Is Dental Work Tax Deductible 2022 Can I deduct my medical and dental expenses ITA home This interview will help you determine if your medical and dental expenses are deductible Information

Can I deduct medical dental and vision expenses SOLVED by TurboTax 6441 Updated November 22 2023 To deduct unreimbursed out of pocket You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat

Is Dental Work Tax Deductible 2022

:max_bytes(150000):strip_icc()/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg)

Is Dental Work Tax Deductible 2022

https://www.investopedia.com/thmb/eGl6pCDUnpBmsiMrrmrKgnntVpQ=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg

Moving For Work Tax Deductible Relocation Expenses Explained K K

https://www.kkcpa.ca/wp/wp-content/uploads/Webp.net-resizeimage.jpg

Are Dental Expenses Tax Deductible Maybe

https://www.deltadentalia.com/webres/image/blog/Taxes-iStock.jpg

Key takeaways Dental expenses may be tax deductible if they help prevent or alleviate dental disease You are only allowed to deduct dental expenses if they total more than 7 5 of your adjusted The deduction for tax year 2022 covers expenses that exceed 7 5 of your adjusted gross income AGI Medical and Dental Expenses You can deduct unreimbursed qualified medical and

Claiming dental expenses is an allowable deduction on your tax return You can claim dental expenses on your taxes if you incurred fees for the prevention and alleviation of Key Takeaways The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross

Download Is Dental Work Tax Deductible 2022

More picture related to Is Dental Work Tax Deductible 2022

How To Avoid Getting Ripped Off By The Dentist Vox

http://cdn0.vox-cdn.com/assets/4888090/179785357.jpg

Is Volunteer Work Tax Deductible

https://www.rosterfy.com/hubfs/Tax Return.jpg#keepProtocol

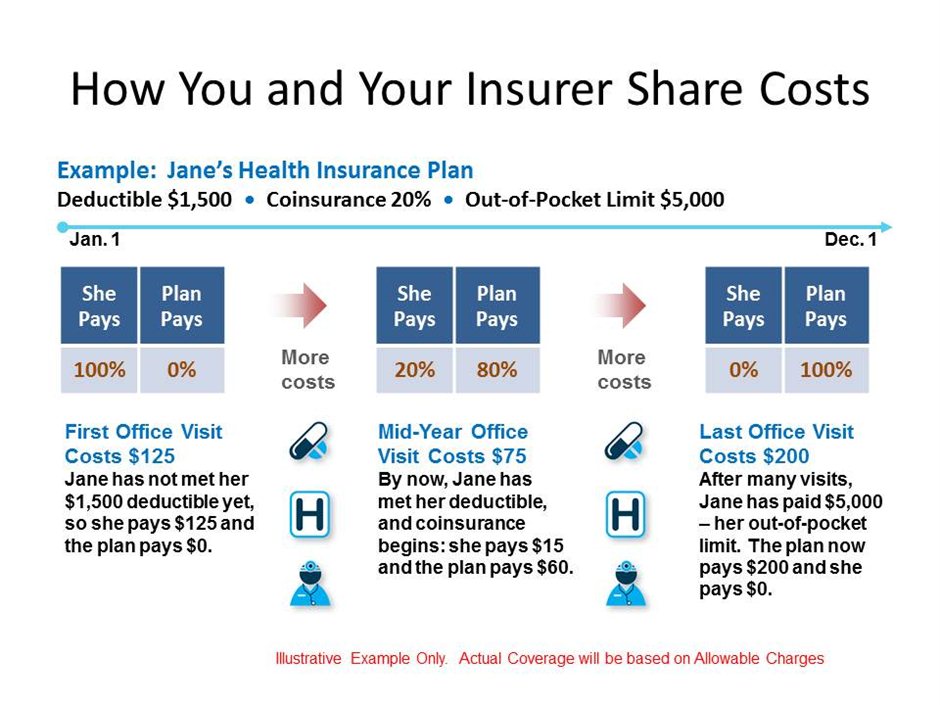

What Is A Dental Insurance Deductible Delta Dental Of Washington

https://www.deltadentalwa.com/-/media/DDWA/page-images/dental-insurance-101/deductible/DDWA_A-Dental-Deductible-Is_Site_540x395.ashx

Which dental procedures are tax deductible and which aren t We ll provide some general guidance and examples of each Dental insurance premiums may be tax deductible The Internal Revenue Service IRS says that to be deductible as a qualifying medical expense the

You can deduct medical expenses that exceed 7 5 of your adjusted gross income AGI For example if you have an AGI of 50 000 and 10 000 in total Yes you can take a dental tax deduction for most of the costs associated with non cosmetic dental expenses for you and your family but only to a certain

Is Volunteer Work Tax Deductible Agingnext

https://agingnext.org/wp-content/uploads/2022/03/Volunteer-Tax-Deductions.jpg

2022 Tax Changes Are Meals And Entertainment Deductible

https://ryanreiffert.com/wp-content/uploads/2022/06/2022-Business-Owner-Update-The-Meals-and-Entertainment-Tax-Deductions.png

:max_bytes(150000):strip_icc()/GettyImages-184878144-fad59359c24245ceb97dafe44c6d0e9e.jpg?w=186)

https://www.irs.gov/help/ita/can-i-deduct-my...

Can I deduct my medical and dental expenses ITA home This interview will help you determine if your medical and dental expenses are deductible Information

https://ttlc.intuit.com/turbotax-support/en-us/...

Can I deduct medical dental and vision expenses SOLVED by TurboTax 6441 Updated November 22 2023 To deduct unreimbursed out of pocket

Tax Rates Absolute Accounting Services

Is Volunteer Work Tax Deductible Agingnext

Do Dental Work And Implants Is Tax Deduction Dental News Network

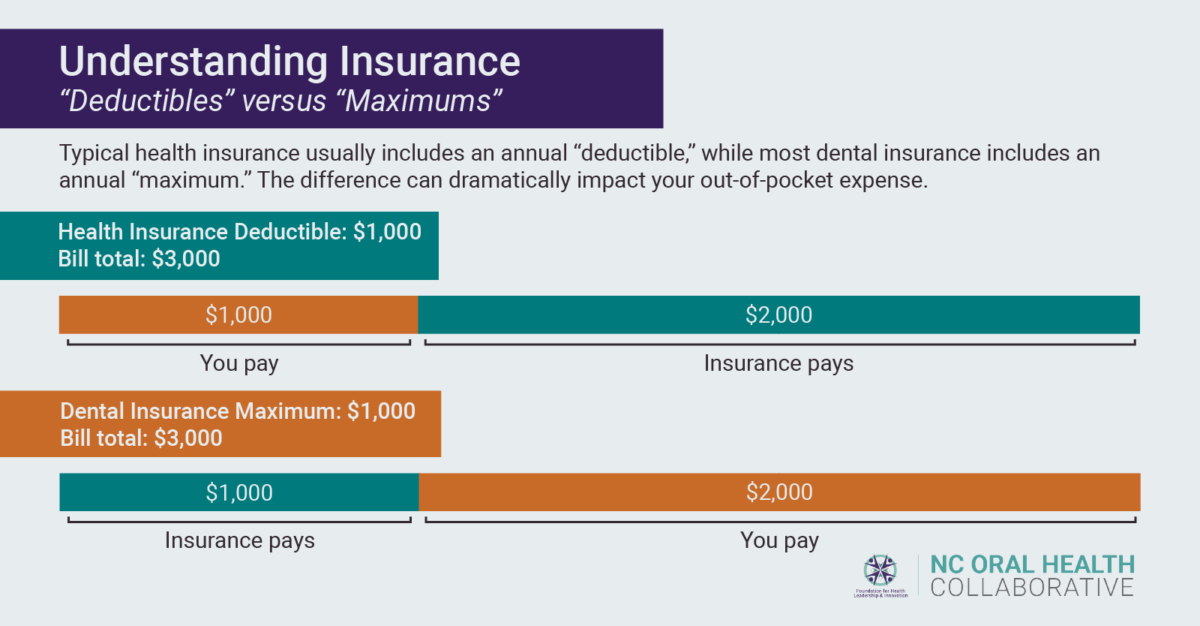

How In The World Does Dental Insurance Work North Carolina Oral

School Supplies Are Tax Deductible Wfmynews2

Tax Deduction Tracker Printable Business Tax Log Expenses Etsy

Tax Deduction Tracker Printable Business Tax Log Expenses Etsy

Tax Deductions You Can Deduct What Napkin Finance

Medical Expense Deduction How To Claim A Tax Deduction For Medical

Insurance And Benefits In Buffalo Grove Arlington Heights IL ARC

Is Dental Work Tax Deductible 2022 - Key Takeaways The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross