Is Loan Principal Tax Deductible Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax

Business Loans In most cases the interest you pay on your business loan is tax deductible This is true for bank and credit union loans car loans credit card Loan Principal and Taxes For Individuals Individual taxpayers may be able to deduct the amount they pay for loan interest each year depending on the type of loan For example

Is Loan Principal Tax Deductible

Is Loan Principal Tax Deductible

https://protium.co.in/wp-content/uploads/2022/10/loan-against-commercial-property.png

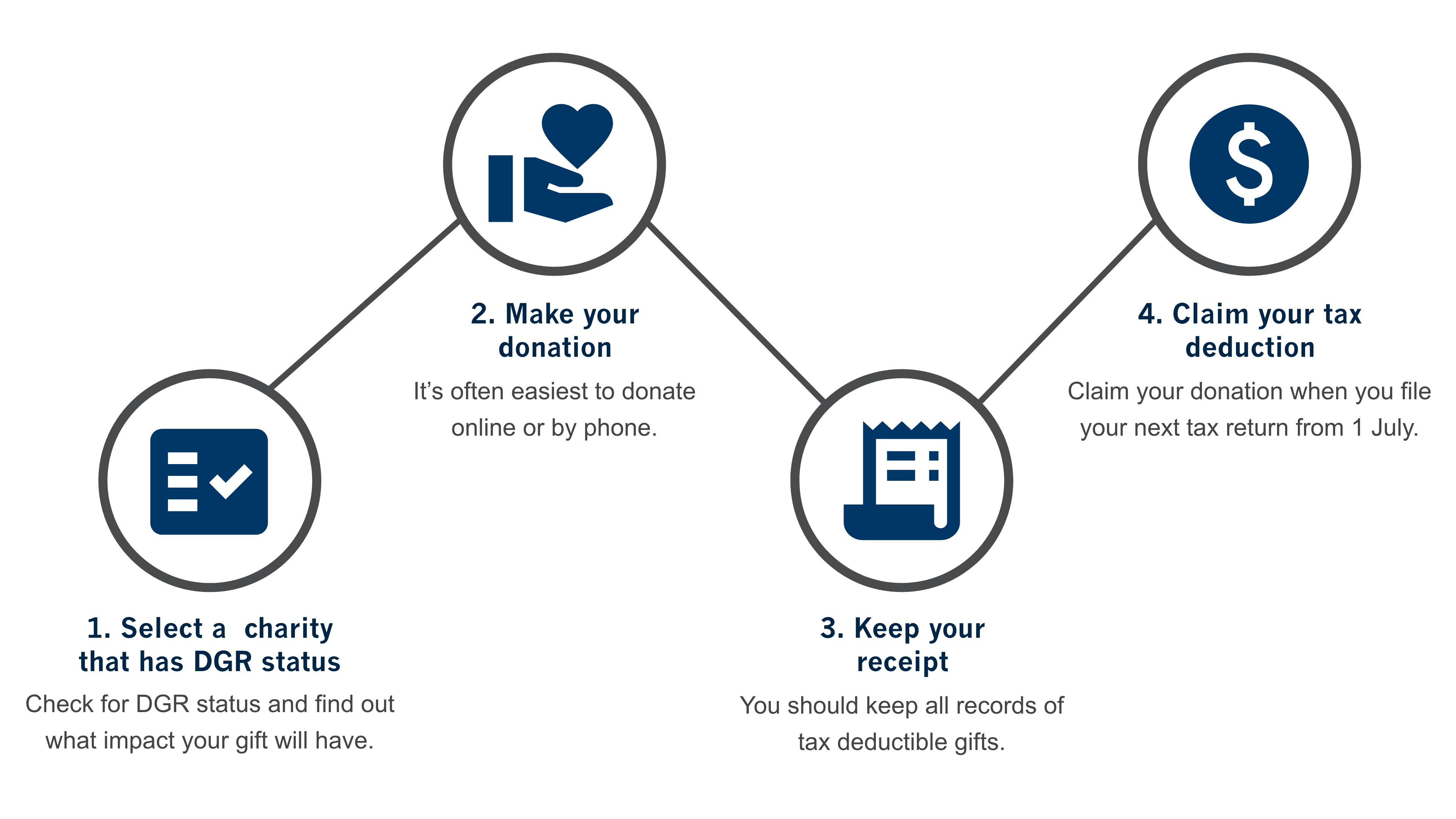

Donations To Charities Are Still Tax Deductible Charitable

https://i.pinimg.com/originals/cd/2e/96/cd2e960802d4b9bb0af533e8140cfd9d.gif

Tax Deductible Donations Reduce Your Income Tax Charity Tax Calculator

https://www.thesmithfamily.com.au/-/media/images/campaigns/tax-steps-infov2/Tax-page-infographicv2.png?h=2160&w=3840&la=en&hash=CD10B58E7976DC39CC2E07D255B005E2

Typically the repayment of a business loan s principal is not tax deductible but you can likely write off the interest that you pay on the loan The proceeds from a business loan will not be The interest you pay on a business loan is tax deductible if you meet specific criteria defined by the IRS Here s what you need to know about these criteria

No principal payments are not tax deductible Think about it you didn t have to include the receipt of your mortgage loan in income when you took it out so you don t get to The principal of a mortgage is the amount you borrow for the loan Your mortgage payments that go toward the principal reduce the loan balance These payments are not tax

Download Is Loan Principal Tax Deductible

More picture related to Is Loan Principal Tax Deductible

Tax Benefits On Home Loan Know More At Taxhelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Tax-benefits-on-Home-Loan-819x1024.jpeg

Tax Benefits Of Paying Home Loan EMI HDFC Sales Blog

https://www.hdfcsales.com/blog/wp-content/uploads/2021/10/benefits-of-paying-home-loan-emi.png

Image Representing Student Loan

https://pics.craiyon.com/2023-09-27/8c327ec78e37494388c5a2445ccd1c9c.webp

The loan is no more income than any other product or service that you pay for With a few exceptions you also cannot deduct your interest or principal payments on a personal loan for the same reason When you make Yes the interest portion of your student loan payments is tax deductible in 2022 However you cannot deduct the principal portion of your loan payments the amount that goes

Interest paid on personal loans car loans and credit cards is generally not tax deductible However you may be able to claim interest you ve paid when you file your taxes if you take Although the interest element of a loan is tax deductible Mark says the repayment of the principal or the sum amount borrowed is not Costs incurred in arranging a

What Does LVR Mean And Why Is It Important For A Home Loan NBS Home

https://www.nbshomeloans.com.au/wp-content/uploads/2022/02/nbs-home-loans-finance-broker-seven-hills-sydney-finance-articles-lvr-loan-to-value-ratio-header.jpg

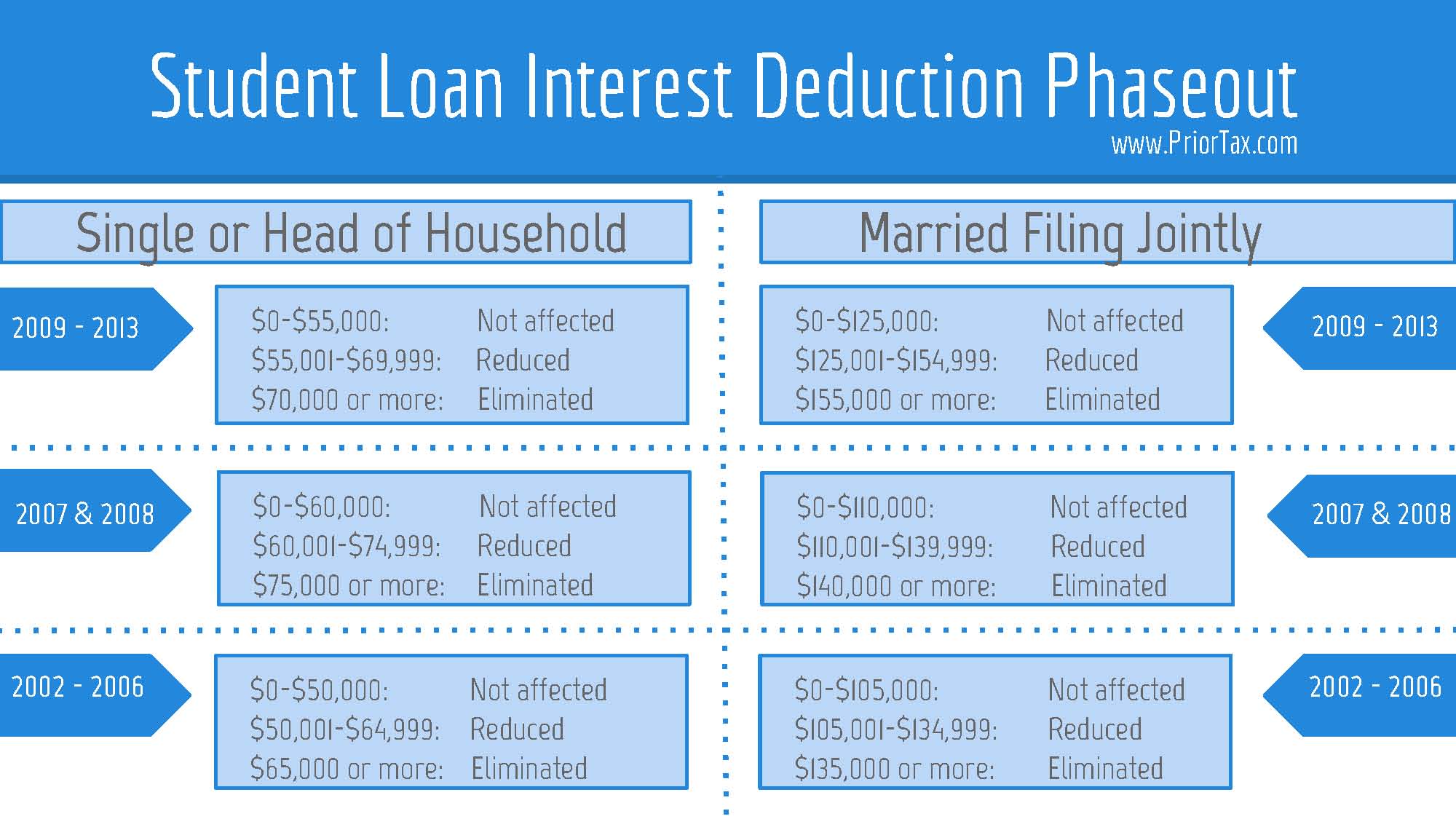

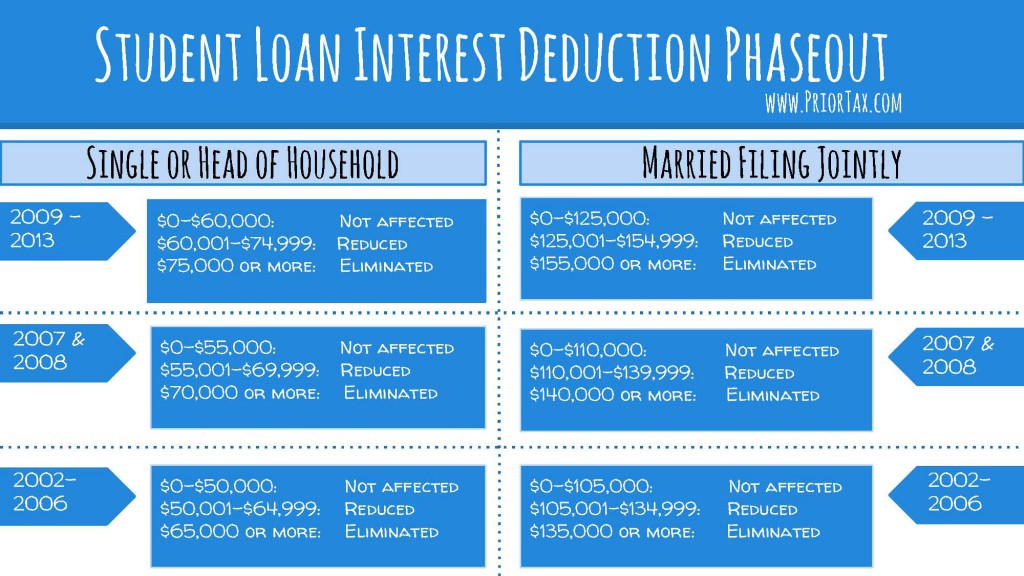

Is Student Loan Interest Tax Deductible RapidTax

http://blog.priortax.com/wp-content/uploads/2014/02/Student-Loan-Interest-Deduction-20131.jpg

https://www.investopedia.com/terms/t/tax-deductible-interest.asp

Tax deductible interest is a borrowing expense that a taxpayer can claim on a federal or state tax return to reduce their taxable income Several types of interest are tax

https://www.thimble.com/blog/are-business-loan...

Business Loans In most cases the interest you pay on your business loan is tax deductible This is true for bank and credit union loans car loans credit card

Tax Deduction Letter Sign Templates Jotform

What Does LVR Mean And Why Is It Important For A Home Loan NBS Home

Your Separation Agreement Impacts Whether Spousal Support Payments Are

Student Loan Interest Deduction 2013 PriorTax Blog

Is Your Business Loan Tax Deductible

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is My Business Loan Repayment Tax Deductible IIFL Finance

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Company Tax Deductible Or Not Santos Business Services

Is Loan Principal Tax Deductible - It s possible that the interest you re paying on your business loan is tax deductible This means that you may be able to subtract that amount you paid in interest from your