Is Sales Tax On Car Purchase Deductible The good news is you may be eligible to deduct the sales tax from your car purchase Learn how to deduct vehicle sales taxes in this article What types of vehicles are eligible for a sales tax deduction Sales tax

If you use the standard method you can add sales tax you paid for purchase of a motor vehicle However you can only deduct general sales tax that is charged at the same A noticeable chunk of the cost of purchasing a car falls under the sales tax It might leave you wondering if there s any way for you to avoid paying it or at least deduct it

Is Sales Tax On Car Purchase Deductible

Is Sales Tax On Car Purchase Deductible

https://multichannelmerchant.com/wp-content/uploads/2020/12/online-sales-tax-keyboard-feature-cropped.jpg

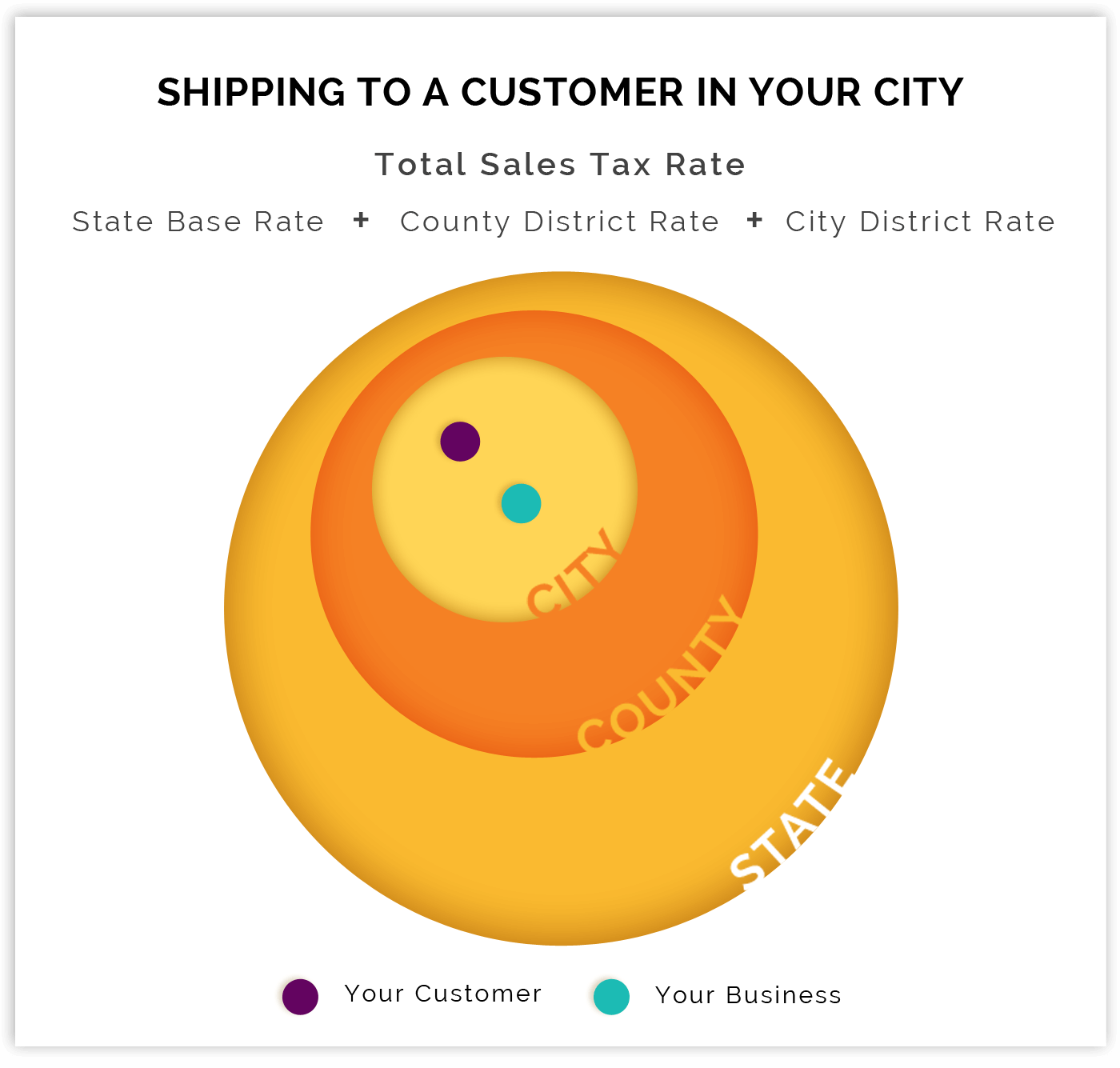

Sales Tax You Pay On Rent Depends On Where You Live

https://www.azcentral.com/gcdn/-mm-/47c683c6bf1f4284c82caa7f005ce65ecbb2dc0b/c=0-260-3703-2343/local/-/media/Phoenix/2014/12/28/B9315535737Z.1_20141228110410_000_G4M9ER7T0.1-0.jpg?width=3200&height=1801&fit=crop&format=pjpg&auto=webp

HMRC Company Car Tax Rates 2020 21 Explained

https://blog-media.vimcar.com/uk-blog/uploads/2021/04/21142208/Optimized-210419_car-taxes-1024x683.jpg

In general the sales tax on a new car purchase can be deducted in the year of purchase while the sales tax on a used car purchase can only be deducted if the state in which the car was purchased imposes a sales tax Sales tax on a car or automobile purchase might be deductible It depends on the taxpayer s circumstances Generally the following conditions must all be met

You can deduct your sales tax on vehicle purchases whether the purchase including the sales tax was financed or not Again you ll need to itemize your deductions to do Learn how to deduct sales tax on a car purchase by itemizing on Schedule A on Form 1040 Find out the rules limitations and exceptions for deducting sales tax on new or used cars and

Download Is Sales Tax On Car Purchase Deductible

More picture related to Is Sales Tax On Car Purchase Deductible

Is A New Car Purchase Tax Deductible Auto Cheat Sheet

https://www.autocheatsheet.com/wp-content/uploads/new-car-purchase-tax-deductible.jpg

Do You Have To Pay Sales Tax On A Semi Truck In Florida RCTruckStop

https://rctruckstop.com/wp-content/uploads/2023/01/sales-tax-2.jpg

How Much Are Sales Tax On Cars In Ontario Loans Canada

https://loanscanada.ca/wp-content/uploads/2023/05/Tax-On-Cars-In-Ontario.png

If you itemize and you choose to use state sales tax instead of state income tax then it is deductible subject to the 10 000 limit on state and local taxes Calculate the amount of state and local general sales tax you can deduct when you itemize on your tax return Enter your filing status income dependents and sales tax

You are allowed to deduct the sales tax on a car purchase don t know if it has to be new or not but this deduction will go under your itemized deductions For itemized deductions to be Section 179 lets you deduct a portion of the car s cost up to 10 100 18 100 with bonus depreciation if it s used over 50 for business You can also deduct sales tax loan

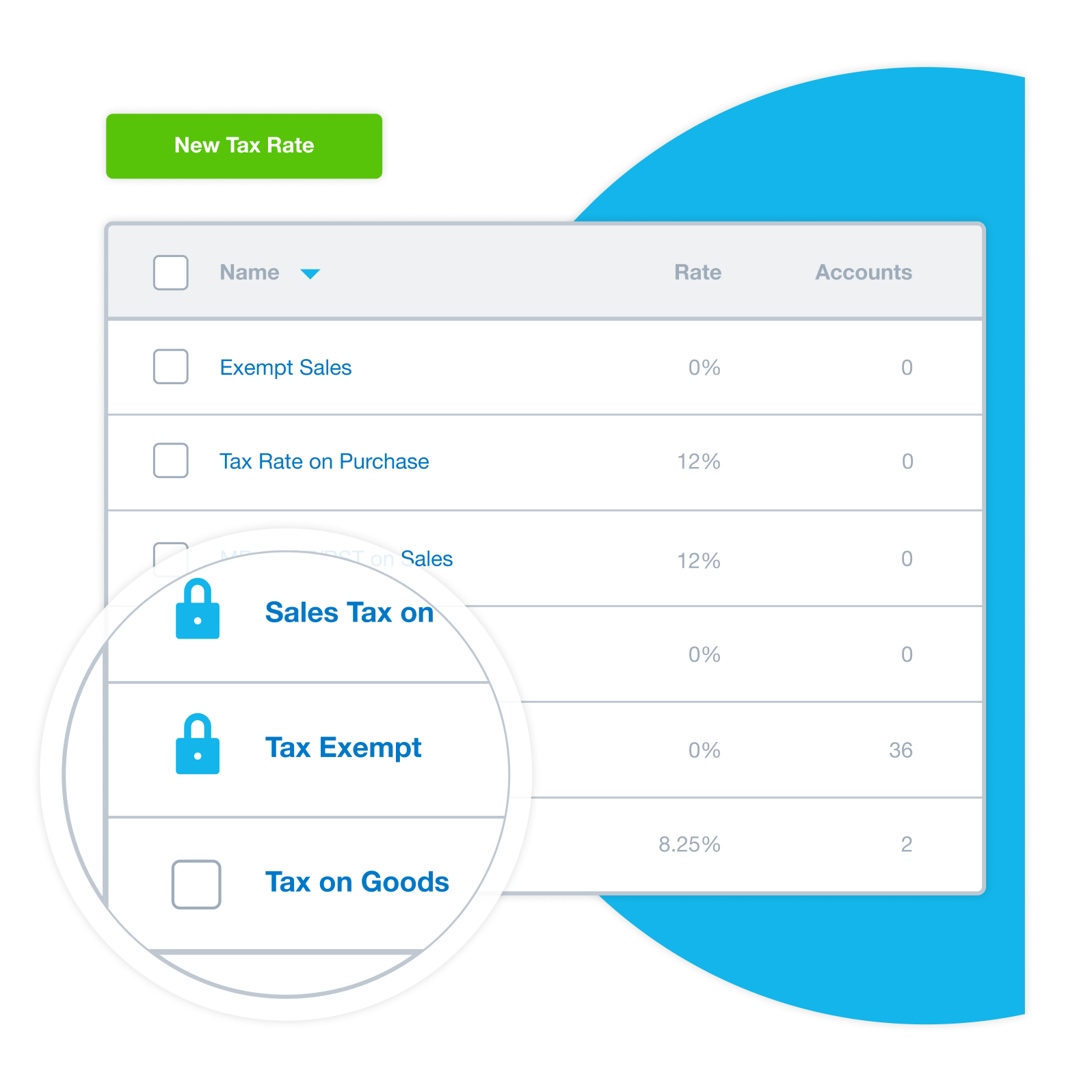

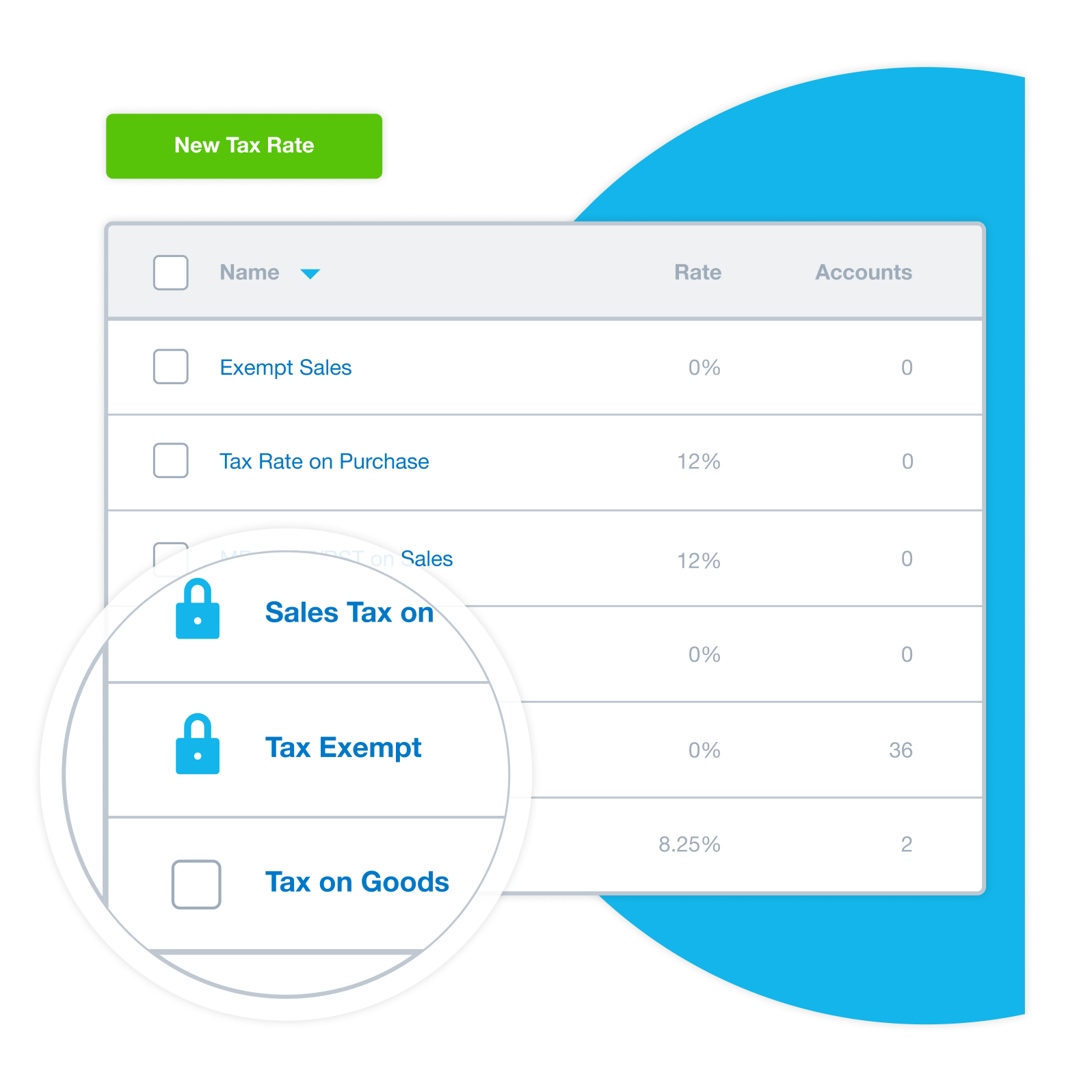

Sales Tax Software Xero PH

https://www.xero.com/content/dam/xero/pilot-images/features/sales-tax/sales_tax-customise_sales_tax_rates.png

The Difference Between Sales Tax And Use Tax A Guide For E commerce

https://thetaxvalet.com/wp-content/uploads/2023/04/Jurence11938_blog_post_header_receipts_bright_colors_cubic_styl_e35d9bff-bb41-4d84-a105-4243f79d4141.png

https://www.taxslayer.com/blog/can-i-d…

The good news is you may be eligible to deduct the sales tax from your car purchase Learn how to deduct vehicle sales taxes in this article What types of vehicles are eligible for a sales tax deduction Sales tax

https://ttlc.intuit.com/community/tax-credits...

If you use the standard method you can add sales tax you paid for purchase of a motor vehicle However you can only deduct general sales tax that is charged at the same

California Sales Tax Small Business Guide TRUiC

Sales Tax Software Xero PH

Is Sales Tax On A Car Tax Deductible Classic Car Walls

Texas House Passes Bill That Would Remove Sales Tax On Menstrual

6 3 3 Adjusting The Sales Tax On An Invoice On Vimeo

Is Sales Tax On A Car Tax Deductible Classic Car Walls

Is Sales Tax On A Car Tax Deductible Classic Car Walls

Sales Tax By State Should You Charge Sales Tax On Digital Products

Washington Sales Tax For Businesses A Complete Guide FreeCashFlow io

Sales Tax Guide For Artists TaxJar Tax Guide Sales Tax Tax Questions

Is Sales Tax On Car Purchase Deductible - You can deduct your sales tax on vehicle purchases whether the purchase including the sales tax was financed or not Again you ll need to itemize your deductions to do