Is There A Tax Credit For Private School Tuition Private school tuition is subject to its own tax ramifications so knowing the tax rules may help you save Learn more about private school tax breaks and deductions

Withdrawals made for private school tuition are tax free on a federal level but you should note that states actually oversee 529 plans If your child is attending a private K 12 school because they have special education needs you may be able to get a tax break on the tuition The deduction requires a physician s referral

Is There A Tax Credit For Private School Tuition

Is There A Tax Credit For Private School Tuition

https://adalawcompliance.com/wp-content/uploads/2021/08/TAX-CREDIT-AND-DEDUCTIONS.png

Historic Tax Benefit For Union Workers Championed By UDW Signed Into

https://udwa.org/wp-content/uploads/TaxCredit.png

Claim A Foreign Tax Credit SF Tax Counsel

https://sftaxcounsel.com/wp-content/uploads/2023/02/shutterstock_2151177601.jpg

There is no simple federal tax credit or deduction for private K 12 educational expenses Most of the federal education related tax credits and deductions are geared toward higher education and career furthering continuing education but there are other federal programs such as Coverdell Education Savings Accounts that help parents save Probably not There s no federal education credit or deduction when paying for private school at the elementary or secondary level However you can claim a tax credit for private school if you pay for your children s college tuition

The federal government does not offer a tax credit either for parents who fund private school tuition Tax credits can be valuable as they reduce your tax liability on a dollar for dollar basis States may however extend tax benefits to parents who pay private school tuition In general qualified tuition and related expenses for the education tax credits include tuition and required fees for the enrollment or attendance at eligible post secondary educational institutions including colleges universities and trade schools

Download Is There A Tax Credit For Private School Tuition

More picture related to Is There A Tax Credit For Private School Tuition

Another Way To Save New Tax Credit For Plan Participants

https://insights.rpag.com/hubfs/Imported_Blog_Media/GettyImages-1077235824-1.jpg

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

https://salemroofers.com/wp-content/uploads/2016/02/roofing-tax-credits.jpg

Tax Credit Digital News Subscription

https://media.licdn.com/dms/image/C4D12AQE4Fgkvo3iVdg/article-cover_image-shrink_720_1280/0/1646183080677?e=2147483647&v=beta&t=iwUgIDgJnZL0UZ-wFyGZPRSzx0G_1kPeZqzZBgX8C4Q

You cannot claim a credit for education expenses paid with tax free funds You must reduce the amount of expenses paid with tax free grants scholarships and fellowships and other tax free education help If your child attends a K 12 private school there is no federal tax deduction or credit you qualify for that will help pay for tuition not even school uniforms However once your child graduates and attends a college you re paying for you ll start qualifying for

An education tax credit allows you to reduce your taxes owed and may in some cases generate a tax refund The IRS offers two types of education tax credits to offset tuition and fees you have paid K 12 private school education expenses are not tax deductible at the federal level at least not when paid directly by parents However you can apply for a tax credit for a private school if you pay your children s college tuition

5 Ways To Save For Private School Tuition Bankrate

https://media.brstatic.com/2019/08/19103054/5-ways-to-save-money-for-private-school-tuition.jpeg

How Much Does It Cost To Start A Private School QuestionsCity

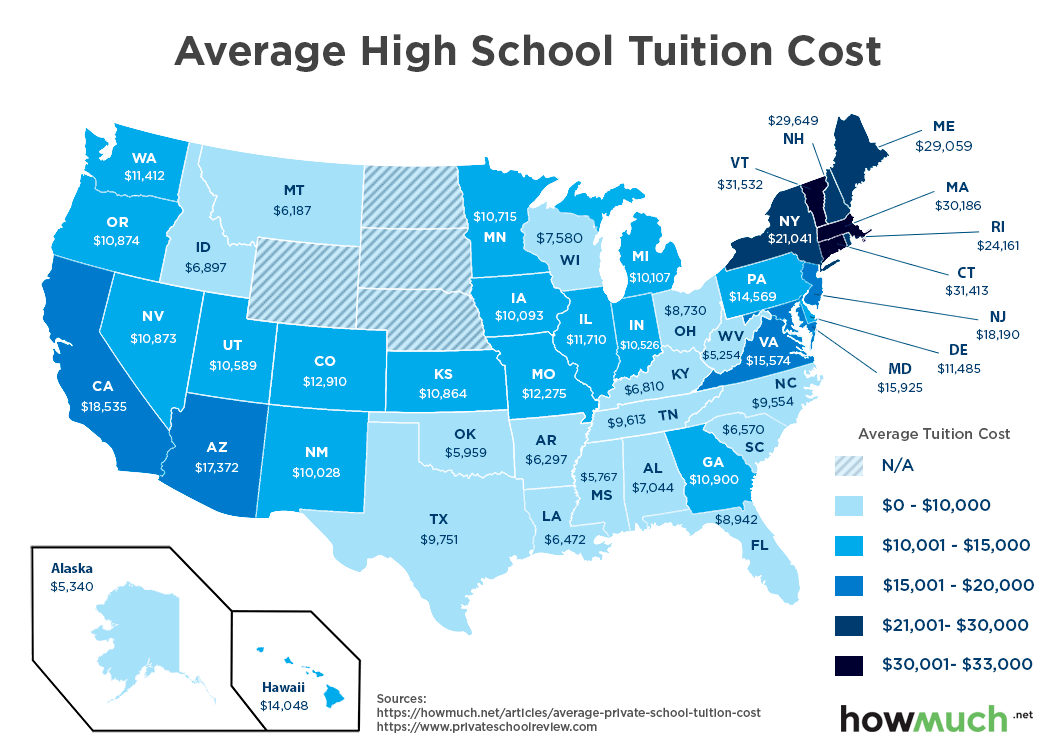

https://cdn.howmuch.net/content/images/average-high-school-tuition-cost-75ea.png

https://www.thebalancemoney.com/tax-deduction-for...

Private school tuition is subject to its own tax ramifications so knowing the tax rules may help you save Learn more about private school tax breaks and deductions

https://www.forbes.com/sites/robertfarrington/2021/...

Withdrawals made for private school tuition are tax free on a federal level but you should note that states actually oversee 529 plans

Don t Miss Out The New Tax Credits Your Business Needs The Incorporators

5 Ways To Save For Private School Tuition Bankrate

SECURE Act Provides Small Businesses With Additional Tax Savings

Do You Need To File Taxes As A Small Business Owner Camino Financial

When Is The Deadline For The Employee Retention Tax Credit

Forbes Taxes

Forbes Taxes

Tax Credits Save You More Than Deductions Here Are The Best Ones

Tuition Agreement Template

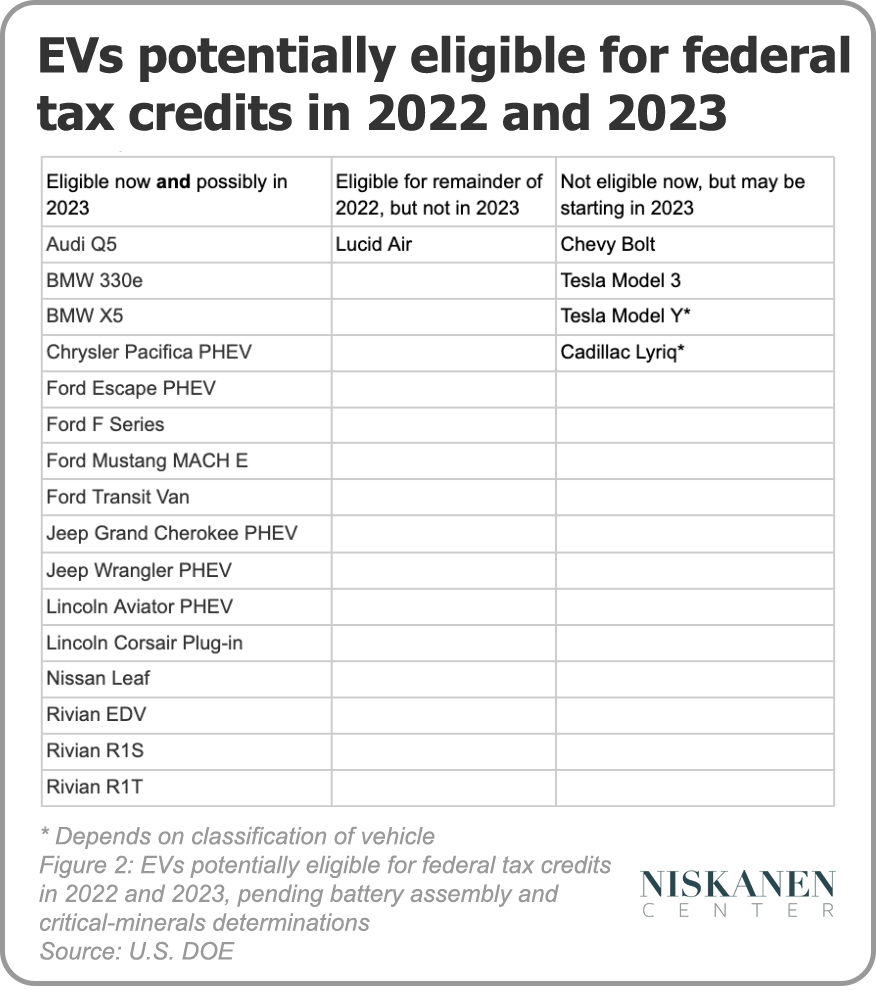

Federal EV Tax Credits Are About To Become Scarce Who Should Get Them

Is There A Tax Credit For Private School Tuition - An education credit helps with the cost of higher education by reducing the amount of tax owed on your tax return If the credit reduces your tax to less than zero you may get a refund There are two education credits available the American Opportunity Tax Credit and the Lifetime Learning Credit