Is Home Loan Principal Tax Deductible No principal payments are not tax deductible Think about it you didn t have to include the receipt of your mortgage loan in income when you took it out so you

Principal no The principal is the total amount you borrow from the lender Your principal is not deductible The portion of your house payment You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second home

Is Home Loan Principal Tax Deductible

Is Home Loan Principal Tax Deductible

https://i.ytimg.com/vi/FN9poyqaIBw/maxresdefault.jpg

Are Personal Loans Tax Deductible Atlantic Financial FCU

https://www.affcu.org/files/AdobeStock_522272961-1280x853.jpeg

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy build or substantially improve the taxpayer s home that secures the loan The loan must be secured by the To be deductible the interest you pay must be on a loan secured by your main home or a second home regardless of how the loan is labeled The loan can be a first or second

Under current law the home mortgage interest deduction HMID allows homeowners who itemize their tax returns to deduct mortgage interest paid on up to What mortgage interest is tax deductible To take the mortgage interest deduction the interest paid must be on a qualified home Your first and second home

Download Is Home Loan Principal Tax Deductible

More picture related to Is Home Loan Principal Tax Deductible

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

The Best Home Loan Rates Offered By Leading Banks Mint

https://www.livemint.com/lm-img/img/2023/10/02/1600x900/asd_1694759178592_1696219420086.jpg

What Is Home Loan Interest Rate Documents Required

https://www.loomsolar.com/cdn/shop/articles/home_loan_d1490422-8834-4a6e-ad9b-c3eff815053a.jpg?v=1692945293

If you ve closed on a mortgage on or after Jan 1 2018 you can deduct any mortgage interest you pay on your first 750 000 in mortgage debt 375 000 for married taxpayers who file separately The principal paid on the home loan EMI for the year is allowed as a deduction under section 80C The maximum amount that can be claimed under this

Interest on a home equity line of credit HELOC or a home equity loan is tax deductible if you use the funds for renovations to your home the phrase is buy build Mortgage points are fees paid to a lender at closing in exchange for a lower interest rate on a home loan Generally the IRS allows you to deduct the full amount of your points in

Company Tax Relief 2023 Malaysia Printable Forms Free Online

https://ringgitplus.com/en/blog/wp-content/uploads/2022/03/income-tax_everything-you-should-claim_ya2021.jpg

Understanding The Different Types Of Mortgage Loans INFOGRAPHIC

https://assets.site-static.com/userFiles/4283/image/Blog/Infographics/Understanding_the_Types_of_Mortgage_Loans.png

https://moneydoneright.com/taxes/personal-taxes/...

No principal payments are not tax deductible Think about it you didn t have to include the receipt of your mortgage loan in income when you took it out so you

https://blog.taxact.com/mortgage-payment

Principal no The principal is the total amount you borrow from the lender Your principal is not deductible The portion of your house payment

Understanding Home Loan Tax Benefits A Comprehensive Guide

Company Tax Relief 2023 Malaysia Printable Forms Free Online

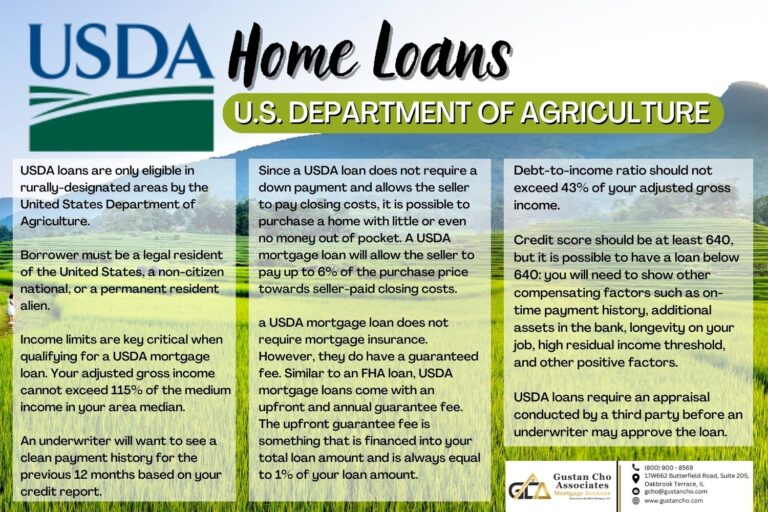

USDA Home Loan Requirements

Home Loan Interest Double Tax Deduction Benefit Removed In Budget 2023

What Are The Tax Benefit On Home Loan Calculate Loan Tax Benefits

Home Loan Rates Rise After Another RBI Repo Rate Hike How Much Will

Home Loan Rates Rise After Another RBI Repo Rate Hike How Much Will

Maximizing Home Loan Tax Benefits In India 2023

What Is Home Loan Statement Why Is It Important

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Is Home Loan Principal Tax Deductible - Yes you claim deductions on two home loans within the specific limit under Section 24 Rs 2 lakhs per annum if the properties are self occupied Only for your first