Is Home Loan Included In New Tax Regime You can still claim deduction on home loan interest The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b The

Interest paid on housing loan taken for a rented out property can be claimed as deduction under section 24 b even in the new proposed tax regime Budget 2020 has proposed a Tax deduction for interest paid on housing loan As the property was self occupied or vacant interest paid on a housing loan for such a property might be

Is Home Loan Included In New Tax Regime

Is Home Loan Included In New Tax Regime

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

Opinion It s Time For A New Tax Regime The Daily Iowan

https://dailyiowan.com/wp-content/uploads/2022/06/taxop.jpg

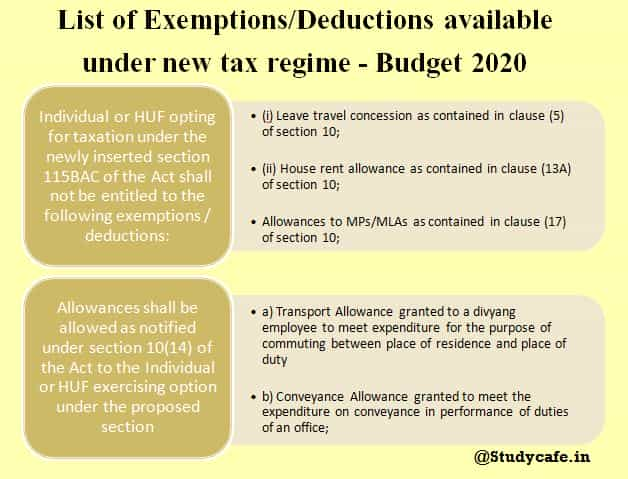

Deductions Allowed Under The New Income Tax Regime Paisabazaar Com

https://studycafe.in/wp-content/uploads/2020/02/List-of-ExemptionsDeductions-available-under-new-tax-regime-Budget-2020-1.jpg

If you financed your home purchase with a loan and you have let it out you can claim a deduction for the interest paid under both old and new tax regimes In So for these houses the interest on home loan municipal taxes paid and the standard deduction of 30 both are available in the new tax regime Vacant house An

Income Tax Benefits on Home Loans in the New Income Tax Regime Under the new income tax return policy you can t get an exemption on the home loan interest rate When deciding which tax regime to opt for those with a home loan may prefer the old tax regime as it still allows many deductions not available under the new regime A home

Download Is Home Loan Included In New Tax Regime

More picture related to Is Home Loan Included In New Tax Regime

New Tax Regime Vs Old Tax Regime Which Is Better Yadnya Investment Vrogue

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

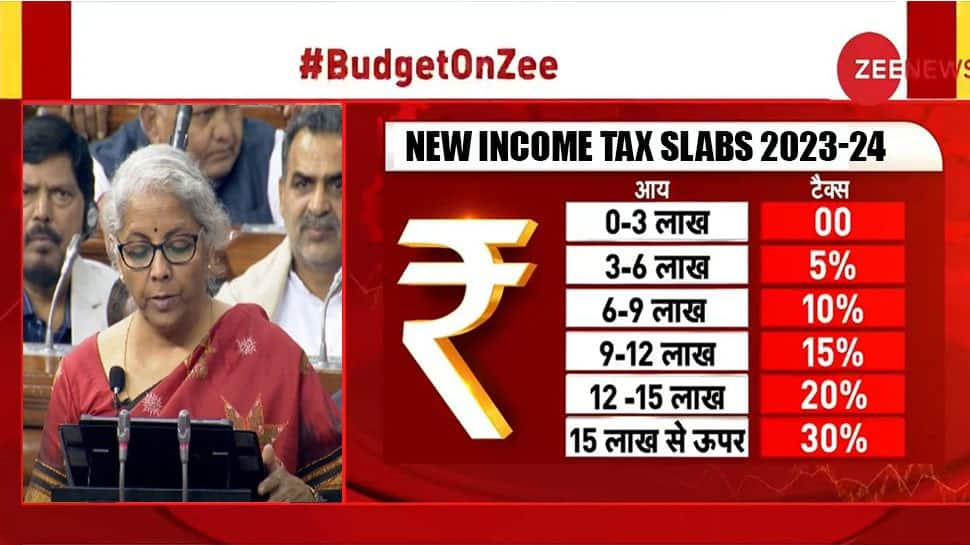

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675260619284.png

How To Choose Between The New And Old Income Tax Regimes Chandan

https://images.moneycontrol.com/static-mcnews/2022/02/New-vs-old-tax-regime-Make-a-wise-choice-R.jpg

While the new tax regime offers lower tax rates it does not provide certain deductions and exemptions that are available under the old tax regime including On one hand the old tax regime provides higher deductions on interest principal payments on home loans while on the other hand the new regime provides

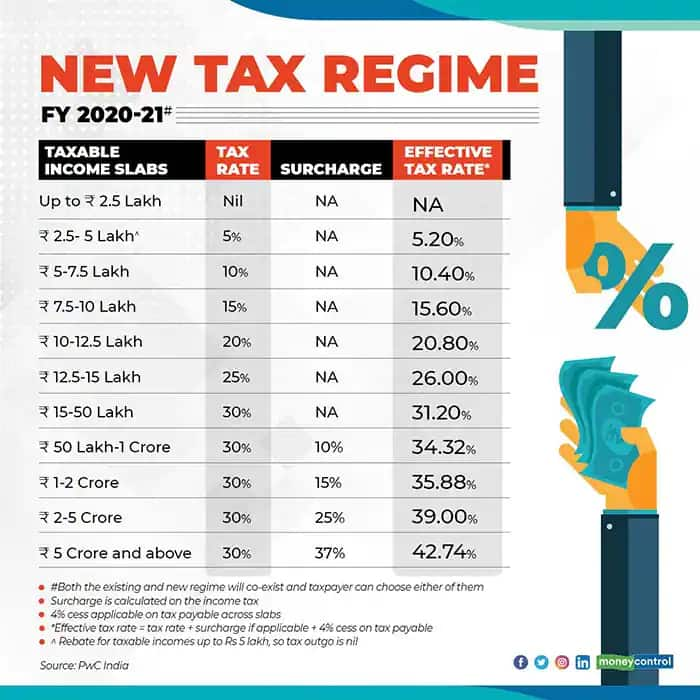

The new tax regime for which you will file your returns in AY2021 22 allows you to pay a lower rate of tax But to avail it you must forgo your tax deductions such as New and old How two tax regimes work for home loan interest benefit You can benefit under the new tax regime but there are a few caveats Premium

Budget 2023 What Are New And Old Income Tax Regimes Which One Should

http://cachandanagarwal.com/wp-content/uploads/2023/01/32015B22-AD0B-4418-9070-2B476CF26ECC.jpeg

Old Versus New Regime Thousands Use Tax Department s Calculator To

https://images.cnbctv18.com/wp-content/uploads/2023/02/tax2.jpg

https://www. livemint.com /money/personal-finance/...

You can still claim deduction on home loan interest The tax rules still allows deduction on interest paid towards loan on a rented property under section 24 b The

https:// economictimes.indiatimes.com /wealth/tax/...

Interest paid on housing loan taken for a rented out property can be claimed as deduction under section 24 b even in the new proposed tax regime Budget 2020 has proposed a

Income Tax Rule 2023 Did New Slabs Confuse You Regarding ZERO Tax On

Budget 2023 What Are New And Old Income Tax Regimes Which One Should

Changes In New Tax Regime All You Need To Know

Income Tax Clarification Opting For The New Income Tax Regime U s

Rebate Limit New Income Slabs Standard Deduction Understanding What

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

New Income Tax Regime Vs Old Key Things To Consider Budget 2023 Regimes

Exemptions Still Available In New Tax Regime with English Subtitles

Old Vs New Tax Regime Choose YouTube

Home Loan Interest Rate New Tax Regime Allows Deduction Of Interest On

Is Home Loan Included In New Tax Regime - Income Tax Benefits on Home Loans in the New Income Tax Regime Under the new income tax return policy you can t get an exemption on the home loan interest rate