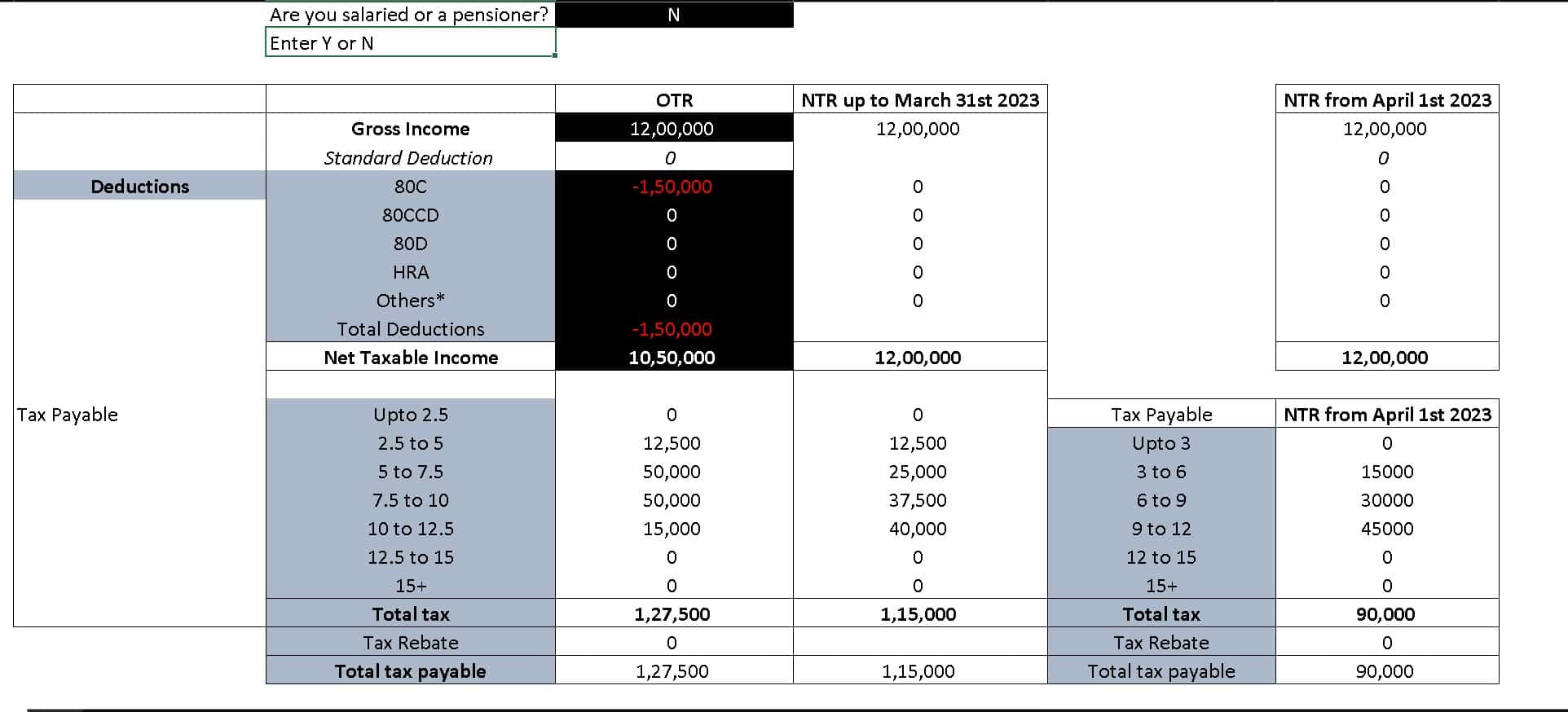

Nps Contribution In New Tax Regime The taxpayers can choose between the new tax regime or the old tax regime from FY 2020 21 If you plan to choose the new tax regime you can deduct the employer s contribution from your NPS account

Is NPS deduction allowed under New Tax Regime In the new tax regime taxpayers will have to forgo most of the income tax exemptions and deductions to Vipul Das The Pension Fund Regulatory and Development Authority manages the National Pension System NPS a government backed pension programme

Nps Contribution In New Tax Regime

Nps Contribution In New Tax Regime

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

Why The New Income Tax Regime Has Few Takers

https://images.moneycontrol.com/static-mcnews/2022/01/New-tax-regime-1.jpeg

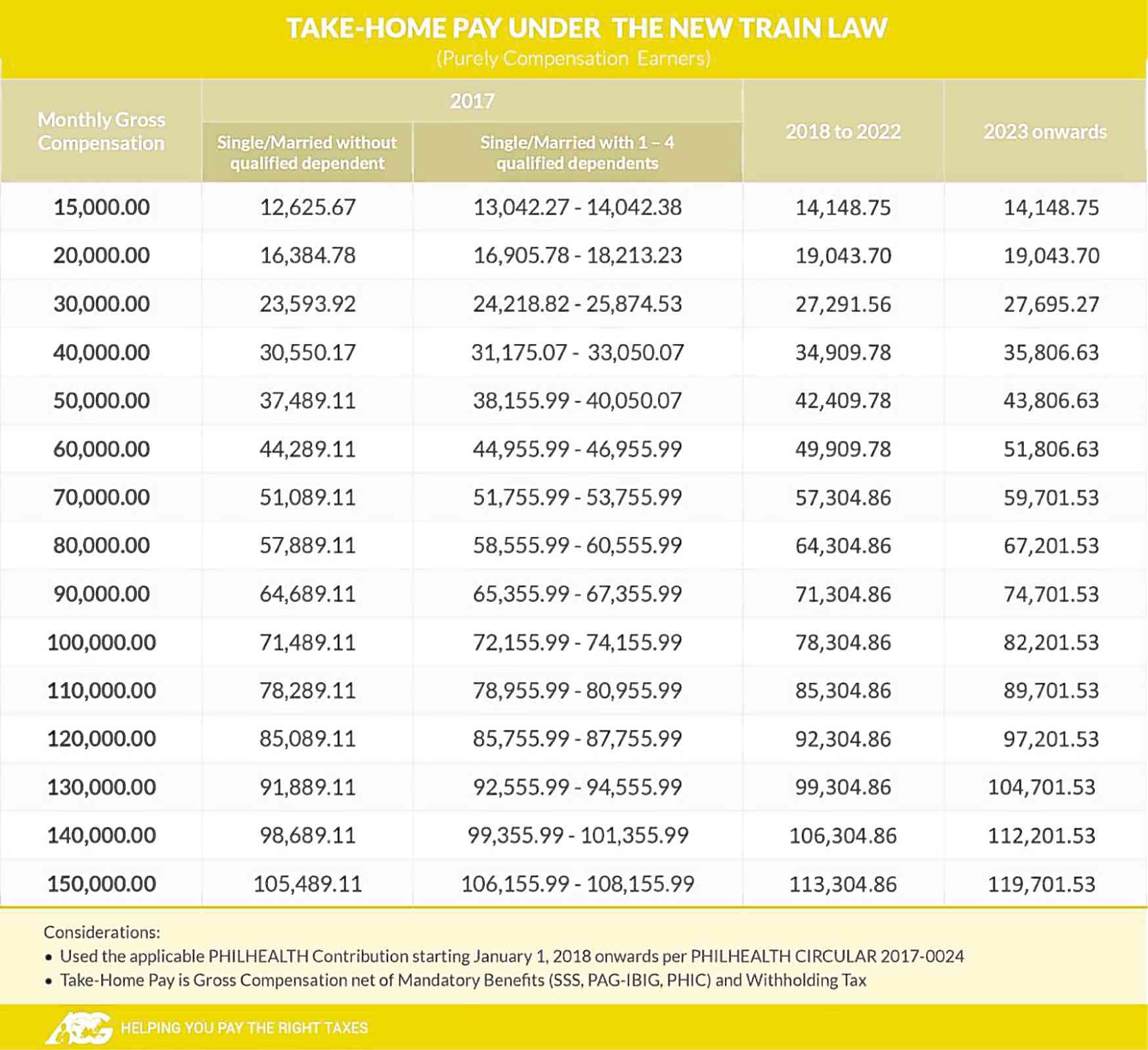

Till March 31 2023 FY 2022 23 standard deduction was only available under the old tax regime From April 1 2023 FY 2023 24 this tax benefit has been Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS website

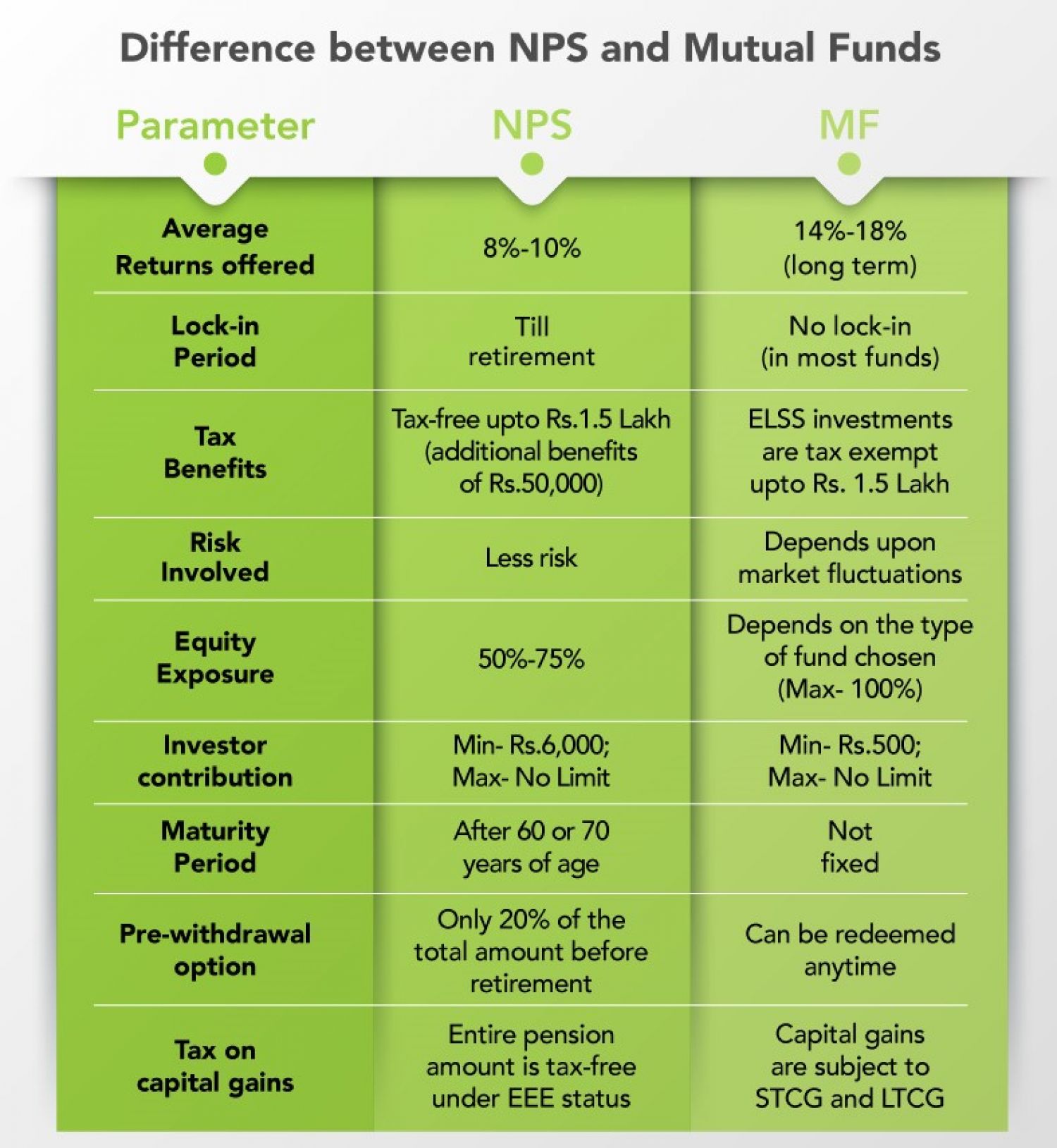

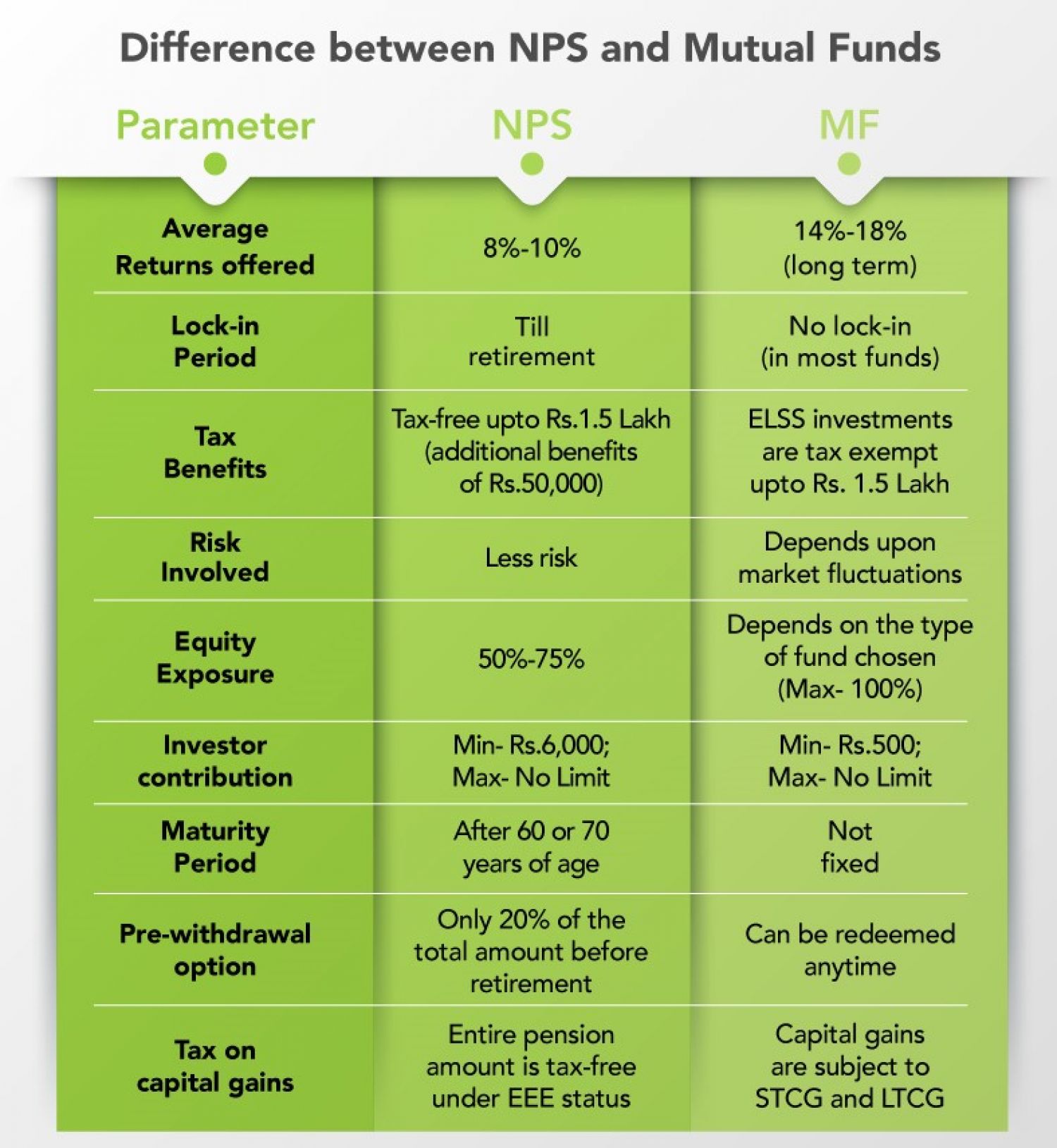

If you are investing in NPS Scheme or planning to invest in NPS you need to be aware of all the latest NPS Income Tax benefits that are currently available under Tax Benefits Under NPS As Per January 2024 The contributions to NPS are tax deductible under 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Indian Income Tax Act 1961 The

Download Nps Contribution In New Tax Regime

More picture related to Nps Contribution In New Tax Regime

New Tax Regime Vs Old Which Is Better For You Rupiko

https://rupiko.in/wp-content/uploads/2020/08/New-vs-Old-Tax-Regime-1.png

Should I Switch To The New Tax Regime From 1st April 2023

https://freefincal.com/wp-content/uploads/2020/02/Screenshot-of-new-tax-regime-vs-old-tax-regime-comparison-table.jpg

Budget 2023 New Income Tax Slabs How To Calculate Your Tax Hindustan

https://images.hindustantimes.com/img/2023/02/01/original/Tax_Regime_table_Web_1675260619284.png

PFRDA has for the current fiscal set its sights on enrolling 13 lakh new subscribers from the non government segment In Budget 2020 the Centre introduced a Income tax benefits for NPS You can claim tax deductions against NPS under three sections of the Income tax Act 1961 in India Sections 80CCD 1 80CCD 1B

This is the National Pension System NPS Investing in Tier I account of NPS via your employer makes you eligible to claim deduction from your gross total income under the Under the old tax regime both the employee s and the employer s contributions to NPS are eligible for tax deduction Employees who contribute to NPS

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

https://www.alankit.com/blog/blogimage/NPS Tax Benefits NPS Rebate in New Tax Regime.jpg

Union Budget 2023 24 Why Old Tax Regime Is Still Better Than New Tax

https://akm-img-a-in.tosshub.com/businesstoday/styles/medium_crop_simple/public/images/story/202302/tax-graphic-1.jpg?itok=AFs3rjIf

https://news.cleartax.in/can-salaried-individua…

The taxpayers can choose between the new tax regime or the old tax regime from FY 2020 21 If you plan to choose the new tax regime you can deduct the employer s contribution from your NPS account

https://www.financialexpress.com/money/new-tax...

Is NPS deduction allowed under New Tax Regime In the new tax regime taxpayers will have to forgo most of the income tax exemptions and deductions to

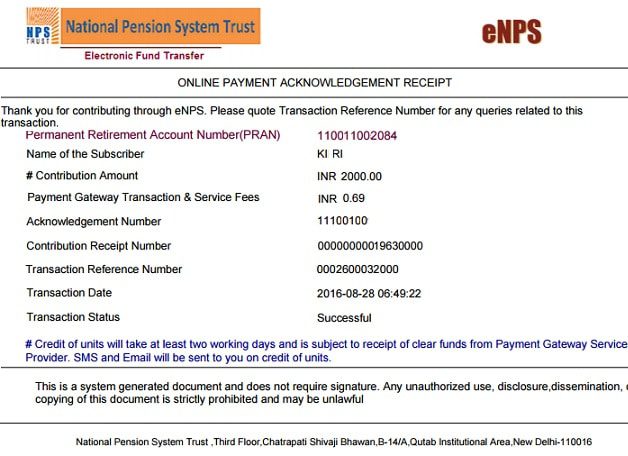

Nps contribution payment receipt

NPS Tax Benefits Know More About NPS Tax Deduction Alankit

Changes In New Tax Regime All You Need To Know

Deductions Under The New Tax Regime Budget 2020 Blog By Quicko

Rebate Limit New Income Slabs Standard Deduction Understanding What

Exemptions Still Available In New Tax Regime with English Subtitles

Exemptions Still Available In New Tax Regime with English Subtitles

Is EPF Employer Contribution Taxable In The Revised New Tax Regime

New Tax Regime Vs Outdated Tax Regime Which One To Choose Https

New Tax Regime For The New Year Inquirer Business

Nps Contribution In New Tax Regime - Employer s NPS contribution for the benefit of employee up to 10 per cent of salary Basic DA is deductible from taxable income up to 7 5 Lakh the NPS website