Is 1099 Ltc Reimbursed Amount Taxable Verkko 28 lokak 2019 nbsp 0183 32 These benefits are all amounts paid out on a per diem or other periodic basis or on a reimbursed basis It includes amounts paid to the insured to the

Verkko amount paid by a viatical settlement provider for the sale or assignment of the insured s death benefit under a life insurance contract Box 3 Check if Per Diem or Verkko 3 marrask 2021 nbsp 0183 32 Are Long Term Care Benefits Taxable David Rodeck November 3 2021 Your long term care insurance policy may pay out tens of thousands of dollars

Is 1099 Ltc Reimbursed Amount Taxable

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png)

Is 1099 Ltc Reimbursed Amount Taxable

https://www.investopedia.com/thmb/w6ojMz00Bp4heSd2aam1H9LZei0=/1664x812/filters:no_upscale():max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png

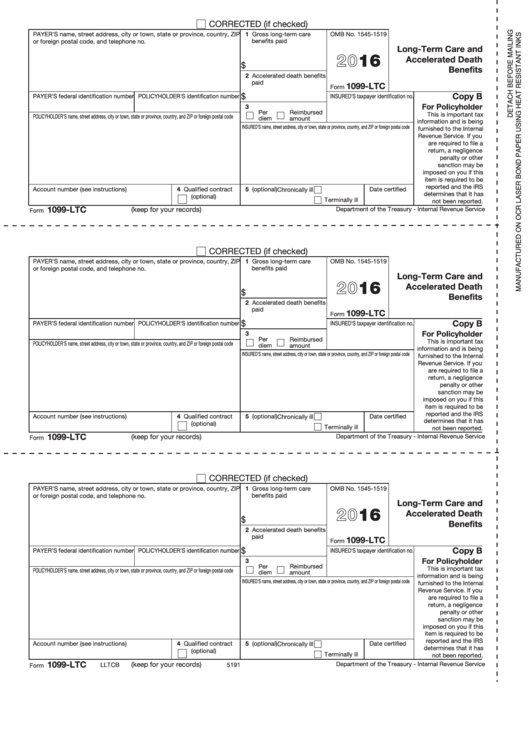

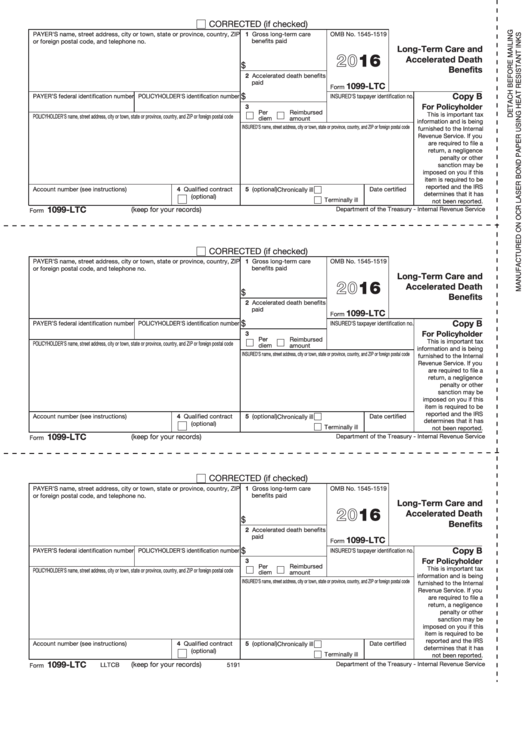

Form 1099 Ltc Long Term Care And Accelerated Death Benefits 2016

https://data.formsbank.com/pdf_docs_html/129/1295/129524/page_1_thumb_big.png

Are Benefits From A Long Term Care Insurance Policy Taxable LTC News

https://ltcnews-cdn.s3.amazonaws.com/misc/irs-form-1099-ltc-medium.png

Verkko 14 helmik 2023 nbsp 0183 32 Information about Form 1099 LTC Long Term Care and Accelerated Death Benefits including recent updates related forms and instructions on how to file Verkko Quick Answer Generally no Tax qualified Long Term Care Insurance benefits come to you tax free Insurance companies that pay long term care insurance benefits are required by the Internal Revenue Service

Verkko 10 helmik 2021 nbsp 0183 32 Accelerated death benefits for individuals certified as chronically ill are generally excludable from income just as they would be if paid under a qualified Verkko Long term care insurance contract Generally amounts received under a qualified long term care insurance contract are excluded from your income However if payments

Download Is 1099 Ltc Reimbursed Amount Taxable

More picture related to Is 1099 Ltc Reimbursed Amount Taxable

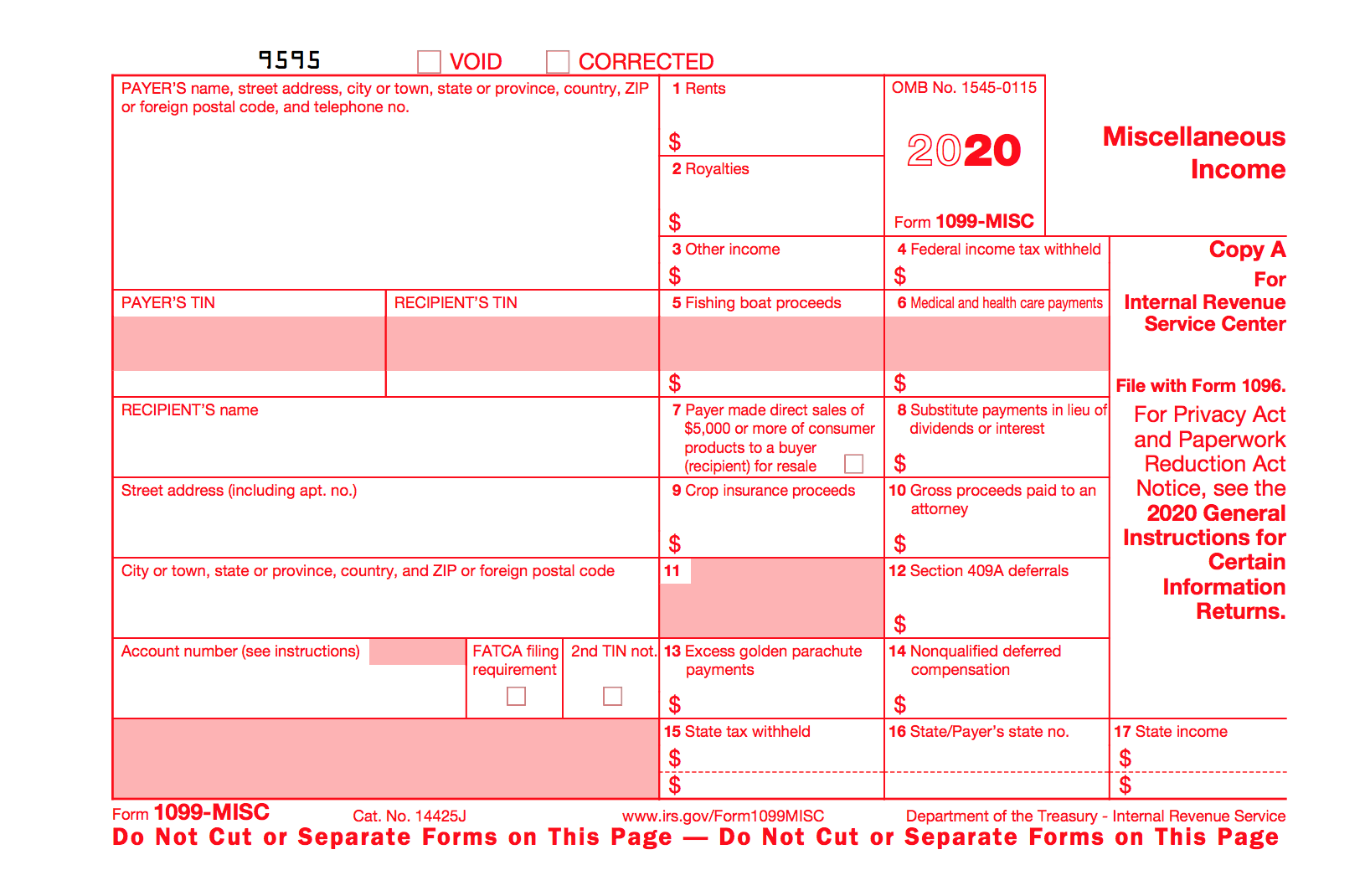

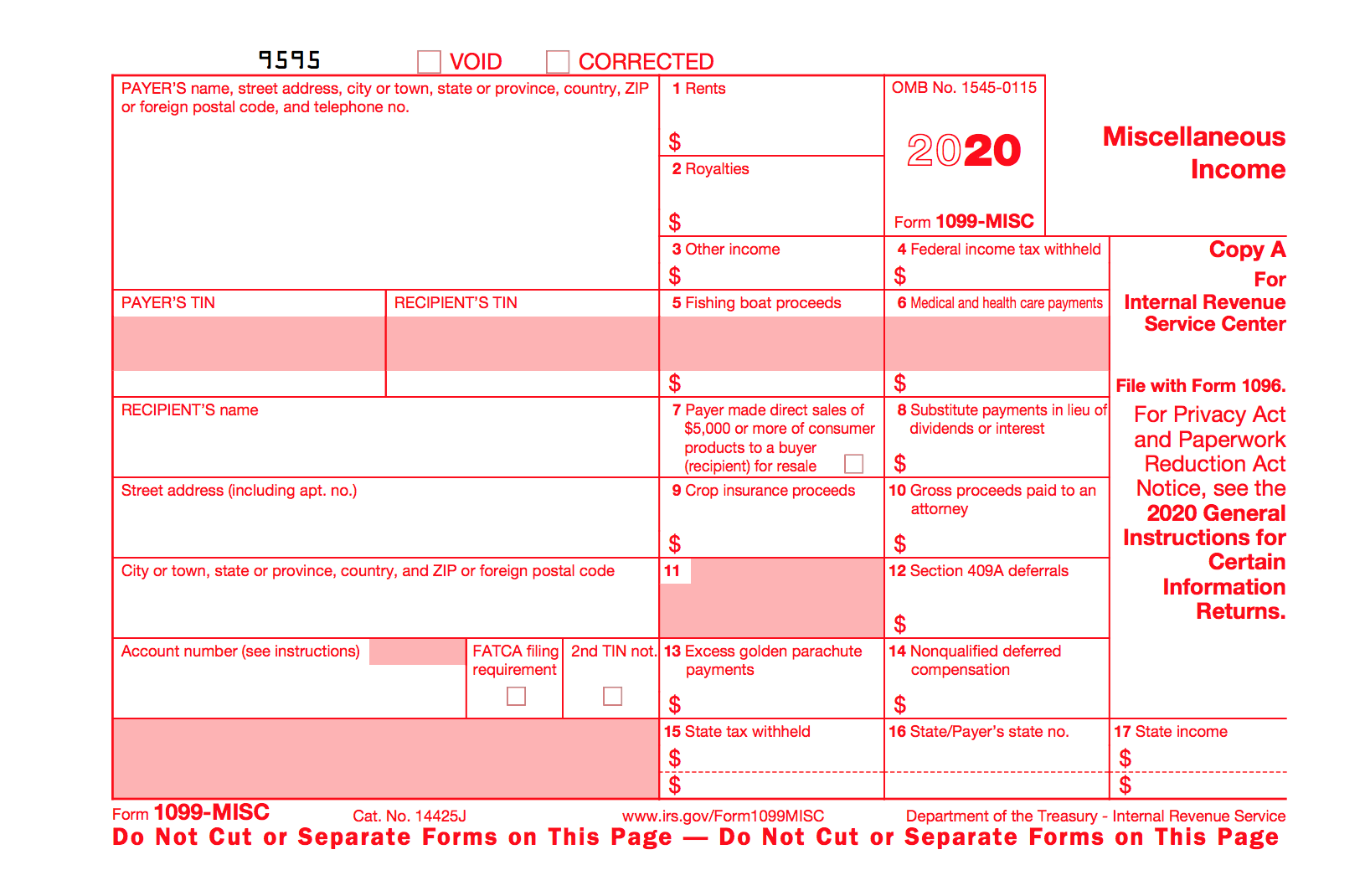

How To PDF Printing 1099 misc Forms

https://www.halfpricesoft.com/images/1099_edit.jpg

Reporting Policy Benefits To The IRS

https://d1o7wu7fti1xhs.cloudfront.net/assets/agent/2/images/irs-tax-form.png

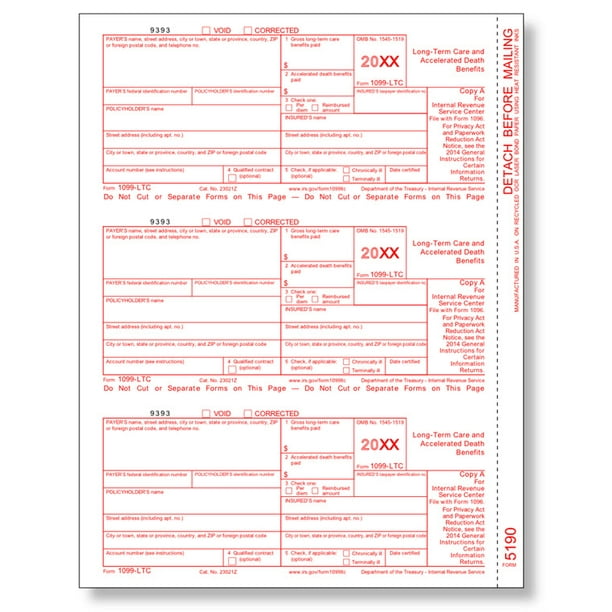

1099 LTC Software To Create Print E File IRS Form 1099 LTC

https://www.idmsinc.com/images/screenshots/1099LTC.png

Verkko 26 maalisk 2014 nbsp 0183 32 I have a 1099 LTC that is quot reimbursed amounts quot checked in box 3 It does not have the quot qualified contract quot box checked It was for actual reimbursements Verkko 7 marrask 2014 nbsp 0183 32 Long Term Care Benefits If the payments received are per diem benefits there is a limit on the nontaxable benefits The taxable amount of the benefit

Verkko The amounts reported on Form 1099 LTC are generally included on Form 8853 Section C for the purpose of determining if any of the benefits received are taxable In TaxSlayer Verkko If the contract simply reimburses the beneficiary for covered medical and personal care expenses or pays those expenses directly then the benefits aren t taxable

What Are 1099s And Do I Need To File Them Singletrack Accounting

https://singletrackaccounting.com/wp-content/uploads/2017/01/Screen-Shot-2019-12-16-at-4.06.06-PM.png

IRS Approved 1099 LTC Federal Copy A Tax Form Walmart Walmart

https://i5.walmartimages.com/asr/b921bf43-2cfe-43c6-b103-515254dc5472_1.8137d6e23cfde5480af9353b81cb8840.jpeg?odnWidth=612&odnHeight=612&odnBg=ffffff

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png?w=186)

https://www.irs.gov/instructions/i1099ltc

Verkko 28 lokak 2019 nbsp 0183 32 These benefits are all amounts paid out on a per diem or other periodic basis or on a reimbursed basis It includes amounts paid to the insured to the

https://www.irs.gov/pub/irs-pdf/i1099ltc.pdf

Verkko amount paid by a viatical settlement provider for the sale or assignment of the insured s death benefit under a life insurance contract Box 3 Check if Per Diem or

IRS Form 1099 Reporting For Small Business Owners

What Are 1099s And Do I Need To File Them Singletrack Accounting

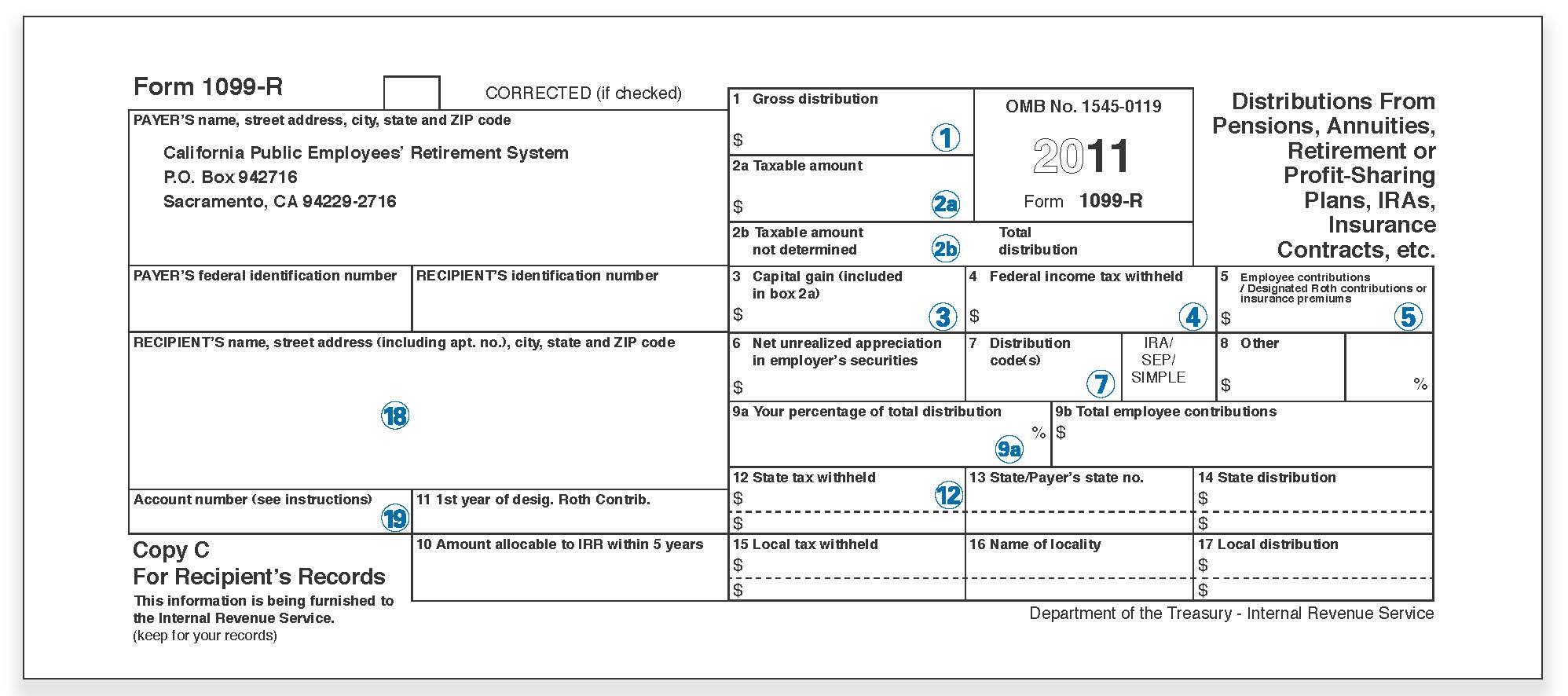

1099 r Taxable Amount Calculation Fill Online Printable Fillable Blank

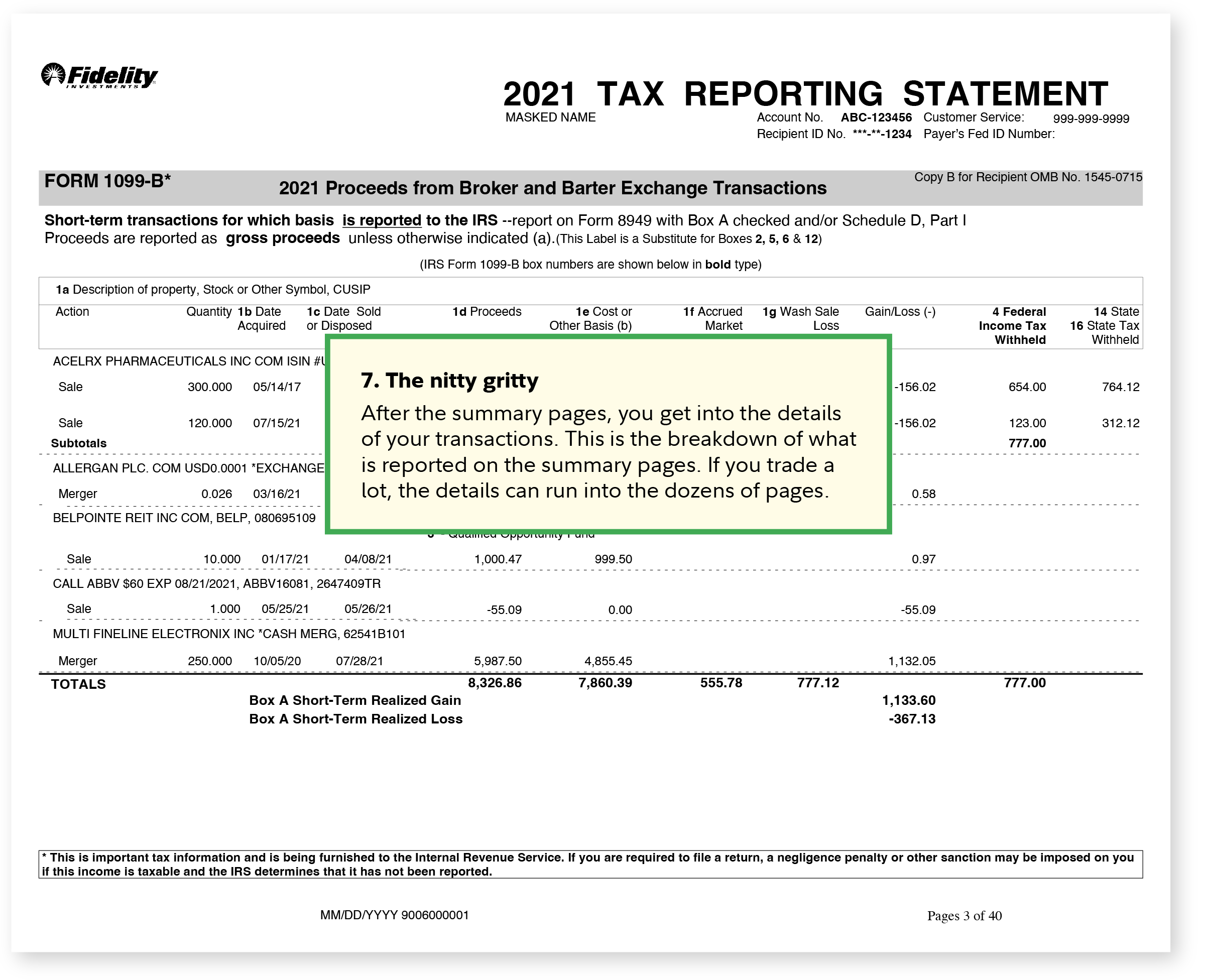

1099 Tax Form 1099 Fidelity

What To Do With The IRS 1099 C Form Cancelation Of Debt Alleviate

New Guidance On Taxable Moving Expenses For Civilians Article The

New Guidance On Taxable Moving Expenses For Civilians Article The

/ScreenShot2020-02-03at11.59.31AM-16c4406790a34c33b8850b5af06d2ae7.png)

Breanna Form 2848 Irsgov

Understanding Your 1099 R Tax Form CalPERS

Motor Car Owned By Employee But Expenses Reimbursed By Employer

Is 1099 Ltc Reimbursed Amount Taxable - Verkko Quick Answer Generally no Tax qualified Long Term Care Insurance benefits come to you tax free Insurance companies that pay long term care insurance benefits are required by the Internal Revenue Service