Is Rebate Applicable For Short Term Capital Gain Web 20 Dez 2021 nbsp 0183 32 Please note the rebate under Section 87A is available against tax liability in respect of short term capital gains on equity products Though this an anomaly under

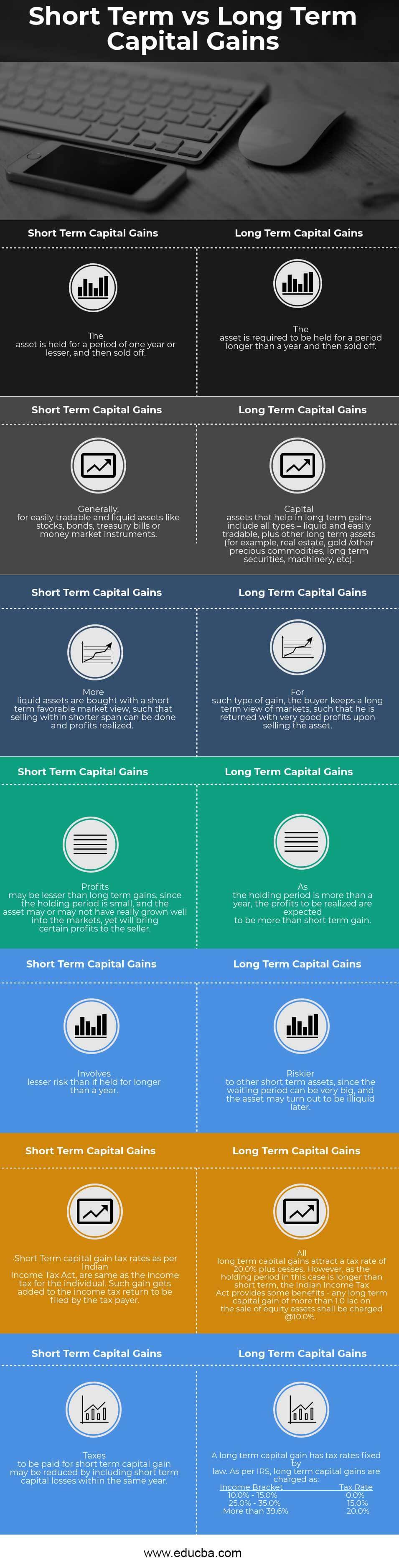

Web 25 Juli 2023 nbsp 0183 32 Short term gains are taxed at the taxpayer s top marginal tax rate or regular income tax bracket which can range from 10 to 37 Short term capital gains Web 22 Dez 2023 nbsp 0183 32 Short term capital gains are taxed as ordinary income long term capital gains are subject to a tax of 0 15 or 20 depending on your income There is a

Is Rebate Applicable For Short Term Capital Gain

Is Rebate Applicable For Short Term Capital Gain

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2022/11/short-term-capital-gain-on-shares-image.jpg

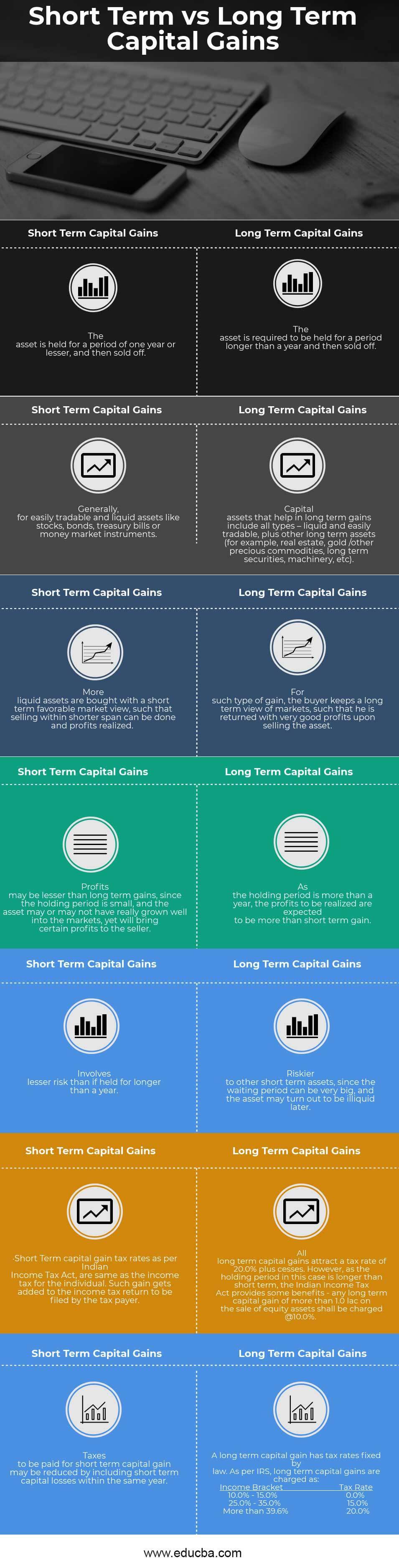

Short Term Vs Long Term Capital Gains Top 7 Awesome Differences

https://cdn.educba.com/academy/wp-content/uploads/2018/09/Short-Term-vs-Long-Term-Capital-Gains.jpg

Massachusetts Tax Reform Enacted Estate Tax Exemption Increase And

https://www.bowditch.com/estateandtaxplanningblog/wp-content/uploads/sites/5/2018/11/Doing-taxes-bw.jpg

Web What is the tax rate for Short term Capital Gains Short term capital gains as provided under section 111A is subject to tax rate of 15 in addition to surcharge and cess as Web 6 Feb 2023 nbsp 0183 32 10 00 000 Short Term Capital Gains 3 40 000 STCG Tax Liability 3 40 000 15 51 000 Salary Income is taxable at slab rates and tax liability INR

Web 28 Dez 2023 nbsp 0183 32 This means under both the old and new tax regimes a resident individual with taxable income up to 5 lakh is eligible to claim the tax rebate of 12 500 or the Web 19 Aug 2021 nbsp 0183 32 There is no shortfall from basic exemption limit of Rs 2 50 000 as total income without short term capital gain is already Rs 2 90 000 Therefore Tax payable

Download Is Rebate Applicable For Short Term Capital Gain

More picture related to Is Rebate Applicable For Short Term Capital Gain

Form The Following Particular Of Mr Gopi calculate His Tax Liability

https://hi-static.z-dn.net/files/da7/63fa748d378bb799c4fb6cfc4191cabf.jpg

Long Term Vs Short Term Capital Gains Tax Moneywise

https://media1.moneywise.com/a/27410/long-term-vs-short-term-capital-gains_facebook_thumb_1200x628_v20230814155212.jpg

Do You Get Paid For Short term Disability How I Got The Job

https://howigotjob.com/wp-content/uploads/2021/10/PAID.jpg

Web 19 Dez 2023 nbsp 0183 32 The short term capital gains tax is typically applied to the sale of securities including stocks and mutual funds But it s also possible to be assessed short term capital gains tax on the sale of other assets Web Vor einem Tag nbsp 0183 32 How capital gains tax rates work depending on your income Investment income is treated differently from wages by the tax code There is a separate set of tax

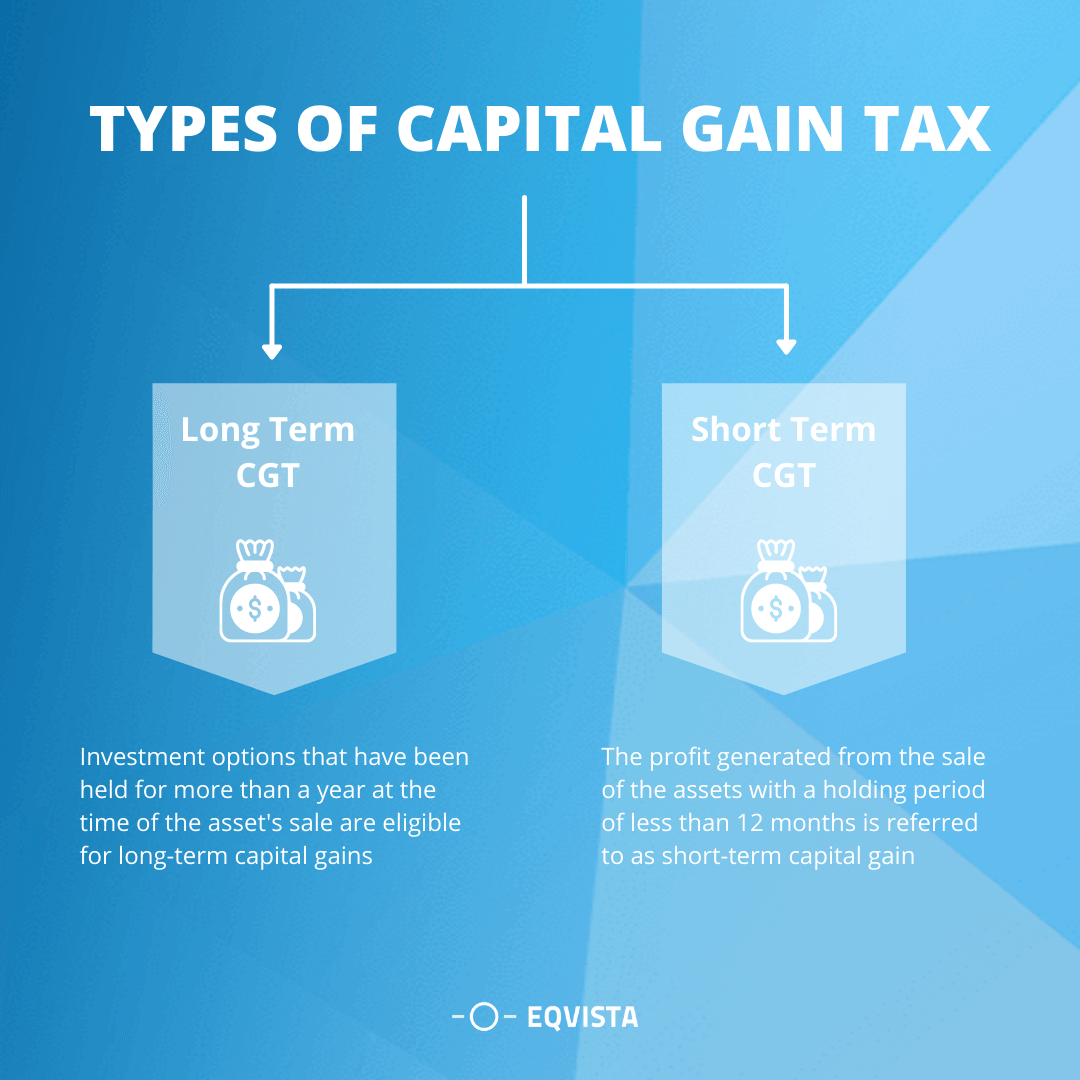

Web Individuals can avail short term capital gain exemption on their short term proceeds and reduce their tax liability on such gains accordingly What is Long term Capital Gain Web As the holding period is less than 12 months gains are classified as short term capital gains The equity shares are transferred through a recognised stock exchange STT

How To Calculate Capital Gain Tax On Shares In India Eqvista

https://eqvista.com/app/uploads/2022/01/image1-7.png

Finding Off Market Properties For Short Term Rental

https://www.findrentals.com/vacations/travel-news/1512/off-market-properties-for-short-term-rental.jpg

https://www.livemint.com/money/personal-finance/explained-income …

Web 20 Dez 2021 nbsp 0183 32 Please note the rebate under Section 87A is available against tax liability in respect of short term capital gains on equity products Though this an anomaly under

https://www.investopedia.com/terms/s/short-term-gain.asp

Web 25 Juli 2023 nbsp 0183 32 Short term gains are taxed at the taxpayer s top marginal tax rate or regular income tax bracket which can range from 10 to 37 Short term capital gains

Can I Use Ultra Short Duration Funds Instead For Short term Goals

How To Calculate Capital Gain Tax On Shares In India Eqvista

What Is Tax On Short Term Capital Gains Majesda

.png)

How To Calculate Short Term Capital Gains Tax On Sale Of Shares Jordensky

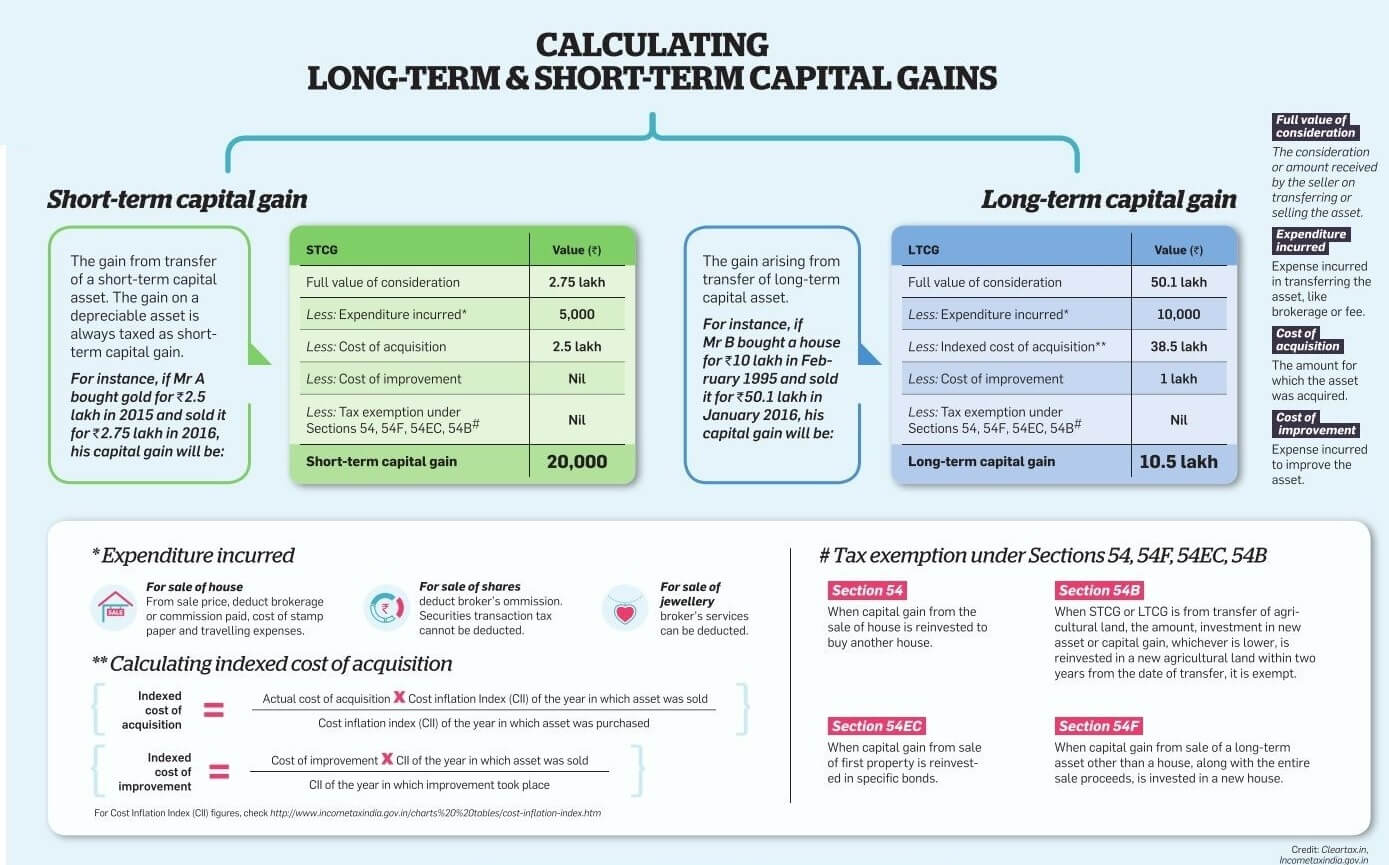

Capital Gain Calculator On Sale On Property Mutual Funds Gold Stocks

Hochul Pitches Sales Tax For Short Term Rentals

Hochul Pitches Sales Tax For Short Term Rentals

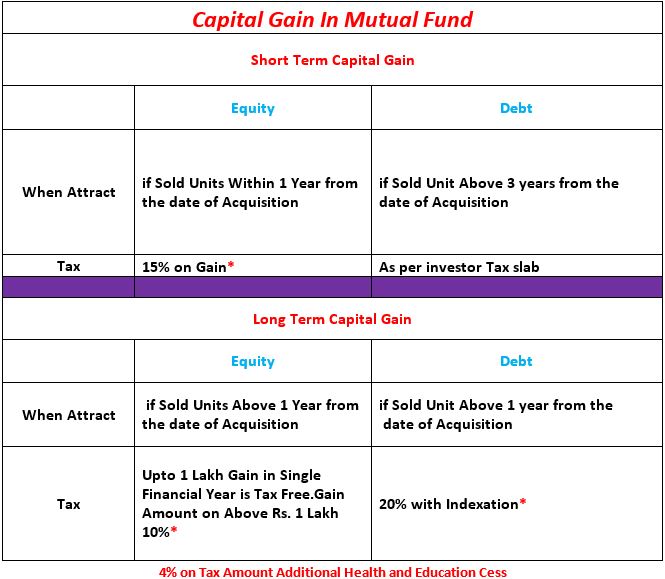

Tax On Capital Gain In Mutual Fund With Examples Universal Invests

Short Term Vs Long Term Capital Gain What s The Difference With Table

Renting For Short Term Rentals Types Tips Tactics

Is Rebate Applicable For Short Term Capital Gain - Web Vor 3 Tagen nbsp 0183 32 In summary understanding Short Term Capital Gains STCG particularly under Section 111A of the Income Tax Act is crucial for investors dealing with shares