Is Dental Work Tax Deductible In Canada You can claim only eligible medical expenses on your tax return if you or your spouse or common law partner paid for the medical expenses in any 12 month period ending in 2023 did not claim them in 2022 Generally you can claim all amounts paid even if they were not paid in Canada

Dental services paid to a medical practitioner or a dentist Expenses for purely cosmetic procedures are not eligible For more information see Common medical expenses you cannot claim Electrolysis only amounts paid to a qualified medical practitioner Here s an in depth guide to making the most of your dental expenditures when filing your taxes in Canada Eligible Dental Expenses For Tax Claims Calculating Your Tax Credit For Optimal Tax Savings Spousal Income Thresholds Claiming Period Keep Your Dental Related Receipts And Invoices Seek Professional Tax Advice Conclusion

Is Dental Work Tax Deductible In Canada

Is Dental Work Tax Deductible In Canada

https://ratesonic.com/wp-content/uploads/2022/03/Home-Insurance-Deductible-1536x1024.jpeg

Moving For Work Tax Deductible Relocation Expenses Explained K K

https://www.kkcpa.ca/wp/wp-content/uploads/Webp.net-resizeimage.jpg

Are Home Renovations Tax Deductible In Canada RooHome

https://roohome.com/wp-content/uploads/2022/01/Are-Home-Renovations-Tax-Deductible-in-Canada-.jpg

Yes dental expenses can be tax deductible in certain situations In Canada you can claim eligible dental expenses as medical expenses on your tax return These expenses may include dental treatments orthodontic work dentures and prescription medications related to dental care Dental hygienist Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Dental nurse not applicable not applicable Yes not applicable not applicable not applicable not applicable not applicable not applicable not applicable not applicable not applicable not applicable Dental technician or technologist Yes Yes Yes

Dental expenses Doctor or physician expenses this varies by province please visit the CRA for details Insulin needles syringes and infusion pumps to treat diabetes Insurance premiums for medical care coverage through plans such as Blue Cross or Canada Life Laboratory fees February 7 2022 Medical expenses are one of the most if not the most overlooked non refundable tax deductions Most Canadians know that they can claim some of their medical expenses but many are unsure of what and how much they can claim

Download Is Dental Work Tax Deductible In Canada

More picture related to Is Dental Work Tax Deductible In Canada

Is Volunteer Work Tax Deductible Agingnext

https://agingnext.org/wp-content/uploads/2022/03/Volunteer-Tax-Deductions.jpg

Are Hearing Aids Deductible In Canada

https://trans4mind.com/counterpoint/index-health-fitness/hearing-aids-deductible-canada1.jpg

.png)

Are Moving Expenses Tax Deductible In Canada

https://www.olympiabenefits.com/hubfs/Untitled design (35).png

Canada Revenue Agency CRA has compiled a list on its website of allowable deductible expenses The list is not exhaustive and includes items such as Prescribed medicines Health insurance premiums Dental prosthetic limbs air conditioners bathroom aids baby breathing monitors crutches environmental control systems medical February 28 2022 Share this Are Medical Expenses Tax Deductible In Canada By Brenda Spiering and Sun Life Staff Did you know you can claim a portion of your family s health expenses and your health insurance premiums on your tax return Here s how it works On this page Do you need health insurance to help cover your medical costs

The maximum amount of medical expenses for tax deduction in Canada is either 3 of your net income or 2 479 whichever is lower For example if 3 of your net income is 1 200 you can claim 1 200 but if 3 of your net The tax credit applies to any number of medical expenses including prescription drugs eyeglasses health related home renovations dental work and even buying gluten free bread or medical

Is The Interest On Your Mortgage Tax Deductible In Canada Lionsgate

https://www.lionsgatefinancialgroup.ca/wp-content/uploads/2022/04/Investing-3-1200x800-layout1194-1h6d5mc.png

Dental Dentist 2006 2023 Form Fill Out And Sign Print Vrogue co

http://cdn0.vox-cdn.com/assets/4888090/179785357.jpg

https://www.canada.ca/en/revenue-agency/services...

You can claim only eligible medical expenses on your tax return if you or your spouse or common law partner paid for the medical expenses in any 12 month period ending in 2023 did not claim them in 2022 Generally you can claim all amounts paid even if they were not paid in Canada

https://www.canada.ca/en/revenue-agency/services...

Dental services paid to a medical practitioner or a dentist Expenses for purely cosmetic procedures are not eligible For more information see Common medical expenses you cannot claim Electrolysis only amounts paid to a qualified medical practitioner

Are Home Renovations Tax Deductible In Canada Surex

Is The Interest On Your Mortgage Tax Deductible In Canada Lionsgate

Is Medical Cannabis Tax deductible In Canada We Have The Answer Leafly

School Supplies Are Tax Deductible Wfmynews2

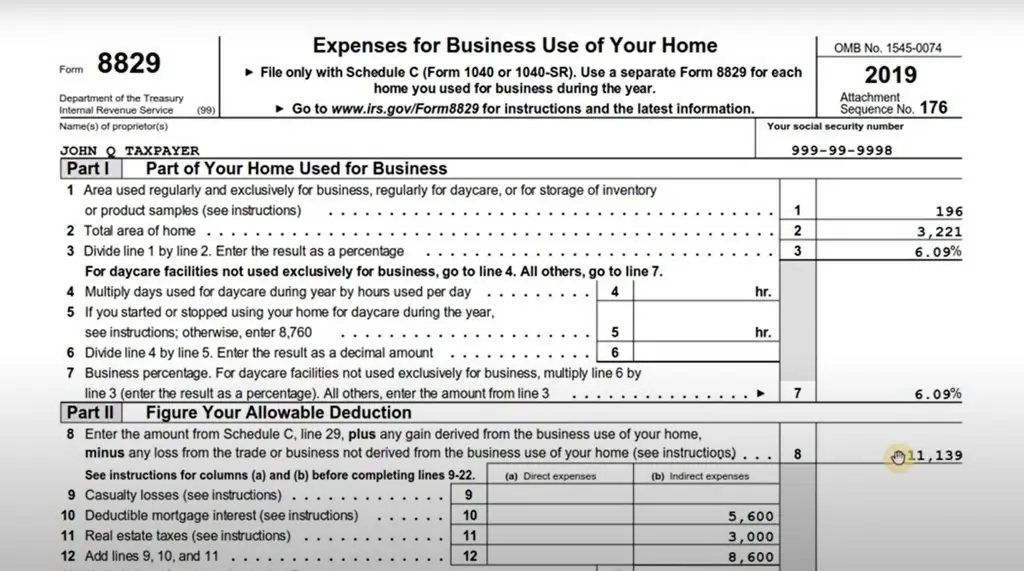

Is A Home Office Tax Deductible File Smarter In The US UK Or Canada

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Tax Deductions The New Rules INFOGRAPHIC Alloy Silverstein

Are Dental Implants Tax Deductible In Canada Find Local Dentist Near

Are Disability Insurance Premiums Tax Deductible In Canada

Are Home Health Care Expenses Tax Deductible In Canada MedNation

Is Dental Work Tax Deductible In Canada - Yes dental expenses can be tax deductible in certain situations In Canada you can claim eligible dental expenses as medical expenses on your tax return These expenses may include dental treatments orthodontic work dentures and prescription medications related to dental care