Is Student Loan Interest Refundable The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in The short answer is yes You can deduct all or a portion of your student loan interest if you meet all of the following requirements You paid interest on a qualified student loan

Is Student Loan Interest Refundable

Is Student Loan Interest Refundable

https://g.foolcdn.com/editorial/images/603604/student-debt.jpg

Trump Administration s Student Loan Policy Has Dire Implications

http://res.cloudinary.com/ivnnews-archive/image/upload/student-loan.jpg.jpg

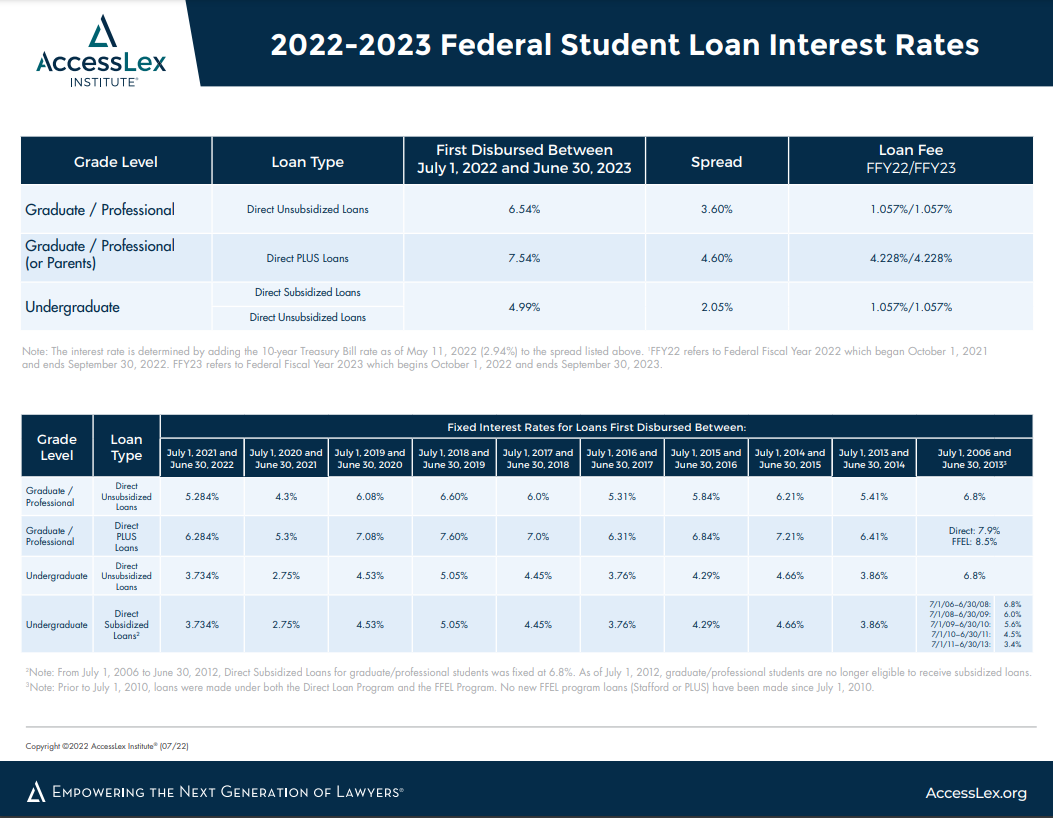

Federal Student Loan Interest Rates AccessLex

https://www.accesslex.org/sites/default/files/inline-images/Federal Student Loan Interest Rates_2022 2023.png

Under the U S Department of Education s income driven repayment plans student loan borrowers are entitled to get any of their remaining debt forgiven after 20 or 25 years Student loan interest deduction For 2023 the amount of your student loan interest deduction is gradually reduced phased out if your MAGI is between 75 000 and 90 000 155 000 and 185 000 if you file a joint

The student loan interest tax deduction is for students and their parents who are repaying federal student financial aid It s the above the line adjustment to your adjusted gross income AGI if you have paid interest If you made federal student loan payments in 2023 you may be eligible to deduct a portion of the interest paid on your 2023 federal tax return This is known as a student loan

Download Is Student Loan Interest Refundable

More picture related to Is Student Loan Interest Refundable

Account Suspended Student Loan Debt Student Loans Best Student Loans

https://i.pinimg.com/originals/6a/19/de/6a19de8f425df290ef065cc9301e5b92.png

How Much Is Student Loan Interest Really Costing You Student Loan

https://i.pinimg.com/originals/98/4d/b8/984db8dffca51558a534c63fbee47e94.png

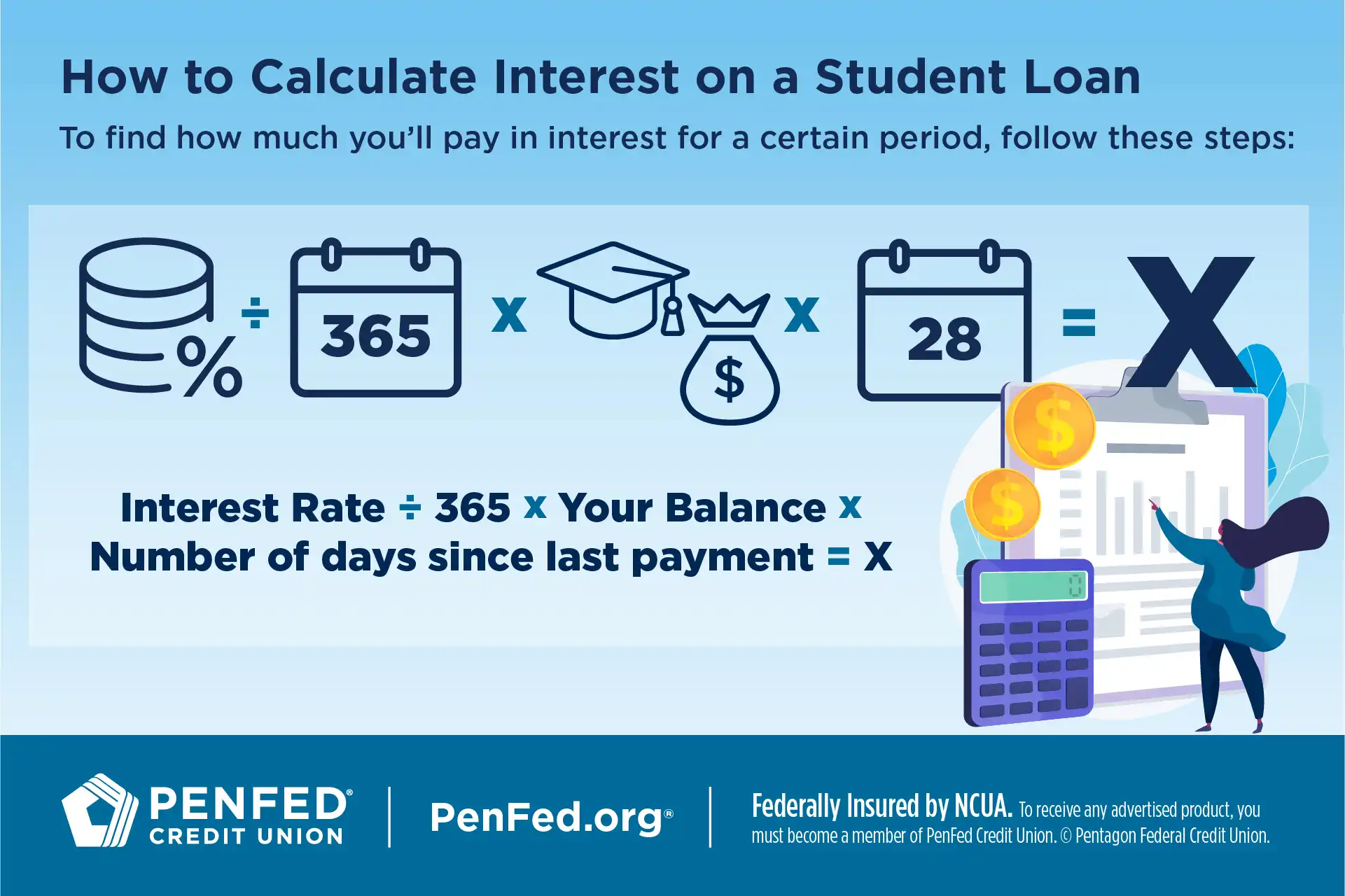

How Does Student Loan Interest Work

https://www.penfed.org/content/dam/penfed/blogimages/2023/infographic-how-to-calculate-interest-on-a-student-loan.webp

The answer is yes In fact federal student loan borrowers could qualify to deduct up to 2 500 of student loan interest per tax return per tax year You can claim the student If you made student loan payments during the payment freeze to take advantage of the 0 interest waiver and paid off your loans you could be eligible for a refund of those

You ll be on the hook for payments and interest on your entire student loan balance including the refunded amount now that bills are due But if you received forgiveness To offer relief for those borrowers the federal government has said that if you have a qualifying direct federal student loan and made payments during the pandemic

Student Loans The Facts You Need To Know Student Loans Student

https://i.pinimg.com/originals/ee/0b/fa/ee0bfa6c6fe86814c22b2210fa4cbd1a.jpg

Student Loan Interest Deduction And Tuition Fees Deduction Offer Tax

https://www.myfederalretirement.com/wp-content/uploads/2021/03/student-loans-chalkboard.jpg

https://www.investopedia.com/terms/s/slid.asp

The student loan interest deduction is a federal income tax deduction that allows borrowers to subtract up to 2 500 of the interest paid on

https://www.nerdwallet.com/article/loans/student...

The student loan interest deduction is a tax break for college students or parents who took on debt to pay for their school It allows you to deduct up to 2 500 in

Student Loan Debt Crisis Reaches 1 5 Trillion How Can Ameritech

Student Loans The Facts You Need To Know Student Loans Student

The Dummies Guide To Unsecured Credit Techno FAQ

/student-loan-interest-deduction-3193022_HL-6a2dfcbfdccb47479d5a544f175feaf1.gif)

The Federal Student Loan Interest Deduction

Student Loan Interest Waiver Here s How It Works Money

Student Loan Interest Deduction H R Block

Student Loan Interest Deduction H R Block

Student Loan Interest Deduction 2013 PriorTax Blog

16 Best Private Student Loans Of March 2021 NerdWallet Student

Is Student Loan Debt Really Such A Bad Thing The Scholarship System

Is Student Loan Interest Refundable - Under the U S Department of Education s income driven repayment plans student loan borrowers are entitled to get any of their remaining debt forgiven after 20 or 25 years