Is Federal Fuel Tax Credit Taxable Income A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel emulsion A credit for exporting dyed fuels or gasoline

Use Form 4136 to claim A credit for certain nontaxable uses or sales of fuel during your income tax year The alternative fuel credit Aa credit for blending a diesel water fuel When using a fuel for a different purpose a taxpayer is likely to be exempt from the fuel excise tax As discussed below while a taxpayer may use fuel for a nontaxable use for

Is Federal Fuel Tax Credit Taxable Income

Is Federal Fuel Tax Credit Taxable Income

https://stnonline.com/wp-content/uploads/2022/10/fuel-pump-money-back-1536x1024.jpg

Are Federal Fuel Tax Changes On The Horizon Rigzone

https://images.rigzone.com/images/news/articles/165667_582x327.png

Opinion A Missed Chance For Rationality About Federal Fuel Taxes

https://www.washingtonpost.com/wp-apps/imrs.php?src=https://arc-anglerfish-washpost-prod-washpost.s3.amazonaws.com/public/ICJV4KGS2EI6XJJ2HNKFB7OKPI.jpg&w=1440

The one most familiar to taxpayers is probably the federal gas tax 18 3 cents gallon as of 2023 which pays for road projects across the country Certain uses of fuels are untaxed however and fuel A 2013 IRS Chief Counsel Advice memorandum CCA 2013 42 010 held that when a taxpayer has no fuel tax liability a refundable credit does not need to be

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act retroactively reinstated and extended the following fuel tax credits Including the Fuel Tax Credit in Income Include any credit or refund of excise taxes on fuels in your gross income if you claimed the total cost of the fuel including the excise

Download Is Federal Fuel Tax Credit Taxable Income

More picture related to Is Federal Fuel Tax Credit Taxable Income

State Gas Tax Rates State Gas Tax Rankings Luglio 2021 Tax

https://files.taxfoundation.org/20210727173044/2021-gas-tax-rates-and-2021-state-gas-tax-rankings.-How-much-is-gas-tax-rates-in-each-state.-Which-state-has-the-highest-gas-tax-rate..png

Fuel Tax Credit Eligibility Form 4136 How To Claim

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEijO1qAMs_napos3v0ETHe96cx_283MPXVZQXocehgFGkIZ6xTYr0RfHfLiwzClgt1pNmbyCoGSW95DXvx_9PPk5WwQI6RomoDtBDcEFIVgflW04uIRTkMDrLhIZsWQ-upuVniwQQasrHnIe-nOvNw5SD0rXmfOFwsR1N0ob2tG3q6cavZuiSNBND-j/s762/ftc.jpg

Claim The Federal Fuel Tax Credit Holden Moss CPAs

http://static1.squarespace.com/static/5afc8b41372b96fdacff8bd6/5b15663a5ebcd56563dc4615/5b1566d25ebcd56563dc5e78/1617904499482/?format=1500w

Using Form 4136 businesses can claim a tax credit for federal excise taxes paid on fuel effectively reducing their overall tax liability This can be a substantial The federal fuel tax credit provided through Form 4136 is not considered taxable income This means that businesses can claim the credit to reduce their federal

This publication covers federal fuel tax credits you may be able to claim on your income tax return It also covers fuel tax refunds you may be able to claim during the year This Is federal fuel tax credit taxable income The fuel tax credit provided by Form 4136 can reduce your income tax liability but you may still need to include the

ERTC Tax Credit Taxable YouTube

https://i.ytimg.com/vi/mM99M6_-obY/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGHIgSCg8MA8=&rs=AOn4CLDXB36TnUHfu6AOLk9Np42IR5yFaA

Your Construction Company May Be Able To Claim The Fuel Tax Credit

https://www.jrcpa.com/wp-content/uploads/Your-construction-company-may-be-able-to-claim-the-fuel-tax-credit-1024x534.jpg

https://www.irs.gov/instructions/i4136

A credit for certain nontaxable uses or sales of fuel during your income tax year A credit for blending a diesel water fuel emulsion A credit for exporting dyed fuels or gasoline

https://www.irs.gov/forms-pubs/about-form-4136

Use Form 4136 to claim A credit for certain nontaxable uses or sales of fuel during your income tax year The alternative fuel credit Aa credit for blending a diesel water fuel

Is The Employee Retention Tax Credit Taxable The Lake Law Firm

ERTC Tax Credit Taxable YouTube

Standard Deduction U s 16 ia For Ay 2021 22 Standard Deduction 2021

Is The Ertc Tax Credit Taxable Income

Is The ERC Tax Credit Taxable

Tax Filing Chart 2023 Printable Forms Free Online

Tax Filing Chart 2023 Printable Forms Free Online

Is The Employee Retention Tax Credit Taxable Authentic Information

Is The Employee Retention Credit Taxable Income ERC Bottom Line Savings

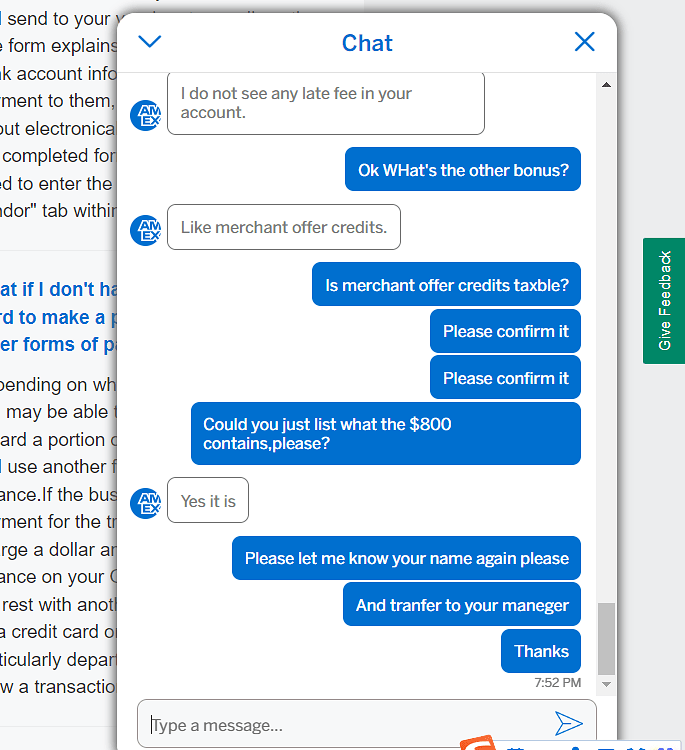

AMEX Merchant Offer Credit Is Taxable

Is Federal Fuel Tax Credit Taxable Income - IRS Form 4136 Credit for Federal Tax Paid on Fuels enables certain taxpayers to claim a fuel credit depending on the type of fuels used and the type of business use the credit is claimed for