Is A Rebate Revenue A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the investor who loaned the

Discount A cash discount is recorded in the books of accounts while a trade discount is not Since the discount allowed is a clear expense for a business in order to earn revenue the journal entry for a discount is Journal entry for recording a discount of 10 on products worth 50 000 Rebate A rebate is a retroactive payment back to a buyer of a good or service After the sale has been made the rebate lowers the full purchase price by returning either a lump sum or percentage of the sales price back to the buyer In some instances rebates are offered only when a certain purchase volume has been met

Is A Rebate Revenue

Is A Rebate Revenue

https://images.squarespace-cdn.com/content/v1/5d8d4c603aab2563d4a30208/1648504189519-EYNC86JYEGG20QUA9STL/2022-PA+Dept+of+Revenue+property+tax-rent+rebate_Page_1.jpg

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax

https://img.money.com/2022/03/News-Recovery-Rebate-Credit.jpg

Volume Incentive Rebate Management And Examples Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/625f1a3324cb3f447874c6e1_varities-of-incentives.png

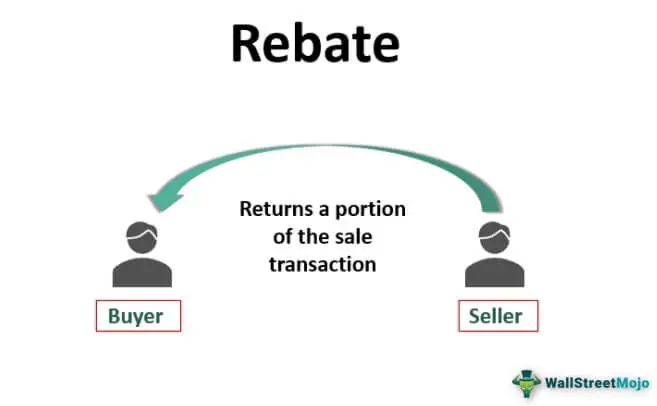

Reviewed by Dheeraj Vaidya CFA FRM What is Rebate A rebate is a cashback or refund given to the customers against the purchase which acts as an incentive to complete the transaction Unlike discounts allotted before the actual sale rebates are offered after the sale Nov 23 Introduction to Rebate Accounting Rebate management is like the ace up a savvy business s sleeve offering a clever way to drive sales and keep customers loyal It s a strategy that when played right can pay off But here s the catch you ve got to know how to keep track of all those rebates

Depending on the terms of the rebate program and applicable accounting rules revenue from sales involving rebates may need to be recognized at the time of sale or deferred until the rebate is fulfilled or treated as a reduction of sale price rather than a reduction of revenue What is a Rebate 2 What are Supplier and Vendor Rebates 3 How to Account for Vendor Rebates 4 How to Account for Customer Rebates 5 What is Vendor Rebates Accounting Treatment 6 What are Unclaimed Rebates 7 How to Account for Coupons 8 How to Pay Rebates to Vendors 9 What are Accounting Challenges of Vendor

Download Is A Rebate Revenue

More picture related to Is A Rebate Revenue

What Is Rebate GETBATS Blog

https://blog.getbats.com/uploads/images/202104/image_750x_607662dab7d45.jpg

Traderider Rebate Program Verify Trade ID

https://traderider.com/rebate/assets/img/rebate-forex.jpg

Rebate Calculations 101 How Are Rebates Calculated Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/63638715cda5ce39da72168b_Blog banners 2400x1348px3.png

A rebate is a portion of the purchase price of a product or service that a seller gives back to the buyer It s typically valid for a specified period Unlike a discount which is deducted from the purchase price at the time of sale a rebate is a refund a purchaser applies for after paying for a product or service Rebates are documented as decreases in revenue or accounts receivable in the financial statements and include things like cashback incentives trade discounts and promotional discounts Accounting plays a vital role in every business by maintaining precise records and enabling efficient financial management

Revenue or COGS reduction Asked on Oct 30 2015 I currently show a revenue line on my income statement line for Vendor rebates I see GAAP guidance that VENDORS should record rebates as a reduction in their sales prices but how should those of us receiving them record them September 02 2023 What is a Rebate A rebate is a payment back to a buyer of a portion of the full purchase price of a good or service This payment is typically triggered by the cumulative amount of purchases made within a certain period of time Rebates are generally designed to increase the volume of purchases made by customers

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

https://asset5.scripbox.com/wp-content/uploads/2021/05/tax-rebate.jpg

Rebate What Is It Example Vs Discount Types Regulations

https://www.wallstreetmojo.com/wp-content/uploads/2021/01/Rebate.jpg.webp

https://www.investopedia.com/terms/r/rebate.asp

A rebate is a credit paid to a buyer of a portion of the amount paid for a product or service In a short sale a rebate is a fee that the borrower of stock pays to the investor who loaned the

https://www.accountingcapital.com/differences-and...

Discount A cash discount is recorded in the books of accounts while a trade discount is not Since the discount allowed is a clear expense for a business in order to earn revenue the journal entry for a discount is Journal entry for recording a discount of 10 on products worth 50 000 Rebate

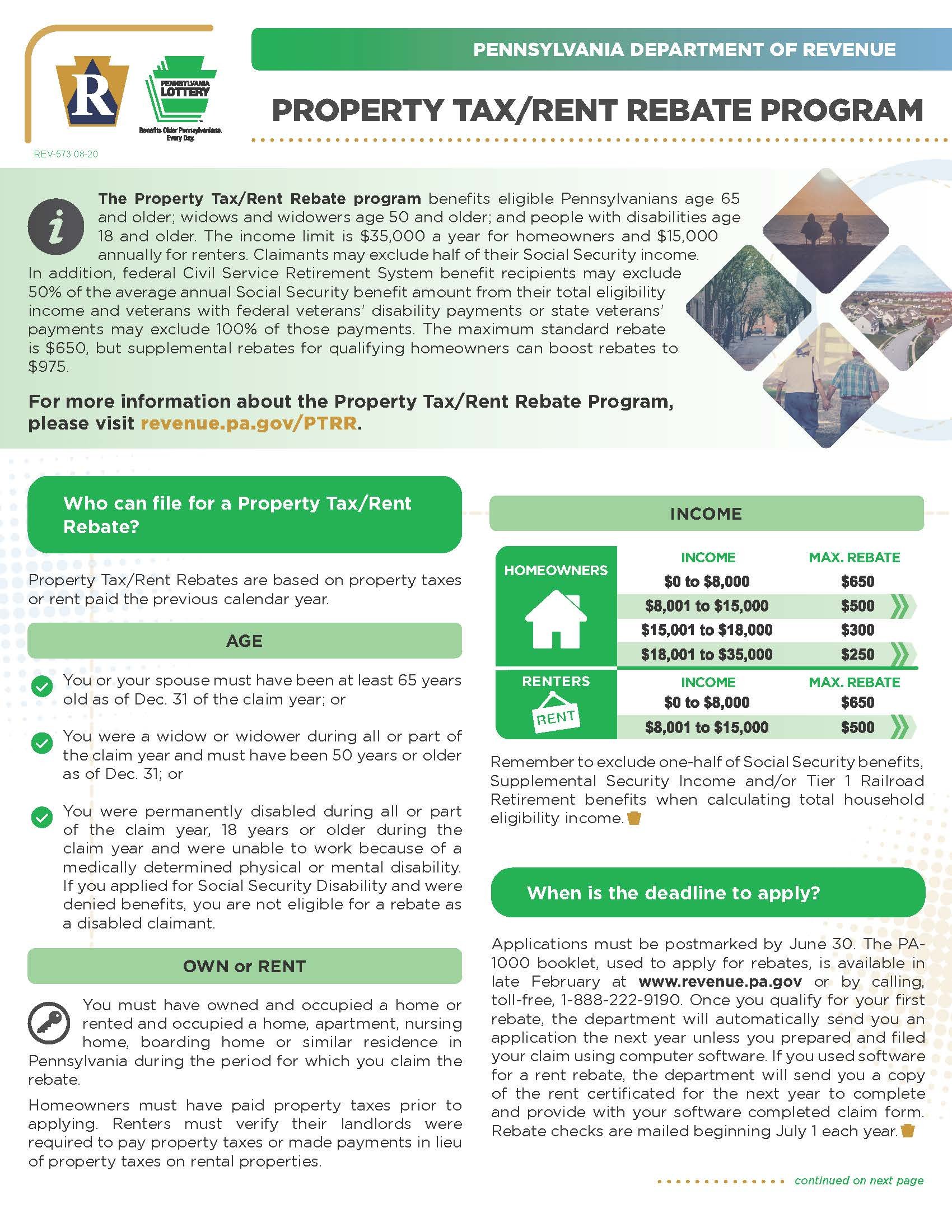

Pennsylvania s Property Tax Rent Rebate Program May Help Low income

What Is A Tax Rebate U s 87A How To Claim Rebate U s 87A Scripbox

Rebate Solutions All Digital Rewards

Tax Rebate Service No Rebate No Fee MBL Accounting

Rebates Vs Discounts What Are The Differences Enable

Revenue Icon 424742 Free Icons Library

Revenue Icon 424742 Free Icons Library

Should Advisors Rebate Revenue Sharing Payments Barron s

Expired 15 Rebate From P G Freebies 4 Mom

Government Solar Rebate QLD Everything You Need To Know

Is A Rebate Revenue - A tax rebate is a return of excess taxes paid by an individual or business over a financial year Unlike traditional rebates that operate as marketing incentives to stimulate sales tax rebates are governmental refunds issued when the actual tax liability is less than the total amount of taxes paid