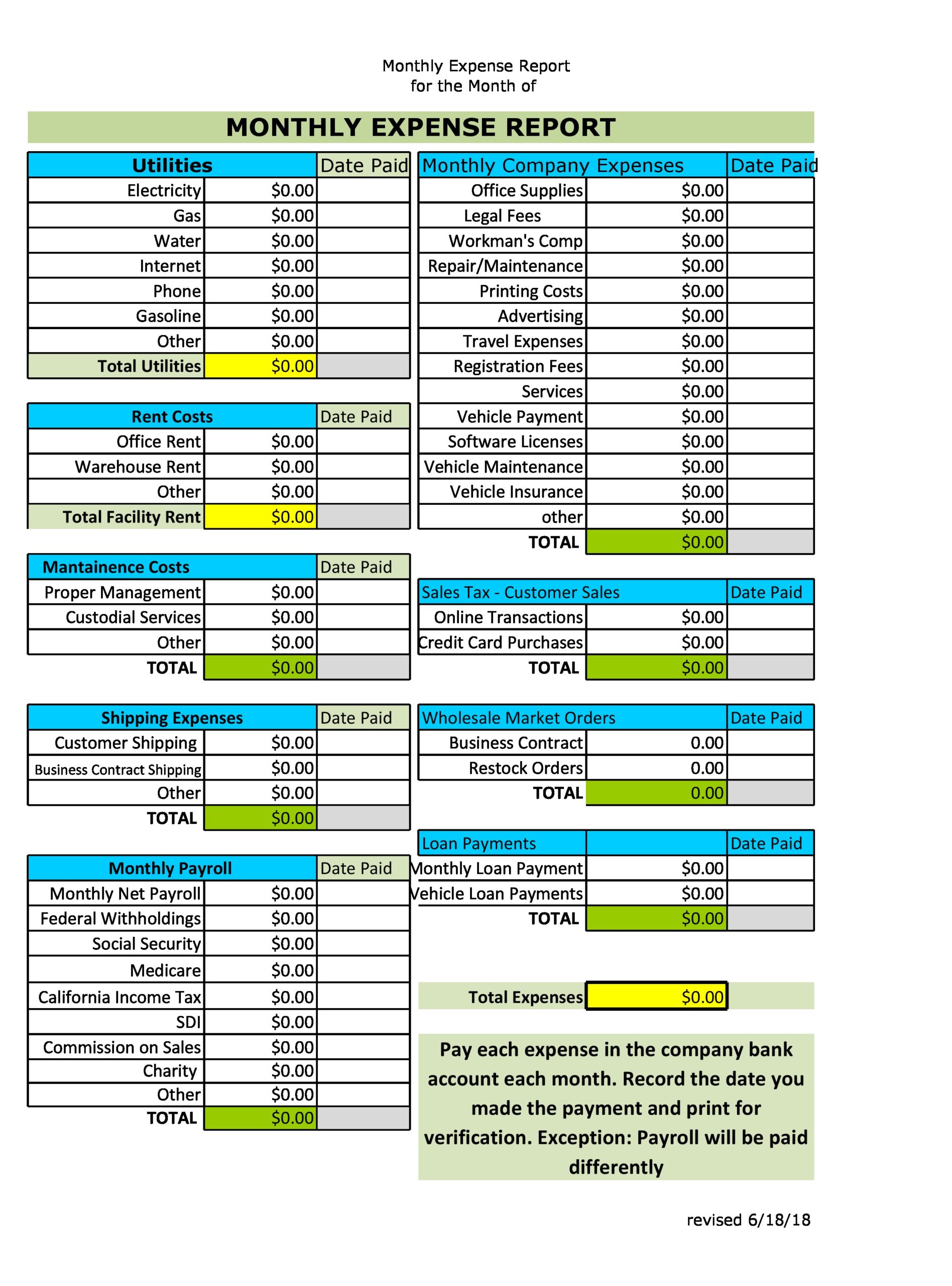

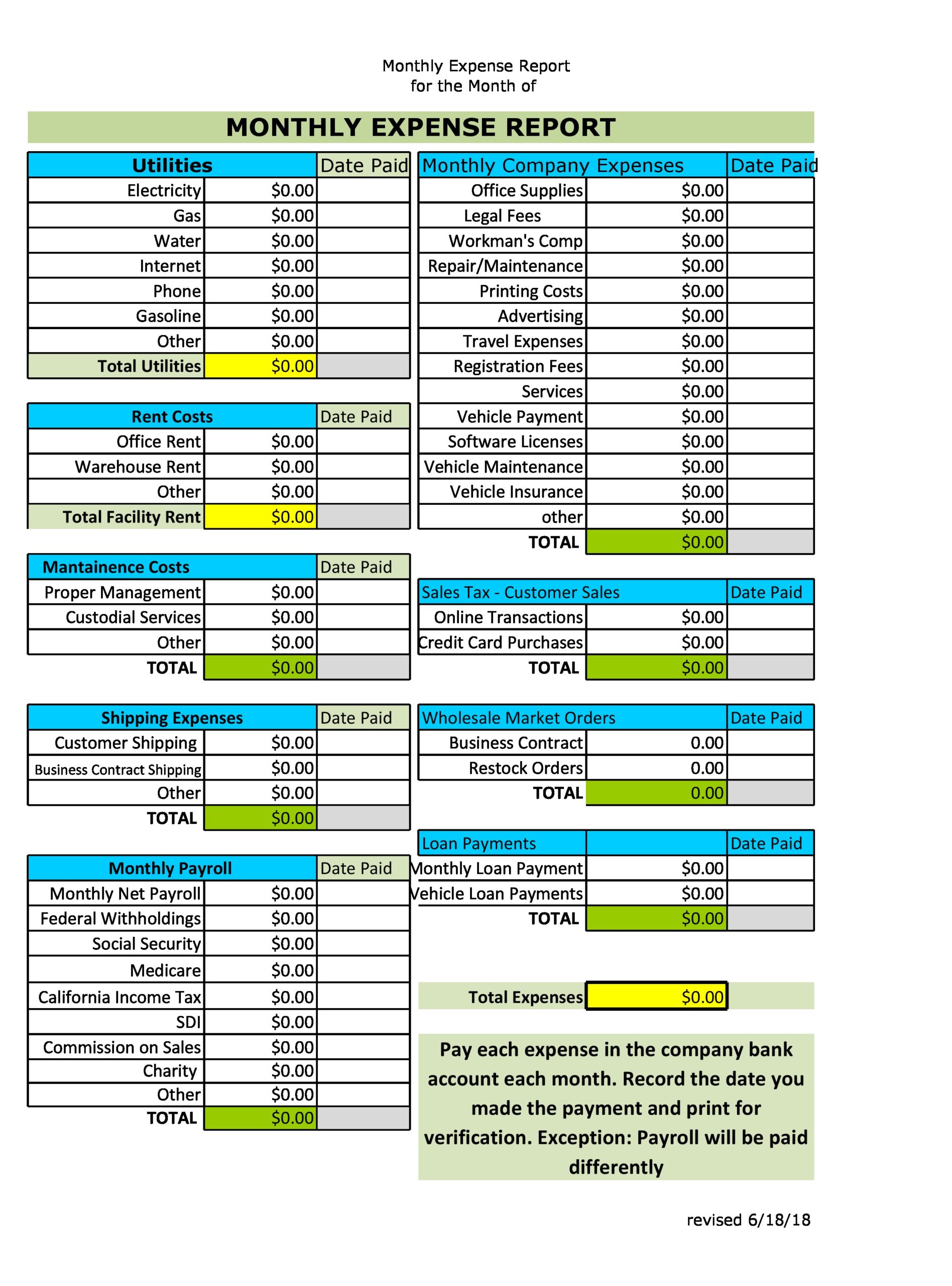

Smallvorti blogg se Monthly Expenses List Template

Smallvorti blogg se Monthly Expenses List Template

:max_bytes(150000):strip_icc()/IRSPublication516_Final_4194223-c10589b645d84fb8b8f6dcf3775126c6.png)

IRS Publication 516 Definition

Qualified Education Expenses

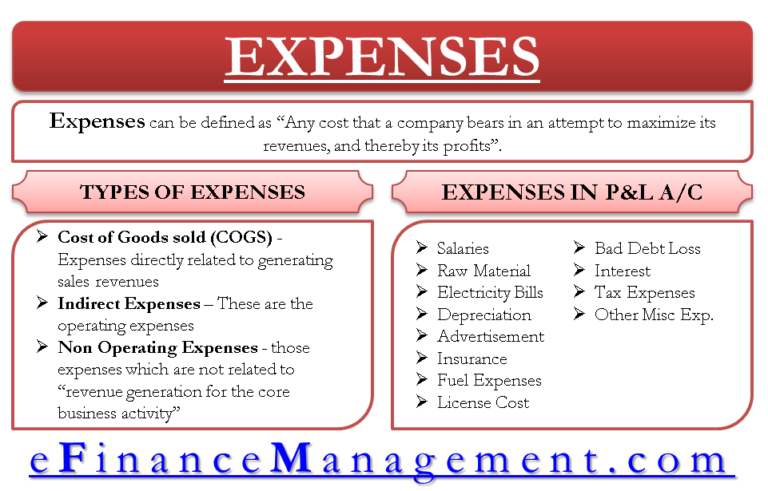

What Is Expense Definition And Meaning

Irs Definition Of Education Expenses - Verkko i The second category of nondeductible educational expenses within the scope of subparagraph 1 of this paragraph are expenditures made by an individual for