Is There A Tax Credit For Energy Star Roofing If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

Tax Credit Amount 10 of the cost up to 500 NOT INCLUDING INSTALLATION Requirements Metal roofs with appropriate pigmented coatings and asphalt roofs with appropriate cooling granules that also meet ENERGY STAR requirements NOTE Tax Credit does NOT include installation costs More Information Homeowners Can Save Up to 3 200 Annually on Taxes for Energy Efficient Upgrades Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent

Is There A Tax Credit For Energy Star Roofing

Is There A Tax Credit For Energy Star Roofing

https://www.livesmartconstruction.com/wp-content/uploads/2020/05/solar-tax-credit-768x519.jpg

Home Improvement Tax Credits Available To Homeowners Looking To Adopt

https://cnccpa.com/wp-content/uploads/2023/04/7.png

Does A New Roof Qualify For The Solar Investment Tax Credit Florida

https://djh4x3uvkdok.cloudfront.net/resources/20210618205145/Solar-Panels-On-A-Roof-Get-A-Tax-Credit.jpg

You can subtract the money for a new roof or any other eligible expense on your federal income tax return as a federal tax credit for the tax year This is a great way to make your home more energy efficient which will help lower your monthly bills and reduce your carbon footprint Windows Doors and Skylights If you replaced any windows doors or skylights or installed new ones that have earned the ENERGY STAR label you may be eligible for a tax credit of 10 percent of the cost not including installation on up to 200 for windows and skylights and up to 500 for doors

IR 2022 225 December 22 2022 WASHINGTON The Internal Revenue Service today released frequently asked questions FAQs about energy efficient home improvements and residential clean energy property credits in Fact Sheet FS 2022 40 PDF Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 Interactive guide to energy credits available under the Inflation Reduction Act 5 ways to save in 2023 with home energy tax credits

Download Is There A Tax Credit For Energy Star Roofing

More picture related to Is There A Tax Credit For Energy Star Roofing

Claim A Tax Credit For Solar Improvements To Your House IRS Form 5695

https://i.ytimg.com/vi/1fI71WzZo5w/maxresdefault.jpg

IRS Tax Credits And Deductions ADA WCAG LAW COMPLIANCE

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

The Federal Solar Tax Credit Has Been Extended Through 2032 Ecohouse

https://www.ecohousesolar.com/wp-content/uploads/2022/09/Ecohouse-Tax-Credit-Featured-09.png

A consumer could only receive a tax credit of up to 30 of the material cost up to a maximum of 1 500 This credit is for funds spent on the energy star approved materials not on installation or labor cost If you re claiming an energy tax credit for a new roof you may qualify if your roof meets certain energy requirements Learn more about taxes at Bankrate

Tax credit for residential energy efficiency has now been extended through December 31 2023 Considering replacement of Columbus roofing this year Keep in mind that certain GAF ENERGY STAR qualified asphalt shingles qualify for this tax credit Tax credit 10 percent of the cost up to 200 for windows and skylights and up to 500 for doors Does not include installation That Second Refrigerator Is Running Up Your Energy Bill

Is There A Tax Credit For A Whole House Generator ThisGenerator

https://thisgenerator.com/wp-content/uploads/2021/09/Is-There-a-Tax-Credit-for-a-Whole-House-Generator.jpg

Benefits Of Energy Star Roofing Rainville Carlson

https://www.rainvillecarlson.com/wp-content/uploads/2019/10/person-installing-roof.jpg

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use previous versions of Form 5695

https://www.energystar.gov/about/federal-tax...

Tax Credit Amount 10 of the cost up to 500 NOT INCLUDING INSTALLATION Requirements Metal roofs with appropriate pigmented coatings and asphalt roofs with appropriate cooling granules that also meet ENERGY STAR requirements NOTE Tax Credit does NOT include installation costs More Information

ENERGY STAR Roofing Program Sunset 2022 Update Sheffield Metals

Is There A Tax Credit For A Whole House Generator ThisGenerator

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

Ropa Roofing Blog Metal Roof Heat Reduction Tips For Denver CO Homeowners

Federal Solar Tax Credit A Quick Rundown Next Energy Solution

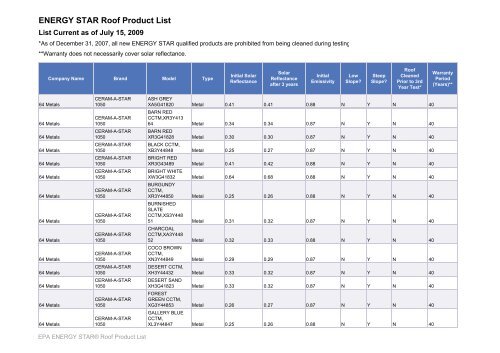

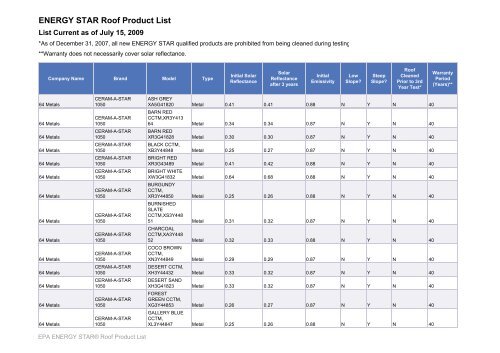

ENERGY STAR Roof Product List Malarkey Roofing Products

ENERGY STAR Roof Product List Malarkey Roofing Products

Technology And Life Science Investment Tax Credit

Another Way To Save New Tax Credit For Plan Participants

Federal Solar Tax Credit What It Is How To Claim It For 2024

Is There A Tax Credit For Energy Star Roofing - Frequently asked questions about energy efficient home improvements and residential clean energy property credits Credits and deductions under the Inflation Reduction Act of 2022 Interactive guide to energy credits available under the Inflation Reduction Act 5 ways to save in 2023 with home energy tax credits