Is Redundancy Payment Taxable Uk You do not usually pay tax on the first combined 30 000 of statutory redundancy pay additional severance or enhanced redundancy payments your employer gives you non cash benefits for

Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of notice will be taxed in the same way as regular income In the UK redundancy pay can be either tax free or taxable depending on the amount and circumstances of the payment The tax rules are designed to provide some financial relief to employees who lose their jobs while ensuring that larger payments are subject to appropriate taxation

Is Redundancy Payment Taxable Uk

Is Redundancy Payment Taxable Uk

https://i.ytimg.com/vi/JDsHD1IDX6g/maxresdefault.jpg

Termination Pay Redundancy CooperAitken Chartered Accountants

http://www.cooperaitken.co.nz/wp-content/webpc-passthru.php?src=https://www.cooperaitken.co.nz/wp-content/uploads/2020/08/Redundancy.png&nocache=1

Are Redundancy Payments Taxable

https://lirp.cdn-website.com/2377e54c/dms3rep/multi/opt/taxabke-1920w.jpg

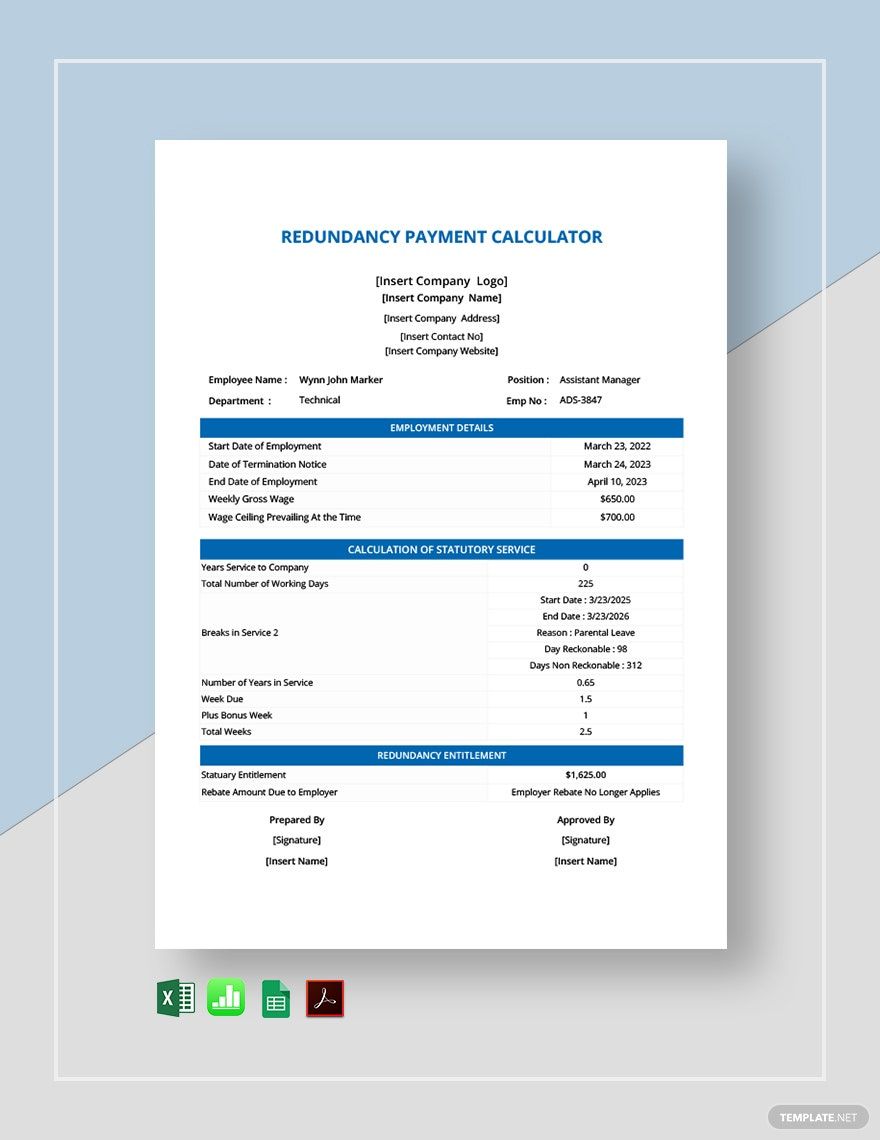

Up to 30 000 of redundancy pay is tax free You may not be eligible for statutory redundancy pay if your employer offers you a suitable alternative job and you turn it down Redundancy pay is based on your weekly pay before tax gross pay the years you ve worked for your employer continuous employment your age Weekly pay should also Are redundancy payments taxable If employees are facing redundancy or considering voluntary redundancy they need to know exactly how much money they will receive within their redundancy payments Unfortunately the answer is not straightforward

Broadly the first 30 000 of any redundancy payment may be paid tax free This includes any statutory amount received under the Employment Protection Consolidation Act 1978 which is tax free anyway You will be taxed on the redundancy payment in the tax year that you receive it even if you were made redundant in an earlier tax year The 30 000 limit applies to one job and can be carried forward to be used against any later redundancy payments from the same job

Download Is Redundancy Payment Taxable Uk

More picture related to Is Redundancy Payment Taxable Uk

Termination Letter Redundancy Free Template Sample Lawpath

https://i.pinimg.com/originals/2a/a8/88/2aa8882f9424f9e3356dffa7784d6353.png

What Is Taxable Income And How To Calculate Taxable Income

https://ebizfiling.com/wp-content/uploads/2022/04/Taxable-Income.png

Redundancy Pay Calculations

https://select.org.uk/images/COVID-19/IMAGE-Redundancy-Calculation-Table-e1593768389477-832x1024.jpg

Is redundancy pay taxed The first 30 000 of your redundancy pay is tax free but any amount above this will be subject to income tax at the standard rate You don t have to pay National Insurance on any of your redundancy pay Outstanding holiday pay owed to you or any other money such as bonuses will be taxed as pay Basic rules Employees can receive up to 30 000 as a qualifying termination payment free of tax and National insurance This amount includes any statutory redundancy pay to which you are entitled If you receive more than 30 000 then the extra amounts over the 30 000 limit are taxable

[desc-10] [desc-11]

Redundancy Payment What To Do With It

https://s.yimg.com/uu/api/res/1.2/rZicfk33qd2AbvQtuxo4wA--~B/aD0xMDgwO3c9MTkyMDtzbT0xO2FwcGlkPXl0YWNoeW9u/https://media-mbst-pub-ue1.s3.amazonaws.com/creatr-uploaded-images/2020-08/ca6904c0-d77f-11ea-bfb3-3160aa51c6da

Free Redundancy Payment Calculator Template Download In Google Docs

https://images.template.net/44503/Redundancy-Payment-Calculator-1.jpg

https://www.gov.uk/termination-payments-and-tax...

You do not usually pay tax on the first combined 30 000 of statutory redundancy pay additional severance or enhanced redundancy payments your employer gives you non cash benefits for

https://www.moneyhelper.org.uk/en/work/losing-your...

Redundancy pay is treated differently to income and up to 30 000 of it is tax free But some other parts of your redundancy package such as holiday pay and pay in lieu of notice will be taxed in the same way as regular income

Is Director Redundancy Pay Taxable Redundancy Claims UK

Redundancy Payment What To Do With It

5 Redundancy Letter Template Uk Sampletemplatess Within Failed

How Is A Redundancy Payment Taxed In Australia Slow Fortune Get

Tax On Redundancy Payments Davis Grant

Chargeback Protection Prevention Payment Facilitator

Chargeback Protection Prevention Payment Facilitator

Taxable Payments Annual Report Bosco Chartered Accountants

Royal Mail Voluntary Redundancy Calculator CALCULATORUK HJW

Contacts Assyst Testing

Is Redundancy Payment Taxable Uk - [desc-14]