Is Hsa Contribution Tax Deductible A health savings account or HSA is a tax advantaged account that those with coverage under a high deductible health plan HDHP can use to save for qualified medical expenses and

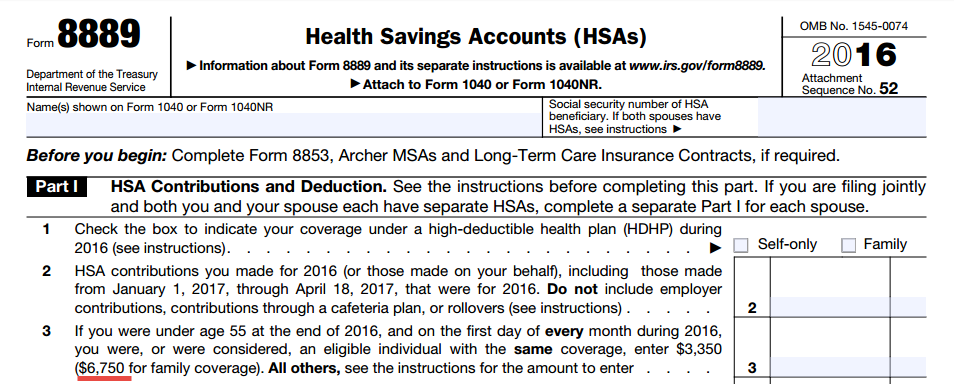

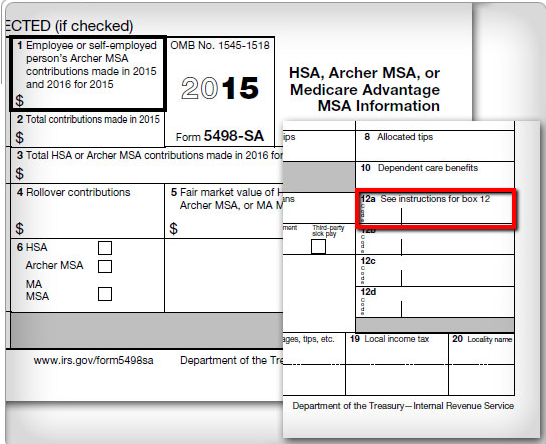

When you make your own HSA contributions you contribute during the year with after tax money before to deducting them on your tax return line 25 on Form 1040 regardless of whether you itemize deductions or take the standard The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses

Is Hsa Contribution Tax Deductible

Is Hsa Contribution Tax Deductible

https://i0.wp.com/www.raablog.com/wp-content/uploads/2016/10/HSA.jpg?fit=800%2C526&ssl=1

2024 HSA HDHP Limits

https://www.cbiz.com/Portals/0/CBIZ_HCM/Images/2024-HSA-HDHP-Limits-Graphics.jpg

Max Hsa Contribution 2024 Family Deductions Audi Marena

https://medcombenefits.com/images/uploads/blog/2023_HSA_Limits_Table.jpg

A health savings account is a tax advantaged savings account combined with a high deductible health insurance policy to provide an investment and health coverage Deposits to the HSA are tax deductible and grow tax free An individual s direct contributions to an HSA are 100 tax deductible from the employee s income Earnings in the account are also tax free

Tax deductible Contributions to an HSA are tax deductible Growth without tax liability Any interest on the earnings in your HSA account grows tax free Tax free withdrawals Any withdrawal for a qualified medical All contributions to your HSA are tax deducible or if made through payroll deductions are pre tax which lowers your overall taxable income Your contributions may be 100 percent tax deductible meaning contributions can

Download Is Hsa Contribution Tax Deductible

More picture related to Is Hsa Contribution Tax Deductible

Is An HSA Right For Me

https://healthaccounts.bankofamerica.com/images/isanHSArightforyou_illus_HDHP-HSA_850x421.png

Hsa Contribution Limits For 2023 And 2024 Image To U

https://images.prismic.io/newfront/5eaebf24-2cce-43a7-b597-292edead893d_Screen+Shot+2023-05-23+at+9.49.27+AM.png?auto=compress,format

HSA Compatible High Deductible Health Plans Www westernhealth

https://www.westernhealth.com/wha/assets/Image/Diagram-PiggyBank.jpg

Yes HSA contributions may be tax deductible depending on how the funds are added to the account If you contribute money to your HSA through your paycheck you can not deduct the contribution on your tax return Are HSA contributions tax deductible In short contributions to an HSA made by you or your employer may be claimed as tax deductions even if you don t itemize deductions on a

Contributions to a health savings account HSA can be made by or on behalf of for example by a family member any eligible individual and are deductible by the eligible And unlike IRAs HSAs have no maximum income level to qualify for tax deductible contributions You can deduct contributions to HSAs at any income level If your

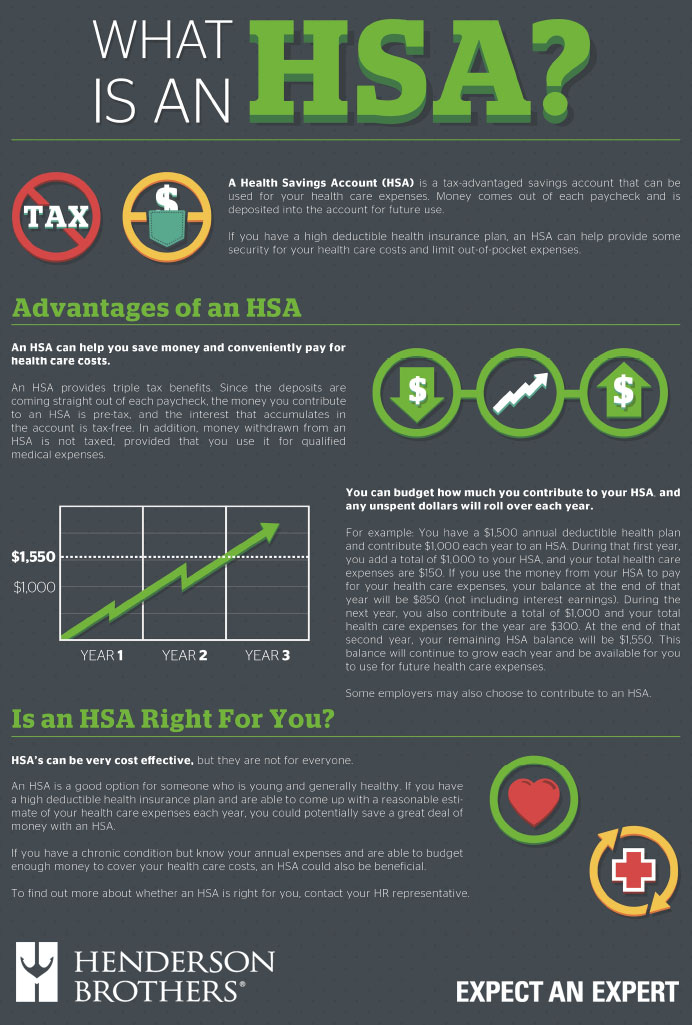

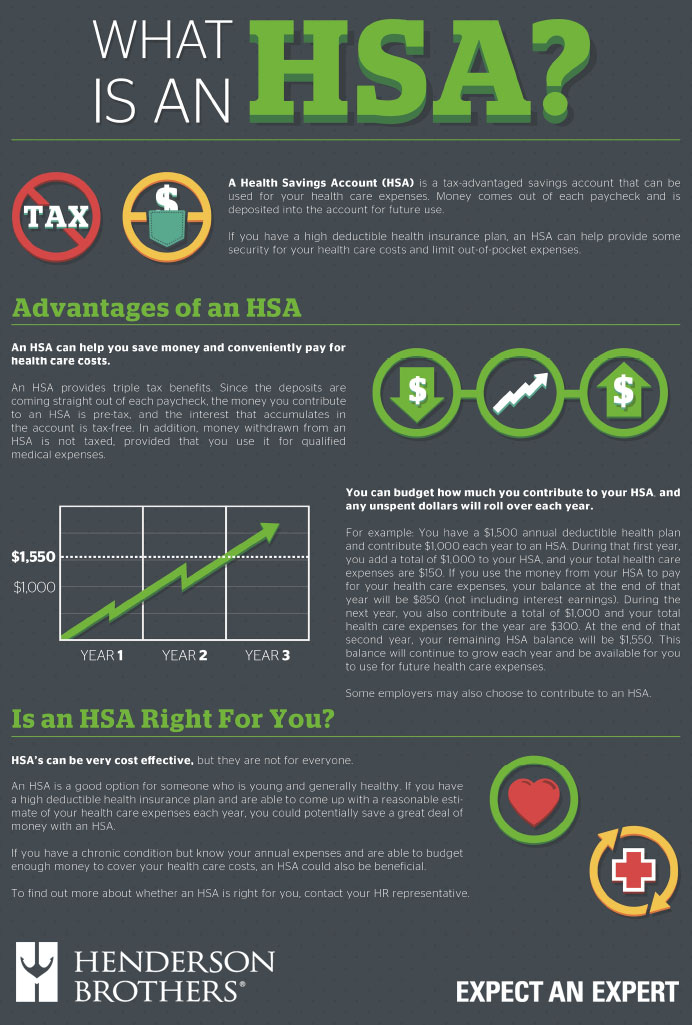

HSAs Health Savings Accounts Henderson Brothers

http://www.hendersonbrothers.com/wp-content/uploads/2017/09/HSA-inforgraphic.jpg

Solved Multiple Choice 5 2 Health Savings Accounts LO 5 1 Chegg

https://media.cheggcdn.com/media/fe6/fe6cf4f9-c3e3-4770-baf5-d7f0f7bc1463/phpgsLCY8

https://www.hrblock.com/tax-center/filing/...

A health savings account or HSA is a tax advantaged account that those with coverage under a high deductible health plan HDHP can use to save for qualified medical expenses and

https://hsastore.com/articles/learn-hsa-tax...

When you make your own HSA contributions you contribute during the year with after tax money before to deducting them on your tax return line 25 on Form 1040 regardless of whether you itemize deductions or take the standard

2023 IRS Contribution Limits And Tax Rates

HSAs Health Savings Accounts Henderson Brothers

2016 HSA Form 8889 Instructions And Example HSA Edge

Tabela Atualizado Irs 2023 Hsa Imagesee Vrogue co

2023 HSA Contribution Limits Increase Considerably Due To Inflation

Hsa Pre Tax Contribution Limits 2024 Tobye Leticia

Hsa Pre Tax Contribution Limits 2024 Tobye Leticia

How Do Employer Contributions Affect My HSA Limit HSA Edge

Irs 2022 Fsa Limits

Health Savings Accounts Contribution Limits Eligibility Rules Benefits

Is Hsa Contribution Tax Deductible - An individual s direct contributions to an HSA are 100 tax deductible from the employee s income Earnings in the account are also tax free