Is Credit Card Cash Back Taxable Canada Fortunately the majority of Canadian consumers don t have to pay taxes on their credit card rewards As long as you re earning points miles or cash back for personal purchases i e

Generally most Canadian consumers do not need to pay tax on credit card rewards including points travel miles and cashback According to the Canada Revenue Agency CRA these benefits are classified as discounts rather than income Fortunately the majority of Canadian consumers don t have to pay taxes on their credit card rewards As long as you re earning points miles or cash back for personal purchases i e

Is Credit Card Cash Back Taxable Canada

Is Credit Card Cash Back Taxable Canada

https://image.cnbcfm.com/api/v1/image/106170696-1570560537220cashcreditcard2.jpg?v=1570560560&w=1400&h=950

/GettyImages-682285434-a997a691bb2441cd81bf952c01ce095b.jpg)

Types Of Cash Back Credit Cards And How To Choose One

https://www.thebalance.com/thmb/VIAMKce-voSlwLdc5NbGowACFG0=/2121x1414/filters:fill(auto,1)/GettyImages-682285434-a997a691bb2441cd81bf952c01ce095b.jpg

How To Redeem Cash back Rewards From Your Credit Card The Points Guy

https://thepointsguy.global.ssl.fastly.net/us/originals/2021/07/2GettyImages-492644377.jpg?width=1920

Credit card rewards can be taxable but it depends on what you use your credit card for and what type of rewards you earn Rewards earned from any personal purchases are not taxable the CRA views them as discounts and not income Canadian tax regulations for cash back credit cards stipulate that if you earn points for work related expenses and if you redeem those points for cash your credit card rewards are considered taxable If you re unsure about whether or not you should claim your credit card rewards speak to your accountant before filing your taxes

Canadian credit card points miles and cash back may be taxable according to the CRA in certain cases Are credit card rewards taxable In this article we take a look at the CRA s current guidance on the tax treatment of frequent flyer miles and credit card points in Canada

Download Is Credit Card Cash Back Taxable Canada

More picture related to Is Credit Card Cash Back Taxable Canada

Amazing Cash Back Credit Cards Credit Card Cash Rewards Credit Cards

https://i.pinimg.com/736x/a3/82/7f/a3827f6213ca6427f67c1dbecc2d62c9.jpg

Here s How To Make The Most Out Of Cash back Credit Cards

https://image.cnbcfm.com/api/v1/image/106040189-1564064178466gettyimages-682299082.jpeg?v=1573690768

How To Get Cash From Your Credit Card Without A PIN Commons credit

https://i4.ytimg.com/vi/a0l2PLzy5aU/sddefault.jpg

Credit card rewards such as travel miles and cashback are not taxable However business credit card rewards are taxable depending on whether the points are used for personal versus business use Credit card rewards that are converted to cash or used as remuneration for employees may be taxable Are Credit Card Rewards Taxable In general credit card rewards which include points travel miles and cashback are not taxable both at the individual and business level The Canada Revenue Agency CRA classifies these types of benefits as discounts not as forms of income so you re not required to report them when filing your taxes

Edit One of the only ways If you choose a cashback card it would be taxable If you choose a points card and never convert the points to cash it is not taxable Find out which credit card rewards are taxable and which are not by going through our in depth analysis of taxes on credit card rewards Insurance Mortgage Credit Cards Loans As is the case with consumer credit cards since this cash back involves a purchase it does not qualify as income However the cash back brings down the net cost

/credit-card-cash-advance-fee-explained-2f669e92e6404f9aa2b6bd7229723cc3.png)

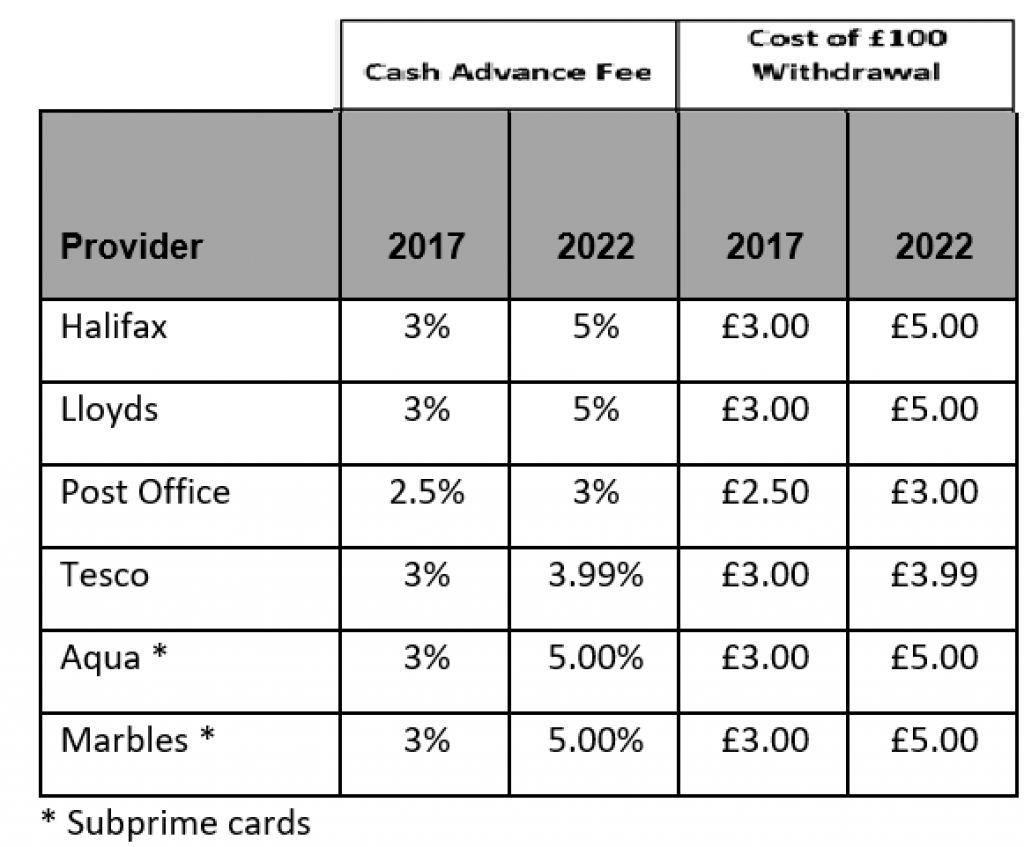

Ulta Credit Card Cash Advance Cards Ideas

https://www.thebalance.com/thmb/sueWrbb1Ap880z0_c8TTE88ZzF4=/1333x1000/smart/filters:no_upscale()/credit-card-cash-advance-fee-explained-2f669e92e6404f9aa2b6bd7229723cc3.png

Are Credit Card Rewards Taxable Income BankBonus

https://bankbonus.com/wp-content/uploads/2022/05/credit-card-rewards-taxable.jpg

https://ca.finance.yahoo.com/news/credit-card...

Fortunately the majority of Canadian consumers don t have to pay taxes on their credit card rewards As long as you re earning points miles or cash back for personal purchases i e

/GettyImages-682285434-a997a691bb2441cd81bf952c01ce095b.jpg?w=186)

https://reviewlution.ca/resources/are-credit-card-rewards-taxable

Generally most Canadian consumers do not need to pay tax on credit card rewards including points travel miles and cashback According to the Canada Revenue Agency CRA these benefits are classified as discounts rather than income

Credit Card Cash Advances Are Expensive Try These Alternatives Cash

/credit-card-cash-advance-fee-explained-2f669e92e6404f9aa2b6bd7229723cc3.png)

Ulta Credit Card Cash Advance Cards Ideas

Pros And Cons Of Getting A Credit Card Cash Advance Cash Credit Card

Credit Card Cash Advance Fees On The Rise Your Money

Credit Card Zactra Inc

How Do Credit Card Interest Rates Work Credit One Bank

How Do Credit Card Interest Rates Work Credit One Bank

Credit Card To Cash In Vellore At Best Price In Chennai

How Much Does Credit Card Debt Cost Now

How To Prevent Chargeback Credit Card Fraud Revenue Loss

Is Credit Card Cash Back Taxable Canada - Are credit card rewards taxable In this article we take a look at the CRA s current guidance on the tax treatment of frequent flyer miles and credit card points in Canada