Is Transport Allowance Taxable Web 20 Sept 2022 nbsp 0183 32 Your means of transport are irrelevant unless you ve travelled in a company car which is not tax deductible Expenses for travel by public transport ship

Web 24 Okt 2023 nbsp 0183 32 Transport allowance is taxable under the head salaries in the hands of the employee It is added to your gross salary You can claim tax exemption for each Web Here is a brief overview of how individual means of transport are taxed Trips by public transport are tax free The travel costs of environmentally friendly means of transport

Is Transport Allowance Taxable

Is Transport Allowance Taxable

https://3.bp.blogspot.com/-FKWFdfUSuF4/Vk9dt-pUKnI/AAAAAAAAAec/nGStHGHOlO8/s1600/Transport-Allowance-7th-cpc-1.png

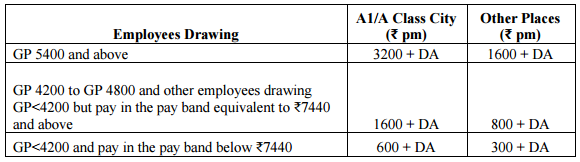

7th Pay Rates Of Transport Allowance Chart 7th Pay Commission For All

https://i.ytimg.com/vi/t9BGCbpYFxo/maxresdefault.jpg

Non taxable Allowance For Transport Costs

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

Web 10 Juli 2023 nbsp 0183 32 Transport allowance is taxable in the hands of the employee since it is added to their gross salaries However employees can claim tax exemption for Web 27 Apr 2023 nbsp 0183 32 Both employees and self employed persons can deduct travel to the workplace as income related expenses This is often referred to as the commuter

Web 18 Feb 2020 nbsp 0183 32 The transport allowance is a tax free allowance that is provided to employees to meet their expenses for commuting from their residence to their place of Web Taxable Not taxable 1 Fixed monthly allowance Taxable 2 Expenses for discharging official duties Reimbursements made Not taxable See Transport Costs for Official

Download Is Transport Allowance Taxable

More picture related to Is Transport Allowance Taxable

Conveyance Allowance Definition Calculations Tax Exemptions

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/12/Template-11.png

Why Is A Car Allowance Taxable What You Need To Know About This Program

https://www.motus.com/wp-content/uploads/2019/06/car-allowance-taxable-1.jpg

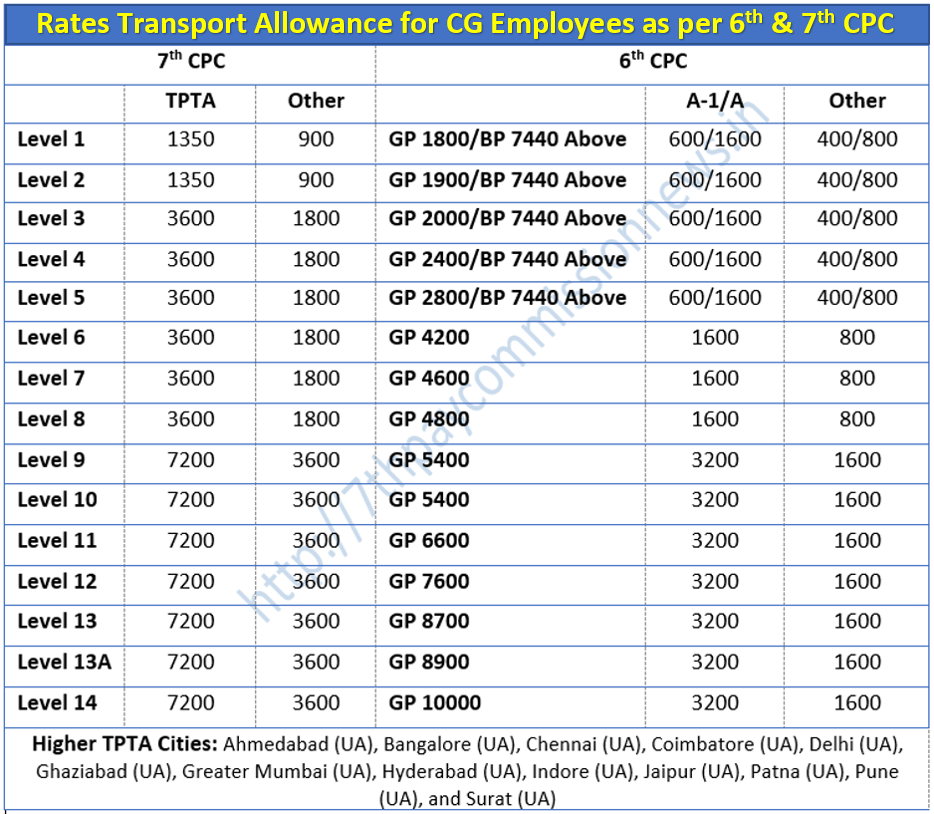

Transport Allowance At Double The Normal Rates To Persons With

https://www.staffnews.in/wp-content/uploads/2022/09/transport-allowance-at-double-rates-compendium-doe-15-09-2022.jpg

Web 1 Jan 2022 nbsp 0183 32 B Estimation of total tax charge revenue 175 B 1 Introduction 175 B 2 Road transport 175 B 3 Rail transport 176 B 4 IWT 177 B 5 Maritime transport 178 B 6 Web 9 Feb 2023 nbsp 0183 32 A transport allowance u s 10 14 of the income tax act is paid to employees to meet the cost of the daily commute from home to work and vice versa or for personal

Web There isn t a limit to this allowance and however the amount of 1600 per month or the transport allowance portion on your salary statement isn t taxable Under section 10 Web 1 M 228 rz 2022 nbsp 0183 32 All Benefits in Kind are technically taxable but Paragraph 8 of the LHDN s Public Ruling No 11 2019 provides for the following exemptions Dental benefit Child

Travelling Conveyance Transport Allowance Exempt Or Taxable

https://i.ytimg.com/vi/-xdoeVxXD90/maxresdefault.jpg

What You Need To Know When Claiming A Car Allowance Fiscal Private

https://fiscal.co.za/wp-content/uploads/2021/11/image.png

https://www.iamexpat.de/expat-info/german-expat-news/how-claim-travel...

Web 20 Sept 2022 nbsp 0183 32 Your means of transport are irrelevant unless you ve travelled in a company car which is not tax deductible Expenses for travel by public transport ship

https://scripbox.com/tax/transport-allowance

Web 24 Okt 2023 nbsp 0183 32 Transport allowance is taxable under the head salaries in the hands of the employee It is added to your gross salary You can claim tax exemption for each

Carers Allowance Raise What Can We Anticipate Regarding Amount In 2024

Travelling Conveyance Transport Allowance Exempt Or Taxable

Is Allowance Taxable In Malaysia Piers Alsop

The Allowance Game Teach Your Kids About Money Planning To Save

Th Pay Commission Rates Of Transport Allowance Central Government

THE PRESCRIBED TRAVEL RATE PER KM INCREASES AND THE DETERMINED TRAVEL

THE PRESCRIBED TRAVEL RATE PER KM INCREASES AND THE DETERMINED TRAVEL

Travelling Allowance To The Officials Deployed For Election Duty

Ketentuan Tax Allowance Direvisi Proses Pengajuan Lebih Sederhana

Transportation Funding EClips Extra

Is Transport Allowance Taxable - Web Taxable Not taxable 1 Fixed monthly allowance Taxable 2 Expenses for discharging official duties Reimbursements made Not taxable See Transport Costs for Official