Is Laundry Allowance Taxable In Australia Web 2 Feb 2021 nbsp 0183 32 A laundry allowance is a taxable allowance meaning it must be shown on your tax return as assessable income Your employer may also be required to withhold

Web 31 Mai 2022 nbsp 0183 32 diary records of your laundry costs if the amount of your laundry expenses claim is greater than 150 and your total claim for work related expenses exceeds 300 Web 4 Apr 2017 nbsp 0183 32 Reimbursements Super obligations when paying allowances As a payer you will have to know the correct withholding for allowances and the differences between as

Is Laundry Allowance Taxable In Australia

Is Laundry Allowance Taxable In Australia

https://www.taxslayer.com/blog/wp-content/uploads/2023/02/Taxable-vs-Nontaxable-Income-min-2.jpg

MA000018 Laundry Allowance

https://www.paycat.com.au/hubfs/Award images/MA000018.jpeg#keepProtocol

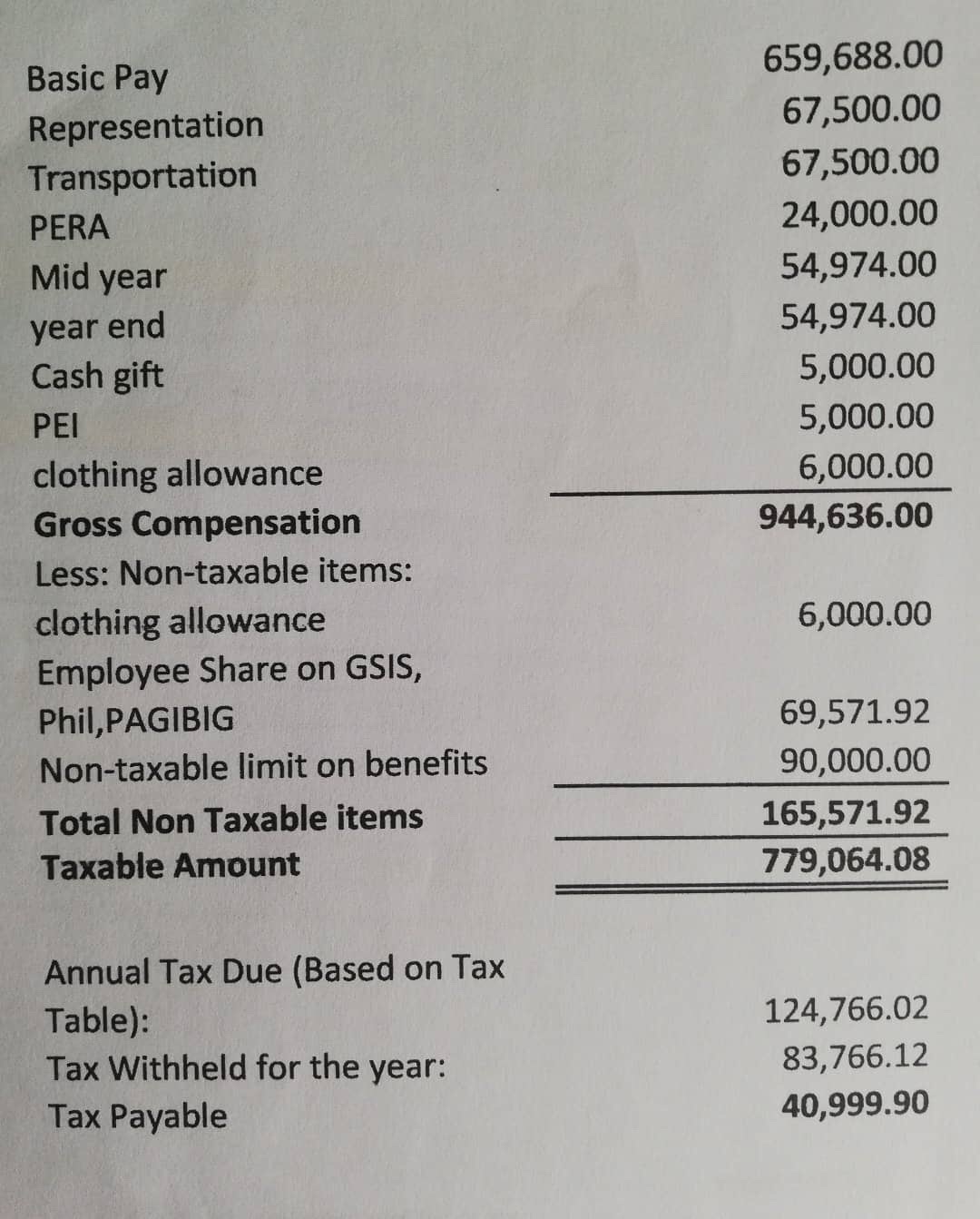

What Compensation Is Taxable And What s Not GABOTAF

https://gabotaf.com/wp-content/uploads/2020/01/img_3738.jpg

Web 4 Apr 2023 nbsp 0183 32 6 25 per week for a full time employee and 1 25 per shift for a part time or casual employee Under the RIA where an employee is responsible for laundering special clothing the employer must pay a Web By way of example both the GRIA and the FFIA contain a provision for a laundry allowance which stipulates If the employee is responsible for laundering any special clothing that is required to be worn by them the

Web 25 Sept 2019 nbsp 0183 32 To calculate the laundry expense including washing drying and ironing the ATO uses the figure of 1 per load if the load is made up only of work related clothing and 50c per load if you include Web Method of calculating expenses At home washing eligible work clothes only 1 per load At home washing eligible work clothes and other laundry items 50 cents per load

Download Is Laundry Allowance Taxable In Australia

More picture related to Is Laundry Allowance Taxable In Australia

Insurance Policies That Are Taxable In Australia Riskipia

https://riskipa.com/wp-content/uploads/2022/12/Insurance-Policies-that-are-Taxable-in-Australia--2048x1152.png

6 Common Mistakes You Make When Doing The Laundry OverSixty

https://oversixtydev.blob.core.windows.net/media/20363/shutterstock_375472924.jpg

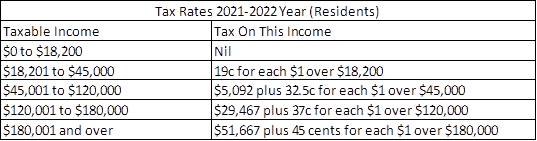

2022 Tax Brackets MeghanBrannan

https://www.downundercentre.com/wp-content/uploads/2022/02/Tax-Rates-2021-2022.png

Web 7 Apr 2017 nbsp 0183 32 Getting deductions for clothing and laundry expenses right Tax Deductions Australia The ATO allows certain taxpayers to claim a deduction for the cost of buying Web 15 Aug 2022 nbsp 0183 32 If you re doing the laundry at home or the laundromat you can claim 1 per load or 50c if you launder the clothing alongside other items For repairs and dry

Web It s possible to claim the costs of washing drying ironing and dry cleaning eligible work clothes Written evidence for your laundry expenses such as diary entries and receipts Web 4 Juli 2022 nbsp 0183 32 Work out costs you can claim for clothing laundry and dry cleaning expenses The allowance types in Table 5a are not considered OTE and SG does not apply See

Laundry Allowance Approved Uniform ATO Measure S W OTE E

https://hf-files-oregon.s3.amazonaws.com/hdpepaydaysupport_kb_attachments/2023/05-23/1f292dd3-3a53-4907-9002-09257760ca09/Laundry_Allowance_Approved_Uniform__ATO_Measure_SW__OTE.png

Carer Allowance Sa489 2022 2024 Form Fill Out And Sign Printable PDF

https://www.signnow.com/preview/611/745/611745160/large.png

https://community.ato.gov.au/s/question/a0J9s0000001HO1

Web 2 Feb 2021 nbsp 0183 32 A laundry allowance is a taxable allowance meaning it must be shown on your tax return as assessable income Your employer may also be required to withhold

https://www.ato.gov.au/individuals-and-families/your-tax-return/...

Web 31 Mai 2022 nbsp 0183 32 diary records of your laundry costs if the amount of your laundry expenses claim is greater than 150 and your total claim for work related expenses exceeds 300

Australian Withholding Tax Artist Escrow Services Pty Ltd

Laundry Allowance Approved Uniform ATO Measure S W OTE E

The Prescribed Travel Rate Per KM Increases And The Determined Travel

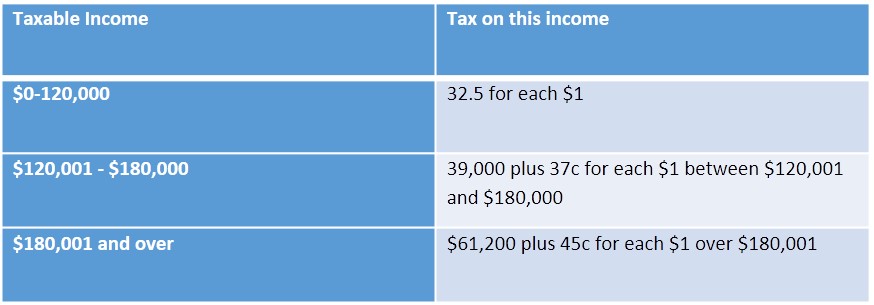

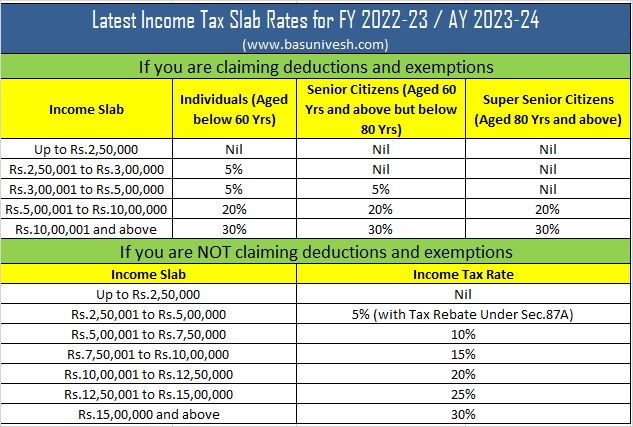

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Laundry Allowance C D Advisory

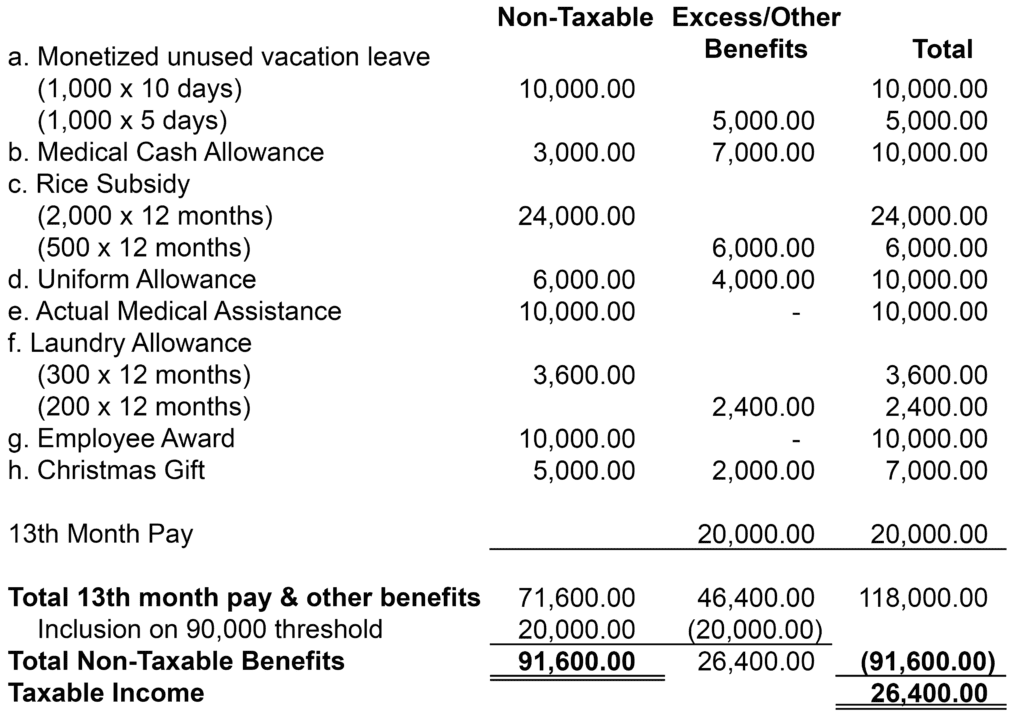

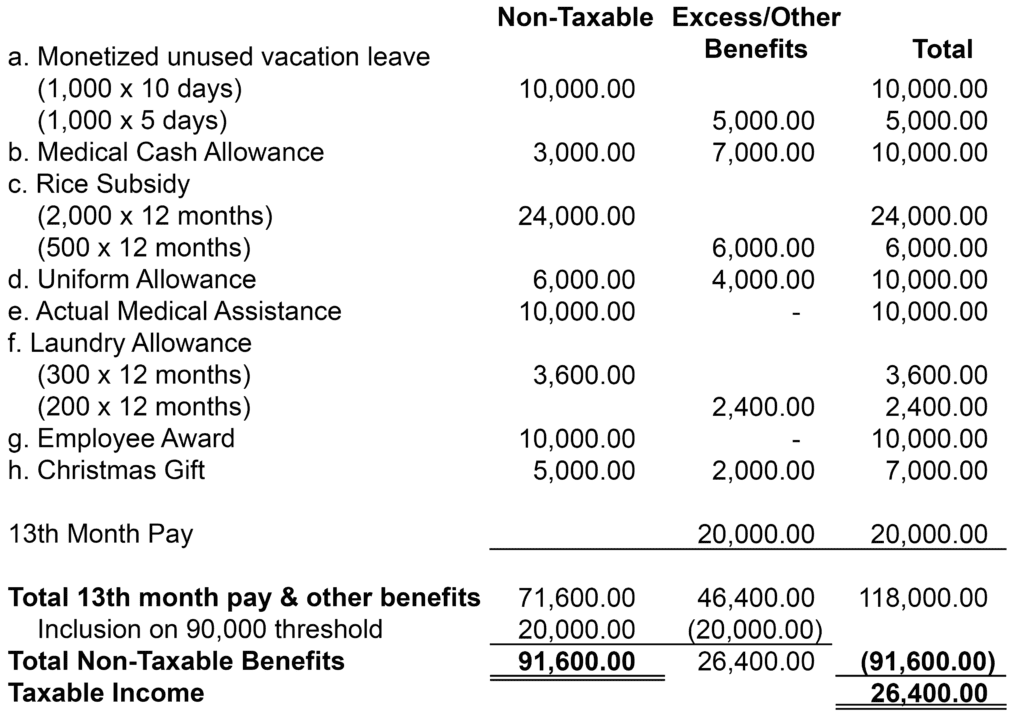

What Are De Minimis Benefits AccountablePH

What Are De Minimis Benefits AccountablePH

Is Car Allowance Taxable Income Your Question Answered Silver Tax

How To Earn Money Chore Chart Editable Allowance Chore Chart Etsy

Laundry Allowance Private Purposes S W OTE E PayDay Support

Is Laundry Allowance Taxable In Australia - Web 25 Sept 2019 nbsp 0183 32 To calculate the laundry expense including washing drying and ironing the ATO uses the figure of 1 per load if the load is made up only of work related clothing and 50c per load if you include