Is Rental Property A Tax Deduction Go to the Individual income tax section select Tax card and prepayments 2024 and click the Tax cards and prepayments link Click Request a new tax card Next click the button that says Select the complete tax card request When you move on to the Rental income section you can select whether you pay the tax in the form of prepayments or in the

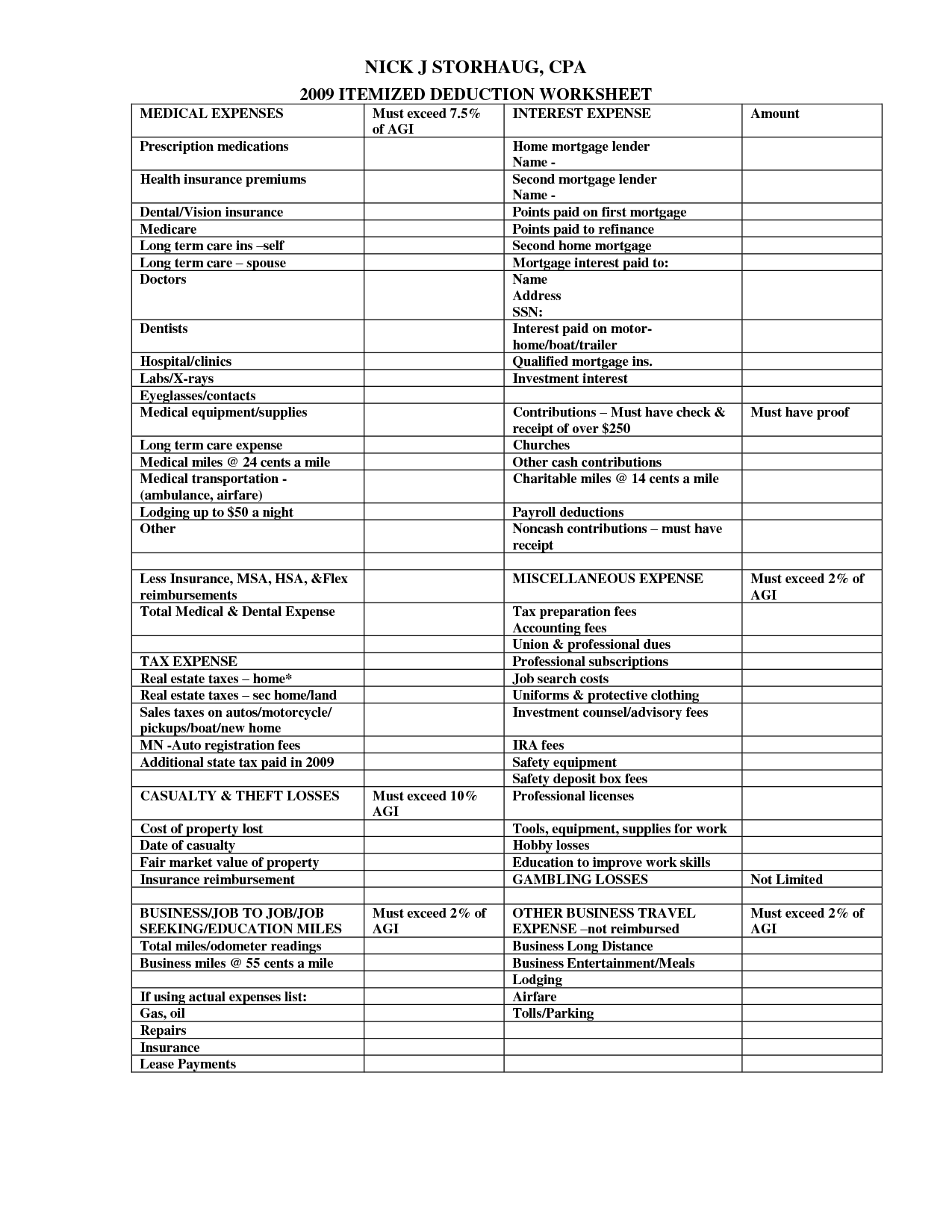

Markku has received a total of 450 in rental income He can deduct the 20 for the rental ad from his income in taxation since advertising costs are directly related to the rental operation In addition he can deduct the housing company charges for the rental period which comes to 75 3 x 25 What Deductions Can I Take as an Owner of Rental Property If you receive rental income from the rental of a dwelling unit there are certain rental expenses you may deduct on your tax return These expenses may include mortgage interest property tax operating expenses depreciation and repairs

Is Rental Property A Tax Deduction

Is Rental Property A Tax Deduction

https://i.pinimg.com/originals/8e/f4/2c/8ef42c9ab3dffc9b087a7a496909a1de.png

Is Rental Property A Tax Write Off Morris Invest

https://morrisinvest.com/wp-content/uploads/2020/05/iStock-140402914-1080x675.jpg

Rental Property Tax Deductions American Landlord

http://americanlandlord.com/wordpress/wp-content/uploads/2017/11/Rental-Property-Tax-Deductions.png

Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 April 25 2024 1 44 PM OVERVIEW Rental property often offers larger deductions and tax benefits than most investments Many of these are overlooked by landlords at tax time This can make a difference in making a profit or losing money on As a rental property owner you can claim deductions to offset rental income and lower taxes Broadly you can deduct qualified rental expenses e g mortgage interest property

Last Updated January 2024 Rental property tax deductions offer significant financial benefits to real estate investors By allowing rental property owners to subtract certain expenses from their taxable income investors can significantly decrease their tax liability to enhance the profitability of their rental properties Rental income is taxed as ordinary income but you may be able to lower your tax burden by claiming certain deductions on your tax return You can deduct expenses related to owning and

Download Is Rental Property A Tax Deduction

More picture related to Is Rental Property A Tax Deduction

Tax Deduction Letter Sign Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-ba34c1cde26cab2d0fb9bbcbf35ce8d5_og.png

The Best Self Employed Tax Deductions And Credits In 2022

https://static.helloskip.com/blog/2022/03/Untitled-design--11-.png

5 Most Overlooked Rental Property Tax Deductions AccidentalRental

http://accidentalrental.com/wp-content/uploads/2017/11/Rental-Tax-Deductions.png

Rental properties have unique tax advantages that allow you to reduce certain expenses and defer certain IRS allowable taxes Keep reading to learn what those tax advantages are and whether they apply to you Table of Contents What is rental income Which rental property tax deductions can you take The nine most common rental property tax deductions are 1 Mortgage Interest Most homeowners use a mortgage to purchase their own home and the same goes for rental properties Landlords with a mortgage will find that loan interest is their largest deductible expense

As the IRS reminds an owner of rental property has a federal tax responsibility to report all rental income on the tax return and deduct the associated expenses from the rental income Common deductions a rental property owner can take include Necessary expenses for managing and maintaining a rental property For tax years beginning in 2023 the maximum section 179 expense deduction is 1 160 000 This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2 890 000 Qualified paid sick leave and qualified paid family leave payroll tax credit

Maybe You Recently Heard That You Could Use Your Rental Property As A

https://i.pinimg.com/originals/ed/55/5e/ed555eac9c1ded5c05879764222b01ce.png

Is Losing Money On A Rental Property A Tax Deduction Know The Facts

https://bridgetownhomebuyers.com/wp-content/uploads/2023/12/Is-losing-money-on-a-rental-property-a-tax-deduction-1080x617.jpg

https://www.vero.fi/en/individuals/property/rental...

Go to the Individual income tax section select Tax card and prepayments 2024 and click the Tax cards and prepayments link Click Request a new tax card Next click the button that says Select the complete tax card request When you move on to the Rental income section you can select whether you pay the tax in the form of prepayments or in the

https://www.vero.fi/en/individuals/property/rental...

Markku has received a total of 450 in rental income He can deduct the 20 for the rental ad from his income in taxation since advertising costs are directly related to the rental operation In addition he can deduct the housing company charges for the rental period which comes to 75 3 x 25

The Tax Deductions And Credits You Can Claim In Australia Your

Maybe You Recently Heard That You Could Use Your Rental Property As A

Is A Tax Deduction A Good Thing

A Free Rental Property Depreciation Spreadsheet Template

PDF The World Of Tax Deductions

What Is A Tax Deduction Tax Credits Tax Deductions Deduction

What Is A Tax Deduction Tax Credits Tax Deductions Deduction

Rental Property Tax Deductions You Need To Know

Tax Deductions On Rental Homes Property Tax Deduction

Rental Property Tax Deductions Worksheet

Is Rental Property A Tax Deduction - Written by a TurboTax Expert Reviewed by a TurboTax CPA Updated for Tax Year 2023 April 25 2024 1 44 PM OVERVIEW Rental property often offers larger deductions and tax benefits than most investments Many of these are overlooked by landlords at tax time This can make a difference in making a profit or losing money on