Irs Inheritance Tax Deduction Web 15 Zeilen nbsp 0183 32 Get information on how the estate tax may apply to your taxable estate at

Web 30 Okt 2023 nbsp 0183 32 To determine if the sale of inherited property is taxable you must first determine your basis in the property The basis of property inherited from a decedent is Web 22 Sept 2023 nbsp 0183 32 What s New Estate and Gift Tax Stay up to date with the tax law changes related to estate and gift taxes Deceased Persons Information to help you resolve the

Irs Inheritance Tax Deduction

Irs Inheritance Tax Deduction

https://cdn.sanity.io/images/cxgd3urn/production/e42a5e395ac6fa23421aa789191be389367074b7-1188x1556.jpg?rect=66,382,1056,792&w=1920&h=1440&fit=crop&auto=format

How Much Is Inheritance Tax Evolve Family Law

https://www.evolvefamilylaw.co.uk/wp-content/uploads/2018/10/What-is-inheritance-tax-scaled.jpg

How Estate Planning Can Minimise Inheritance Tax Walsh Solicitors

https://walshsolicitors.com/wp-content/uploads/2023/07/shutterstock_1729849522.jpg

Web Page Last Reviewed or Updated 21 Nov 2023 Find common questions and answers about estate taxes including requirements for filing selling inherited property and taxable gifts Web 2 Okt 2023 nbsp 0183 32 This interview will help you determine for income tax purposes if the cash bank account stock bond or property you inherited is taxable The tool is designed

Web 26 Nov 2023 nbsp 0183 32 There is no federal inheritance tax in the U S While the U S government taxes large estates directly imposing estate taxes and if relevant income tax on any earnings from the Web 19 Okt 2010 nbsp 0183 32 Money in traditional IRAs 401 k s 403 b s and annuities is taxed to the heir Federal taxes When someone dies the need to deal with federal and state tax

Download Irs Inheritance Tax Deduction

More picture related to Irs Inheritance Tax Deduction

But Why Hate Inheritance Tax If Only 4 Pay It Adam Smith Institute

https://images.squarespace-cdn.com/content/v1/56eddde762cd9413e151ac92/1696188689158-TZAXB786KBII0LBLG7V8/image-asset.jpeg

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

Don t Rush Inheritance Decisions EKS Associates

https://eksassociates.com/wp-content/uploads/2021/11/inheritance-management-m.jpeg

Web Vor 6 Tagen nbsp 0183 32 An inheritance tax is a tax on assets inherited from someone who died The person who inherits the assets pays the tax and rates can vary based on the size of the inheritance as well as Web 19 Okt 2022 nbsp 0183 32 Starting in 2023 individuals can transfer up to 12 92 million to heirs during life or at death without triggering a federal estate tax bill up from 12 06 million this

Web 17 Nov 2023 nbsp 0183 32 What Is the Estate Tax Exemption The federal estate tax exclusion exempts from the value of an estate up to 13 61 million in 2024 up from 12 92 million in 2023 Only the value over these Web 20 Dez 2023 nbsp 0183 32 An estate tax is most notably levied at the federal level and it s charged to a decedent s estate before their assets pass on to their beneficiaries Most estates won t

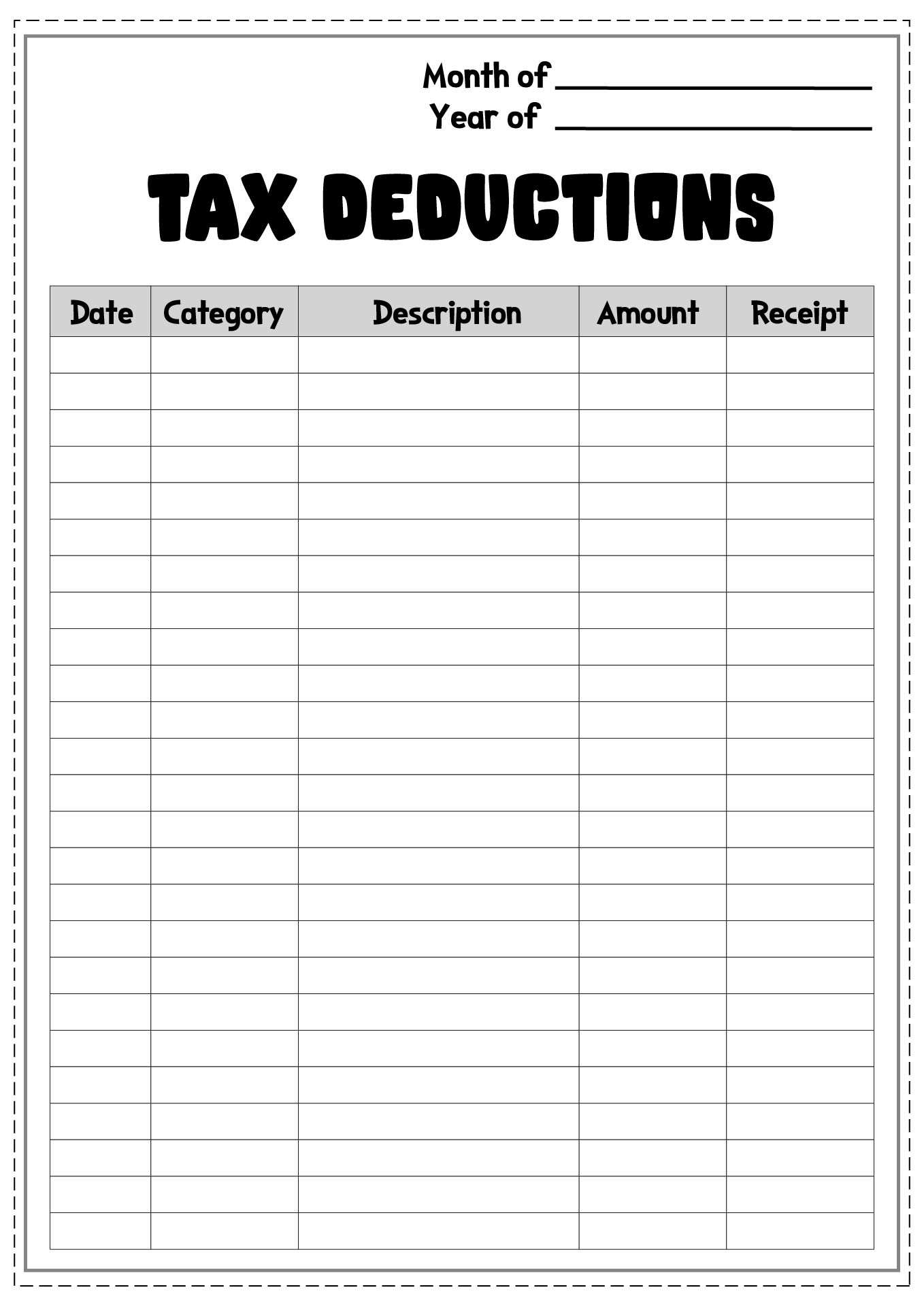

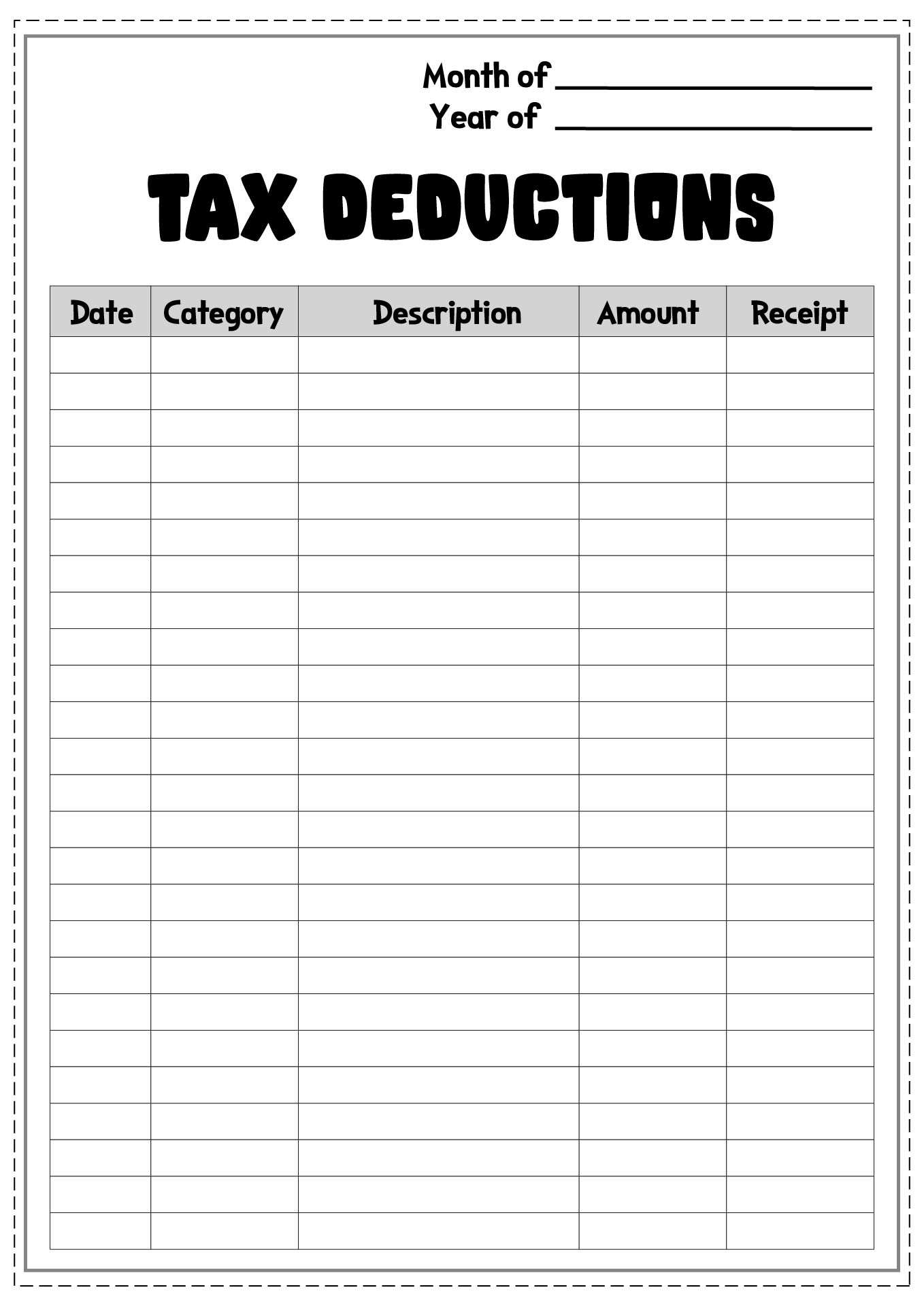

8 Tax Preparation Organizer Worksheet Worksheeto

https://www.worksheeto.com/postpic/2015/05/2015-itemized-tax-deduction-worksheet-printable_449272.png

Inheritance Tax Headway Wealth

https://headwaywealth.com/wp-content/uploads/2021/07/INHERITANCE-TAX-PLANNING-1280x1024.png

https://www.irs.gov/businesses/small-businesses-self-employed/estate-tax

Web 15 Zeilen nbsp 0183 32 Get information on how the estate tax may apply to your taxable estate at

https://www.irs.gov/.../gifts-inheritances/gifts-inheritances

Web 30 Okt 2023 nbsp 0183 32 To determine if the sale of inherited property is taxable you must first determine your basis in the property The basis of property inherited from a decedent is

:max_bytes(150000):strip_icc()/inheritancetax.asp-final-96944c15e1cc4e17b4b94d7b88eb8cec.jpg)

Jeannie Brock Info Inheritance Tax Reduction

8 Tax Preparation Organizer Worksheet Worksheeto

Inheritance Tax Basics Edge Magazine

What Are Pre tax Deductions Before Tax Deduction Guide

Planning For Inheritance Tax Challenges As Penalties Surge In 2022 23

The Terrible Argument That Won t Die inheritance Tax Is Double

The Terrible Argument That Won t Die inheritance Tax Is Double

What Is Inheritance In Cpp MillyHub

Get Relief From Inheritance Tax FAS

Do You Have To Pay Inheritance Tax Before Probate

Irs Inheritance Tax Deduction - Web 4 Nov 2022 nbsp 0183 32 The IRS has come out with the exemption amounts for 2023 Gift and Estate Tax Exemption The amount you can give during your lifetime or at your death and be