Is There A Lifetime Limit On Residential Energy Credit The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit

In 2018 2019 2020 and 2021 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows There are also other individual credit limitations 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water boiler 300 for The Inflation Reduction Act modified the two existing individual income tax credits for energy related residential improvements Some of the modifications included the extension of both credits the elimination of a lifetime cap for one credit and the addition of properties eligible for both credits

Is There A Lifetime Limit On Residential Energy Credit

Is There A Lifetime Limit On Residential Energy Credit

https://piggybank.ca/wp-content/uploads/Canada-Training-Credit-Limit.png

What You Need To Know About Energy Efficient Property Credits

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

Residential Energy Credit YouTube

https://i.ytimg.com/vi/U5PlatCELRc/maxresdefault.jpg

Regardless of which improvements you opt for there is a 500 lifetime limit for the nonbusiness energy property credit There is no limit on the residential energy credit which offer more opportunities for current and future tax and energy savings The Act repeals the lifetime credit limitation and instead limits the allowable credit to 1 200 per taxpayer per year In addition there are annual limits of 600 for credits with respect to qualified energy property expenditures 600 for exterior windows and skylights and 250 for any exterior door and 500 total for all exterior doors

The maximum residential energy credit amount you can claim is capped each tax year Key limitations include Lifetime limit There is a total lifetime limit of 500 on the tax credits you can claim for qualifying improvements Annual limit For 2023 you can only claim a maximum of 600 in credits each year This limit changes periodically Key Takeaways As incentive to make energy efficient upgrades to your home the federal government offers two nonrefundable tax credits The Residential Clean Energy Credit offers a credit of 30 of the costs of alternative energy equipment such as solar hot water heaters

Download Is There A Lifetime Limit On Residential Energy Credit

More picture related to Is There A Lifetime Limit On Residential Energy Credit

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

Powering Progress IRS Releases Proposed Rules For Low Income Community

https://frostbrowntodd.com/app/uploads/2023/06/renewable-energy-solar-subsidy-incentives-stockpack-gettyimages-scaled.jpg

Coming Soon New Residential Energy Credit On The Mark Tax Service

https://otmtax.com/wp-content/uploads/2023/01/gamechanger-1024x576.jpg

Residential Energy Tax Credits Changes in 2023 November 21 2022 P L 117 169 commonly referred to as the Inflation Reduction Act of 2022 IRA expanded and extended two nonrefundable tax credits meant to encourage individuals to invest in energy efficiency improvements or clean energy in their homes There is no longer a 500 lifetime credit limit instead for qualified property placed in service on or after January 1 2023 and before January 1 2033 you can now claim up to 1 200 annually until 2033 when you make eligible improvements The limits are as follows 250 per exterior door and 500 total 600 for exterior windows and skylights

In addition the 500 lifetime limit is replaced by a 1 200 annual limit on the credit amount the lifetime limit on windows will go away too So if you spread out your qualifying Your tax credit is up to 10 percent of these costs with a maximum total lifetime credit of 500 and a lifetime limit of 200 for the windows portion 2 000 this one category qualifies to go above the 1 200 annual limit Residential Clean Energy credit In addition to the credits mentioned above you can also claim the Residential

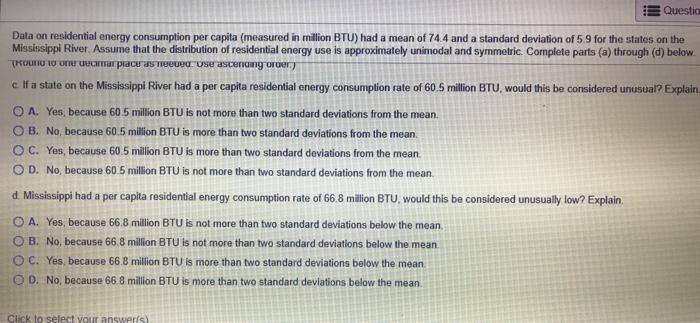

Solved Data On Residential Energy Consumption Per Capita Chegg

https://media.cheggcdn.com/study/17f/17f0ac67-bae7-41c1-a48b-cd621e5ce6a3/image

2023 Residential Clean Energy Credit Guide ReVision Energy

https://www.revisionenergy.com/application/files/9816/7416/5521/Residential_Clean_Energy_Tax_Credit_Graphic.png

https://www.irs.gov/credits-deductions/home-energy-tax-credits

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit 2034 22 no annual maximum or lifetime limit Get details on the Residential Clean Energy Credit

https://www.irs.gov/newsroom/energy-incentives-for...

In 2018 2019 2020 and 2021 the residential energy property credit is limited to an overall lifetime credit limit of 500 200 lifetime limit for windows There are also other individual credit limitations 50 for any advanced main air circulating fan 150 for any qualified natural gas propane or oil furnace or hot water boiler 300 for

Residential Energy Credits

Solved Data On Residential Energy Consumption Per Capita Chegg

Residential Energy Credit Application 2024 ElectricRate

Energy Credit Tips Fox Peterson

TaxprepSmart How To Claim Residential Energy Credits

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

2015 2016 Federal Energy Efficiency Tax Credit Ciel Power LLC

IRS Updates On Residential Energy Credits Key Insights

Federal Solar Tax Credit Take 30 Off Your Solar Cost Page 2 Of 3

IRS Form 5695 Residential Energy Credits Forms Docs 2023

Is There A Lifetime Limit On Residential Energy Credit - Key Takeaways As incentive to make energy efficient upgrades to your home the federal government offers two nonrefundable tax credits The Residential Clean Energy Credit offers a credit of 30 of the costs of alternative energy equipment such as solar hot water heaters