Is Mileage Reimbursement Taxable Income 2021 OVERVIEW If you use your own car for work purposes and are reimbursed by your employer for the related expenses the mileage reimbursement generally isn t taxable income if it s paid under an accountable plan However if it s paid under a nonaccountable plan the reimbursement is generally taxed TABLE OF CONTENTS Getting reimbursed

Yes the allowance will be taxable Whether or not you need to withhold from the allowance depends on a couple of things First it depends on if the employee is paid an ATO rate or an award agreement rate It sounds like the employee is paid a rate according to their award or agreement Mileage reimbursement is not considered taxable income as long as you do it right In this short article you will learn how to avoid pitfalls and get your reimbursement tax free An inevitable step is to keep a detailed mileage logbook

Is Mileage Reimbursement Taxable Income 2021

Is Mileage Reimbursement Taxable Income 2021

https://www.hfcc.edu/sites/hfcmain/files/newsroom/photos/2021-0107-mileage_reimbursement_rate_2022.jpg

Mileage Reimbursement Rates What You Need To Know Tax Alert June

https://www2.deloitte.com/content/dam/Deloitte/nz/Images/infographics/tax alert/tax-alert-infographics-June-2021.JPG

Is Mileage Reimbursement Taxable

https://www.moneytaskforce.com/wp-content/uploads/2022/06/Is-Mileage-Reimbursement-Taxable.webp

For 2023 the standard mileage rate for the cost of operating your car for business use is 65 5 cents 0 655 per mile Fixed and variable rate FAVR This is an allowance your employer may use to reimburse your car expenses If the amount you reimbursed to your employee to compensate for using their own vehicle does not meet all conditions above the reimbursement is taxable Generally it is only taxable if you reimburse your employee for personal expenses Situation You provide an accountable advance to your employee Non taxable situation

If the employer pays a mileage rate equal to or less than the 2024 IRS business rate and properly tracks mileage the payments are tax free If the rate exceeds the federal mileage rate then the amount over 0 67 mile multiplied by mileage will be taxable income In addition if any expenses are paid in excess of IRS limitations then the excess is taxable income For example if an employer reimburses an employee for mileage at more than the standard mileage rate then the excess is taxable income

Download Is Mileage Reimbursement Taxable Income 2021

More picture related to Is Mileage Reimbursement Taxable Income 2021

2021 Mileage Reimbursement Calculator

https://www.irstaxapp.com/wp-content/uploads/2021/01/2021-mileage-reimbursement-calculator-1.png

Vehicle Programs Is Mileage Reimbursement Taxable Motus

https://www.motus.com/wp-content/uploads/2022/02/Is-Mileage-Reimbursement-Taxable.jpg

Government Mileage Reimbursement For 2021 IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/2021-mileage-reimbursement-rates-falcon-blog-2.jpg

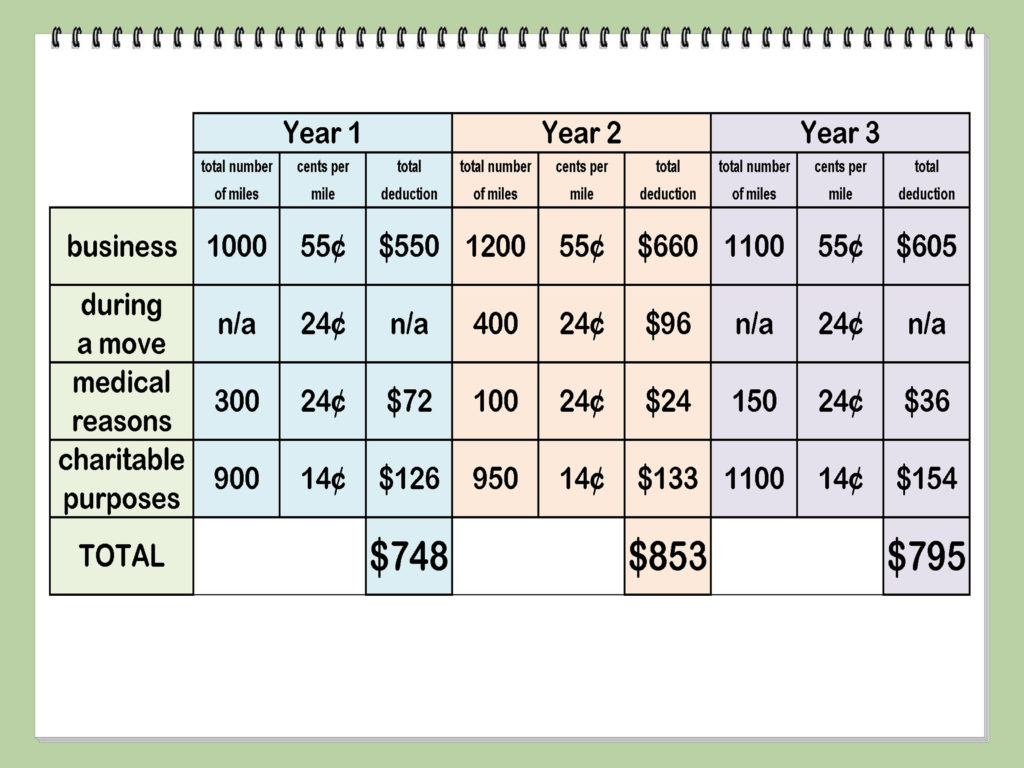

In most cases an amount included in your income is taxable unless it is specifically exempted by law Income that is taxable must be reported on your return and is subject to tax Income that is nontaxable may have to be shown on your tax return but isn t taxable For the 2022 tax year taxes filed in 2023 the IRS standard mileage rates are 65 5 cents per mile for business 14 cents per mile for charity 22 cents per mile for medical purposes or moving purposes for qualified active duty members of the armed forces

The standard mileage rates for 2023 are Self employed and business 65 5 cents mile Charities 14 cents mile Medical 22 cents mile Moving military only 22 cents mile Find out when you can deduct vehicle mileage The IRS has announced the 2021 standard mileage rates for business medical and other uses of an automobile and the 2021 vehicle values that limit the application of certain rules for valuing an automobile s use

Standard Mileage Reimbursement 2021 Mileage Reimbursement 2021

https://sabarwallaw.com/wp-content/uploads/2020/12/pexels-photo-5835435.jpeg

What Is Mileage Reimbursement And How To Track It

https://images.volopay.com/vmn7rx6aup52hyrfc1z9vzqcfy8j

https://turbotax.intuit.com/tax-tips/jobs-and...

OVERVIEW If you use your own car for work purposes and are reimbursed by your employer for the related expenses the mileage reimbursement generally isn t taxable income if it s paid under an accountable plan However if it s paid under a nonaccountable plan the reimbursement is generally taxed TABLE OF CONTENTS Getting reimbursed

https://community.ato.gov.au/s/question/a0J9s0000002KWn

Yes the allowance will be taxable Whether or not you need to withhold from the allowance depends on a couple of things First it depends on if the employee is paid an ATO rate or an award agreement rate It sounds like the employee is paid a rate according to their award or agreement

What Is Mileage Reimbursement 2021

Standard Mileage Reimbursement 2021 Mileage Reimbursement 2021

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

Is A Mileage Reimbursement Taxable

Mileage Reimbursement 2021 Calculator

Mileage Reimbursement 2021

Mileage Reimbursement 2021

Government Mileage Calculator IRS Mileage Rate 2021

Mileage Reimbursement Advantages Laws More

Mileage Reimbursement Amount For 2021 Mileage Reimbursement 2021

Is Mileage Reimbursement Taxable Income 2021 - For 2023 the standard mileage rate for the cost of operating your car for business use is 65 5 cents 0 655 per mile Fixed and variable rate FAVR This is an allowance your employer may use to reimburse your car expenses