Is Transport Allowance Taxable In Malaysia A review on 3 types of allowances with reference from LHDN Tax Ruling including the newest listing of tax incentive tax deduction for company in Malaysia

a within Malaysia including meals and accomodation for travel not exceeding 3 times in any calendar year or b outside Malaysia not exceeding one passage in any calendar year is limited to a maximum of RM3 000 4 3 All BIKs received by an employee are taxable However benefits described in paragraph 8 of this PR are exempt from tax 4 4 In the case of accommodation provided by on behalf of the employer to his employee this benefit is not covered under paragraph 13 1 b of the ITA

Is Transport Allowance Taxable In Malaysia

Is Transport Allowance Taxable In Malaysia

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

GST Taxable And Non taxable Goods Infographic Data Visualization

https://i.pinimg.com/originals/98/9b/0a/989b0a3c8303af1fa42c07a6de15b5c7.jpg

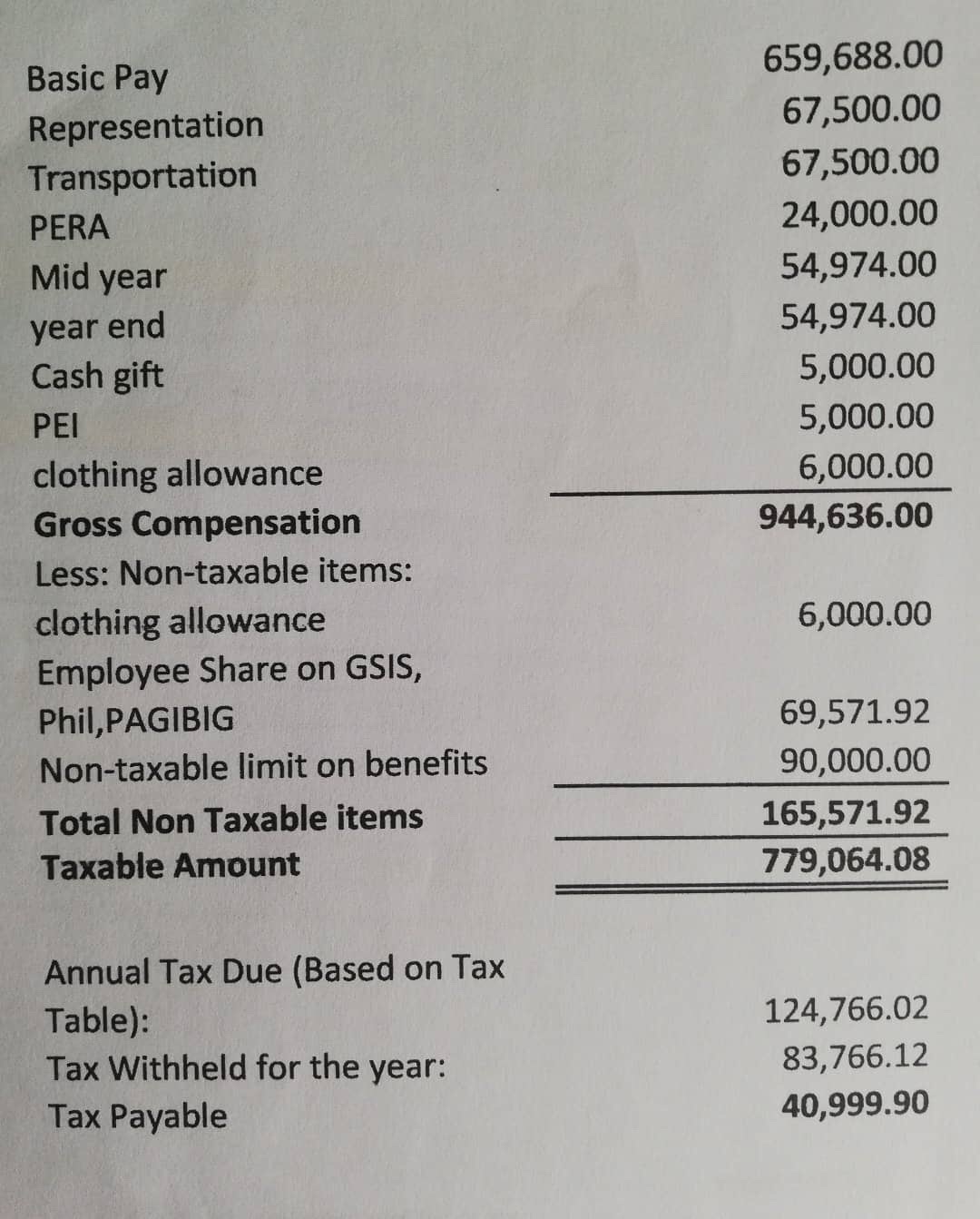

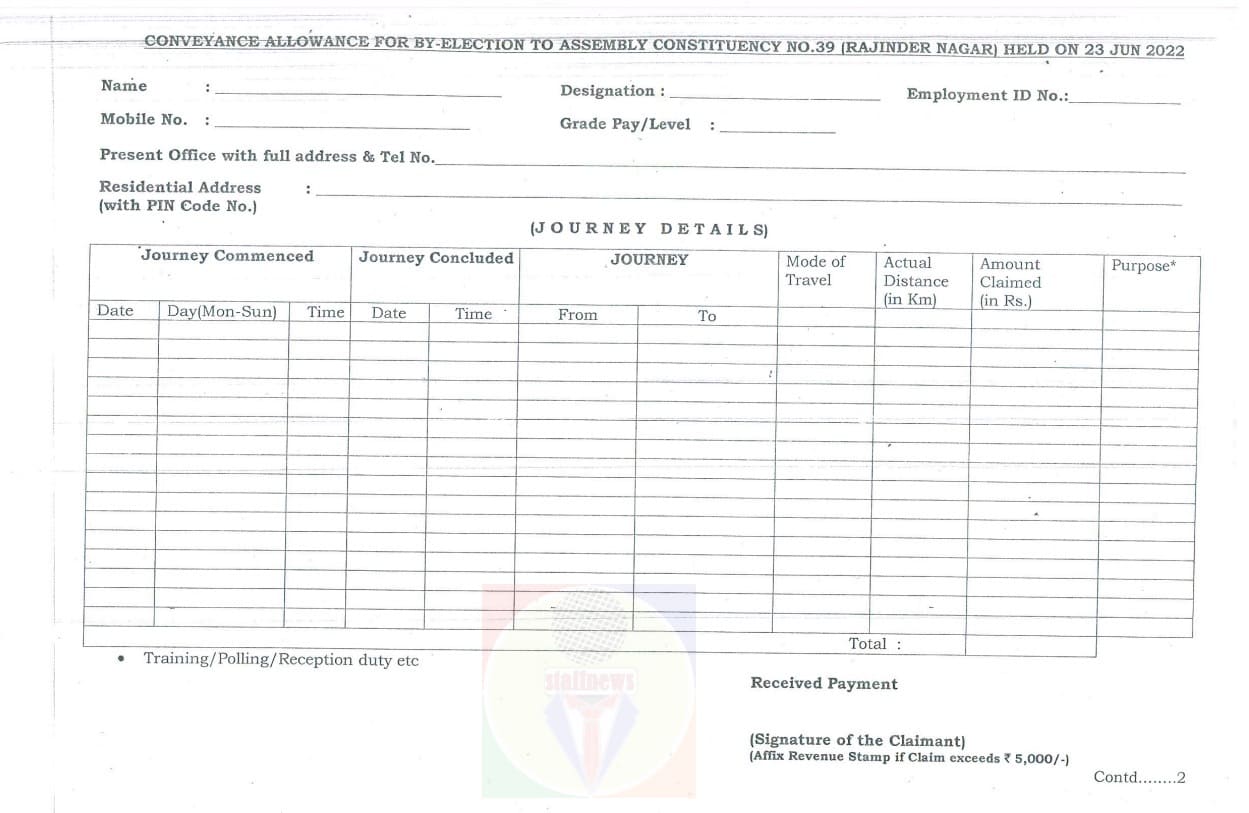

What Compensation Is Taxable And What s Not GABOTAF

https://gabotaf.com/wp-content/uploads/2020/01/img_3738.jpg

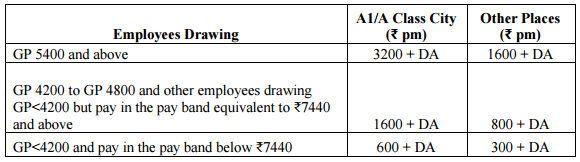

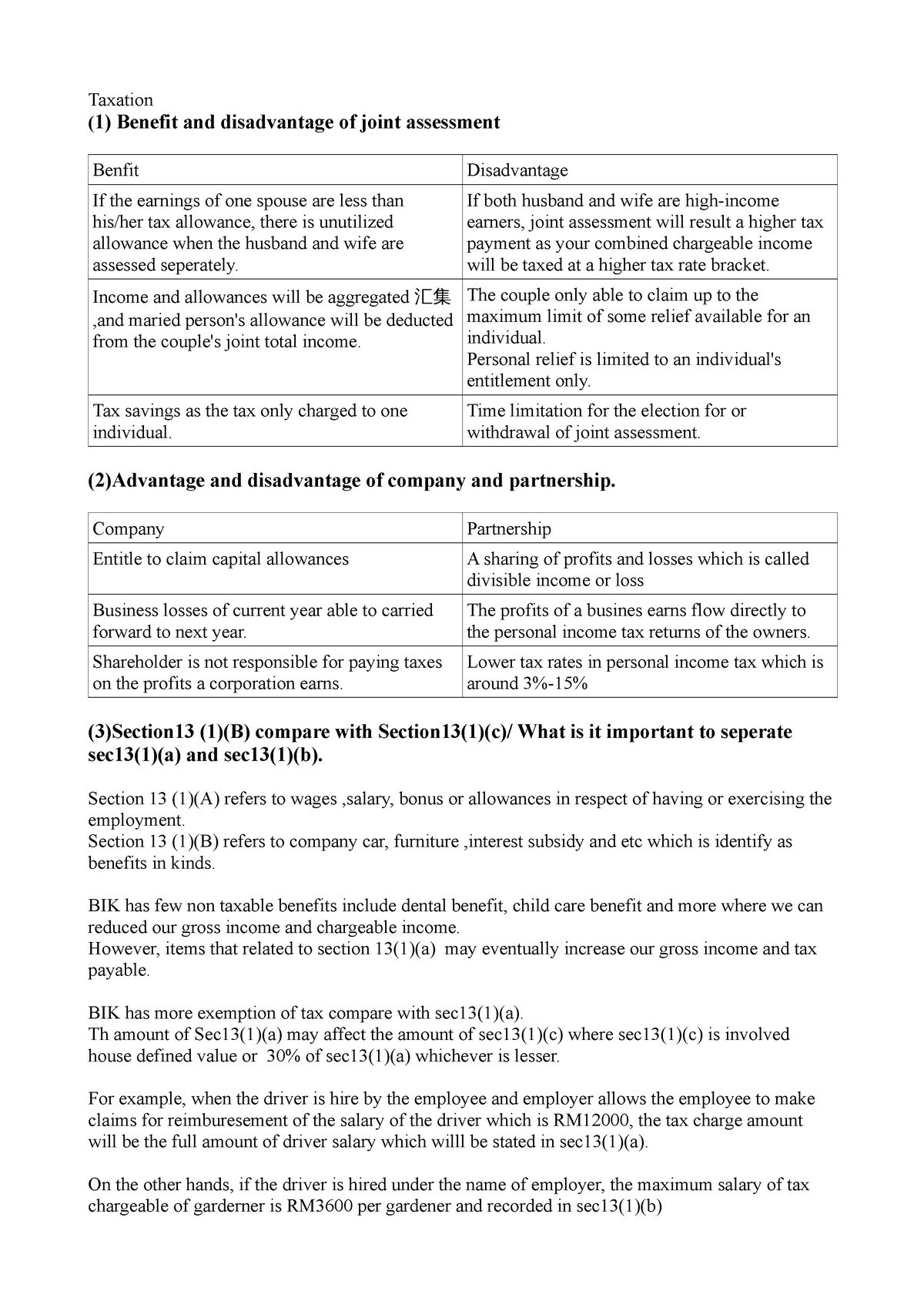

The five categories of benefits that are taxable in Malaysia are as follows Accommodation The taxable amount is fixed Car Hire The taxable amount is variable 1 1 This guideline is issued pursuant to the amendment of Paragraph 28 of Schedule 6 Income Tax Act 1967 ITA 1967 by Finance Act 2021 Act 833 which foreign income received in Malaysia by a person who is resident will be taxable effective from 1

Employment income is regarded as derived from Malaysia and subject to Malaysian tax where the employee exercises an employment in Malaysia is on paid leave which is attributable to the exercise of an employment in Malaysia Tax exempt as long the amount is not unreasonable Includes payment by the employer directly to the parking operator Petrol allowance petrol card travelling allowance or toll payment or any combination Tax exempt up to

Download Is Transport Allowance Taxable In Malaysia

More picture related to Is Transport Allowance Taxable In Malaysia

Is Allowance Taxable In Malaysia Piers Alsop

https://www.crowe.com/my/-/media/crowe/firms/asia-pacific/my/crowemy/insights/reinvestment-allowance-2022_cover.png?h=803&iar=0&mw=556&w=556&hash=990A3E098C3D564D5AB620417FA89FDA

Car Allowance Taxable In Malaysia JorgefvSullivan

https://chengco.com.my/wp/wp-content/uploads/2021/08/POINT14.jpg

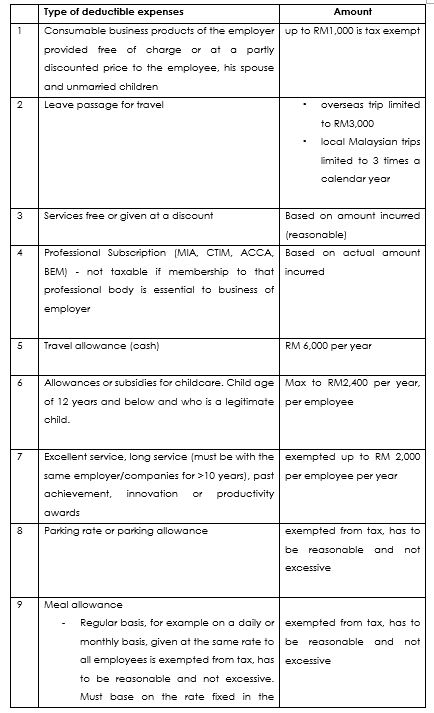

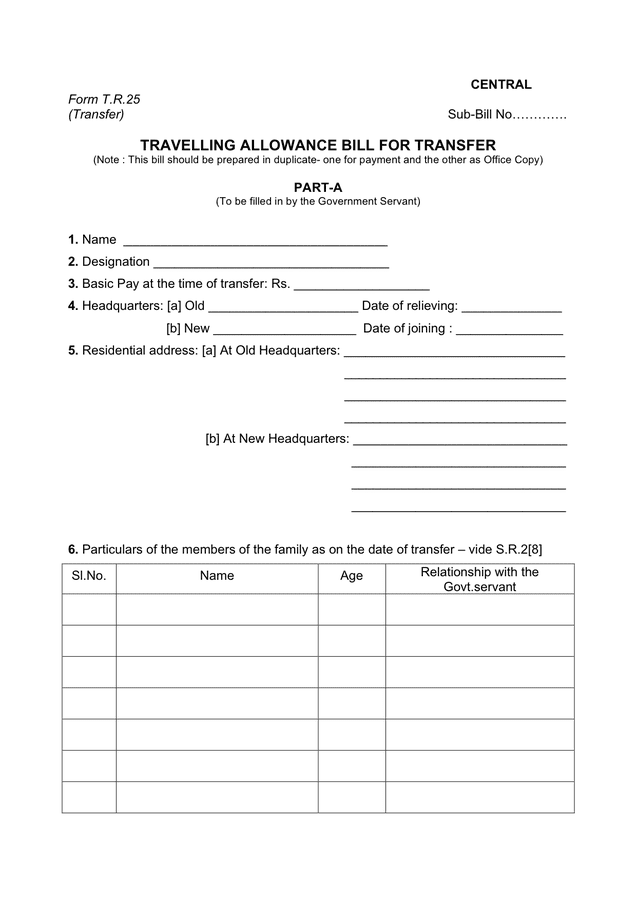

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

Foreign sourced income received in Malaysia from outside Malaysia by resident individuals is subject to tax However the following income received in Malaysia from 1 January 2022 to 31 December 2026 may qualify for tax exemption subject to This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices This booklet incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021 These proposals will not become law until their

Yes tax exemption is applicable for travel within Malaysia limited to a maximum of three times per year or abroad limited to one trip per year with a tax exemption limit of RM 3 000 Employee Benefits That are Tax Deductible Employers Tax Exempted Employees Official Travelling Allowance It must be related to business including petrol subsidies and highway tolls Up to RM6000 per annum Childcare Allowance For children under 12 years old only

AverieewaCarson

https://i2energy.my/wp-content/uploads/2021/04/news-taxincentives-by-mida.jpg

Are Gifts From Employer Taxable In Malaysia Mar 22 2022 Johor

https://cdn1.npcdn.net/image/1647910389b86773a8071a60603eb37c7b0c2a40d7.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

https://seekers.my/blog/lhdn-types-of-allowances

A review on 3 types of allowances with reference from LHDN Tax Ruling including the newest listing of tax incentive tax deduction for company in Malaysia

https://www.hasil.gov.my/pdf/pdfam/Notes_PartF_2.pdf

a within Malaysia including meals and accomodation for travel not exceeding 3 times in any calendar year or b outside Malaysia not exceeding one passage in any calendar year is limited to a maximum of RM3 000

What Is Tax Exempted Allowance In Malaysia Feb 16 2022 Johor Bahru

AverieewaCarson

All India Association Of Inspectors And Assistant Superintendents

Is Allowance Taxable In Malaysia Rebecca Bond

The Prescribed Travel Rate Per KM Increases And The Determined Travel

Transport Allowance Exemption Meaning Is Transport Allowance Taxable

Transport Allowance Exemption Meaning Is Transport Allowance Taxable

Travelling Allowance Form In Word And Pdf Formats

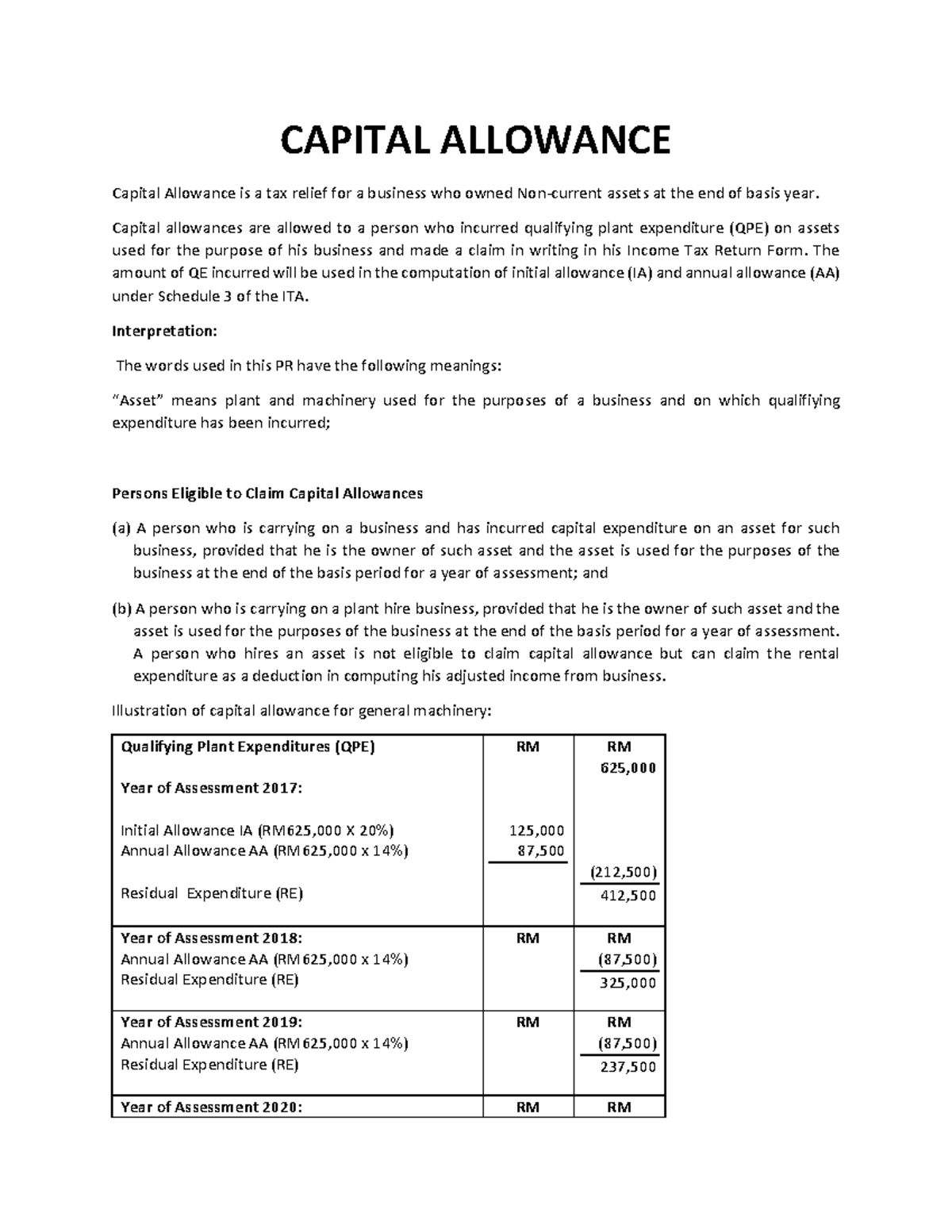

How To Calculate Capital Allowance Malaysia David Scott

Cherish Childhood Memories Quotes

Is Transport Allowance Taxable In Malaysia - 2018 2019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope Income attributable to a Labuan business