Is Nps Contribution By Employee Taxable Under New Tax Regime Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits

Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the NPS on your behalf which is exempt from tax NPS additions under New Tax Regime Budget 2024 25 1 Employees choosing the New Tax Regime are now eligible for a higher deduction of up to 14 of

Is Nps Contribution By Employee Taxable Under New Tax Regime

Is Nps Contribution By Employee Taxable Under New Tax Regime

https://images.indianexpress.com/2023/01/income-tax-1200.jpg

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

Whether NPS Contribution Is Allowable Under New Tax Regime Or Not

https://i.ytimg.com/vi/mQShXjsBpPo/maxres2.jpg?sqp=-oaymwEoCIAKENAF8quKqQMcGADwAQH4Ac4FgAKACooCDAgAEAEYciBNKD0wDw==&rs=AOn4CLCkpkmWo3qvnPH3taWj8wAlJM3XJg

National Pension Scheme NPS NPS contribution limit for employer in private sector raised from 10 to 14 of the employees basic salary For both private Employer s contribution towards NPS of an employee is eligible for a tax deduction of up to 10 of salary i e basic plus DA or 14 of salary if such

Employees opting for the New Tax Regime are now entitled to a larger deduction of up to 14 of their basic salary for the contributions made by the employer Individuals opting for the new tax regime in the current financial year can get a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS This

Download Is Nps Contribution By Employee Taxable Under New Tax Regime

More picture related to Is Nps Contribution By Employee Taxable Under New Tax Regime

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-13.jpg

Budget 2023 No Income Tax Up To 7 Lakh Revised Tax Slabs For New

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675260988354.png

Is EPF Employer Contribution Taxable In The Revised New Tax Regime

https://freefincal.com/wp-content/uploads/2023/02/Is-EPF-employer-contribution-taxable-in-the-revised-New-Tax-Regime.jpg

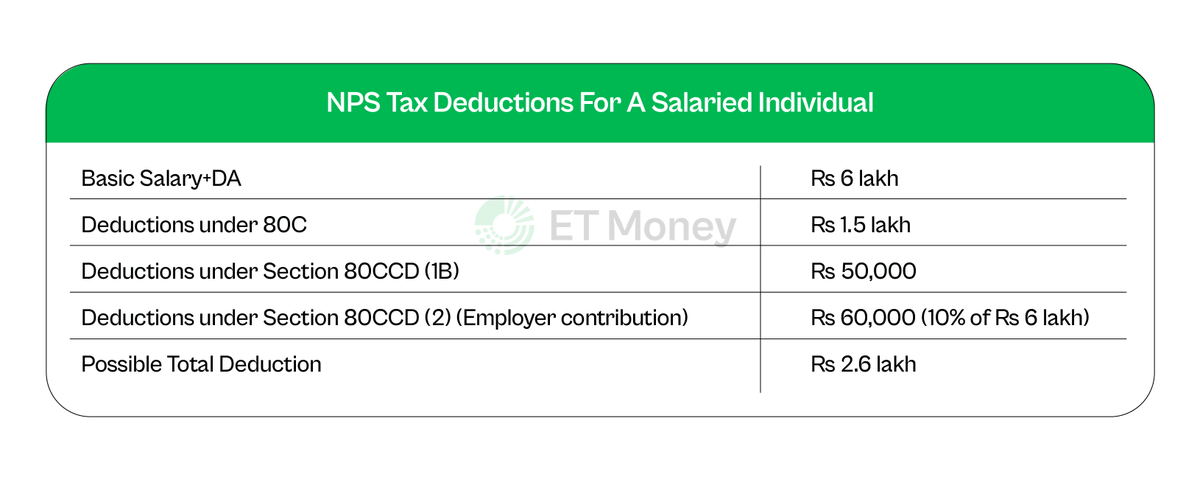

Employees contributing to NPS are eligible for following tax benefits on their own contribution Tax deduction up to 10 of salary Basic DA under section 80 CCD 1 Employer s Contribution Tax benefits can also be claimed if the contribution has been made by the employer into your NPS account This tax exemption is available up to 10 of the basic salary

Under the new tax regime the contribution made by employer towards Tier 1 NPS account is eligible for tax deduction under section 80CCD 2 of Income Tax Act Under old New Tax Regime If you are selecting New Tax Regime in your Income Tax Return then there is now a threshold limit u s 80CCD 2 with effective

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh

https://certicom.in/wp-content/uploads/2020/09/Employee-Provident-Fund.png

Exemptions Still Available In New Tax Regime with English Subtitles

https://i.ytimg.com/vi/_UAh2kQIrtc/maxresdefault.jpg

https://cleartax.in/s/taxability-on-nps-empl…

Employer contributions to NPS are part of taxable salary and employees can claim deductions under 80CCD 1 80CCD 1B and 80CCD 2 Learn how to calculate deductions and maximize tax benefits

https://timesofindia.indiatimes.com/busin…

Latest NPS benefits under new tax regime after Budget 2024 If your basic salary is Rs 1 lakh your employer can contribute Rs 10 000 10 of basic pay to the NPS on your behalf which is exempt from tax

Employer Contribution May Be Tax Free Under National Pension Scheme

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh

Amount Received After Closing NPS Account Taxable Or NOT YouTube

Budget 22 23 Tax Deduction Limit On Employers Contribution To NPS

NPS Contribution With UPI Online Payment At ENPS Portal

Deduction Under Section 80CCD 2 For Employer s Contribution To

Deduction Under Section 80CCD 2 For Employer s Contribution To

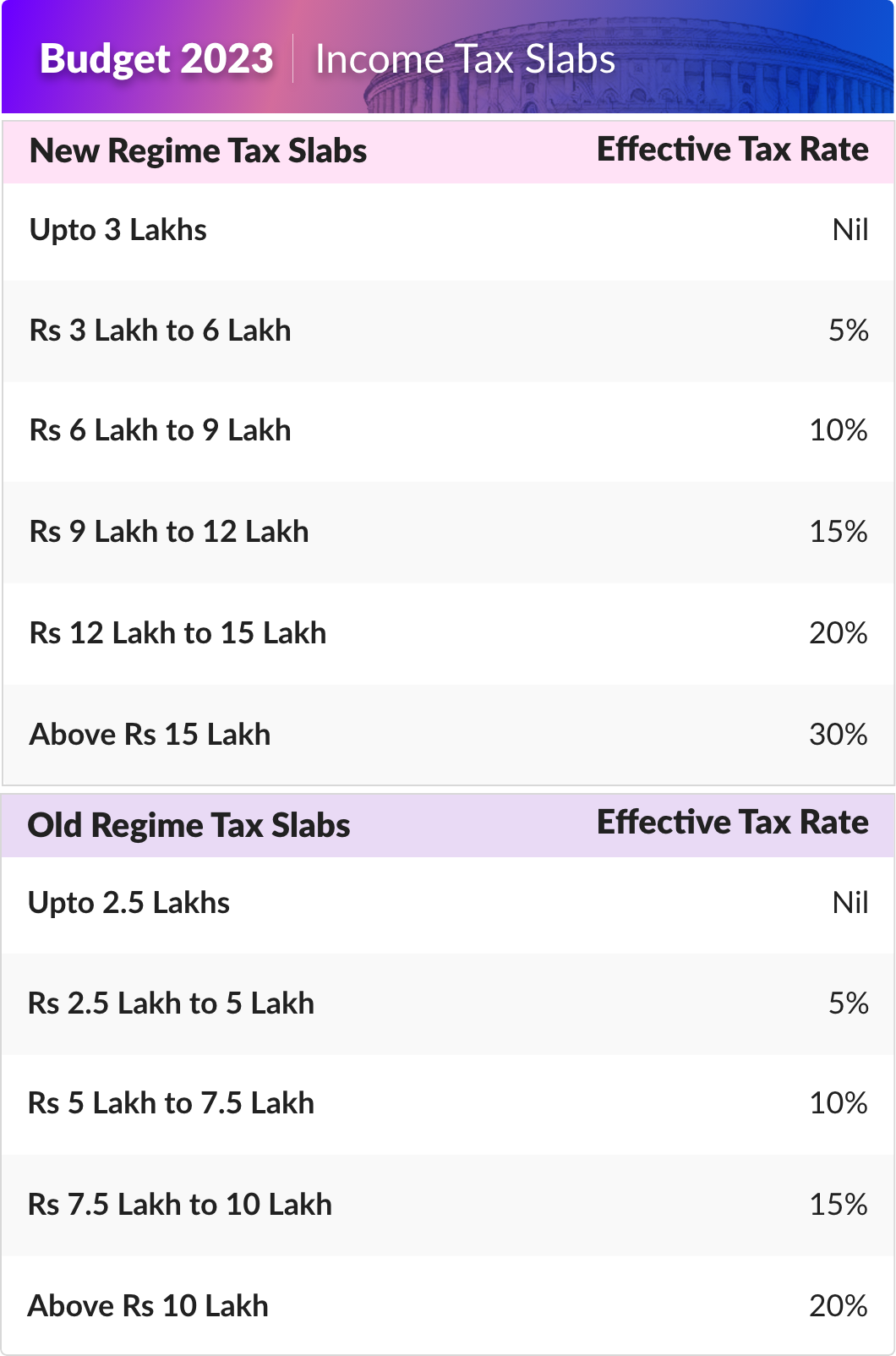

Income Tax Slabs Ahead Of Budget 2023 Know Existing Tax Rates Under

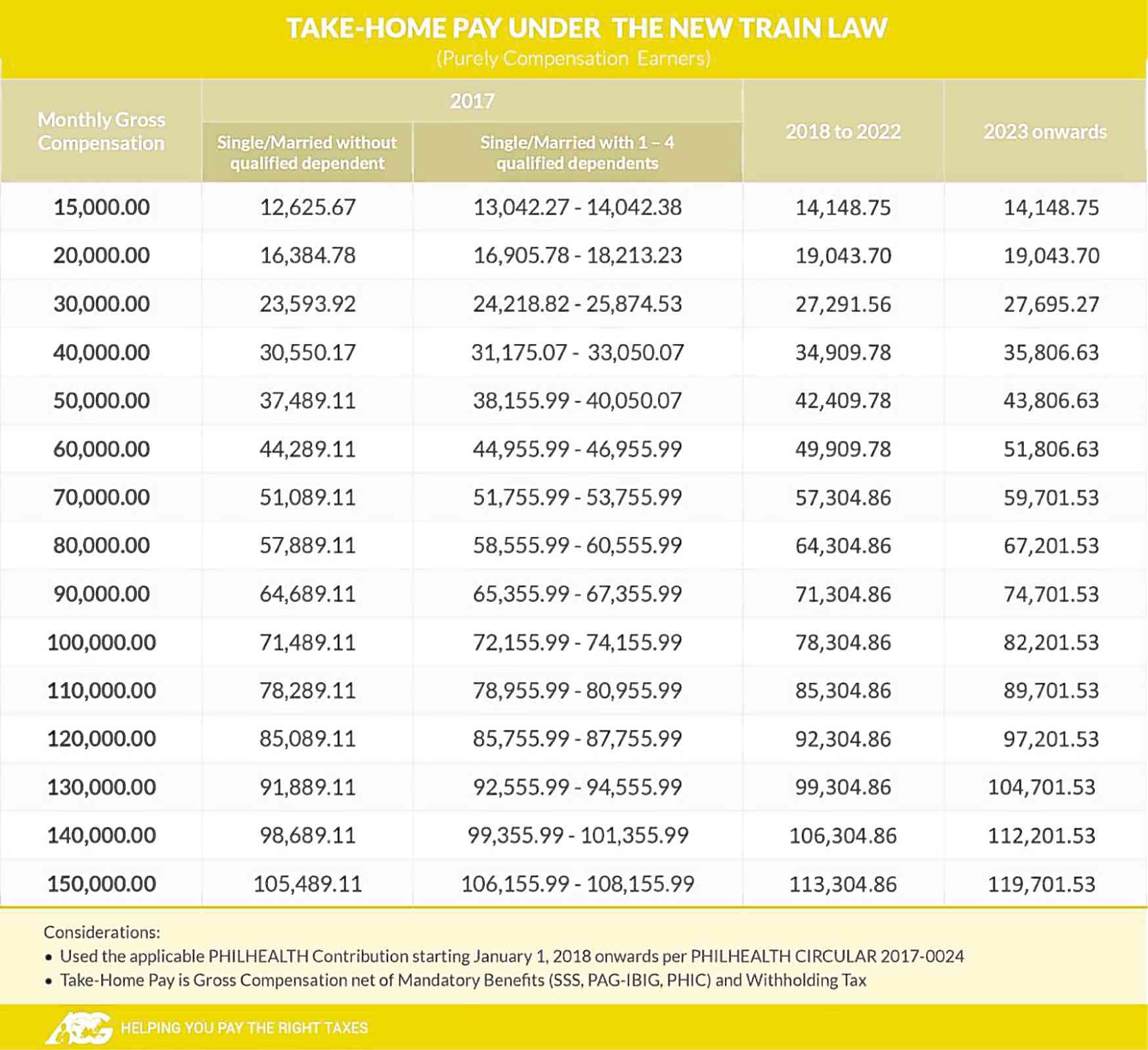

New Tax Regime For The New Year Inquirer Business

Invest Rs 50 000 Annually In NPS And You Can Create A Retirement

Is Nps Contribution By Employee Taxable Under New Tax Regime - Individuals opting for the new tax regime in the current financial year can get a deduction under Section 80CCD 2 of the Income Tax Act by investing in NPS This