Is Fixed Deposit Taxable Fixed Deposits FDs under Section 80C can yield tax benefits but interest income is taxable TDS is deducted when interest exceeds Rs 40k or Rs 50k for senior citizens Reporting interest income is necessary to avoid higher tax slabs at maturity

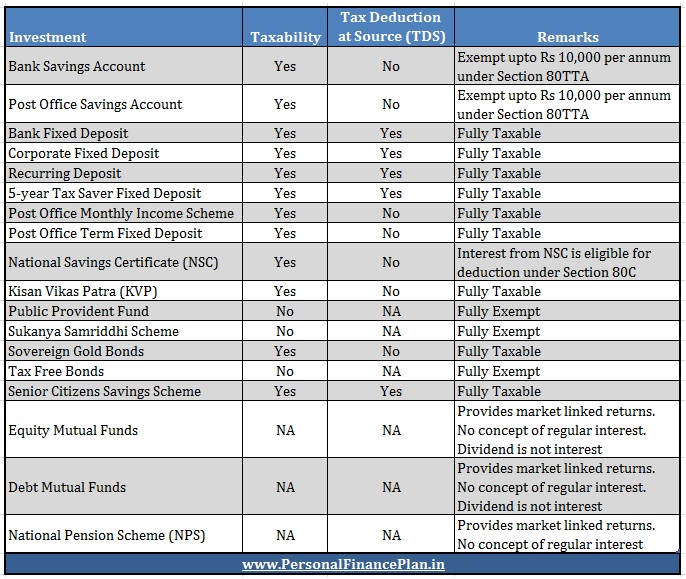

Fixed deposit interest is fully taxable If you file an income tax return you must include this amount under Income from Other Sources FD interest is taxed at your slab rate plus any applicable surcharge cess The interest earned on a Fixed Deposit FD is subject to tax based on the income tax slab you fall into There is TDS Tax Deducted at Source on FD interest along with any applicable surcharge or cess For example if your total annual income is above Rs 10 lakh you fall into a 30 tax slab

Is Fixed Deposit Taxable

Is Fixed Deposit Taxable

https://freosave.com/wp-content/uploads/2023/03/Is-Fixed-Deposit-Taxable.jpg

How Is Interest Income From Your Investments Taxed Personal Finance Plan

http://www.personalfinanceplan.in/wp-content/uploads/2017/04/20170420-Taxation-of-interest-income-tax.jpg

Fixed Deposits Investment In Chennai EarnWealth

https://earnwealth.in/citywise_loan_pages/images/FixedDeposit.png

The amount of Fixed Deposit FD that is tax free depends on the type of FD and the investor s tax slab For individuals and Hindu Undivided Families HUFs who are in the highest tax slab of 30 the interest earned on FDs is fully taxable A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961 Any investor can claim a deduction of a maximum of Rs 1 5 lakh per annum by investing in a tax saving fixed deposit account

Use our fixed deposit calculator to find out your potential earnings on your investment Our user friendly FD calculator makes it easy to determine your interest rate and returns Learn more You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account The scheme ensures returns along with capital protection However you must note that the interest income from the account is fully taxable

Download Is Fixed Deposit Taxable

More picture related to Is Fixed Deposit Taxable

Bank FD Is Fixed Deposit Interest Taxable Mint

https://images.livemint.com/img/2022/09/21/1600x900/2121f67c-3986-11ed-aa0a-736e94ef98be_1663748552861.jpg

Tax On Fixed Deposit FD How Much Tax Is Deducted On Fixed Deposits

https://www.hdfcsales.com/blog/wp-content/uploads/2021/06/tax-deduction-on-fixed-deposit.jpg

Comparing Fixed Deposit Rates Post Office Vs SBI And Other Banks

https://www.india.com/wp-content/uploads/2021/03/Bank-Fixed-Deposits.jpg

The interest earned from FDs is a taxable income and is subject to tax deductions This deduction of tax is known as Tax Deducted at Source TDS It is deducted before making the final Chin Hui Shan SINGAPORE A 27 year old man will be charged on Sept 5 for allegedly cheating his customers of 348 000 by promoting fictitious fixed deposit products with high interest rates

[desc-10] [desc-11]

What Is Fixed Deposit A Guide By BIATConsultant

https://www.biatconsultant.com/blog/wp-content/uploads/2019/08/1-955x449.jpg

Ghim Tr n Fixed Deposit Account

https://i.pinimg.com/originals/1b/57/70/1b577024f8558589793c9f786835e3d4.jpg

https://cleartax.in/s/income-tax-on-fixed-deposit-interest

Fixed Deposits FDs under Section 80C can yield tax benefits but interest income is taxable TDS is deducted when interest exceeds Rs 40k or Rs 50k for senior citizens Reporting interest income is necessary to avoid higher tax slabs at maturity

https://moneyview.in/fixed-deposit/is-fd-interest-taxable

Fixed deposit interest is fully taxable If you file an income tax return you must include this amount under Income from Other Sources FD interest is taxed at your slab rate plus any applicable surcharge cess

NRE FD Is Interest On NRE Fixed Deposit Taxable

What Is Fixed Deposit A Guide By BIATConsultant

Fixed Deposit Meaning Types Documents And Eligibility

Savings

What Is Taxable Income And How To Calculate Taxable Income

Is Recurring Deposit Taxable

Is Recurring Deposit Taxable

How To Calculate FD Interest

Axis Bank FD Rates Fixed Deposit Interest Rates 2023 Kuvera

NRE FD Is Interest On NRE Fixed Deposit Taxable

Is Fixed Deposit Taxable - Use our fixed deposit calculator to find out your potential earnings on your investment Our user friendly FD calculator makes it easy to determine your interest rate and returns Learn more