Is 2nd Home Loan Tax Exemption Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be Q6 Can I claim a home loan tax benefit on the second property Answer Yes you can claim a home loan tax benefit on the second property This includes deductions on both the principal repayment under Section 80C

Is 2nd Home Loan Tax Exemption

Is 2nd Home Loan Tax Exemption

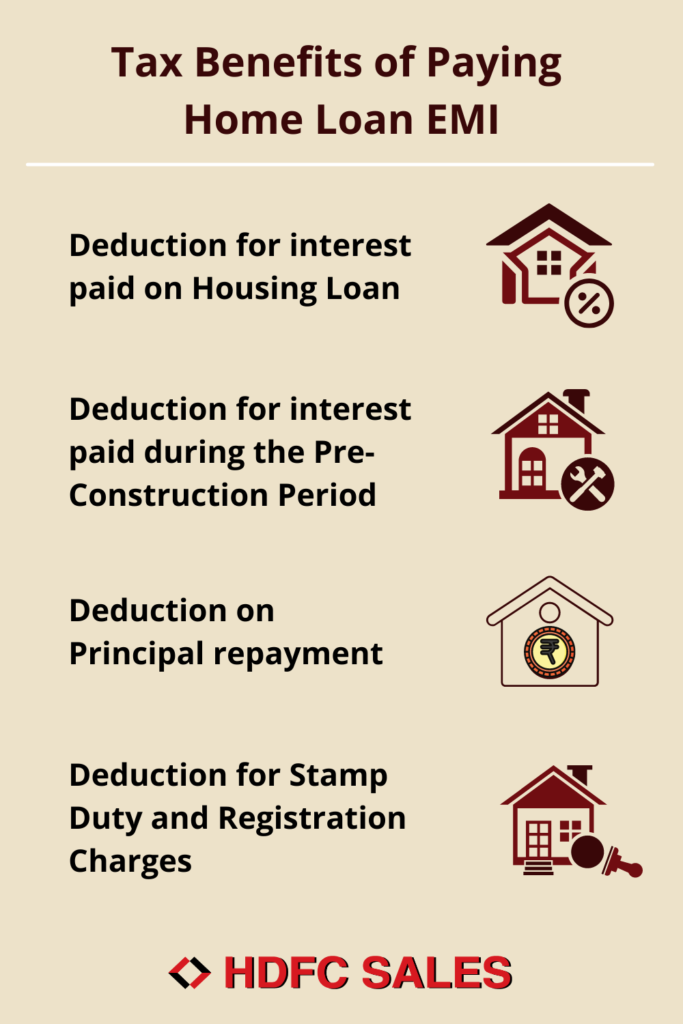

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Tax Implications On A Second Home Loan A Must Read 50 Plus Finance

https://lh6.googleusercontent.com/w_e9i99W9SvqYOBbWqQxERD5AzHhpmdEcw09mGgy1ZWdDiC7-C8Q1jyt3LX456i6wng2vhA6VOXlsfPdLvoSAB4Gl5eZ4uCg7Bp5T-4fxGr_FMF4-0jeHdOlFb_1GgBq6yZDHo4Gl8ed_KHZRg=w1200-h630-p-k-no-nu

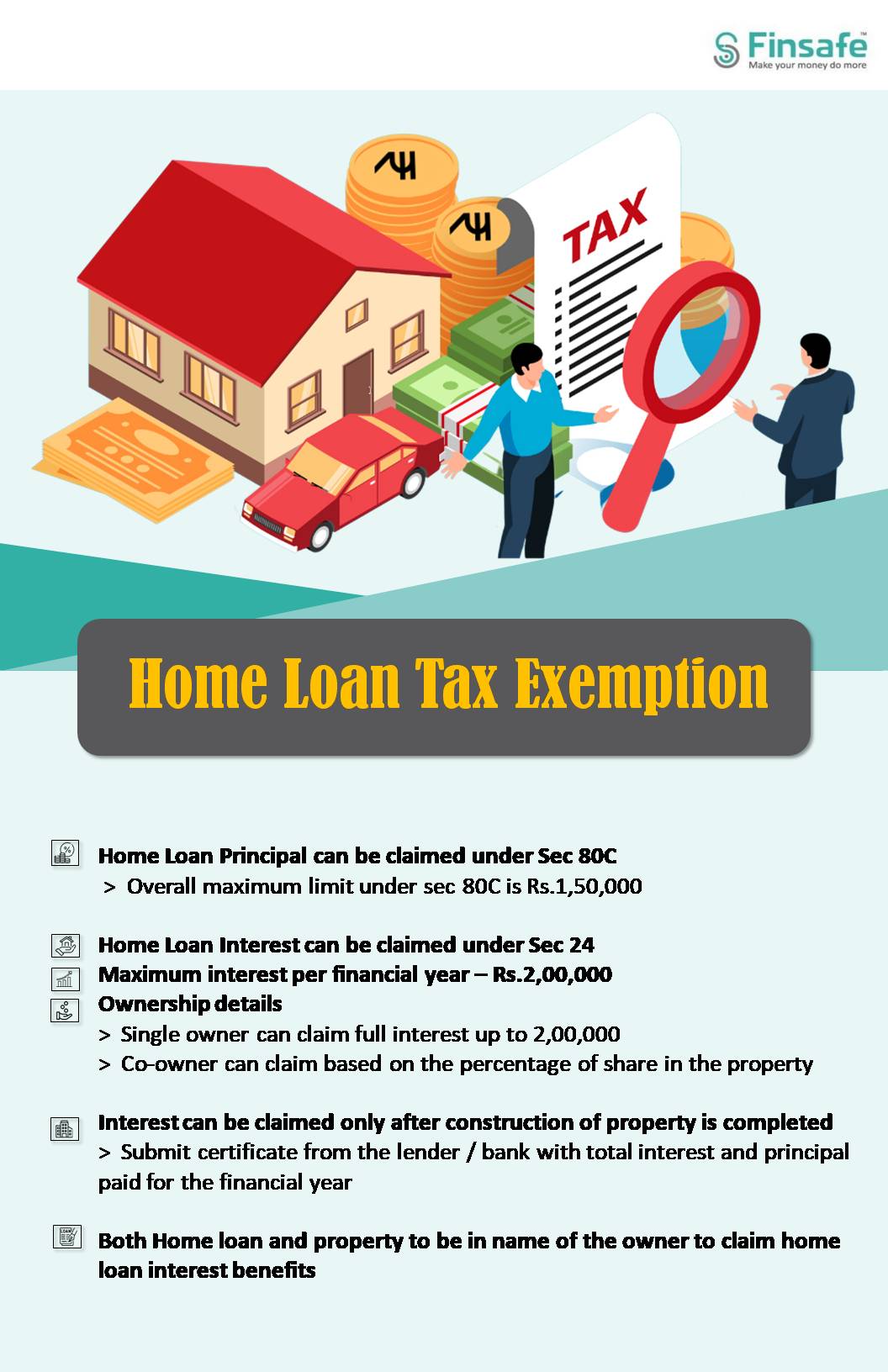

Vodafone Dashboard Finsafe Wellness

https://www.finsafe.in/financial-wellness/wp-content/uploads/2022/12/Home-Loan-Tax-Exemption-vodafone.jpg

The answer to that is a resounding yes Read on to know more While purchasing a home has always been considered a good investment option the tax benefits on home loans were earlier restricted to only one loan If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married filing

Borrowers can claim the following tax benefits on second home loan repayment Section 80 Rs 1 5 lakh tax deduction on principal payment Available for Yes a second home loan is eligible for tax exemption in India You can claim tax benefits on both the principal and interest payments Under Section 80C you

Download Is 2nd Home Loan Tax Exemption

More picture related to Is 2nd Home Loan Tax Exemption

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2022/10/Is-plot-loan-eligible-for-tax-exemption-V1-724x1024.png

Home Loan Tax Exemption Home Loan Tax Rebate Rules YouTube

https://i.ytimg.com/vi/1DNKE2fuoA4/maxresdefault.jpg

Income tax benefits on second home loan Explained 1 min read 20 Apr 2024 08 10 AM IST Balwant Jain Tax benefits on home loan interest and principal Even when you own a second home the maximum tax deduction you can claim on your Home Loan principal amount continues to remain INR 1 5 Lakh The deduction under

1 One flat is given on rent of Rs 15000 per month For this flat home loan interest per annum is Rs 1 41 859 2 Second flat is also given on rent of Rs 15000 You can get the above tax benefits if you take a second home loan to buy another property however the aggregate amount of deductions is subject to the respective caps

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

https://i.ytimg.com/vi/DmRsyjsDM7c/maxresdefault.jpg

You Can Claim Tax Exemption On HRA And Home Loan Know What Is The

https://himcarehealth.com/wp-content/uploads/2022/07/You-can-claim-tax-exemption-on-HRA-and-Home-Loan-know-what-is-the-condition-1.png

https://www.livemint.com/money/personal-finance/i...

Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan Whether you have one home

https://www.hdfcbank.com/personal/resources/...

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be

Housing Loan Tax Exemption Revision In Fiscal 2022 PLAZA HOMES

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

What Are The Income Tax Benefits On Mortgage Loan Loanfasttrack

How To Claim Home Loan Tax Exemption Real Estate Sector Latest News

Home Loan Tax Deduction Home Sweet Home Modern Livingroom

Personal Loan Tax Exemptions Eligibility Criteria Limitations Tax

Personal Loan Tax Exemptions Eligibility Criteria Limitations Tax

House Loan Tax Exemption Tax Benefits On Home Loan How To Save Tax

Claim HRA And Home Loan Tax Exemption At The Same Time Get More From

Pin On Infographics

Is 2nd Home Loan Tax Exemption - Updated on Mar 18th 2024 8 min read Acquiring a home loan can provide opportunities to save on taxes in accordance with the regulations of the Income tax Act 1961 The