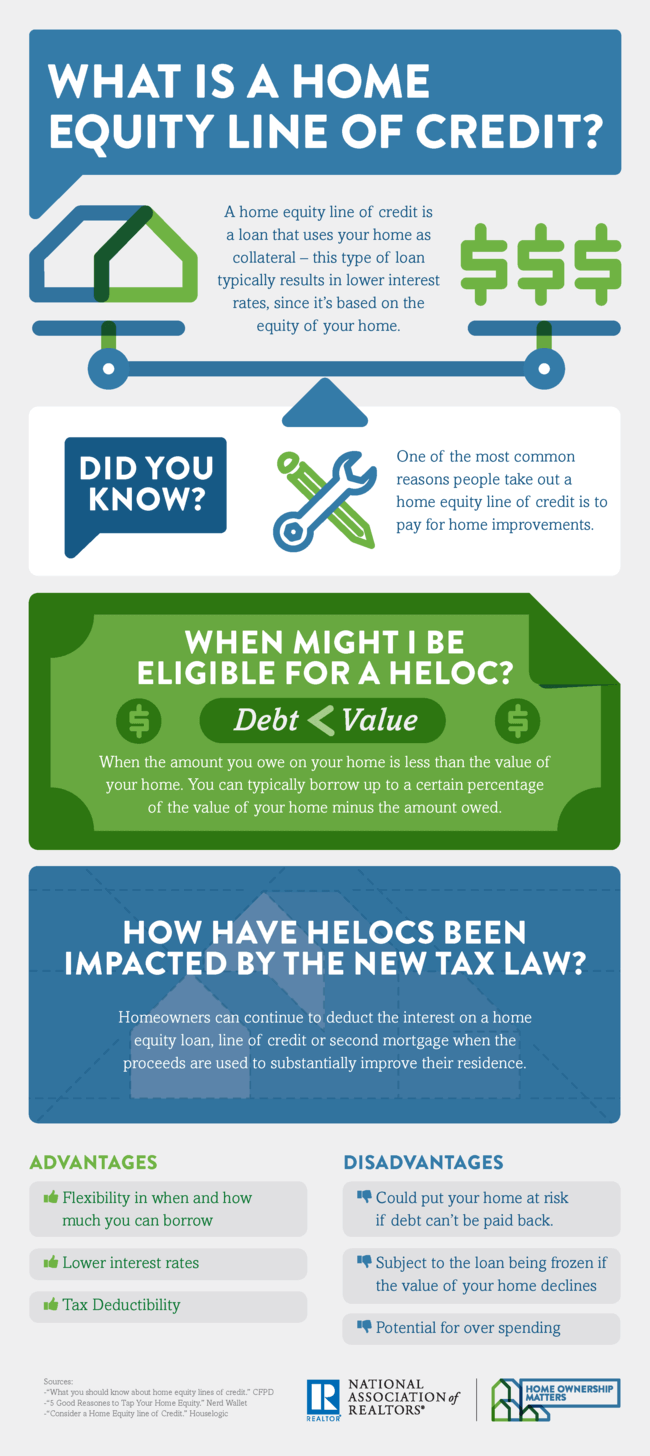

Is Home Equity Loan Interest Tax Deductible In 2021 Verkko 28 jouluk 2022 nbsp 0183 32 Interest paid on a home equity loan or a home equity line of credit HELOC can still be tax deductible Don t take out a home equity loan or a HELOC

Verkko As it has been for decades mortgage interest is deductible as an itemized deduction and will be reported on your Schedule A Interest paid on home equity loans and HELOCs are also deductible on Verkko 1 jouluk 2023 nbsp 0183 32 Yes the interest from your home equity loan will be tax deductible in 2024 However it is possible changes may come

Is Home Equity Loan Interest Tax Deductible In 2021

Is Home Equity Loan Interest Tax Deductible In 2021

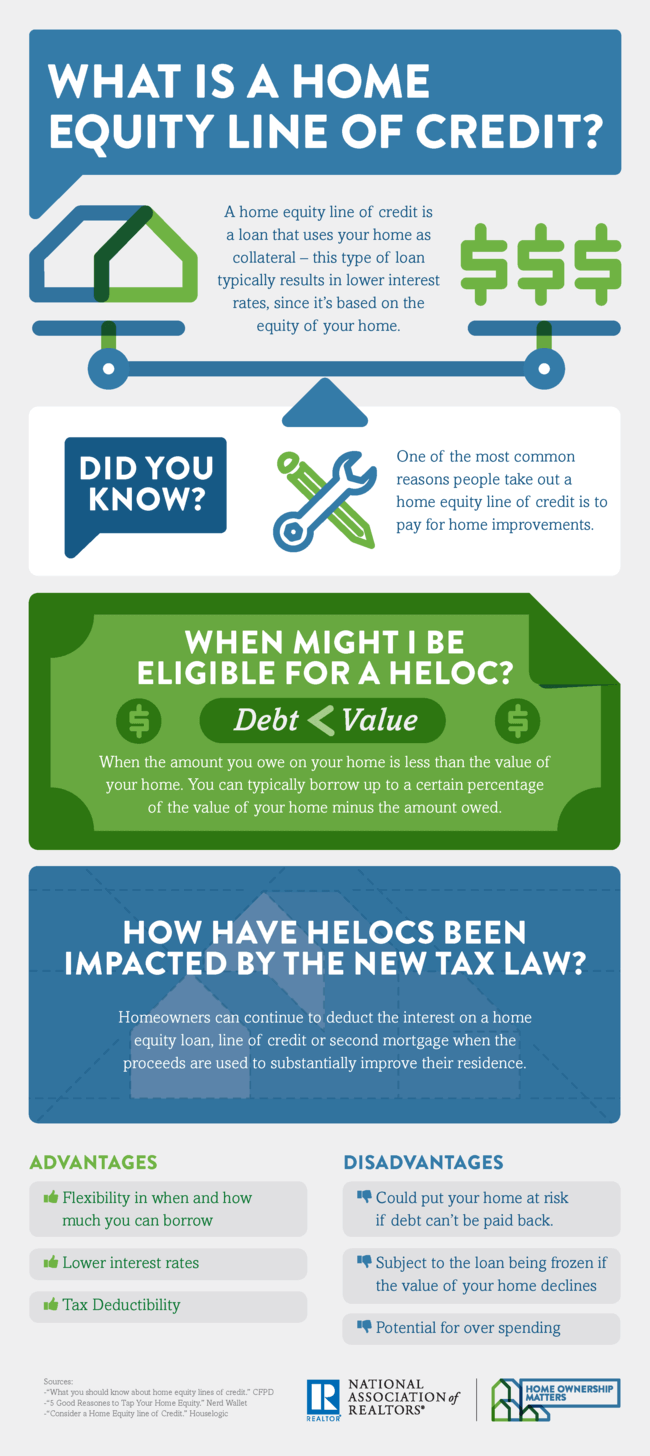

https://homeownershipmatters.realtor/wp-content/uploads/2018/07/HELOC_Infographic-Normal.png

Is Home Equity Loan Interest Tax Deductible

https://corvee.com/wp-content/uploads/2021/07/BLOG-Is-Home-Equity-Loan-Interest-Tax-Deductible-in-2021_1000X429.jpg

Is Home Equity Loan Interest Tax Deductible In 2021

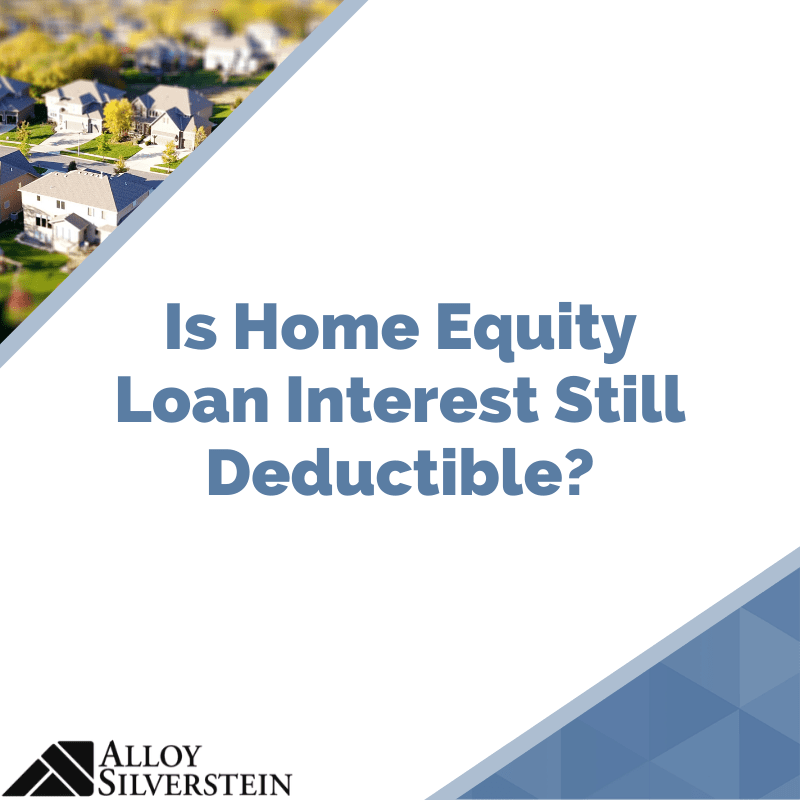

https://corvee.com/wp-content/uploads/2021/07/Screen-Shot-2021-07-28-at-3.33.00-PM.png

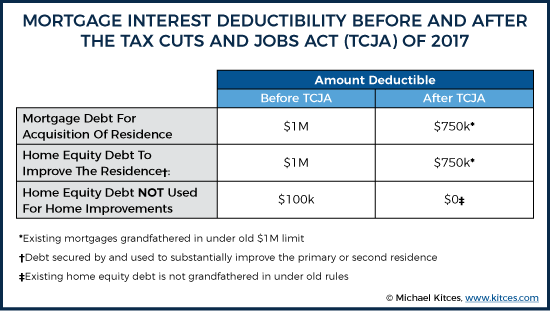

Verkko 21 jouluk 2023 nbsp 0183 32 To deduct the interest paid on your home equity loan or on a home equity line of credit known as a HELOC you ll need to Verkko 5 hein 228 k 2023 nbsp 0183 32 For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750 000 That cap includes your existing mortgage balance one vacation or second home and any deductible

Verkko 28 jouluk 2023 nbsp 0183 32 Rules on deducting home equity loan HELOC or second mortgage interest The home mortgage interest deduction allows you to deduct interest paid on your home equity loan in a Verkko 4 kes 228 k 2023 nbsp 0183 32 Despite provisions in the Tax Cut and Jobs Act TCJA home equity loan interest still may be deductible for some homeowners along with interest on

Download Is Home Equity Loan Interest Tax Deductible In 2021

More picture related to Is Home Equity Loan Interest Tax Deductible In 2021

New Tax Law Home Equity Loan Deductibility

https://www.lendingtree.com/content/uploads/2018/12/7-Home-Equity-infographic.png

Is Home Equity Loan Interest Still Deductible Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2020/01/Home-Equity.png

How Does A Home Equity Loan Work REVOLUTION REPORTS

https://www.visionbank.com/media/cms/HELOC_916px01_19435591CA1A5.jpg

Verkko 4 lokak 2022 nbsp 0183 32 Therefore the interest on the home equity loan is not tax deductible Partially deductible mortgage loan In January 2022 Kat took out a 500 000 Verkko 7 tammik 2023 nbsp 0183 32 According to the IRS interest on home equity loans or home equity lines of credit is not tax deductible if the borrowed amount is not used to buy build or

Verkko 20 maalisk 2023 nbsp 0183 32 Yes interest on home equity loans is tax deductible but only if you use the loan to buy build or substantially improve a qualified home Under IRS rules Verkko 4 tammik 2023 nbsp 0183 32 If you took out your home equity loan after Dec 15 2017 joint filers can deduct interest of up to 750 000 375 000 for single filers If however your

Interest On Home Equity Loans Is No Longer Tax Deductible Main Line

https://mainlinehomesales.files.wordpress.com/2018/01/home-equity-interest-no-longer-tax-deductible.png?w=1200

How To Calculate A Home Equity Loan

http://www.vertex42.com/Files/screenshots/HomeEquityLoanCalculator-1.jpg

https://www.investopedia.com/home-equity-tax-deductions-5271403

Verkko 28 jouluk 2022 nbsp 0183 32 Interest paid on a home equity loan or a home equity line of credit HELOC can still be tax deductible Don t take out a home equity loan or a HELOC

https://corvee.com/.../is-home-equity-loan-in…

Verkko As it has been for decades mortgage interest is deductible as an itemized deduction and will be reported on your Schedule A Interest paid on home equity loans and HELOCs are also deductible on

Are Home Equity Loans Tax Deductible In 2023 Orchard

Interest On Home Equity Loans Is No Longer Tax Deductible Main Line

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Mortgages Vs Home Equity Loans What s The Difference 2022

Home Equity Loans Can Be Tax Deductible NextAdvisor With TIME

Tax Deductions For Home Mortgage Interest Under TCJA

How Many Home Loans Are Eligible For Tax Exemption Leia Aqui How Many

How Many Home Loans Are Eligible For Tax Exemption Leia Aqui How Many

Is Interest On A Home Equity Line Of Credit Tax deductible

Who Is Responsible For A Home Equity Loan

Is Home Equity Loan And Mortgage Interest Still Tax Deductible

Is Home Equity Loan Interest Tax Deductible In 2021 - Verkko 28 jouluk 2023 nbsp 0183 32 Rules on deducting home equity loan HELOC or second mortgage interest The home mortgage interest deduction allows you to deduct interest paid on your home equity loan in a