Is Special Allowance Taxable While special allowance is either fully taxable or fully partially taxable Is the special allowance fully paid Yes a special allowance is fully paid by the employer every month

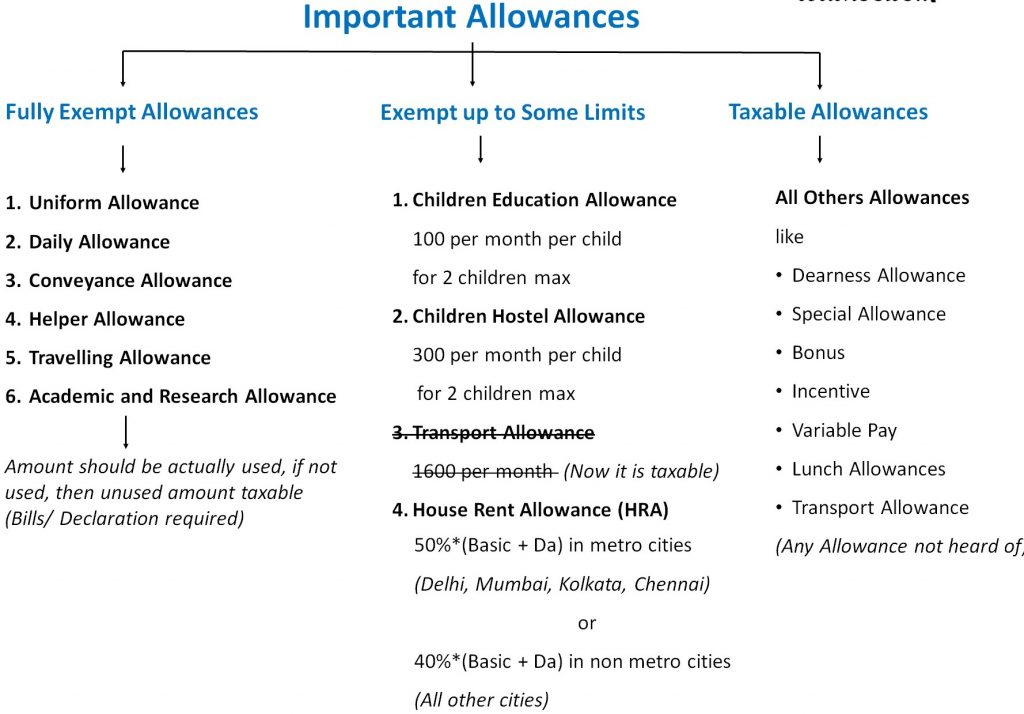

Allowances differentials and other special pay Payments received by U S Government civilian employees for working abroad including pay differentials are taxable However certain foreign areas allowances cost of living allowances and travel allowances are tax free Income tax Act contains provisions for taxability of various allowances received by a taxpayer These allowances are either in the nature of income which is exempt from tax or is an expenditure which provides weighted deductions to the taxpayer

Is Special Allowance Taxable

Is Special Allowance Taxable

https://studycafe.in/cdn-cgi/image/fit=contain,format=webp,gravity=auto,metadata=none,quality=80,width=1200,height=730/wp-content/uploads/2022/03/Everything-You-Need-to-Know-About-Special-Allowance.jpg

Special Allowances In India Under Income Tax Return ITR TaxHelpdesk

https://www.taxhelpdesk.in/wp-content/uploads/2021/01/Special-Allowances.png

All About Special Allowance Its Taxation Calculation In India

https://khatabook-assets.s3.amazonaws.com/media/post/2021-07-16_064235.6150590000.jpg

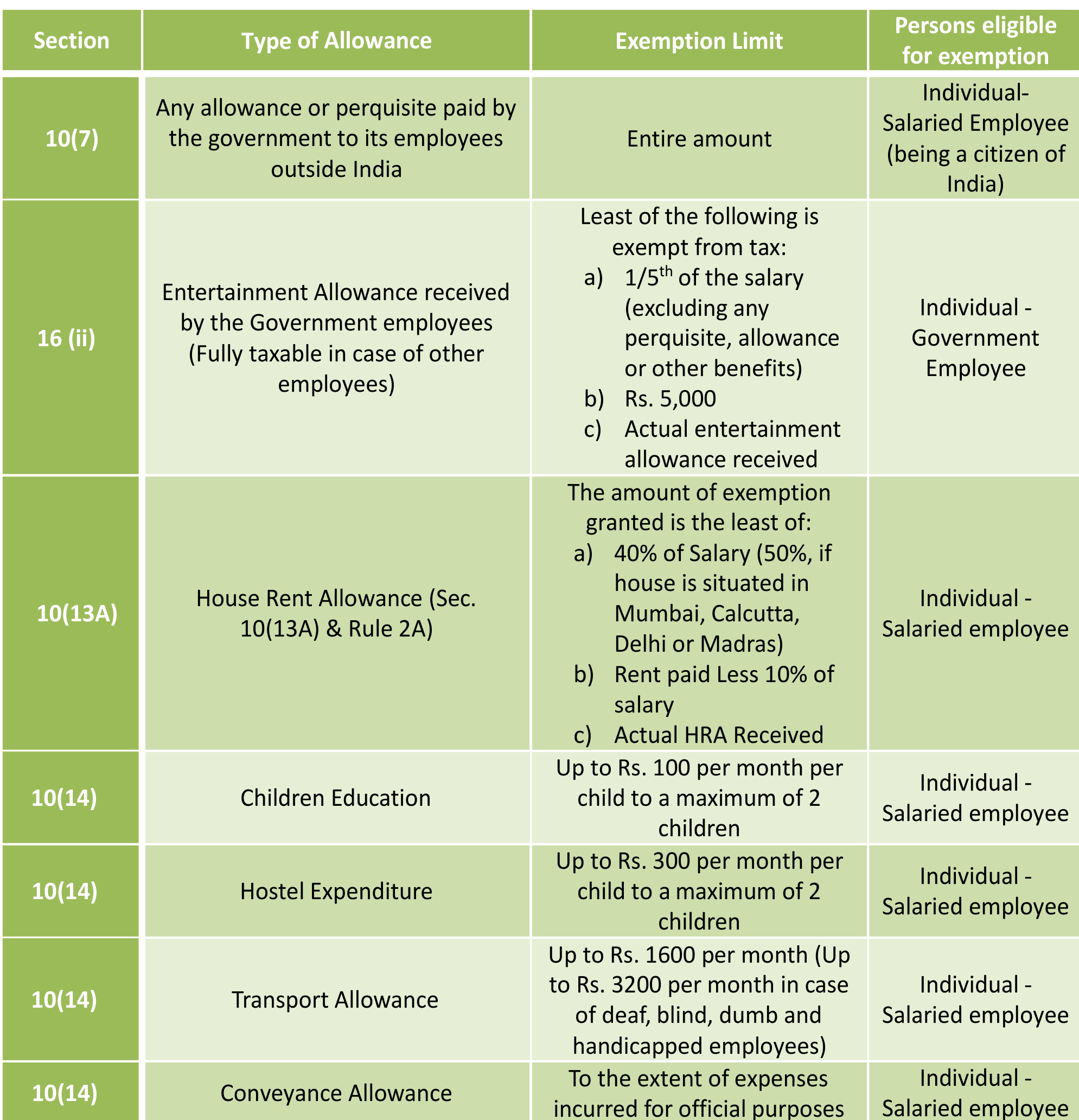

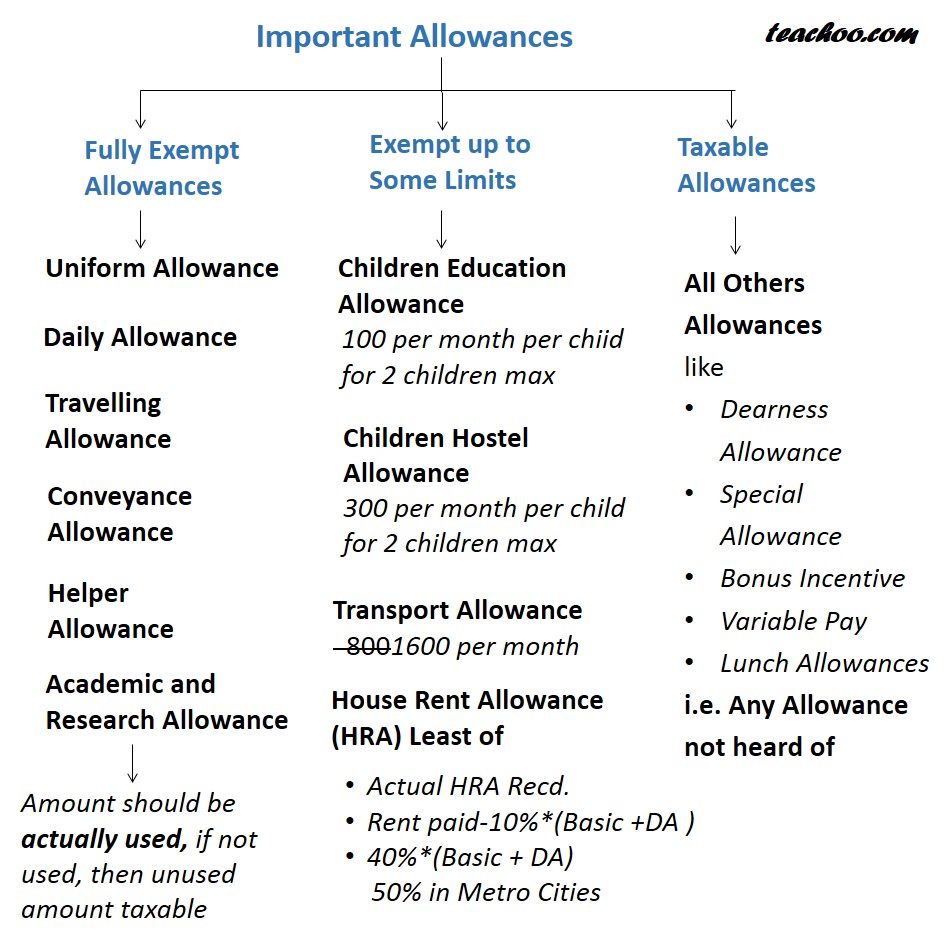

Read to learn about rules for taxation and the calculation of special allowances A special allowance is one of the many allowances an employer provides to an employee as a part of their salary While some of this allowance is exempted certain parts are taxable under the Income Tax law Only those allowances or grants are taxable which are not expressly mentioned under any IT Act exemptions Most exemptions are covered under Section 10 14 of the IT Act 1961 Furthermore there are specific conditions where extraordinary allowances will not be taxable these are mentioned under the following IT sections They are

Several conditions define when extraordinary allowances are not taxable as specified in relevant sections of the Income Tax Act Exemptions apply only if the allowance is not considered a prerequisite This distinction is crucial and applies solely to permanent employees Allowances are fully taxable in the hands of the employee receiving them unless specific exemptions have been provided under the Act Certain special allowances are exempted through sections 10 14 i and 10 14 ii of the Act

Download Is Special Allowance Taxable

More picture related to Is Special Allowance Taxable

Special Allowance In Salary Special Compensatory Allowance Central

https://7thpaycommissionnews.in/wp-content/uploads/2019/12/Special_Allowance_in_India_-_Rates_and_Exemption_from_Income_Tax-min1.jpg

All About Allowances Income Tax Exemption CA Rajput Jain

https://carajput.com/blog/wp-content/uploads/2020/10/important-allowances-2-1-1024x714.jpg

Why Is A Car Allowance Taxable What You Need To Know About This Program

https://www.motus.com/wp-content/uploads/2021/09/car-allowance-taxable-1024x705.jpg

Special Allowance and Taxation Allowances which are part of salary are taxable if no specific exemption is provided under the Income Tax Act Rules Certain allowances have been exempted from Income tax as per section 10 14 of the Income Tax Act Section 10 14 has two clauses i and ii The availability of a special allowance for employees to fulfil duties is mentioned in Section 10 14 of the Income Tax Act The special allowance is included in the total salary These allowances are based solely on an employee s basic pay

[desc-10] [desc-11]

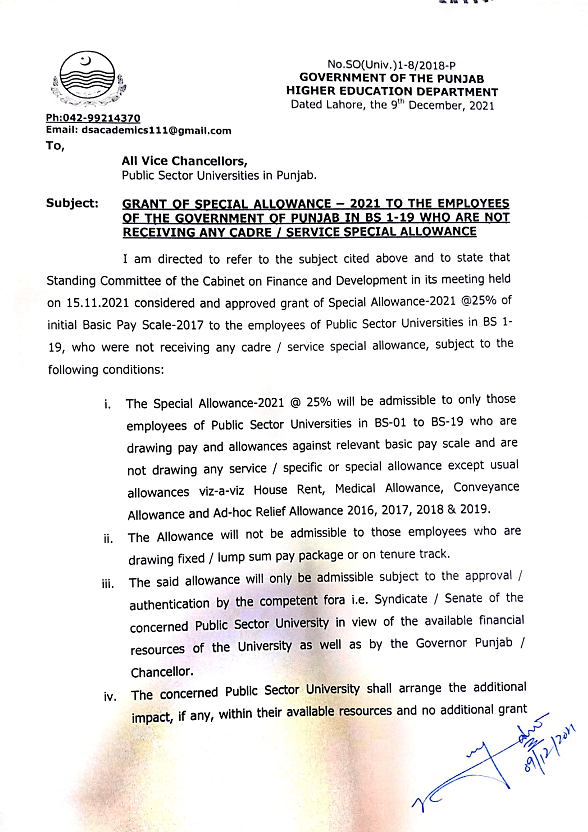

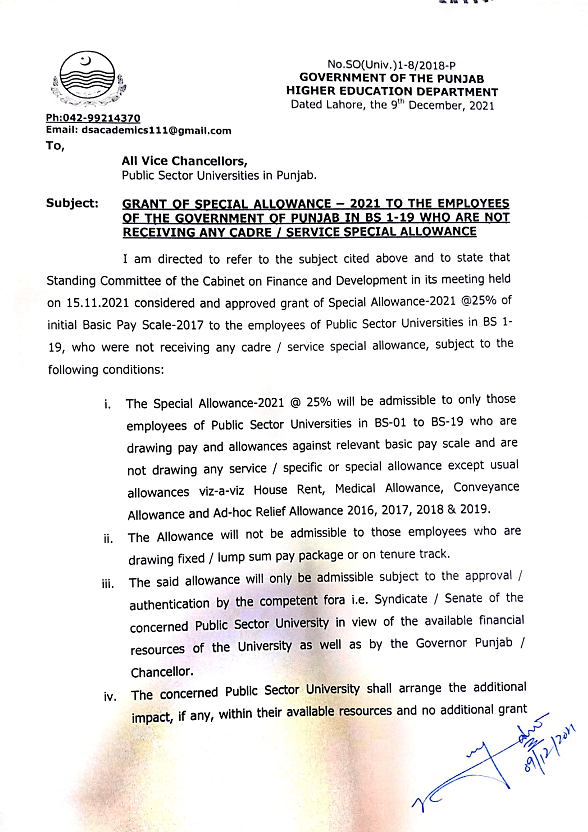

Special Allowance 2021 To University Employees 25 Basic Pay

https://www.glxspace.com/wp-content/uploads/2021/12/Special-Allowance-2021-to-University-Employees-@-25-initial-basic-pay.png

All About Allowances Income Tax Exemption CA Rajput Jain

https://carajput.com/blog/wp-content/uploads/2020/10/Salary-allowances-1.png

https://scripbox.com/tax/special-allowance

While special allowance is either fully taxable or fully partially taxable Is the special allowance fully paid Yes a special allowance is fully paid by the employer every month

https://www.irs.gov/individuals/international...

Allowances differentials and other special pay Payments received by U S Government civilian employees for working abroad including pay differentials are taxable However certain foreign areas allowances cost of living allowances and travel allowances are tax free

Important Allowances And Their Questions Taxability Of Allowances

Special Allowance 2021 To University Employees 25 Basic Pay

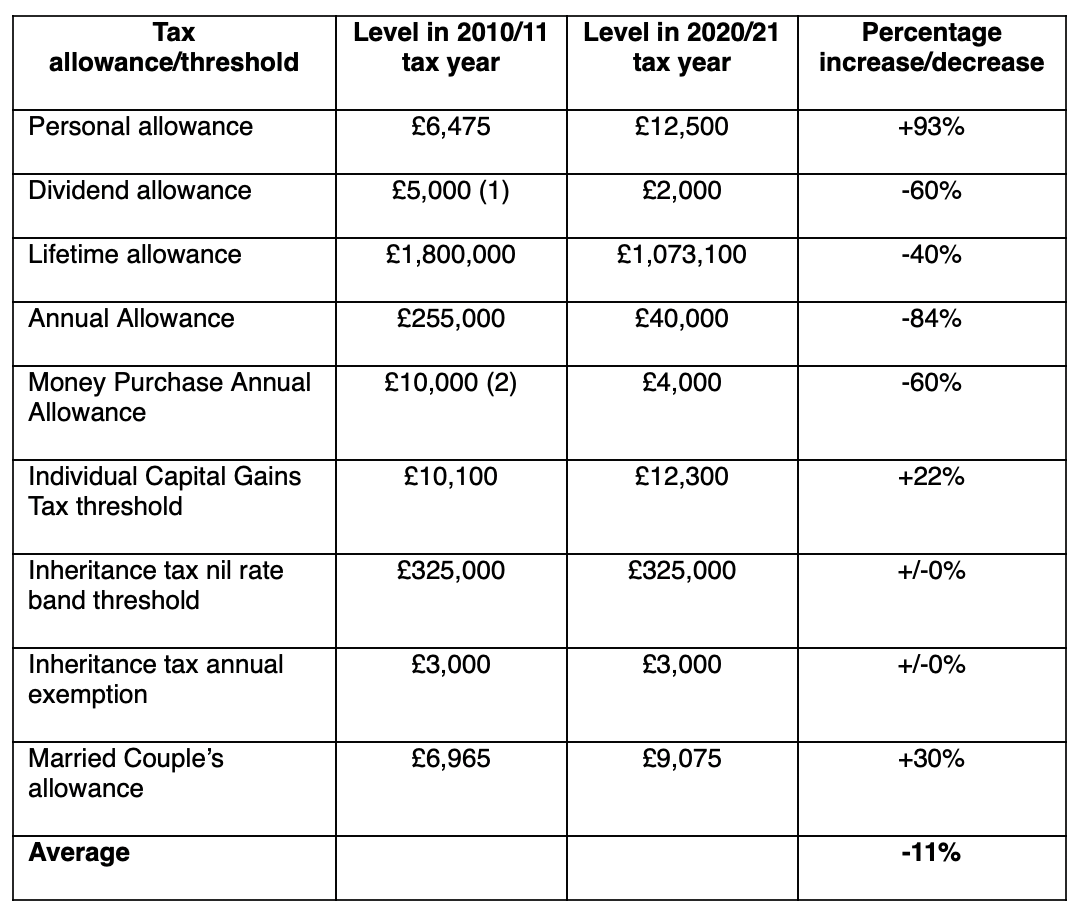

Tax Allowances Down 11 In Value Over Decade And Will Fall Further

Conveyance Allowance Definition Calculations Tax Exemptions

Allowances Partially Taxable Allowances Section 10 14 Income

Prescribed Special Allowances Which Are Exempt To A Certain Extent

Prescribed Special Allowances Which Are Exempt To A Certain Extent

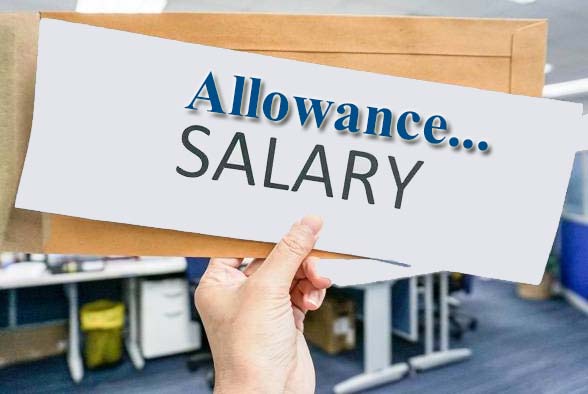

Notification Of Special Allowance 2022 Revision Pay Scales LG

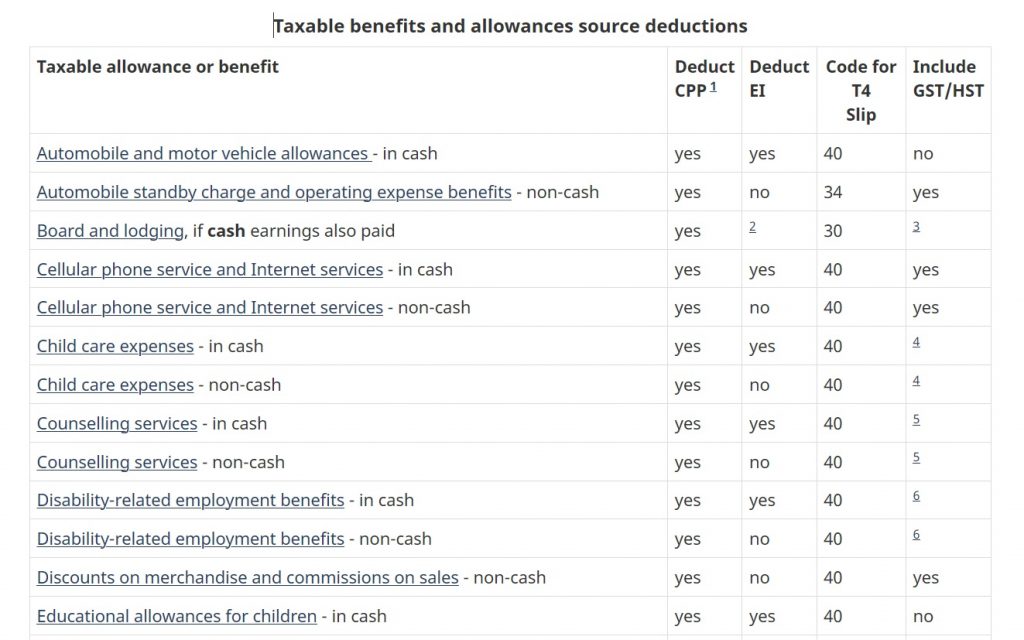

Helpful Resources For Calculating Canadian Employee Taxable Benefits

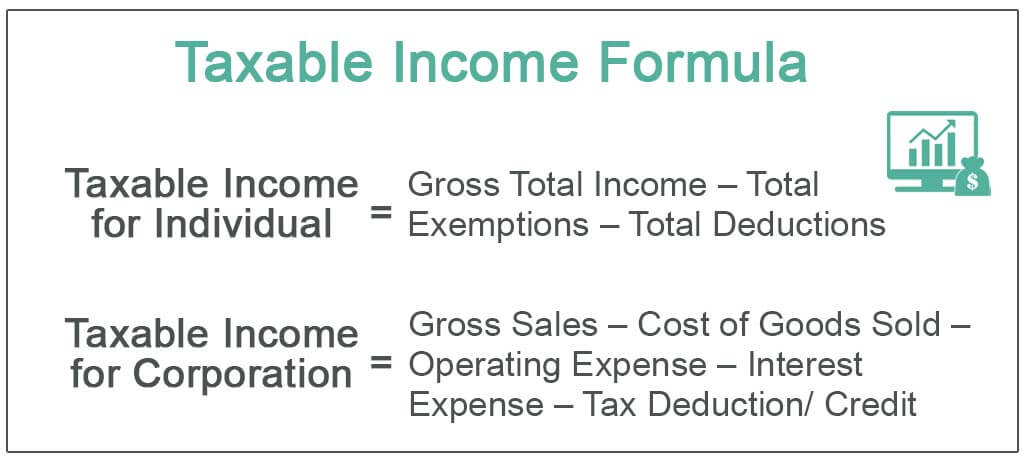

Taxable Income Formula Examples How To Calculate Taxable Income

Is Special Allowance Taxable - [desc-13]