Is Interest Charged Taxable What Types of Interest Income Are Taxable Earned interest income is almost always taxable if it is earned in an account that isn t a tax deferred account such as a 401 k Some examples of

Tax treatment of interest income and interest expense Back to Advanced Taxation ATX How to approach Advanced Taxation Relevant to ATX MYS This article is relevant to Interest income becomes taxable when it s actually paid to you assuming you use the cash method of accounting and the vast majority of taxpayers do It might accrue in 2022 but if it s not credited to

Is Interest Charged Taxable

Is Interest Charged Taxable

https://i.pinimg.com/originals/fe/ca/85/feca8578870667d92e8413074d133608.jpg

How Is Interest Charged On A Margin Account Trading Thread

https://tradingthread.com/wp-content/uploads/2022/02/How-is-interest-charged-on-a-margin-account.png

Person Of Interest 2011

https://m.media-amazon.com/images/M/MV5BMjE3Mzk0NzQ0Nl5BMl5BanBnXkFtZTcwMzg4NTMwNw@@._V1_.jpg

Interest on bonds mutual funds CDs and demand deposits of 10 or more is taxable Taxable interest is taxed just like ordinary income Payors must file Form 1099 INT and send a copy to the Taxable interest income is simply the money you earn on investments for which you re required to pay taxes In most cases your tax rate on earned interest

Interest income and ordinary dividends qualified dividends are taxed at capital gains rates are taxed at the same rate as your ordinary income tax For example Interest Deduction A deduction for taxpayers who pay certain types of interest Interest deductions reduce the amount of income subject to tax The two main types of interest deductions are for

Download Is Interest Charged Taxable

More picture related to Is Interest Charged Taxable

Hassatou Aisha Diallo On Twitter RT bankofengland The Monetary

https://pbs.twimg.com/media/Fn9c4SUXgAEleAA.jpg

Fed Raising Interest Rates Duncan Oil Company

https://duncan-oil.com/wp-content/uploads/2015/12/shutterstock_313530239.jpg

Solved Jacques Is Getting Ready To Do His Taxes He Is Chegg

https://d2vlcm61l7u1fs.cloudfront.net/media/a94/a9468ccd-36b4-4c06-b25f-9c9c733e9183/phpjir3e3.png

The defaulted or unpaid interest is not income and is not taxable as interest if paid later When you receive a payment of that interest it is a return of capital that reduces the Is High Yield Savings Account Interest Taxable Savings account interest is taxable but don t let that scare you away from a high yield savings account Here s what you need to know

Knowing how much interest is taxable is easy all of it is taxable If you file a tax return at all you ll also need to report the interest you ve earned on your bank Most interest that you receive or that is credited to an account that you can withdraw from without penalty is taxable income in the year it becomes available to you

What Income Is Subject To The 3 8 Medicare Tax

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

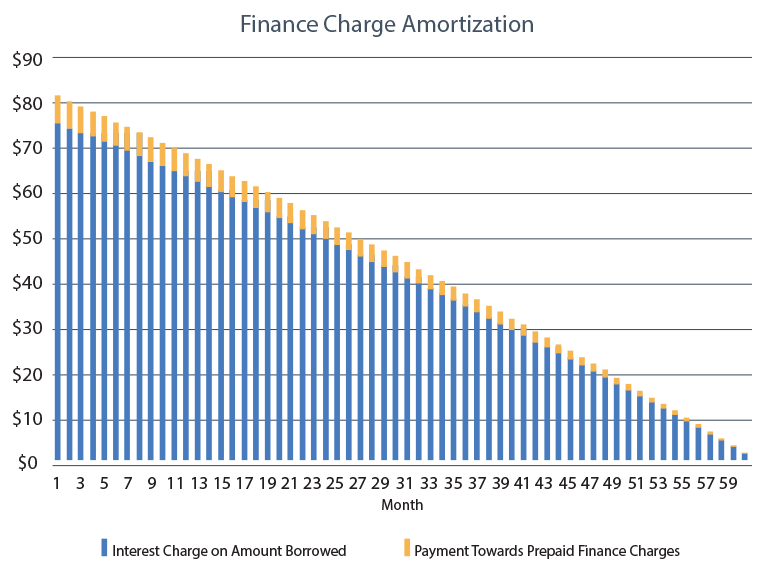

How Is Interest Charged Monthly Leia Aqui How Is Interest Charged Per

https://mytresl.com/wp-content/uploads/2020/01/FinanceChargeAmortizationChart-1.png

https://smartasset.com/taxes/how-much-inter…

What Types of Interest Income Are Taxable Earned interest income is almost always taxable if it is earned in an account that isn t a tax deferred account such as a 401 k Some examples of

https://www.accaglobal.com/gb/en/student/exam...

Tax treatment of interest income and interest expense Back to Advanced Taxation ATX How to approach Advanced Taxation Relevant to ATX MYS This article is relevant to

.png?format=1500w)

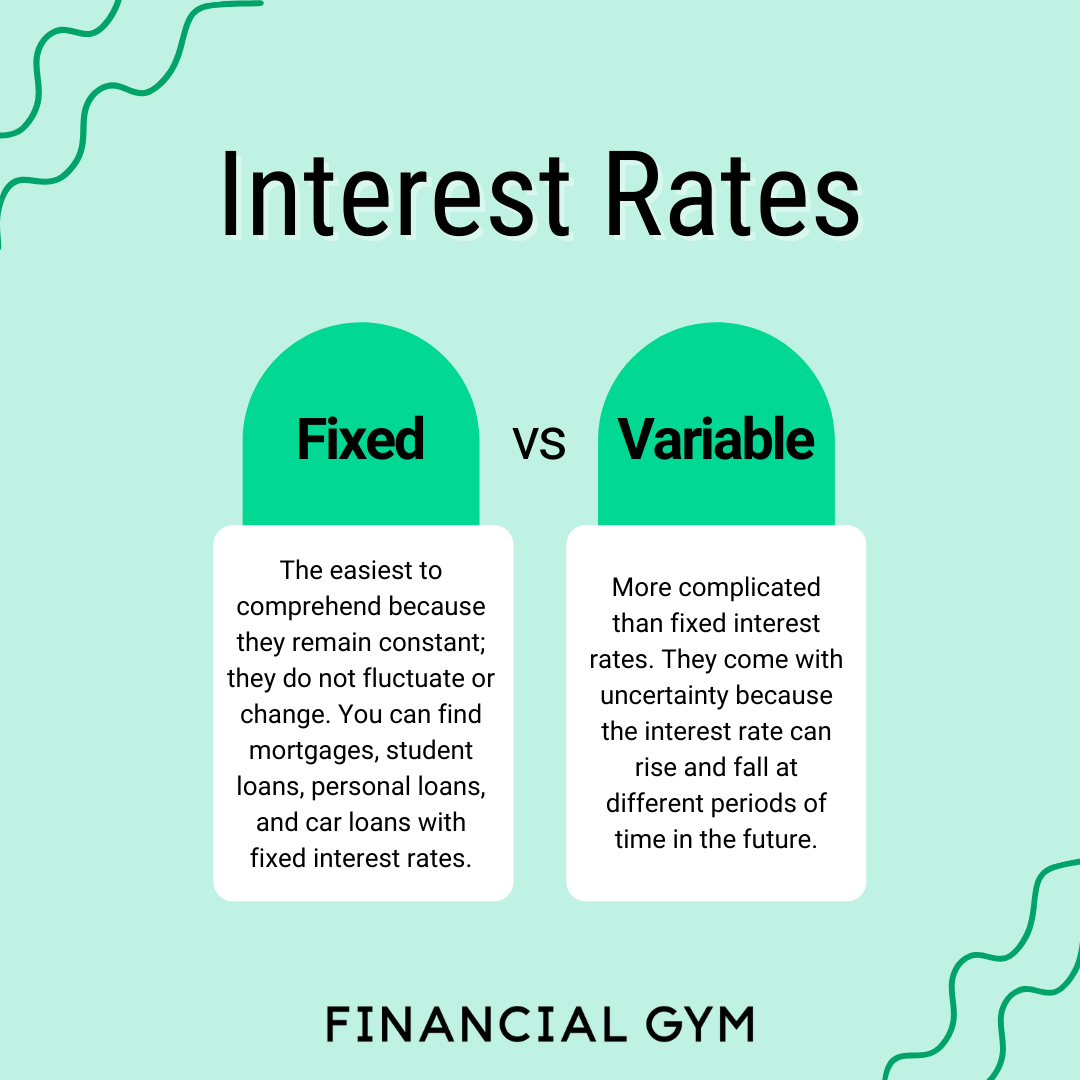

Fixed Vs Variable Interest Rates Student Loans CAREER KEG

What Income Is Subject To The 3 8 Medicare Tax

Fha Interest Rates Cheap Selling Save 41 Jlcatj gob mx

Fed Decision September 2020 Interest Rates Unchanged

What You Need To Know About Interest Rates DriveTime Blog

What Employers Can Expect From Biden s Presidency A Temporary

What Employers Can Expect From Biden s Presidency A Temporary

Compound Interest Calculator Google LaithQuinnlan

Where Could Interest And Tax Rates Be Headed Mercer Advisors

Interest Rate Clipboard Image

Is Interest Charged Taxable - The federal income taxes due on savings account interest are calculated as a percentage of your taxable income according to the current federal income tax brackets