Is Credit Card Rebate Taxable Most tax experts agree that credit card rewards earned through credit cards are non taxable rebates and that you should be fine as long as you spend money to get something Based on this

Credit card rewards generally aren t taxable but there are exceptions Are Credit Card Rewards Taxable Rewards earned from meeting certain spending requirements cannot be taxed In general business credit card rewards earned are not considered income which means they are not taxable Instead credit card rewards are considered rebates on items you purchased with a credit card

Is Credit Card Rebate Taxable

Is Credit Card Rebate Taxable

https://bettingproonline.com/wp-content/uploads/2022/09/Credit-Card-Roulette1.jpeg

50 Discount Tire Credit Card Rebate Chevy Colorado GMC Canyon

https://discounttire.scene7.com/is/image/discounttire/syncc_AT_40_920_002?$PromoHero$

Recovery Rebate Credit Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Recovery-Rebate-Credit-Form-2021-768x767.jpg

A 2010 memorandum from the IRS says cash back earned via credit card spending is not considered taxable income However if you receive it as part of opening a bank account where you didn t have to complete a minimum spending requirement you Most credit card rewards are not taxable but be wary of those that don t have a spending threshold required in order to redeem rewards Although these cards offer an upfront incentive you

In general the IRS views credit card rewards as a discount rather than as income So if you re getting 2 cash back on a 100 purchase that would be considered a 2 discount Discounts aren t This month the U S Tax Court ruled that in some cases credit card rewards can be subject to taxation by the Internal Revenue Service IRS But don t panic this ruling likely doesn t affect you

Download Is Credit Card Rebate Taxable

More picture related to Is Credit Card Rebate Taxable

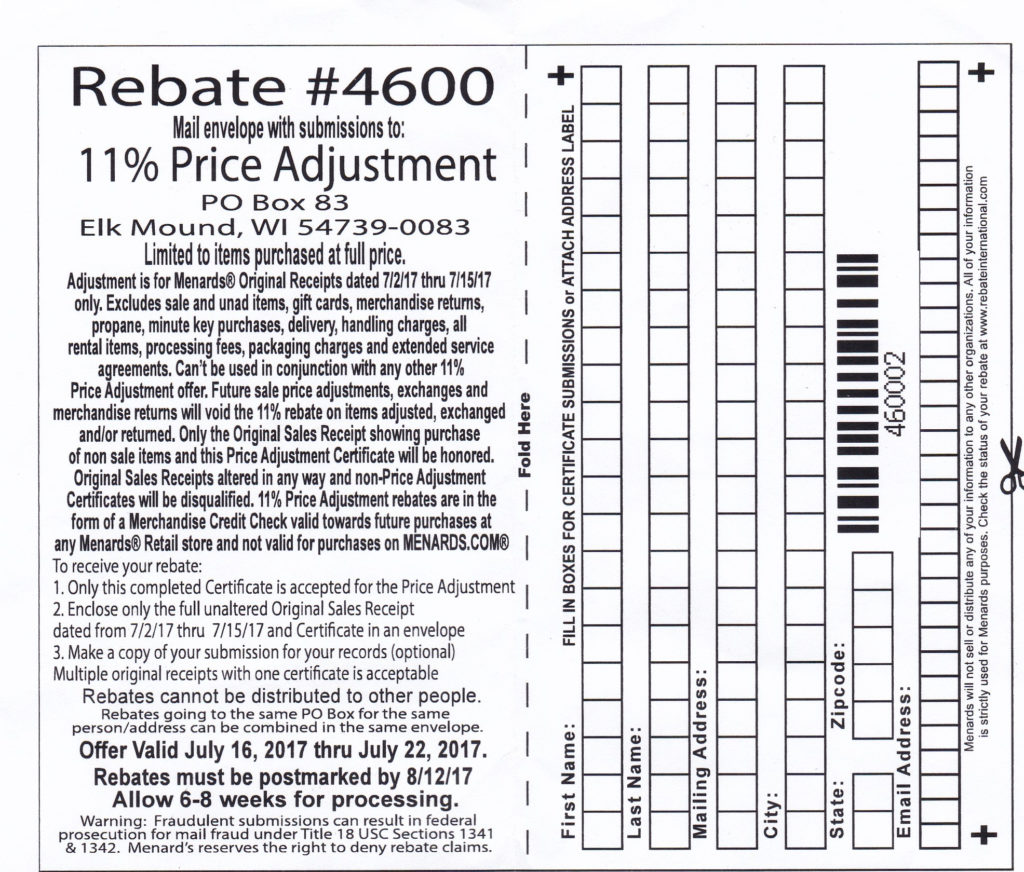

Printable Menards Gift Card Printable World Holiday

https://www.homeurl.us/wp-content/uploads/2021/04/menards-11-price-adjustment-rebate-struggleville-2-1024x872.jpg

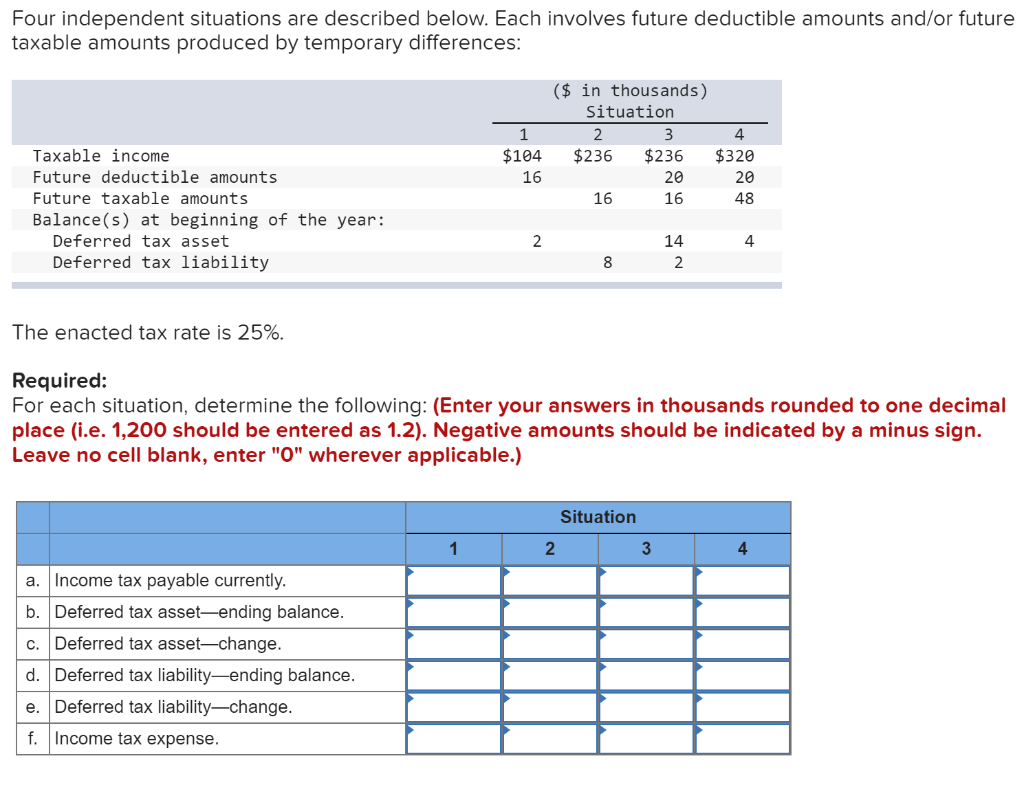

Solved Four Independent Situations Are Described Below Each Chegg

https://media.cheggcdn.com/media/0c4/0c4f6d2b-4b27-4f28-a061-b83200553416/phpXaXizV.png

Credit Card Debt Relief For A Fresh Start

https://www.nationaldebtrelief.com/wp-content/uploads/2022/09/NDR_LHendricks_Nov21_010.jpeg

The good news is that credit card rewards are not taxable The IRS considers them rebates or promotional discounts and not taxable income You might have to pay tax if the cash back is not part of a rebate for a transaction such as a sign up bonus not linked to card activity In most cases no but there are exceptions Credit card rewards points and cash back are generally considered a promotional benefit or rebate and are not taxable said David Shipper a

Only credit card rewards that cardholders receive without having to spend money to earn them in any way are considered taxable income If a cardholder earns cash back for spending money using their credit card it won t count as taxable income Your bank or credit card can offer them or the vehicle you just purchased may come with rebate kickback to you Tip That 5 000 rebate you received on your new pickup truck may be subject to sales tax

CIMB Cash Rebate Platinum Mastercard YouTube

https://i.ytimg.com/vi/rSWhprWCiZc/maxresdefault.jpg

How To Pay Off Multiple Credit Cards And Lower The Debt You Owe Daddy

http://www.daddy-geek.com/wp-content/uploads/2020/03/How-to-Pay-Off-Multiple-Credit-Cards-and-Lower-the-Debt-You-Owe.jpg

https://www.investopedia.com › ask › answers › ...

Most tax experts agree that credit card rewards earned through credit cards are non taxable rebates and that you should be fine as long as you spend money to get something Based on this

https://money.usnews.com › credit-cards › articles › are...

Credit card rewards generally aren t taxable but there are exceptions Are Credit Card Rewards Taxable Rewards earned from meeting certain spending requirements cannot be taxed

CIMB Cash Rebate Platinum

CIMB Cash Rebate Platinum Mastercard YouTube

How Much Credit Card Debt Is Too Much

Solved Please Note That This Is Based On Philippine Tax System Please

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax

Offer Best Credit Card Rebate Strictlye Business Expo Find Leading

Offer Best Credit Card Rebate Strictlye Business Expo Find Leading

Will Credit Card Rewards Be Classified As Taxable Income APF

The Best Gas Rebate Credit Cards In The Philippines GasRebate

Best Credit Cards For October 2022 The Ascent Credit Card Best

Is Credit Card Rebate Taxable - A 2010 memorandum from the IRS says cash back earned via credit card spending is not considered taxable income However if you receive it as part of opening a bank account where you didn t have to complete a minimum spending requirement you