Is Donation To Political Party Tax Deductible In India Section 80GGC of the Income Tax Act provides tax deductions for contributions made to political parties The amount of deduction that can be claimed depends on the mode of payment If the

For example if a taxpayer has a Gross Tax Income of Rs 10 00 000 and has donated Rs 2 00 000 to a political party they can claim a deduction of Rs Tax benefits on donations to political parties are available under two sections namely 80GGB and 80GGC Deduction under Section 80GGB Eligible Tax

Is Donation To Political Party Tax Deductible In India

Is Donation To Political Party Tax Deductible In India

https://i.ytimg.com/vi/sMVNp-_Y66M/maxresdefault.jpg

Are Political Donations Tax Deductible H R Block

https://www.hrblock.com/tax-center/wp-content/uploads/2016/08/political-cash-contributions-825x510-1.jpg

Donation To Political Party Get Deduction Under Income Tax 80GGB

https://1.bp.blogspot.com/-8buHZhLUxTw/X_iLrydeO2I/AAAAAAAAoX4/7P9sCLyMOjo7u1L3t_TYeCbW23YfhHnPQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Donation%2Bto%2BPolitical%2Bparty.jpg

Yes government employees can claim deductions for contributions or donations made to political parties under this section However they should not be Treasurer of political party any person authorised by political party in this behalf has furnished a report of donations received in excess of Rs 20 000 to Election Commission

Section 80GGC of the Income Tax Act allows taxpayers to avail of tax benefits for their contributions to political parties Hence if you meet certain eligibility If the parties do not submit an annual report of donations received above Rs 20 000 they would not be eligible for tax relief under Section 29C of the RPA Is

Download Is Donation To Political Party Tax Deductible In India

More picture related to Is Donation To Political Party Tax Deductible In India

Section 80GGC Donation To Political Parties By Individuals

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/06/section-80ggc-image.jpg

How To Download BJP Donation Receipt Get Your BJP Donation Receipt In

https://www.autospyders.com/how-to/wp-content/uploads/2022/08/Meta-App-Installer-1.jpg

Tax Free Deduction On Donation To Political Party 10 Certicom

https://i0.wp.com/certicom.in/wp-content/uploads/2023/06/Tax-Free-Deduction-on-Donation-to-political-party-10.jpg?resize=768%2C960&ssl=1

Eligible donations Under Section 80GGC contributions made to any registered political party or electoral trust are tax deductible However cash donations over Rs 2 000 are not eligible for a tax The ADR report based on the analysis of political parties income tax returns and donation statements filed with the EC said that between FY05 and FY21

The Donation made u s 80GGC are 100 tax deductible What is the Eligibility Criteria for Claiming Tax Benefits under Section 80GGB Cash contributions As per a decision of the Ahmedabad Tribunal funds given by the assessee as donations to political parties for claiming deduction under section 80GGC could not

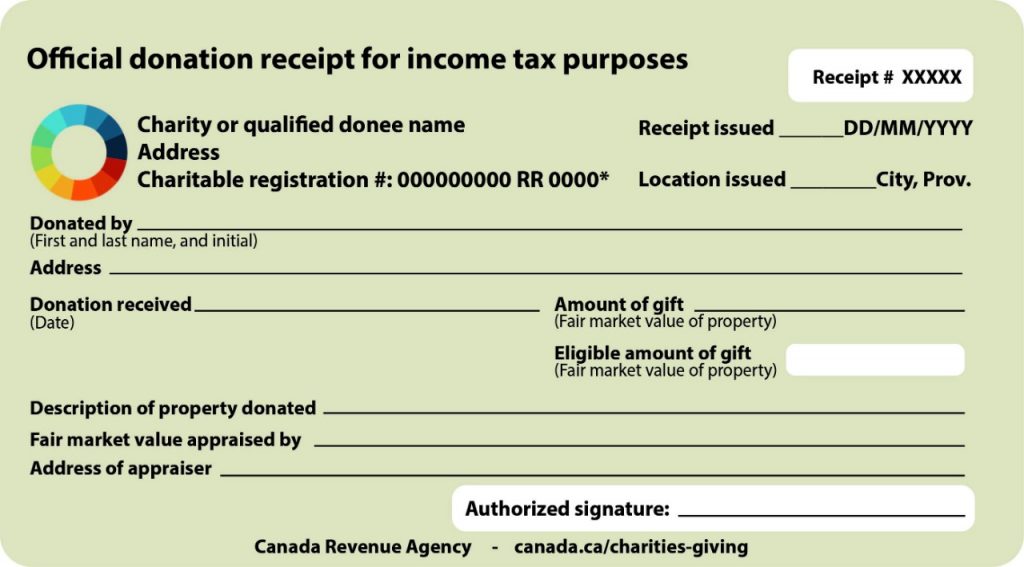

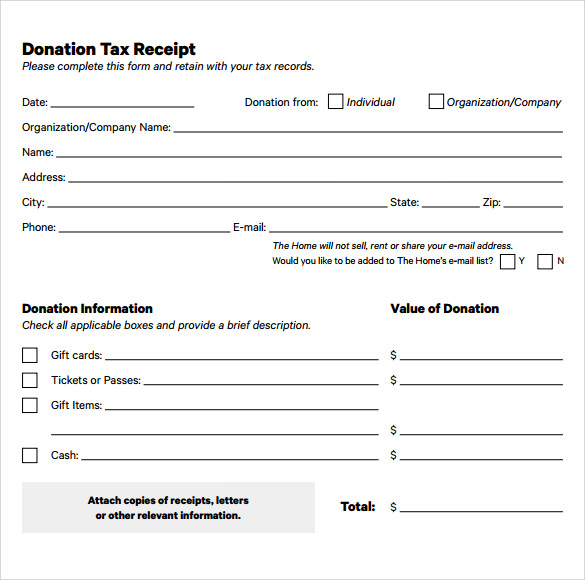

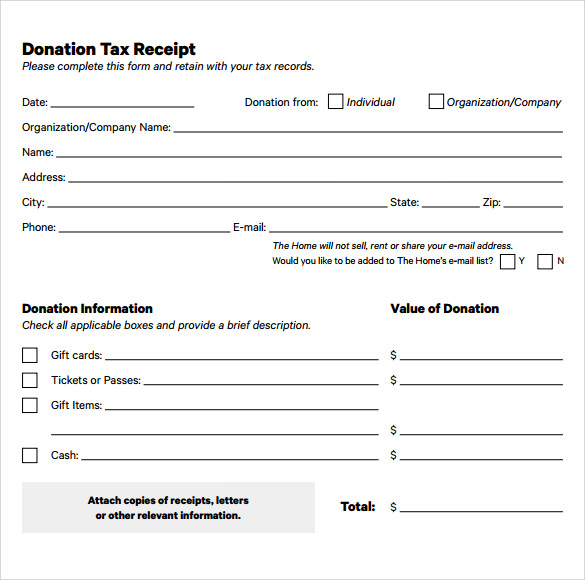

Browse Our Example Of Tax Receipt For Donation Template Receipt

https://i.pinimg.com/originals/88/49/6d/88496d91d13bcb909c03ec93216394a1.jpg

Deduction For Donations Given To Political Parties FinancePost

https://financepost.in/wp-content/uploads/2022/05/donation-to-political-party-678x381.jpg

https://taxguru.in/income-tax/contribution...

Section 80GGC of the Income Tax Act provides tax deductions for contributions made to political parties The amount of deduction that can be claimed depends on the mode of payment If the

https://news.cleartax.in/navigating-tax-deductions...

For example if a taxpayer has a Gross Tax Income of Rs 10 00 000 and has donated Rs 2 00 000 to a political party they can claim a deduction of Rs

Political Party Donations Now Tax Deductible Says Government

Browse Our Example Of Tax Receipt For Donation Template Receipt

Donation Receipts For Providing Services Smith Neufeld Jodoin LLP

Donor Tax Receipt Template Premium Printable Receipt Templates

Free Images Writing Receipt Giving Charity Label Brand Document

7 Donation Receipt Templates And Their Uses Gambaran

7 Donation Receipt Templates And Their Uses Gambaran

Raunak Haldipur The Aam Aadmi Party And How It Handles Donations My

Trick Of The Trade How Sadhguru s Isha Foundation Evades Paying Taxes

Nonprofit Tax Deductible Receipt Template

Is Donation To Political Party Tax Deductible In India - Technically a donor can claim full deduction on the donation made to a party registered under section 29A of Representation of the People Act 1951 However