Is Second Home Loan Eligible For Tax Exemption If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be

While Home Loan borrowers are generally well aware of the income tax benefits on their loans many buyers have doubts regarding whether tax benefits on such loans are allowed if taken for the second time The REUTERS Under the income tax laws there are no restrictions on the number of houses for which you can claim the tax benefits for home loan

Is Second Home Loan Eligible For Tax Exemption

Is Second Home Loan Eligible For Tax Exemption

https://www.goodneighbours.com.au/wp-content/uploads/2020/06/tax-3.jpg

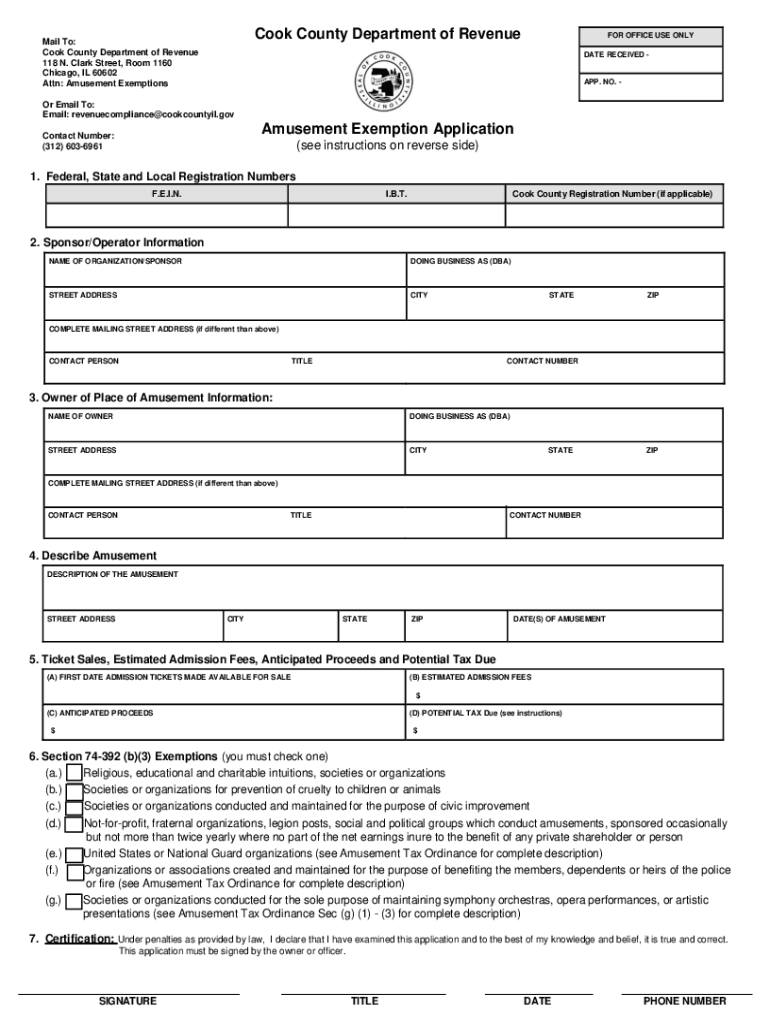

Cook County Amusement Tax Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/5/485/5485536/large.png

CBDT Notifies And Amends Rules Regarding Accumulation Of Unspent Income

https://capindia.in/wp-content/uploads/2022/08/Income-Tax-Rules.jpg

The tax benefit on a second home loan governed by the Income Tax Act under Sections 80C and 24 can significantly impact your financial planning Whether Q6 Can I claim a home loan tax benefit on the second property Answer Yes you can claim a home loan tax benefit on the second property This includes deductions on both the principal repayment under Section 80C

If your second property is considered a personal residence you can deduct mortgage interest in the same way you would on your primary home up to 750 000 if you are single or married filing The tax benefit for a home loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied home Up to Rs 1 5

Download Is Second Home Loan Eligible For Tax Exemption

More picture related to Is Second Home Loan Eligible For Tax Exemption

Loan Certificate PDF

https://imgv2-2-f.scribdassets.com/img/document/135548537/original/4d8afdd60a/1631372599?v=1

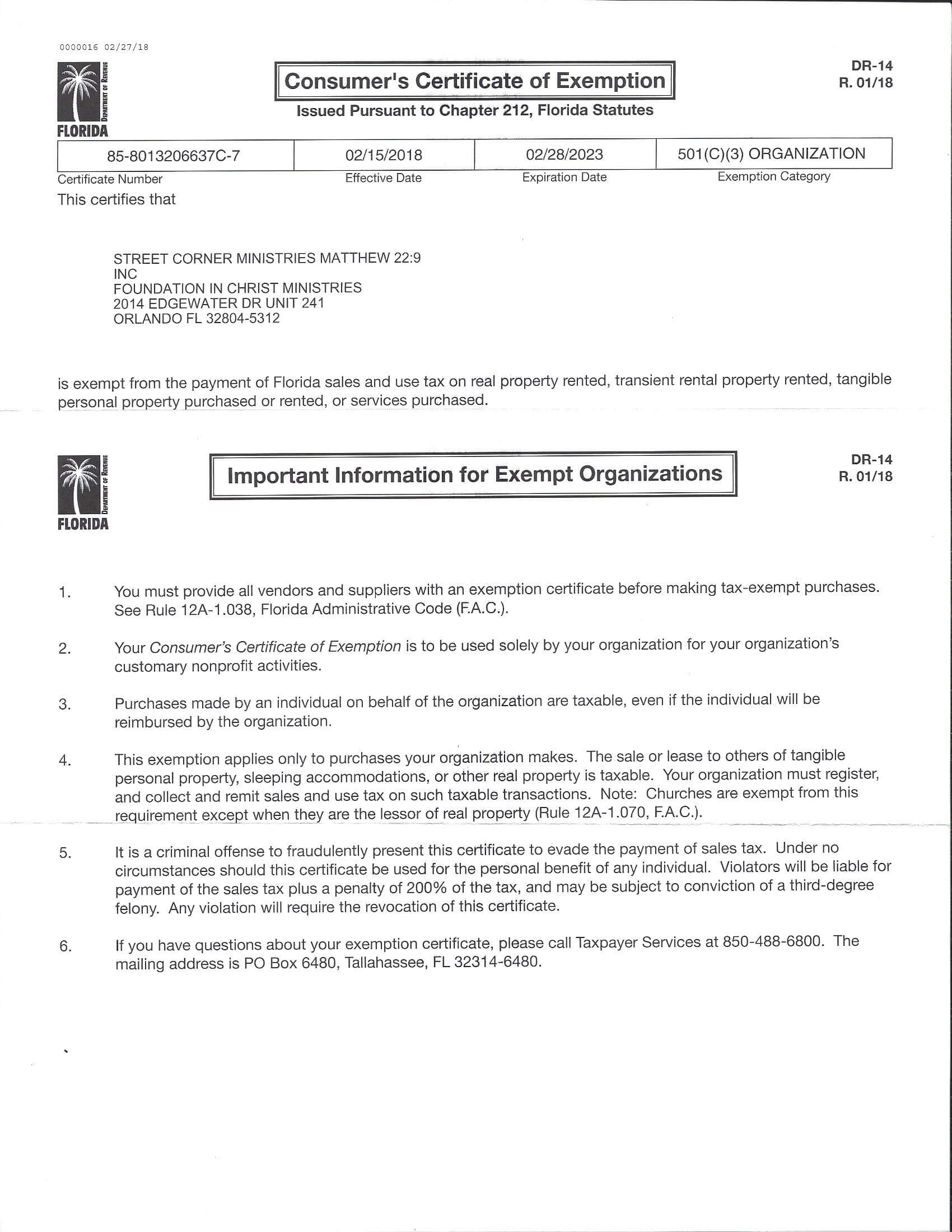

Florida Sales Tax Exemption Certificate Foundation In Christ Ministries

https://eoqsmt5wite.exactdn.com/wp-content/uploads/FL-Sales-Tax-Exemption-Certificate.jpg?strip=all&lossy=1&w=2560&ssl=1

Home Loan Tax Exemption Check Tax Benefits On Home Loan

https://www.urbanmoney.com/blog/wp-content/uploads/2022/10/HOME-LOAN-TAX-EXEMPTION-Always-good-to-save-more-100-1-1.jpg

Yes Ms Sethi is eligible for a second home loan and second home loan tax benefit The deduction is available under Section 80C for up to Rs 1 5 lakh If you use the house as a second home rather than renting it out interest on the mortgage is deductible within the same limits as the interest on the mortgage on

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs Home loan is eligible for tax benefits as follows Tax deductions on principal repayment Under Section 80C Under section 80 c of the Income Tax Act tax deduction of a

State Lodging Tax Exempt Forms ExemptForm

https://i0.wp.com/www.exemptform.com/wp-content/uploads/2022/08/ny-hotel-tax-exempt-fill-online-printable-fillable-blank-pdffiller-8.png

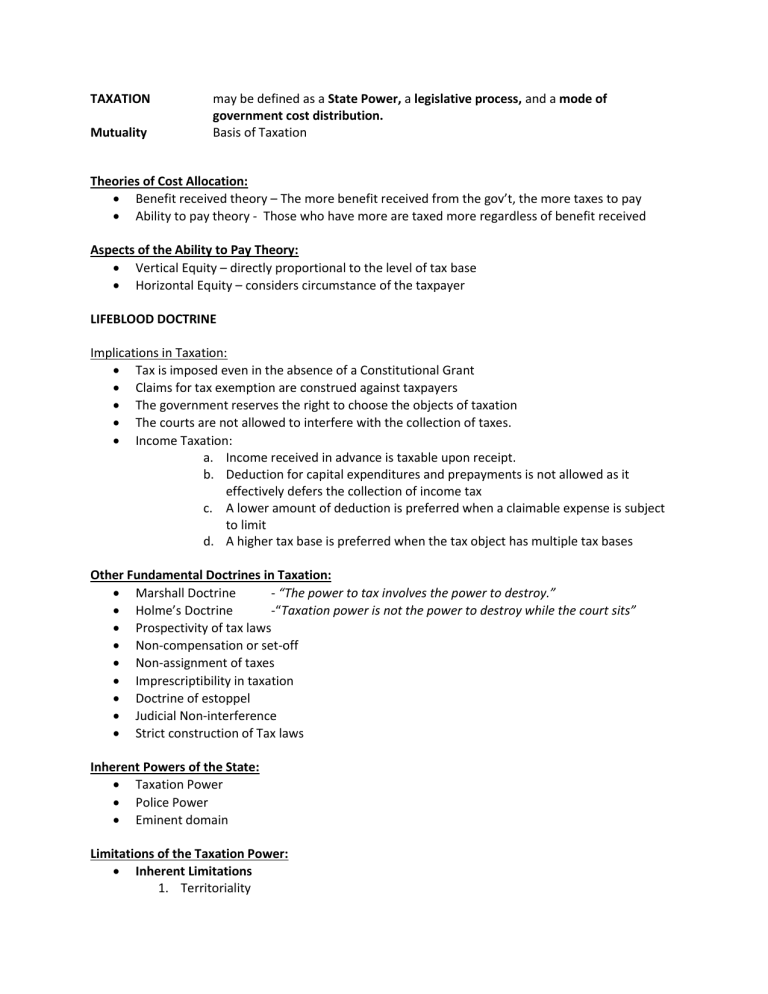

TAX Summary Notes 1

https://s2.studylib.net/store/data/025963115_1-fdd367a29c37c3655891dbac839ea1ba-768x994.png

https://www.hdfcbank.com/personal/resources/...

If you buy a second home on Home Loan you can even avail of tax deductions on it While deductions under Section 80C on the principal amount of the loan may not be

https://www.icicibank.com/blogs/hom…

While Home Loan borrowers are generally well aware of the income tax benefits on their loans many buyers have doubts regarding whether tax benefits on such loans are allowed if taken for the second time The

How To Apply For Tax Exemption In Selling Books Philippines

State Lodging Tax Exempt Forms ExemptForm

Proof Of No Income Letter For Tax Exemption Purposes How To Templates

Commission Approves Income Tax Exemption Rates Financial Tribune

Tax Exempt Letter

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Certificate Of Exemption Form Fill Out Sign Online DocHub

Home Loan Top Up Interest Rates Eligibility Tax Benefits Tata Capital

Sample Letter Exemptions Fill Out Sign Online DocHub

Is Second Home Loan Eligible For Tax Exemption - Q6 Can I claim a home loan tax benefit on the second property Answer Yes you can claim a home loan tax benefit on the second property This includes deductions on both the principal repayment under Section 80C