Is There A Tax Credit For Pellet Stoves The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and

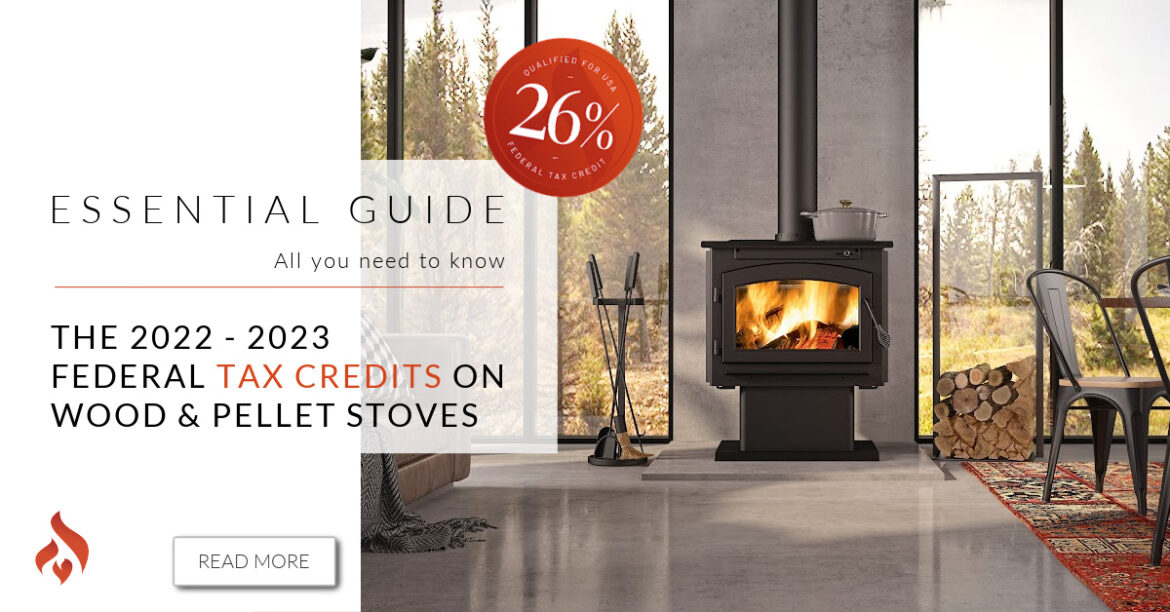

The 2021 pellet stove tax credit applies to qualifying biomass fueled heaters at least 75 efficient or greater based on the higher heating value HHV To get the pellet heater tax break you must purchase and install the appliance between January 1 2021 and December 31 2023 What is the Pellet and Wood Stove Tax Credit This legislation provides a significant tax credit for the purchase of qualifying wood and pellet stoves that are highly energy efficient For the remainder of 2022 get a 26 credit of the full purchase and installation amount

Is There A Tax Credit For Pellet Stoves

Is There A Tax Credit For Pellet Stoves

https://energycentermanhattanpool.com/wp-content/uploads/2022/07/All-the-Details-on-the-Pellet-and-Wood-Stove-Tax-Credit.jpg

Buying A House With Fully Owned Solar Panels

https://jiowhatsapp.com/wp-content/uploads/2021/06/Buying-a-House-with-Fully-Owned-Solar-Panels.jpg

Here s Your Chance To Earn A Tax Credit For Saving Toward Retirement

https://g.foolcdn.com/editorial/images/612049/black-young-woman-hugging-her-pink-piggy-bank.jpg

Beginning in 2021 consumers buying qualifying wood or pellet appliances or larger residential biomass heating systems will be able to claim an income tax credit on 26 of the full cost purchase and installation of the unit The Federal Biomass Stove 25 C Tax Credit is also known as the Wood and Pellet Heater Investment Tax Credit It s a financial incentive for anyone who installs a highly efficient heating system typically a wood or

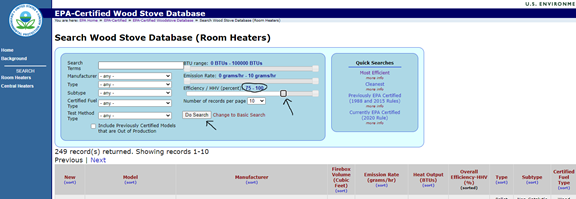

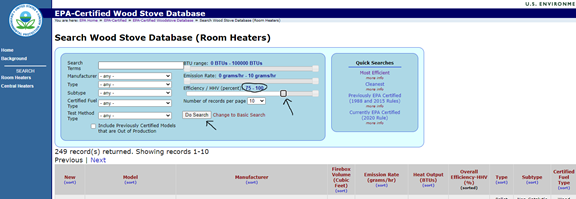

As of January 1 st 2023 the new IRS tax code of Sec 25 C allows for a tax credit of up to 30 of the total purchase price and cost of installation of any qualifying pellet stoves with an annual cap of 2 000 but not all EPA certified stoves qualify it must have an efficiency rating of 75 or higher This new tax code will be in The Inflation Reduction Act of 2022 changed the wood and pellet heater tax credit for calendar years 2023 2032 This federal tax credit covers 30 percent of purchase AND installation costs on qualifying new wood and pellet stoves and inserts There is a 2 000 cap on the credit for any one year

Download Is There A Tax Credit For Pellet Stoves

More picture related to Is There A Tax Credit For Pellet Stoves

About The 2023 Wood And Pellet Home Heater Tax Credit Higgins Energy

https://www.higginsenergy.com/wp-content/uploads/30-percent-tax-credit.png

Electric Cars In Illinois OsVehicle

https://cdn.osvehicle.com/does_illinois_have_a_tax_credit_for_electric_cars.jpg

Get A 300 Tax Credit For Qualifying Wood Stoves Milford CT The Cozy

https://thecozyflame.com/wp-content/uploads/2016/01/Get-a-300-Tax-Credit-for-Qualifying-Wood-Stoves-The-Cozy-Flame-Milford-CT.jpg

Beginning in 2023 consumers buying highly efficient wood stoves pellet stoves pellet stove inserts or larger residential biomass heating systems may be eligible to claim a 30 tax credit capped at 2 000 annually based on the full cost purchase and installation of the unit The credit runs through December 31 2032 Your ComforBilt pellet stove qualifies for a federal tax rebate Not only does your new pellet stove quality but the cost of pellet stove installation and materials related to the pellet stove installation also qualify for the 30 rebate

The credit for pellet stoves is part of the Residential Energy Credit or Home Energy Credit This is found under deductions and credits Your Home TurboTax does not specifically list pellet stoves of Biomass Pellet stoves that meet Energy Star efficiency standards may qualify for a tax credit of up to 30 of the cost of the stove and installation with a maximum credit of 1 500 To claim this credit the stove must be installed in your primary residence before January 1 2023

Is There A Tax Credit For A Whole House Generator

https://thisgenerator.com/wp-content/uploads/2021/09/Is-There-a-Tax-Credit-for-a-Whole-House-Generator.jpg

Best Hybrid And Electric Cars

https://i.pinimg.com/736x/7d/0a/ea/7d0aea59943343612866a574a52e36c4.jpg

https://www.energystar.gov/about/federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and

https://energex.com/news/federal-tax-credit

The 2021 pellet stove tax credit applies to qualifying biomass fueled heaters at least 75 efficient or greater based on the higher heating value HHV To get the pellet heater tax break you must purchase and install the appliance between January 1 2021 and December 31 2023

Is There A Tax Tax On Electric Bicycles Electric Bike Guide

Is There A Tax Credit For A Whole House Generator

Pellet Stoves And The New IRS Tax Code Sec 25 C US Stove Company

Is There A Tax Credit For Electric Bicycle Electric Bike Guide

300 Tax Credit For Qualifying Wood Stoves Charlotte NC Owens

The 2022 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire

The 2022 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire

The 2022 Federal 26 Tax Credit On Wood Pellet Stoves We Love Fire

Is There A Tax Cut For A Used Electric Car OsVehicle

Tax Credit Biomass Stove Initiatives HPBA

Is There A Tax Credit For Pellet Stoves - The biomass stove tax credit is a federal income tax credit that applies to the purchase and installation costs of high efficiency wood stoves pellet stoves fireplace inserts and other qualified biomass fuel burning heating equipment installed in