Rebate Rate In Income Tax Web 25 mai 2021 nbsp 0183 32 Income Tax rebate is the refund or reduction amount offered by the Income Tax when you file your taxes All you need to know about an Income Tax Rebate In the

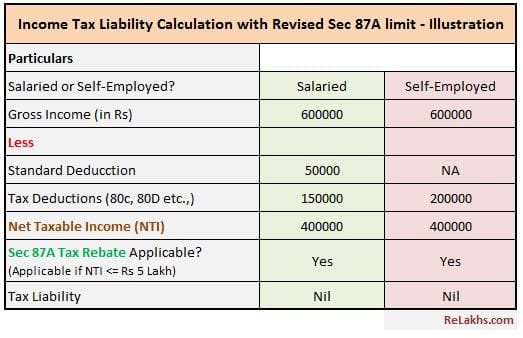

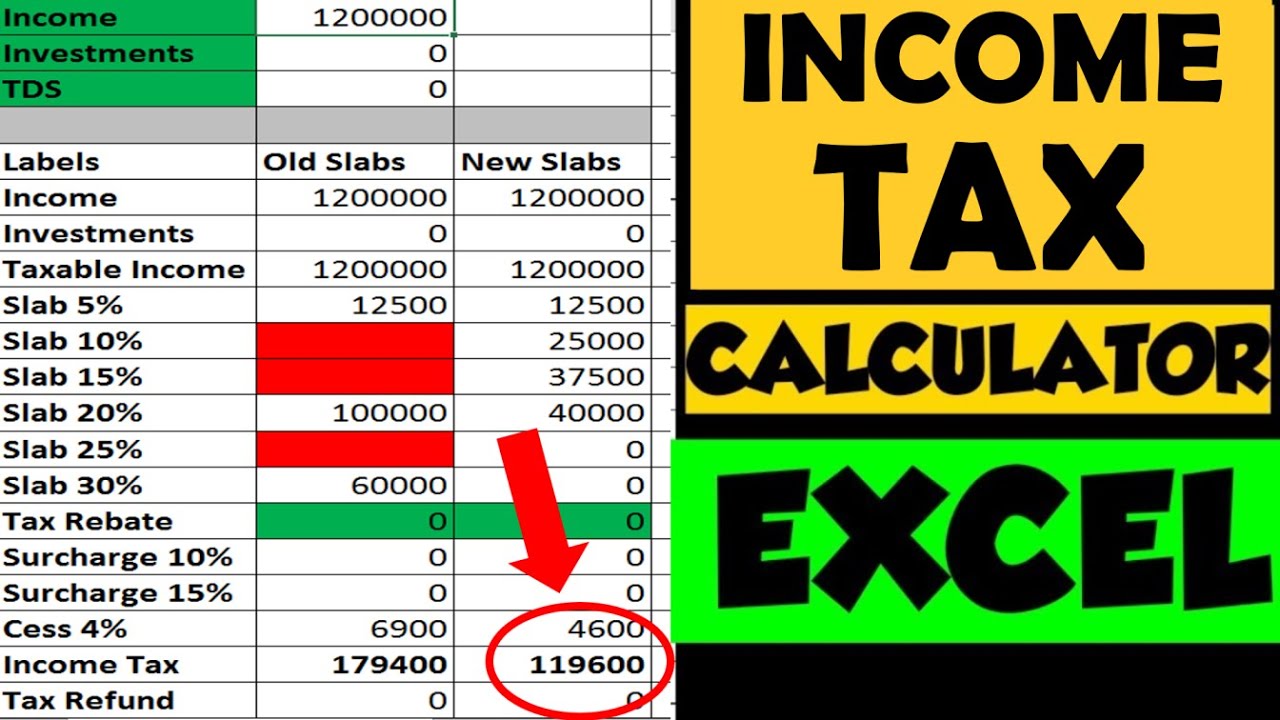

Web 1 d 233 c 2022 nbsp 0183 32 The National Bureau of Economic Research credited this tax rebate with helping to counteract the recession by increasing aggregate consumption by 2 9 percent in the third quarter of 2001 and 2 percent in Web 7 lignes nbsp 0183 32 11 avr 2023 nbsp 0183 32 As per Section 87A of the Income Tax Act if the total income of an individual does not exceed

Rebate Rate In Income Tax

Rebate Rate In Income Tax

https://tradebrains.in/wp-content/uploads/2019/02/income-tax-rebate-min.png

Income Tax Deductions List FY 2019 20

https://www.relakhs.com/wp-content/uploads/2019/02/Revised-Section-87A-Tax-Rebate-impact-on-Income-tax-liability-calculation-FY-2019-20-AY-2020-21.jpg

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

https://4.bp.blogspot.com/-ygld82QNGGs/Xd_7fFpO9WI/AAAAAAAAJBU/w2H37lRhli4Tk4pgjN-Ra8So_O_t_RJ-wCK4BGAYYCw/s1600/slab_rate_%25281%2529-20190201043639.png

Web 7 lignes nbsp 0183 32 16 mars 2017 nbsp 0183 32 Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh The maximum Web 3 Rebate u s 87A Rs 12 500 or 100 of income tax whichever is less if total income does not exceed Rs 5 00 000 applicable for resident individual Sec 87A 4 The

Web 4 ao 251 t 2023 nbsp 0183 32 A rebate in income tax is a refund or credit given to taxpayers by the government for overpaying their taxes or meeting certain criteria It is a way to reduce Web 20 ao 251 t 2022 nbsp 0183 32 70 000 No rebate available for Individual and HUF with GTI of more than 5 00 000 Individual having salary of less than 1 00 000 which is more than 90 of

Download Rebate Rate In Income Tax

More picture related to Rebate Rate In Income Tax

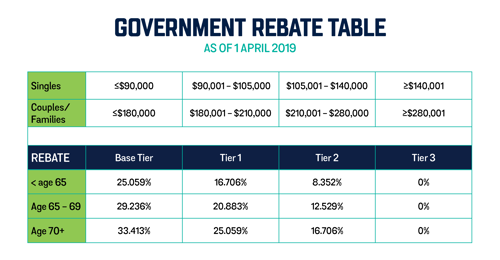

Tax Time And Private Health Insurance Teachers Health

https://www.teachershealth.com.au/media/2111/2019-govt-rebate-table2.png?width=500&height=260.4838709677419

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

https://1.bp.blogspot.com/-d8vHwIDCAgs/YO0G5DDkc2I/AAAAAAAAPMM/lt0uwqs-BicHDIFCG1xMLW38tssq4hDpQCLcBGAsYHQ/w1200-h630-p-k-no-nu/Screenshot_20210713-082223_WPS%2BOffice.jpg

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

http://taxguru.in/wp-content/uploads/2016/05/87A-Computation.jpg

Web Income Tax Rebate When an individual pays more than his her tax liability he she receives a refund on the paid amount which is known as tax rebate The excess money is Web 3 f 233 vr 2023 nbsp 0183 32 Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their

Web 6 f 233 vr 2023 nbsp 0183 32 Frequently Asked Questions Can an NRI claim rebate allowed u s 87A No only resident individual taxpayers can claim the income tax rebate An NRI taxpayer is not allowed to claim an income tax rebate Web 4 f 233 vr 2023 nbsp 0183 32 A tax Rebate is a benefit on income tax given by the government which means the total amount of salary you get in a year including bonuses and other benefits

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

https://www.relakhs.com/wp-content/uploads/2019/04/Income-Tax-Calculation-for-FY-2019-20-AY-2020-21-with-revised-Section-87A-limit-illustrations-pic.jpg

Rebate U s 87A For F Y 2019 20 And A Y 2020 21 ArthikDisha

https://i2.wp.com/arthikdisha.com/wp-content/uploads/2019/02/pdfresizer.com-pdf-crop-page-001.jpg?resize=720%2C400&ssl=1

https://www.icicidirect.com/ilearn/tax-planning/articles/income-tax...

Web 25 mai 2021 nbsp 0183 32 Income Tax rebate is the refund or reduction amount offered by the Income Tax when you file your taxes All you need to know about an Income Tax Rebate In the

https://turbotax.intuit.com/tax-tips/tax-relief/w…

Web 1 d 233 c 2022 nbsp 0183 32 The National Bureau of Economic Research credited this tax rebate with helping to counteract the recession by increasing aggregate consumption by 2 9 percent in the third quarter of 2001 and 2 percent in

New Income Tax Calculator Income Tax Calculation FY 2020 21 Slab

Section 87A Tax Rebate FY 2019 20 How To Check Rebate Eligibility

Incometax Individual Income Taxes Urban Institute This Service

Malaysia Personal Income Tax Guide 2020 YA 2019

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Income Tax Rebate U s 87A For The Financial Year 2022 23

Corporate Tax Rebate Budget 2022 Rebate2022

FY 2020 21 Income Tax Sections Of Deductions And Rebates For Resident

Rebate Rate In Income Tax - Web 7 lignes nbsp 0183 32 16 mars 2017 nbsp 0183 32 Claim a tax rebate under section 87A if your total income does not exceed Rs 5 lakh The maximum