Irs Recovery Rebate Credit Faq Nearly 940 000 taxpayers can still claim a refund but the money disappears after May 17 If you re missing a tax refund from the 2021 filing season you only have a few days left to claim your

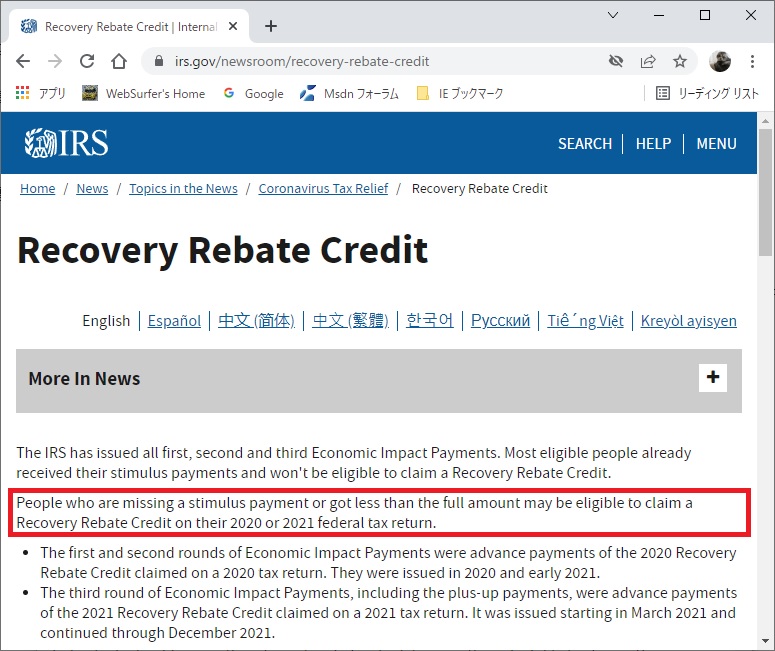

The IRS owes more than 1 billion in unclaimed refunds to nearly 1 million people including many who reside in Washington D C Maryland and Virginia The Recovery Rebate Credit is a What is the Recovery Rebate Credit The credit is the money you receive in Economic Impact Payments If you do not receive the amount you are entitled to you can apply to receive those funds when you file your 2020 tax return You can visit the IRS website for more information about the Recovery Rebate Credit Is the money I receive

Irs Recovery Rebate Credit Faq

Irs Recovery Rebate Credit Faq

https://www.greenbacktaxservices.com/wp-content/uploads/2022/03/Recovery-Rebate-Credit-for-US-expats.jpg

IRS Provides FAQs Regarding The Recovery Rebate Credit YouTube

https://i.ytimg.com/vi/nz9htXqBoXI/maxresdefault.jpg

:max_bytes(150000):strip_icc()/GettyImages-162233497-56cb365f3df78cfb379b575a.jpg)

Recovery Rebate Credit What It Is How It Works FAQ

https://www.investopedia.com/thmb/hi0D3xSBspI8wFFXoV3cb7efock=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-162233497-56cb365f3df78cfb379b575a.jpg

The 2020 tax deadline was postponed to May 17 2021 amid the pandemic and the three year deadline to file 2020 returns and collect refunds is now upon us If you let if you let it slip The deadline to file the refunds is Friday In Washington the IRS estimates 2 900 people could get money back and some may receive up to 968 The IRS estimates around 22 000 Marylanders could

CNET Staff Almost 1 million people are about to lose their tax refunds from 2021 including a stimulus check in the form of the 2020 recovery rebate credit simply because they didn t file a The tax return originally filed included the correct amount of the refundable recovery credit The ProSeries tax program came back with a change to the tax return report showing the original filing with out the recovery credit and the revised information with the credit I prepared the return with the credit originally

Download Irs Recovery Rebate Credit Faq

More picture related to Irs Recovery Rebate Credit Faq

Recovery Rebate Credit Update FAQs And IRS Letters YouTube

https://i.ytimg.com/vi/7wxdqtNS2Ko/maxresdefault.jpg

The Recovery Rebate Credit Calculator MollieAilie

https://www.irstaxapp.com/wp-content/uploads/2021/01/irs-update-stimulus-1024x475.png

IRS Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

https://www.gannett-cdn.com/presto/2022/01/31/PDTF/b7acf011-8827-427c-87dd-1b4ac9c5ff02-extra.jpg?crop=2015,1134,x0,y75&width=2015&height=1134&format=pjpg&auto=webp

2020 Recovery Rebate Credit file a tax return by May 17 2024 2021 Recovery Rebate Credit file a tax return by April 15 2025 Get free help Qualified taxpayers can also find free one on one tax preparation help nationwide through the Volunteer Income Tax Assistance and Tax Counseling for the Elderly programs What are IRS Recovery Rebate Credits In March 2020 during the early phases of the pandemic the Coronavirus Aid Relief and Economic Security CARES Act was passed and residents were given the Recovery Rebate Credits as payment For married couples who live together and file their taxes jointly the payment credit amount

If you didn t your 2020 tax refund may still be unclaimed and the Internal Revenue Service IRS says time is running out to cash in More than 21 000Massachusetts residentscould be leaving behind an average of 975 per individual filer estimated to be more than 25 million total in unclaimed 2020 tax returns In the event that they file for the Recovery Rebate Credit they could be eligible for up to 1 400 Stimulus Checks 2024 each child Technically referred to as Economic Impact Payments the IRS started distributing stimulus funds in March 2021 1400 Stimulus Checks 2024 Details

The Recovery Rebate Credit Calculator MollieAilie

https://lithium-response-prod.s3.us-west-2.amazonaws.com/turbotax.response.lithium.com/RESPONSEIMAGE/de418507-0277-4b17-89a7-765557117ca4.default.png

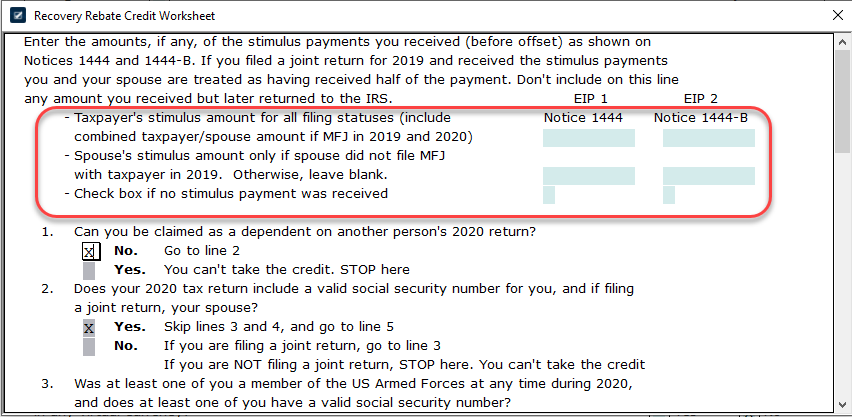

Irs Recovery Rebate Credit Worksheet Pdf IRSYAQU Recovery Rebate

https://i0.wp.com/www.recoveryrebate.net/wp-content/uploads/2023/01/irs-recovery-rebate-credit-worksheet-pdf-irsyaqu-2.png

https://www.cnet.com/personal-finance/last-chance...

Nearly 940 000 taxpayers can still claim a refund but the money disappears after May 17 If you re missing a tax refund from the 2021 filing season you only have a few days left to claim your

https://www.msn.com/en-us/money/taxes/stimulus...

The IRS owes more than 1 billion in unclaimed refunds to nearly 1 million people including many who reside in Washington D C Maryland and Virginia The Recovery Rebate Credit is a

Recovery Rebate Credit Form Printable Rebate Form

The Recovery Rebate Credit Calculator MollieAilie

Menards Printable Rebate Form MenardsRebate Form

Recovery Rebate Credit Form 2021 Printable Rebate Form Rebate2022

IRS Reducing Correcting Recovery Rebate Credit Claims Scott M Aber

IRS Updates Info On Recovery Rebate Credit And Pandemic Response

IRS Updates Info On Recovery Rebate Credit And Pandemic Response

2022 Irs Recovery Rebate Credit Worksheet Recovery Rebate

2020 Tax Year Recovery Rebate Credit Calculation Expat Forum For

IRS 2

Irs Recovery Rebate Credit Faq - Taxpayers can claim this credit every year they install eligible property on or after Jan 1 2023 and before Jan 1 2033 This is a nonrefundable credit which means the credit amount received cannot exceed the amount owed in tax Taxpayers can carry forward excess unused credit and apply it to any tax owed in future years