Is Term Deposit Taxable A CD is typically issued by a bank or a credit union and pays interest on deposited funds in return for leaving that money in the

No CDs are generally taxed annually For example if you had a 5 year CD you would include interest earned in your tax return each year not at the end of the 5 Just as with savings accounts the interest earned on a term deposit is treated as income by the Australian Taxation Office ATO The amount is combined

Is Term Deposit Taxable

Is Term Deposit Taxable

https://images.news9live.com/wp-content/uploads/2023/07/SBI-Fixed-Deposit-FD-vs-Post-Office-Term-Deposit-scheme.png?w=1200&enlarge=true

Landlords Are Rent Deposits Received Taxable

https://truemanbrown.co.uk/wp-content/uploads/2019/07/deposit__FocusFillWzEyMDAsNzAwLCJ5Iiw1MF0.jpg

Rocky Credit Union Ownership Community Innovation Wealth

https://www.rockycreditunion.com/media/1766/term-deposit.png

There are three tax brackets depending on the amount of the deposit Up to 6 000 19 Between 6 000 and 50 000 21 Between 50 000 and 200 000 23 Over Fact checked If you ve invested money in a term deposit you will need to pay tax on the interest income you earn The amount of tax you ll need to pay on your

A certificate of deposit CD is a type of savings vehicle that pays a fixed interest rate over a set term typically ranging from a few months to several years While many people think of CDs Exceptions to Paying Taxes on CD Interest If the CD is placed in a tax deferred 401 k or individual retirement account IRA any interest earned on the CD

Download Is Term Deposit Taxable

More picture related to Is Term Deposit Taxable

Tax On FD Is Fixed Deposit Taxable In India Freo Save

https://freosave.com/wp-content/uploads/2023/03/Is-Fixed-Deposit-Taxable.jpg

What Is Taxable Income And How To Calculate Taxable Income

https://ebizfiling.com/wp-content/uploads/2022/04/Taxable-Income.png

Accounting For Long Term Deposit

https://tothefinance.com/wp-content/uploads/2022/09/Accounting-for-long-term-desposits.jpg

Yes Certificates of deposit CDs also known as term deposits or time deposits are FDIC insured savings accounts available at most banks CDs earn interest Updated January 31 2024 CDs certificates of deposit provide holders with taxable interest income They are fixed income investments issued by banks and pay interest at

Tax saver term deposits Tax saver deposits are eligible for a tax deduction of up to Rs 1 5 lakh under Section 80C of the Income Tax Act These tax saver term Most likely income from your certificates of deposit CDs is going to hit your tax return as ordinary income tax said Christopher Johns founder of Spark Wealth

Term Deposit Luminor

https://www.luminor.lv/sites/default/files/styles/base_image_1440/public/documents/images/common/deposit_eng.png?itok=WlBMdLZ4

_1.png)

Income Tax Calculator

https://www.wyomingmi.gov/portals/0/What is taxable income (3)_1.png

https://www.investopedia.com/ask/answers/…

A CD is typically issued by a bank or a credit union and pays interest on deposited funds in return for leaving that money in the

https://www.businessinsider.com/personal-finance/...

No CDs are generally taxed annually For example if you had a 5 year CD you would include interest earned in your tax return each year not at the end of the 5

Baroda Tax Savings Term Deposit Account Open A Tax Saving Bank Fixed

Term Deposit Luminor

Is Recurring Deposit Taxable

Fixed Deposits Term Deposit Accounts Business Sampath Bank PLC

Monthly Or At Maturity Interest Mozo

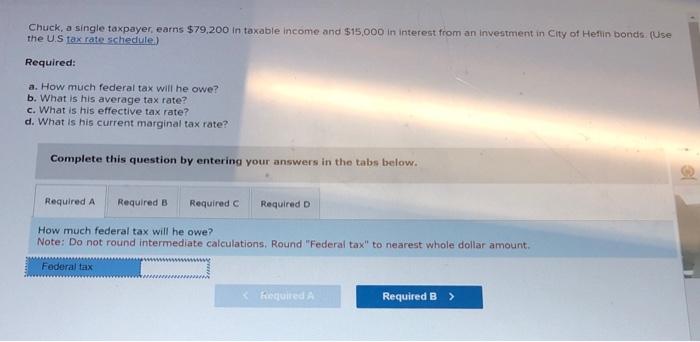

Solved Chuck A Single Taxpayer Earns 79 200 In Taxable Chegg

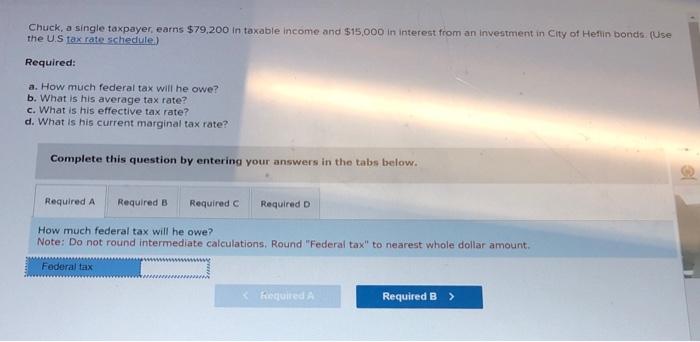

Solved Chuck A Single Taxpayer Earns 79 200 In Taxable Chegg

What Is A Taxable Benefit Lewer Canada

Oregon Lawmakers Amend The Understatement Of Taxable Income Penalty

Taxable Payments Annual Report Bosco Chartered Accountants

Is Term Deposit Taxable - There are three tax brackets depending on the amount of the deposit Up to 6 000 19 Between 6 000 and 50 000 21 Between 50 000 and 200 000 23 Over