Is Home Equity Loan Interest Tax Deductible Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or substantially

Home equity loan and HELOC interest may be tax deductible if the borrowed money was used to buy build or improve your home Under these rules you could potentially deduct home equity loan interest up to the maximum limits if you Buy a primary residence or second home using a home equity loan or HELOC Build a primary residence or second home using a home equity loan or HELOC Make home improvements to your primary residence or second home

Is Home Equity Loan Interest Tax Deductible

Is Home Equity Loan Interest Tax Deductible

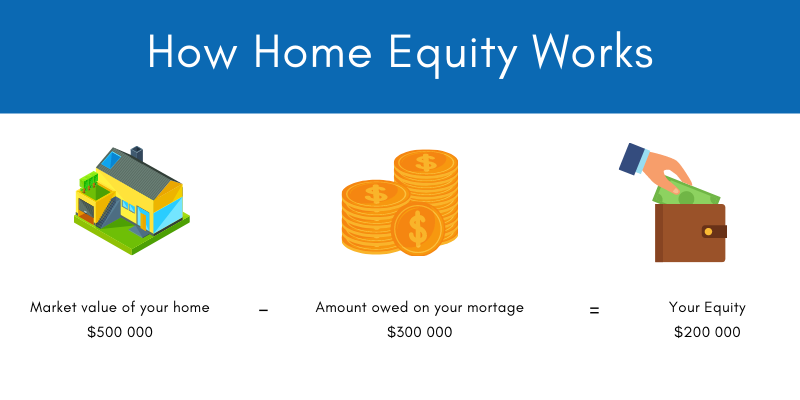

https://www.homerunfinancing.com/wp-content/uploads/2021/07/how-to-calculate-home-equity-954x750.png

Home Equity Loans Swoosh Finance

https://www.swooshfinance.co.nz/wp-content/uploads/2020/10/How-Home-Equity-Works.png

Can You Deduct Home Equity Loan Interest From Taxes

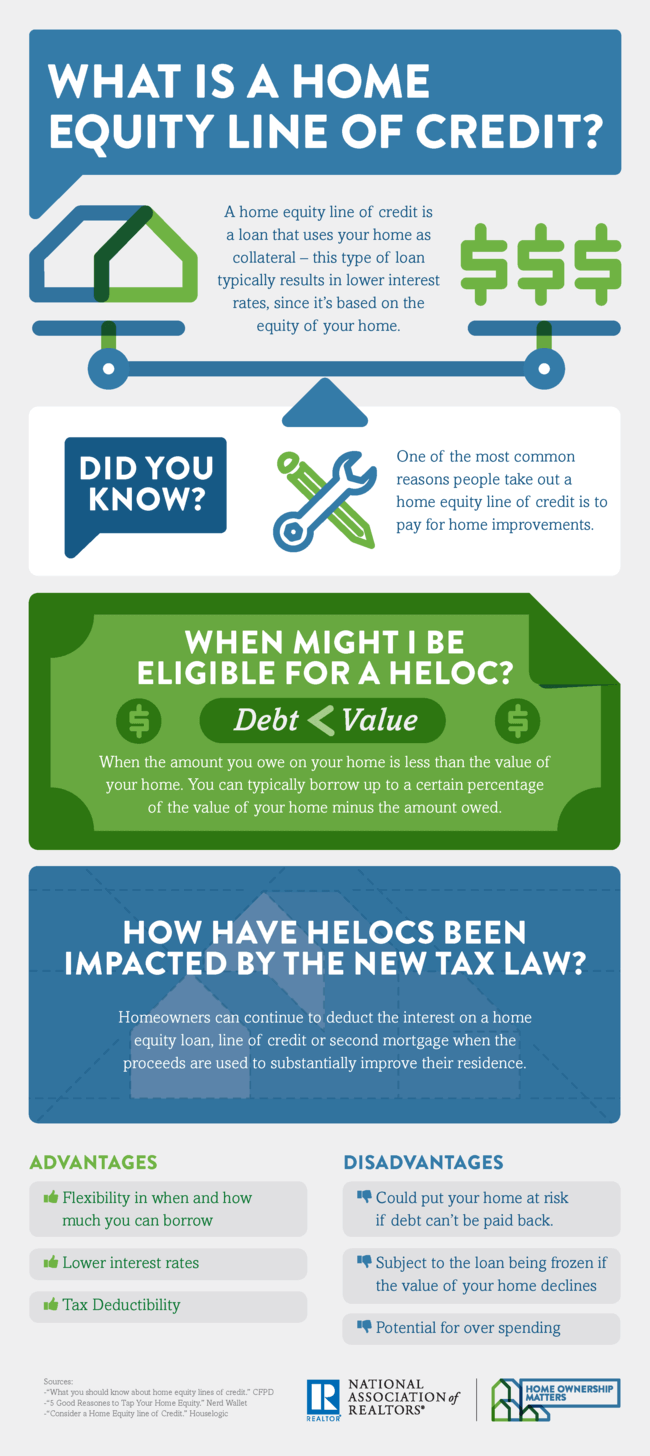

https://homeownershipmatters.realtor/wp-content/uploads/2018/07/HELOC_Infographic-Normal.png

According to the Tax Cuts and Jobs Act home equity loan interest is tax deductible through 2026 This means you can deduct your home equity loan interest if it meets the IRS guidelines and you itemize your deductions The interest on a home equity loan is tax deductible provided the funds were used to buy or build a home or make improvements to one as defined by the IRS However if the combined

The interest you pay on a home equity loan may be tax deductible if you use the proceeds to make substantial changes to your home the loan is secured by your first or second home and you intend to repay the loan Interest paid on a home equity loan or a home equity line of credit HELOC can still be tax deductible Don t take out a home equity loan or a HELOC just for the tax deduction

Download Is Home Equity Loan Interest Tax Deductible

More picture related to Is Home Equity Loan Interest Tax Deductible

What Is Home Equity And What Can It Do For You Credible

https://www.credible.com/blog/wp-content/uploads/2021/01/Ways-to-tap-your-home-equity-infographic-2x.png

How Home Equity Loans Affect Taxes Optima Tax Relief

https://optimataxrelief.com/wp-content/uploads/2022/10/2022-optima-tax-home-equity-loans-scaled.jpg

5 Tips For Choosing A Home Equity Loan In 2021 Best Finance Blog

https://www.bestfinance-blog.com/wp-content/uploads/2021/04/AdobeStock_165000956-scaled.jpeg

For tax years before 2018 and after 2025 for home equity loans or lines of credit secured by your main home or second home interest you pay on the borrowed funds may be deductible subject to certain dollar limitations regardless of how you The short answer is yes the interest you pay on home equity loans can be tax deductible But it depends on how you use your loan

If you use a home equity loan or HELOC to renovate or improve your home the interest you pay on it is tax deductible But if you use that money for any other purpose it won t serve as a tax According to the Internal Revenue Service interest on a home equity loan or home equity line of credit is deductible if the borrowed funds are used for home improvements upgrades or

Is Home Equity Loan Interest Still Deductible Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2020/01/Home-Equity.png

Home Equity Loan Full Guide How It Works YouTube

https://i.ytimg.com/vi/zD567J7RrvY/maxresdefault.jpg

https://www.investopedia.com/mortgage/heloc/tax-deductible

Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build or substantially

https://www.nerdwallet.com/article/mortgages/home...

Home equity loan and HELOC interest may be tax deductible if the borrowed money was used to buy build or improve your home

5 Things To Know About Equity In The Home

Is Home Equity Loan Interest Still Deductible Alloy Silverstein

What Is A Home Equity Loan Market Business News

:max_bytes(150000):strip_icc()/home_equity.asp-final-59af37ca6ebe48f3a1e0fd6e4baf27e4.png)

Home Equity What It Is How It Works And How You Can Use It

Interest On Home Equity Loans Is No Longer Tax Deductible Main Line

What Is A Home Equity Loan YouTube

What Is A Home Equity Loan YouTube

Home Equity Loan Vs Line Of Credit Debt Consolidation Home Sweet Home

Home Equity Loan Vs Line Of Credit Cobalt Credit Union

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)

How A Home Equity Loan Works Rates Requirements Calculator

Is Home Equity Loan Interest Tax Deductible - The interest you pay on a home equity loan may be tax deductible if you use the proceeds to make substantial changes to your home the loan is secured by your first or second home and you intend to repay the loan