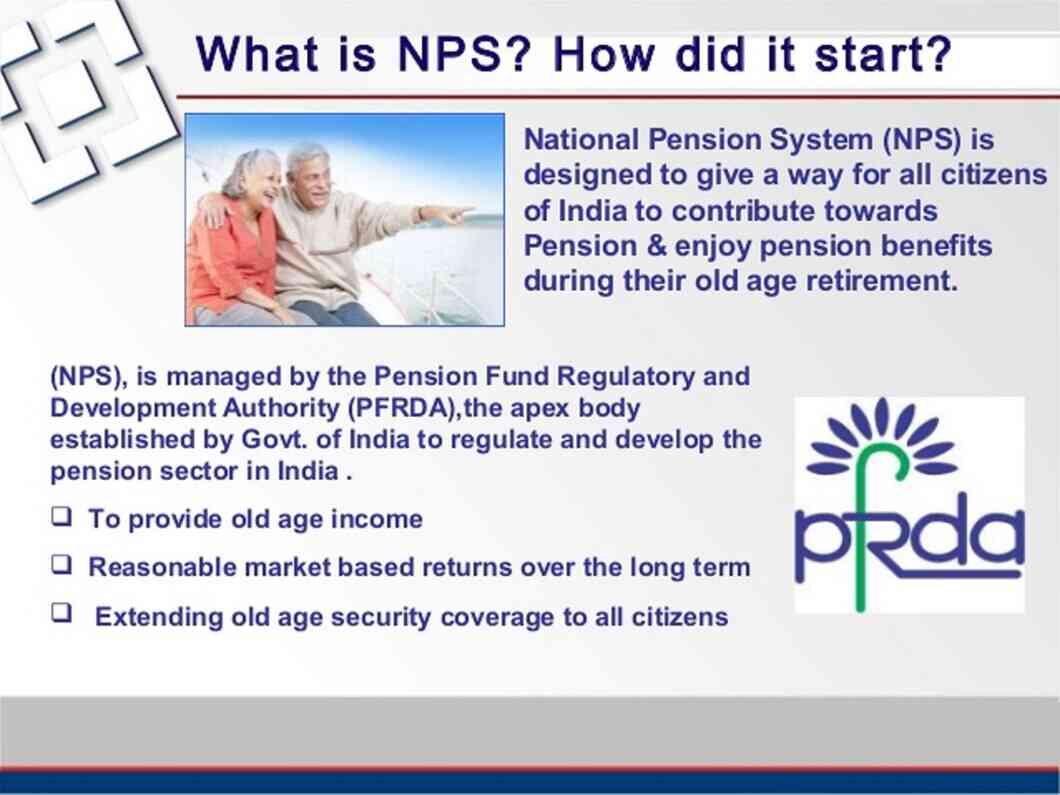

Is Nps Investment Comes Under 80c How much should I invest in NPS for tax benefit NPS account tax benefits extend up to 2 00 000 per annum for each individual As an investor investing this amount will

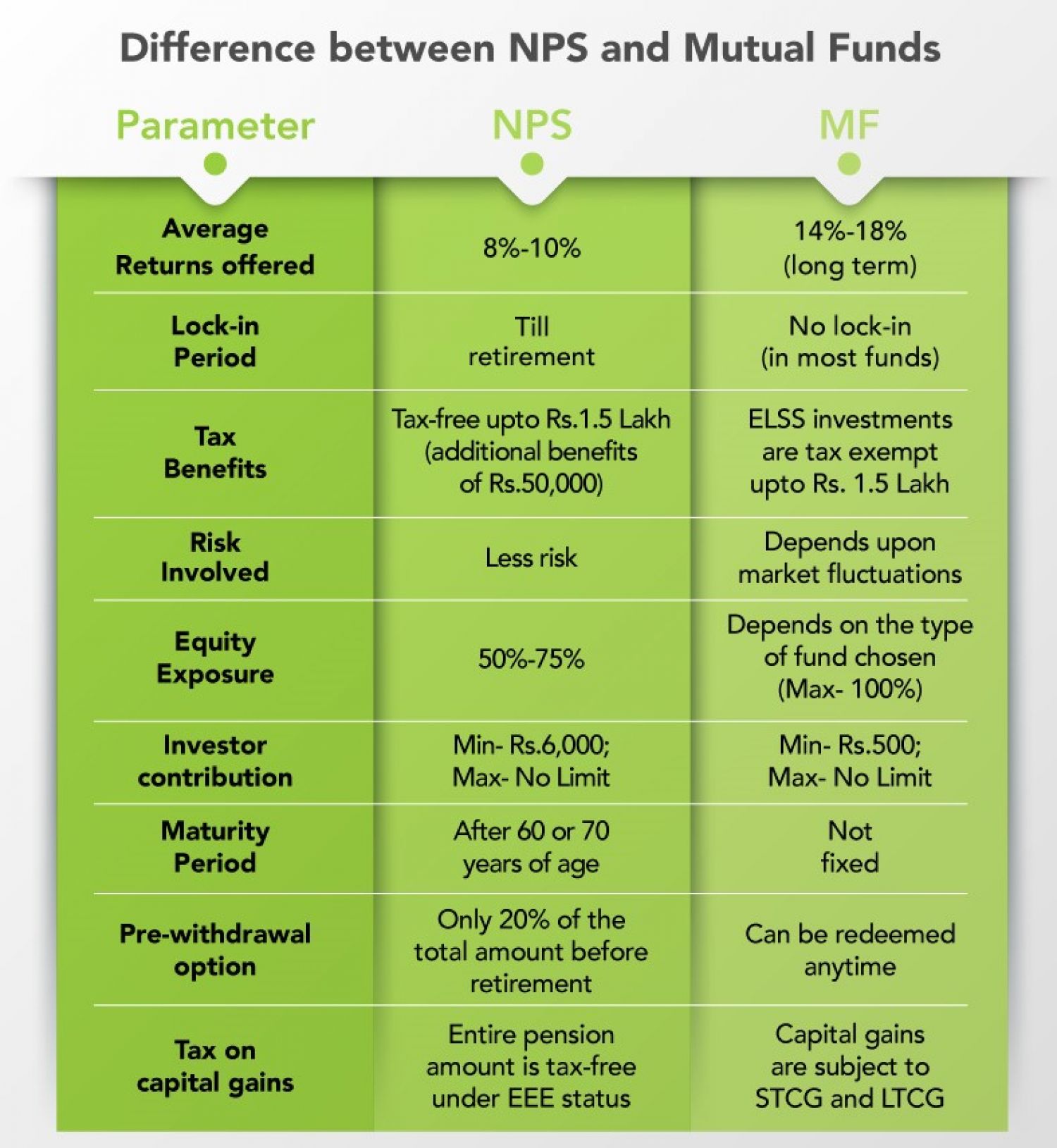

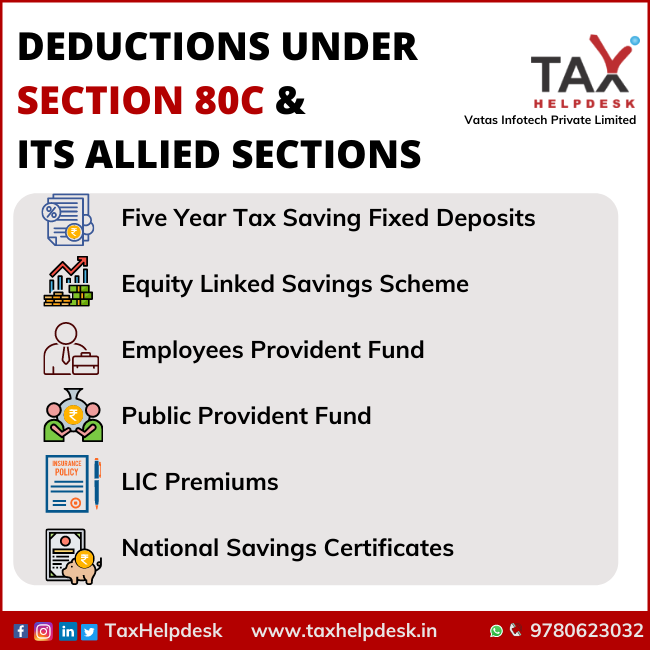

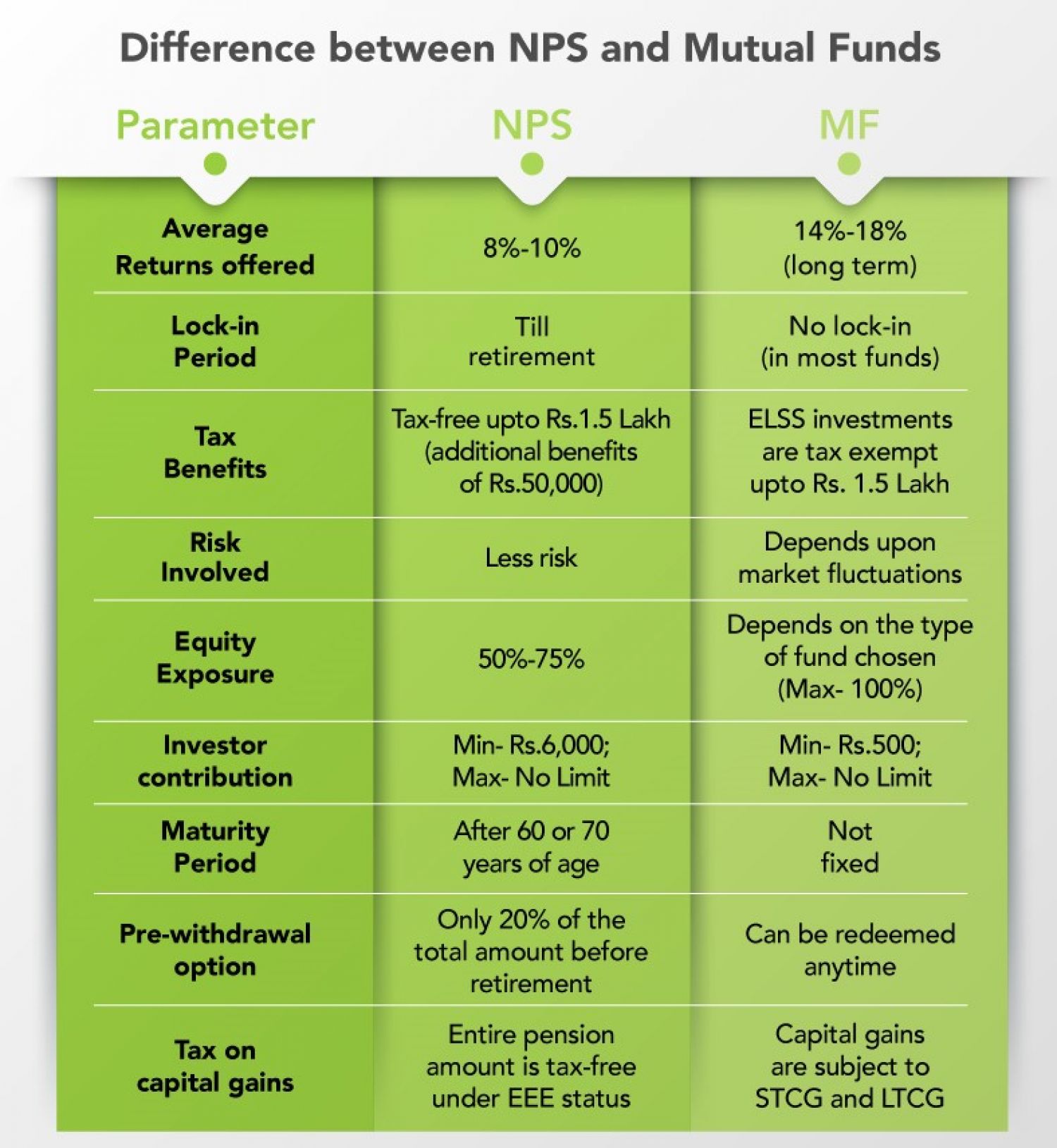

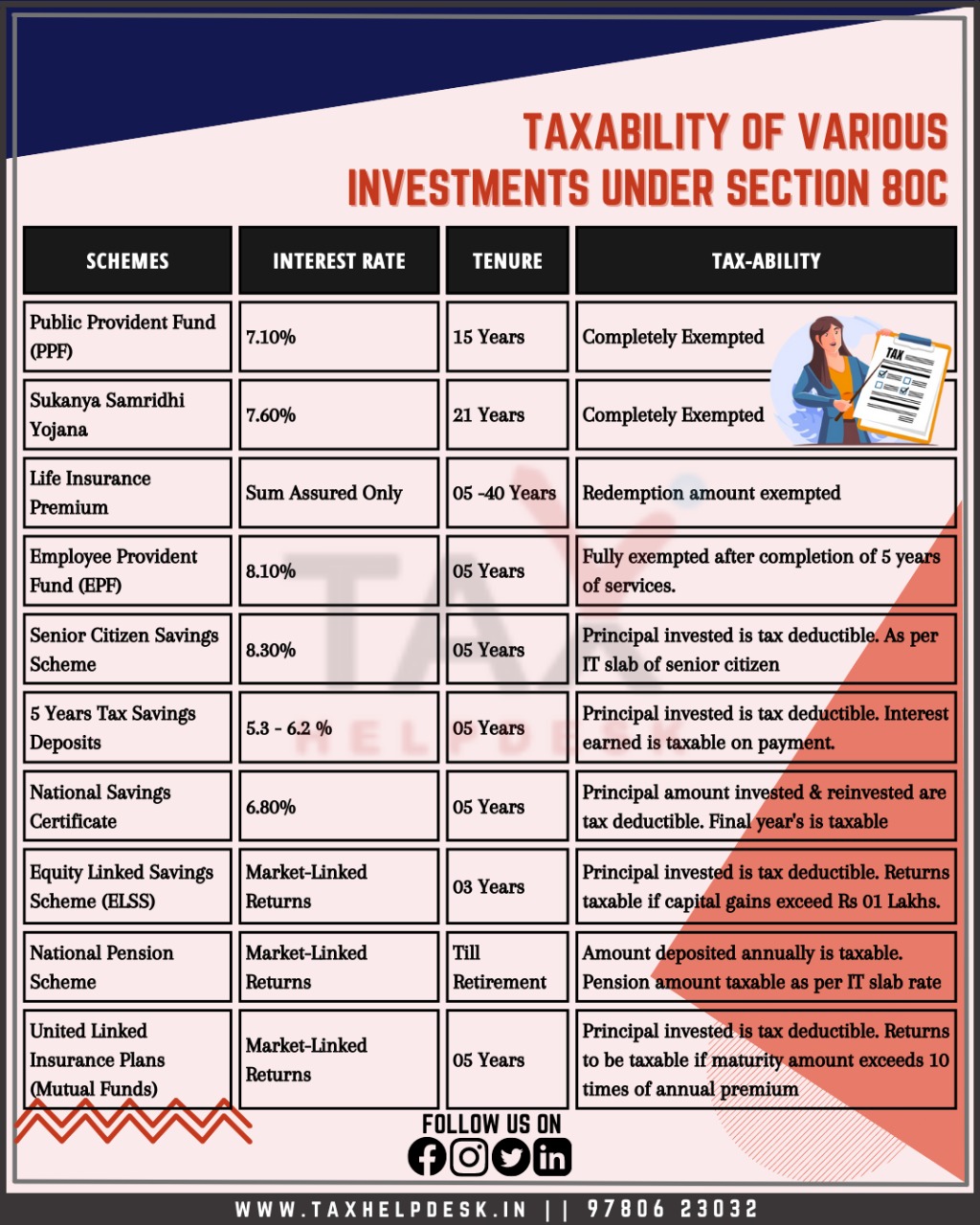

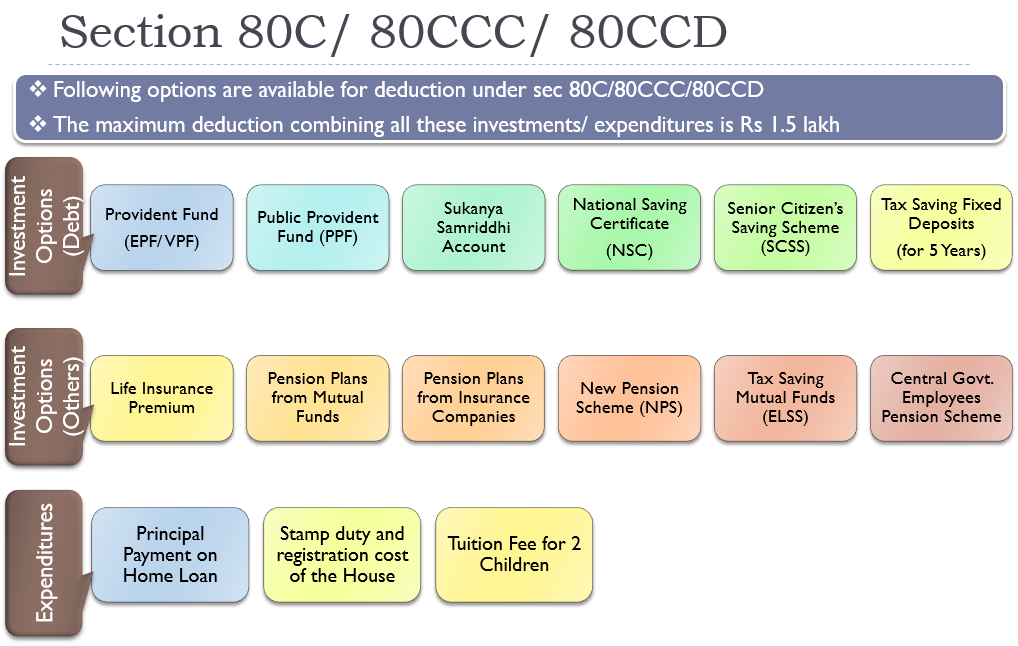

No the maximum deduction allowed under Sections 80C 80CCC and 80CCD put together is Rs 1 50 000 Over and above this limit a further deduction of Rs 50 000 is available under section 80CCD 1B for The maximum deduction under Section 80C are 80CCC and 80CCD 1 put together is Rs 1 5 lakhs However you may claim an additional deduction of Rs 50 000 allowed u s 80CCD 1B for contributions made to NPS National

Is Nps Investment Comes Under 80c

Is Nps Investment Comes Under 80c

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/Deductions-under-Section-80C-its-allied-sections.png

Should Invest In NPS Just For The Tax Benefits NPS

https://carajput.com/art_imgs/why-we-should-invest-in-nps-just-for-the-tax-benefits.jpg

Deductions Under Chapter VIA

https://life.futuregenerali.in/media/5utfvrlk/chapter-via-section.jpg

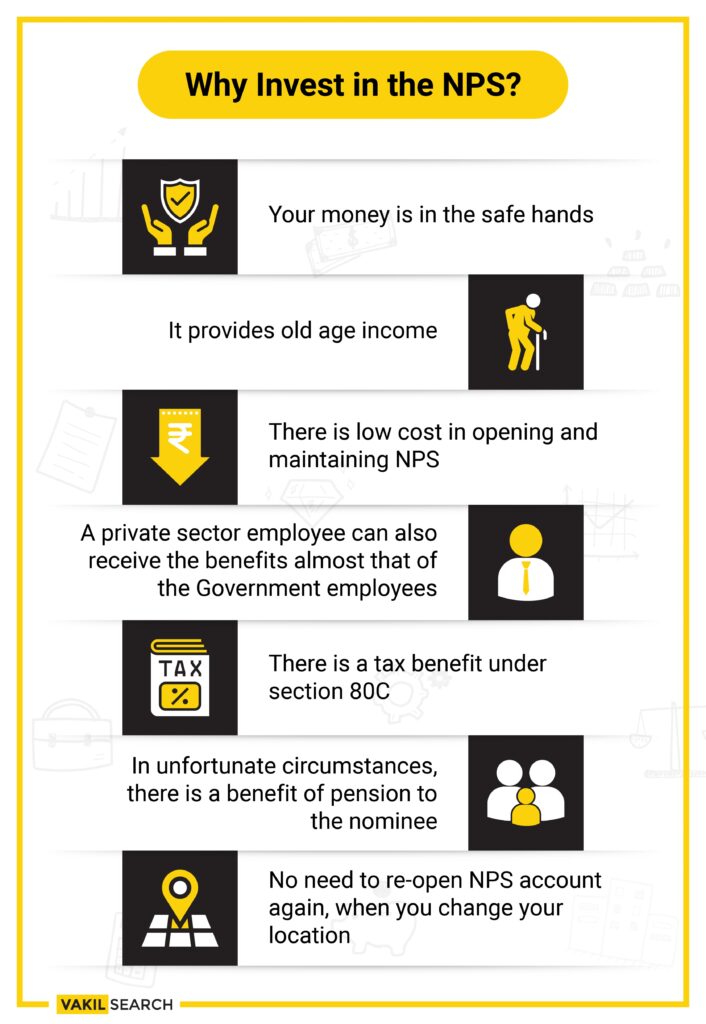

For someone in the 30 per cent tax bracket this is a clear benefit of Rs 15 000 on investment of Rs 50 000 over and above the Rs 1 5 lakh allowed under Section 80 C This article Investments of up to Rs 1 5 lakh in NSCs can be made to save taxes under Section 80C NSCs can be bought from designated post offices and come with a lock in period of 5 years The interest is compounded annually

On the amount invested in NPS one can avail tax breaks under Section 80CCD 1 Section 80CCD 1B and Section 80CCD 2 of the Act Importantly as per Section 80CCE the Here s how the NPS works under Section 80C 1 Maximum Deduction of Rs 1 5 Lakh Under Section 80C a taxpayer can claim deductions of up to Rs 1 5 lakh on

Download Is Nps Investment Comes Under 80c

More picture related to Is Nps Investment Comes Under 80c

NPS Tax Benefits How To Avail NPS Income Tax Benefits

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nps-tax-benefits.jpg

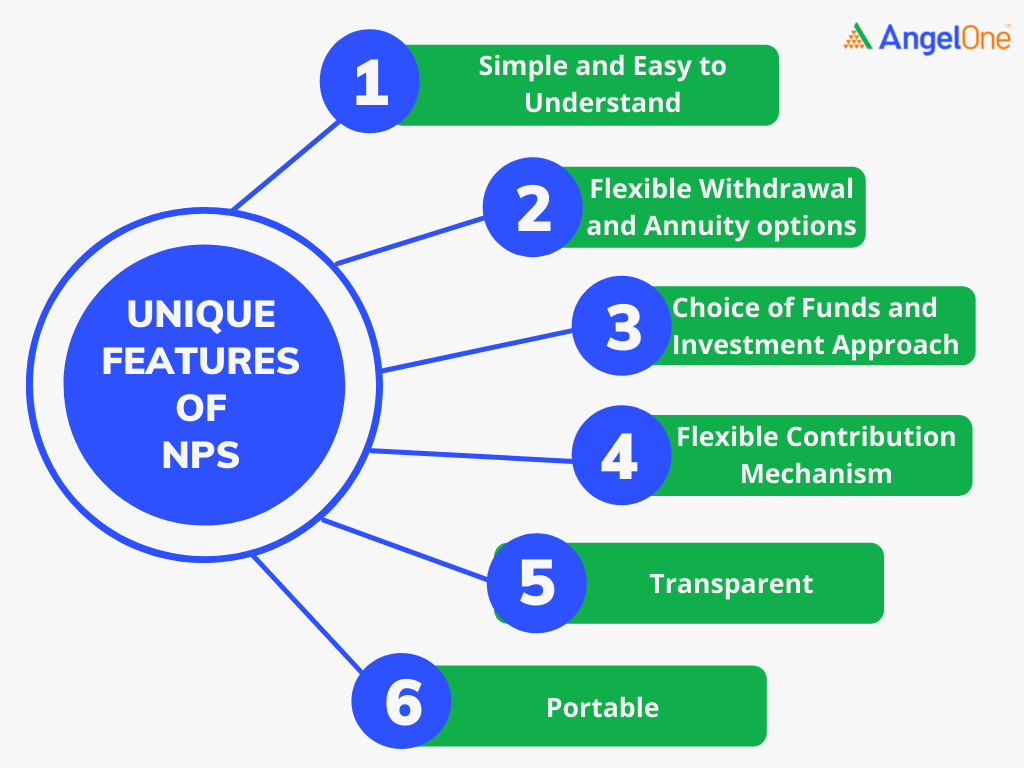

NPS All You Need To Know Angel One

https://w3assets.angelone.in/wp-content/uploads/2022/06/NPS.png

How To Update Details In NPS Account Nominee Address DOB Other Changes

https://www.godigit.com/content/dam/godigit/directportal/en/contenthm/nominee-in-nps.jpg

Section 80CCD 2 covers the employer s NPS contribution which will not form a part of Section 80C This benefit is not available for self employed taxpayers National Pension Schemes provide tax benefits under section 80C Check out Eligibility to get tax exemption other NPS benefits and how it helps in savings

If you have exhausted the Rs 1 5 lakh limit under Section 80C then additional tax can be saved by investing Rs 50 000 in NPS This deduction claimed will be over and above Section 80C deduction of Rs 1 5 lakh Here is Total amount of income tax deduction under sections 80C 80CCC investment in pension plan offered by an insurer and Section 80CCD 1 for NPS cannot exceed Rs 1 5

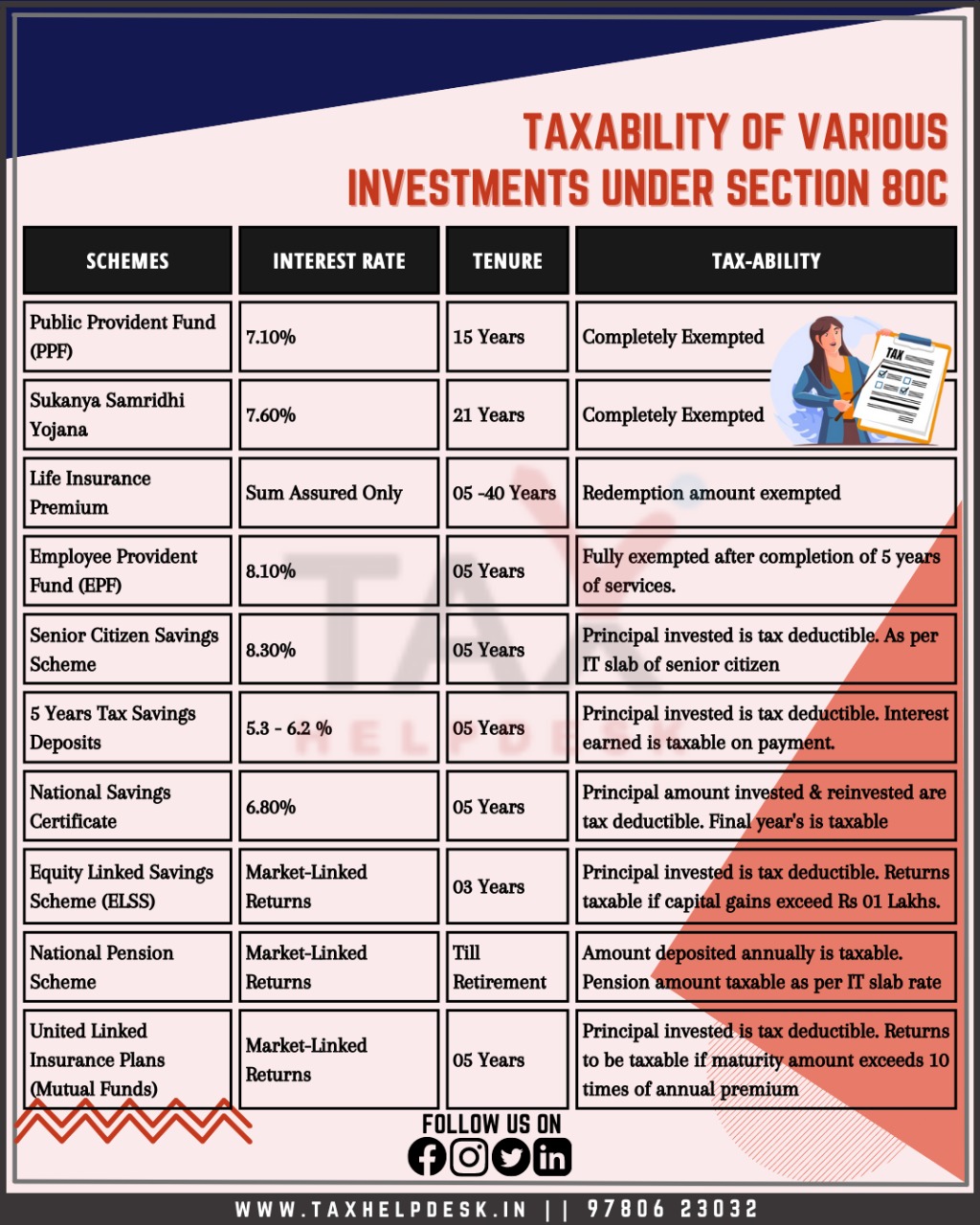

Understand About Taxability Of Various Investments Under Section 80C

https://www.taxhelpdesk.in/wp-content/uploads/2022/07/Investments-under-Section-80C.jpeg

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2020/01/section-80c.jpg

https://www.etmoney.com › learn › nps › np…

How much should I invest in NPS for tax benefit NPS account tax benefits extend up to 2 00 000 per annum for each individual As an investor investing this amount will

https://cleartax.in

No the maximum deduction allowed under Sections 80C 80CCC and 80CCD put together is Rs 1 50 000 Over and above this limit a further deduction of Rs 50 000 is available under section 80CCD 1B for

NPS Scheme Basics Features Rules And Top NPS Schemes

Understand About Taxability Of Various Investments Under Section 80C

Section 80C Deductions Save Up To 1 5 Lakhs On Taxes

Investment Options To Avail Tax Deduction Under Section 80C

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Section 80C Deduction Under Section 80C In India Paisabazaar

Section 80C Deduction Under Section 80C In India Paisabazaar

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

Section 80C Deduction For Tax Saving Investments Learn By Quicko

How To Choose A Good NPS Scheme HDFC Sales Blog

Is Nps Investment Comes Under 80c - Income Tax Act allows benefits under NPS as per the following sections On Employee s contribution Employee s own contribution is eligible for tax deduction under sec 80 CCD 1 of