Is Fuel Allowance Taxable Federal Board of Revenue FBR has issued a clarification on a news story published in the daily Express Tribune in its issue dated 14 th June 2021 regarding recent budget proposals on taxation of salary income

While allowances are helpful they are typically taxable Consider suggesting alternative approaches to your employer Fuel Card vs Fuel Allowance If you receive a fuel card billed to the company it s not considered part of your salary and therefore not taxable 1 Taxable Salary Any salary received by an employee in a tax year which is not exempt from taxation under the ordinance will be subject to tax under the Salary category 2

Is Fuel Allowance Taxable

Is Fuel Allowance Taxable

https://nationalpensionhelpline.ie/wp-content/uploads/2022/10/fuel-allowance.png

Application Form For Fuel Allowance Under The National Fuel Scheme

https://handypdf.com/resources/formfile/htmls/10000/application-form-for-fuel-allowance-under-the-national-fuel-scheme/bg3.png

Waterford News Star New Online System For Fuel Allowance Scheme

https://waterford-news.ie/wp-content/uploads/2022/12/FuelAllowance.jpg

This document explains the tax computation and deduction for salaried persons in Pakistan for tax year 2003 It also provides the valuation of perquisites and benefits such as housing conveyance loan and medical allowance in salary Fuel allowance Flexible Benefit Plans allow organisations to include fuel costs in the salary structure of their employees Employees can claim a reimbursement of their petrol or diesel bills by submitting the bills to their employers Employees can save up to 30 tax on the amount of bills submitted

Significant exemptions available under salary income are as follows Medical allowance expenses Reimbursement of expenses on medical treatment or hospitalisation or both received by an employee is exempt from tax Medical allowance of up to 10 of basic salary is exempt if the facility of reimbursement of medical expenses is not Taxable Income means Total Income reduced by donations qualifying straight for deductions and certain deductible allowances Total Income Total Income is the

Download Is Fuel Allowance Taxable

More picture related to Is Fuel Allowance Taxable

Thousands Of Irish To Get 5 Weekly Boost To 33 Fuel Allowance Payment

https://www.thesun.ie/wp-content/uploads/sites/3/2022/09/NINTCHDBPICT000704722782.jpg

Fuel Allowance Ireland 2019 When Does Fuel Allowance 2019 20 Start

https://www.thesun.ie/wp-content/uploads/sites/3/2019/08/NINTCHDBPICT000469925069.jpg

What Date Is Fuel Allowance Lump Sum Paid YouTube

https://i.ytimg.com/vi/3wCdoe95Ihk/maxresdefault.jpg

Where taxable income exceeds Rs 4 000 000 but does not exceed Rs 6 000 000 Rs 680 000 32 5 of the amount exceeding Rs 4 000 000 Allowances and Benefits The attached document is classified by HMRC as guidance and contains information about rates and allowances for travel including mileage and fuel allowances Updates to

[desc-10] [desc-11]

What Is Taxable Income Explanation Importance Calculation Bizness

https://i1.wp.com/biznessprofessionals.com/wp-content/uploads/2020/02/Capture34.png?fit=2630%2C1497&ssl=1

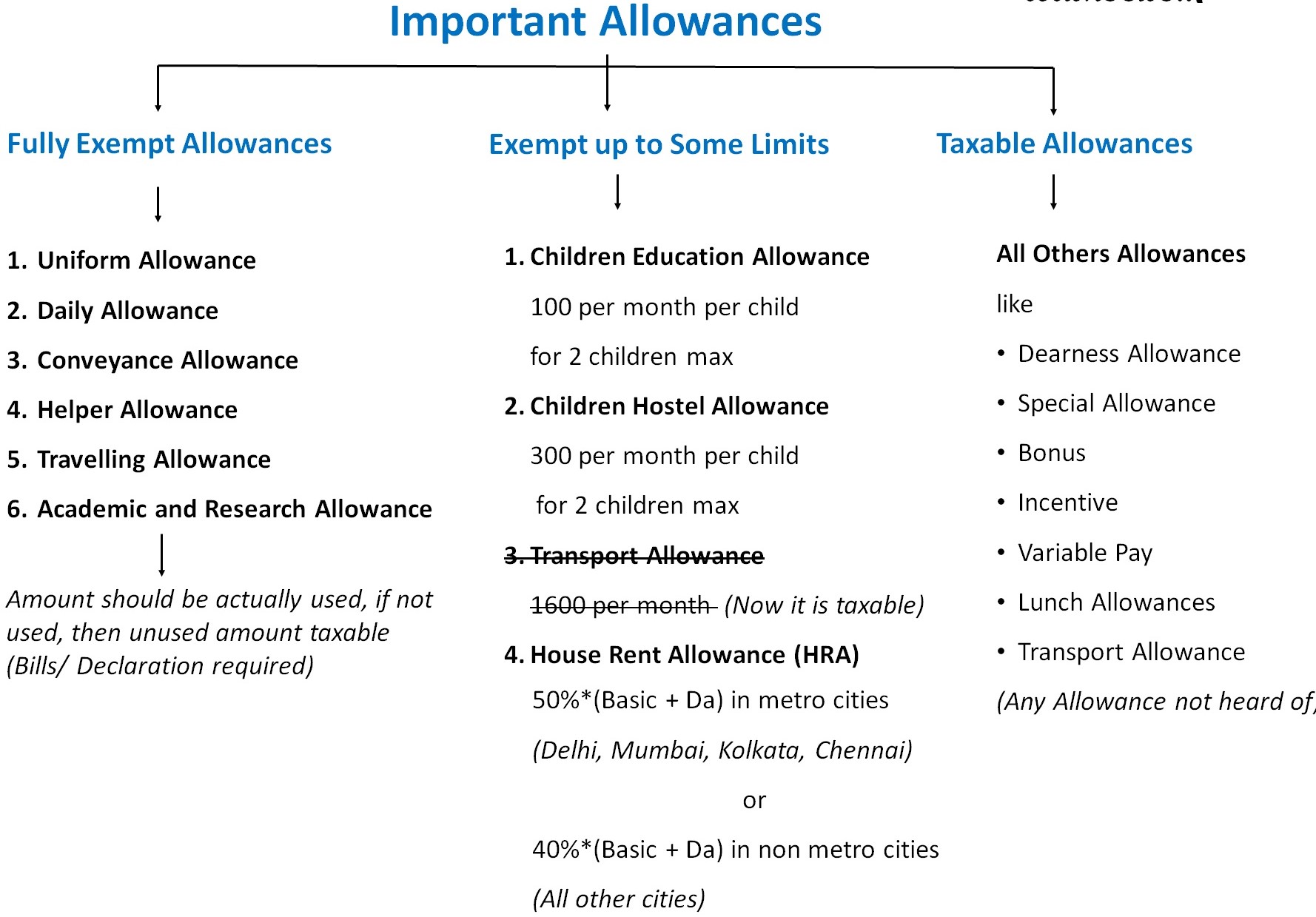

Types Of Allowance Taxable Non Taxable Partially Taxable

https://www.saralpaypack.com/wp-content/uploads/2020/01/Types-of-Allowance-Taxable-Non-Taxable-Partially-Taxable..jpg

https://www.fbr.gov.pk/tax-on-salary--fbr-issues-clarification/153022

Federal Board of Revenue FBR has issued a clarification on a news story published in the daily Express Tribune in its issue dated 14 th June 2021 regarding recent budget proposals on taxation of salary income

https://taxationpk.com/understanding-taxes-on-income-from-salary...

While allowances are helpful they are typically taxable Consider suggesting alternative approaches to your employer Fuel Card vs Fuel Allowance If you receive a fuel card billed to the company it s not considered part of your salary and therefore not taxable

John Paul O Shea Fuel Allowance Expansion Update John Paul O Shea

What Is Taxable Income Explanation Importance Calculation Bizness

2024 Fuel Allowance Form Fillable Printable PDF Forms Handypdf

New York Taxable Fuel Bond Surety Bond Authority

Annual Allowances YouTube

Iowa Taxable Fuel Bond Surety Bond Authority

Iowa Taxable Fuel Bond Surety Bond Authority

Missouri Taxable Fuel Bond Surety Bond Authority

Texas Taxable Fuel Bond Surety Bond Authority

All About Allowances Income Tax Exemption CA Rajput Jain

Is Fuel Allowance Taxable - Fuel allowance Flexible Benefit Plans allow organisations to include fuel costs in the salary structure of their employees Employees can claim a reimbursement of their petrol or diesel bills by submitting the bills to their employers Employees can save up to 30 tax on the amount of bills submitted