Is Transport Allowance Taxable In Uganda Web 2020 2021 Income tax Corporations Corporation rate Rate Capital deductions www pwc ug Income Tax Resident Individuals Resident Individual monthly rate

Web 25 Nov 2022 nbsp 0183 32 Transport costs Cost of passage incurred by employer in respect of employee s appointment if recruited out of Uganda for employer s sole purpose only Web 22 Feb 2022 nbsp 0183 32 In March 2021 Uganda s Tax Appeals Tribunal Tribunal ruled in favor of the Uganda Revenue Authority URA collecting withholding tax WHT at the rate of

Is Transport Allowance Taxable In Uganda

Is Transport Allowance Taxable In Uganda

https://2.bp.blogspot.com/-KNcUFEVrsKo/WsxLAuoZhOI/AAAAAAAAEZU/_IhGLo9Urdk_-PYyW-XGQPu5vOYrNlKfACLcBGAs/s1600/TRANSPORT%2BALLOWANCE%2BNOW%2BTAXABLE.jpg

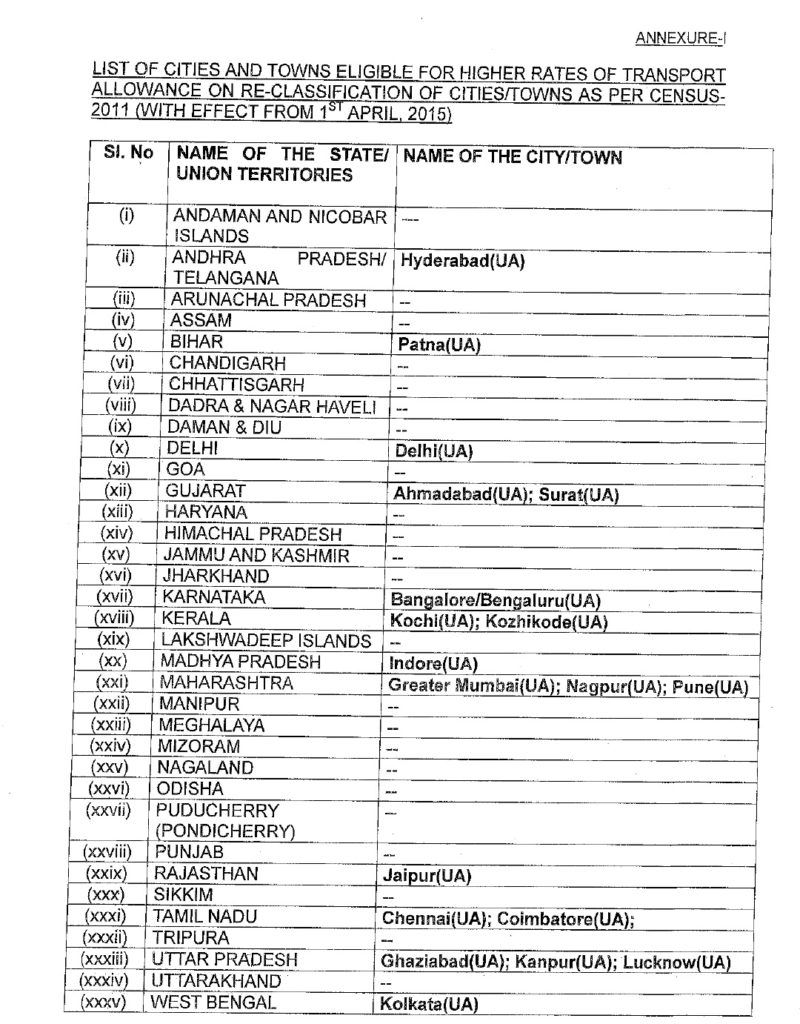

Enhanced Transport Allowance For 6 Cities From 1st April 2015 Order

https://www.staffnews.in/wp-content/uploads/2015/08/annexure-12Benhanced2Btransport2Ballowance2Border-800x1024.jpg

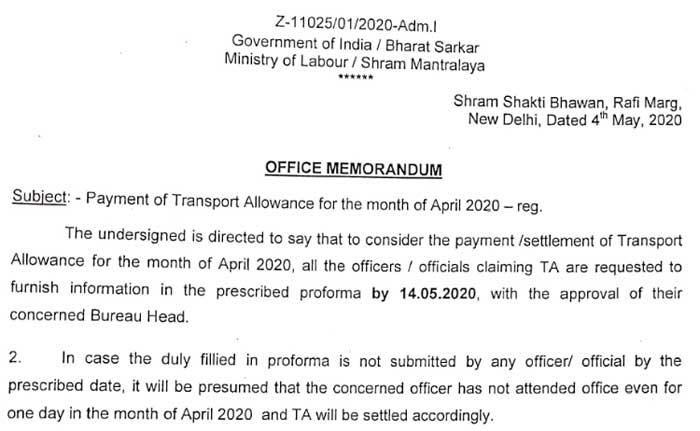

Settlement Of Transport Allowance For The Month Of April 2020 To Claim TA

https://www.centralgovernmentnews.com/wp-content/uploads/2020/05/Payment-of-Transport-Allowance-for-the-month-of-April-2020.jpg

Web This comprehensive encyclopedia of the law covers all parts of Uganda Web Uganda s Minister of Finance Planning and Economic Development tabled Tax Amendment Bills of 2021 before Parliament of Uganda for debate

Web In Uganda an Employer is a person individual or corporate who employs or remunerates an employee And an Employee is an individual engaged in employment The made Web A payment to a foreign transport operator for the carriage of goods embarked in Uganda is liable to withholding tax at 2 Such a payment for goods embarked outside Uganda

Download Is Transport Allowance Taxable In Uganda

More picture related to Is Transport Allowance Taxable In Uganda

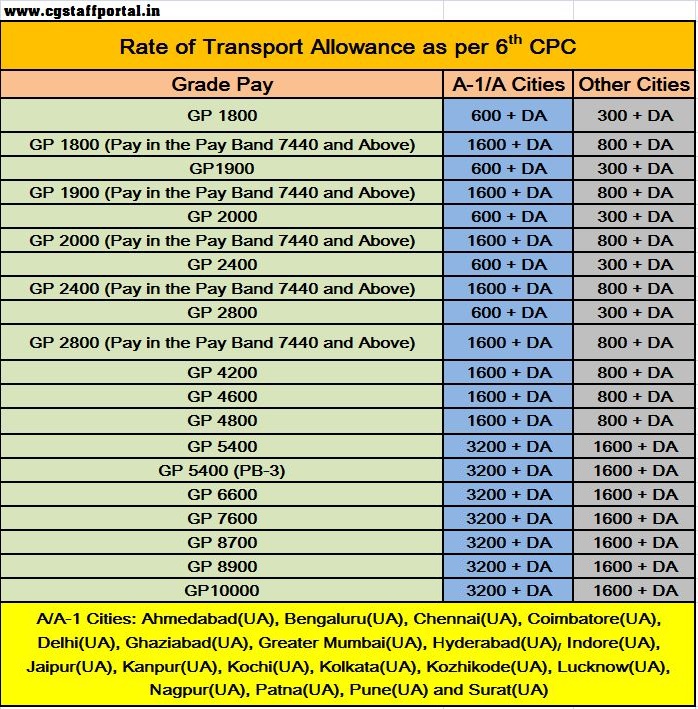

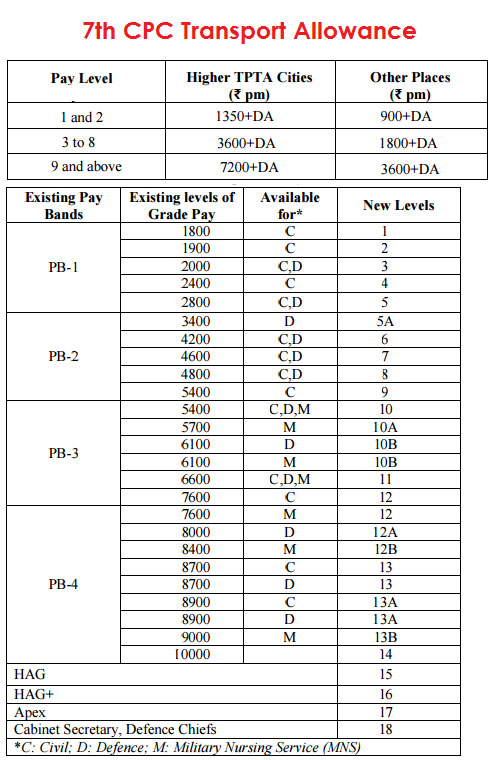

Rates Of 7th CPC Transport Allowance Chart

https://4.bp.blogspot.com/-tAJF_ovYVaM/WZVbImMcxgI/AAAAAAAAHTY/4l4iRY0e6pwfmwH85NL-GNTvVujypm7RQCLcBGAs/s1600/6th-cpc-ta-chart.jpg

Transport Allowance Transport Allowance For Central Government

https://geod.in/wp-content/uploads/2022/02/Keeping-Double-1-600x600.jpg

Is Transport Allowance Paid To Employees Fully Taxable

https://images.moneycontrol.com/static-mcnews/2019/03/Ahmedabad-Metro-770x433.jpg?impolicy=website&width=770&height=431

Web 21 Apr 2022 nbsp 0183 32 To clear any further ambiguities the government is amending section 85 of the Income Tax Act emphasize that there is no withholding tax WHT due in Uganda Web Taxation in Uganda is both source and resident based Income sourced from Uganda is taxable in Uganda and tax residents in Uganda are taxed on worldwide income We

Web 18 Jan 2022 nbsp 0183 32 Pursuant to section 86 of the ITA transportation income earned by non resident transporters is subject to taxation in Uganda via the withholding tax mechanism Web The balance is taxed at 10 20 or 30 depending on the income bracket Individuals who earn above UGX 120 000 000 pa pay an additional 10 on the income above

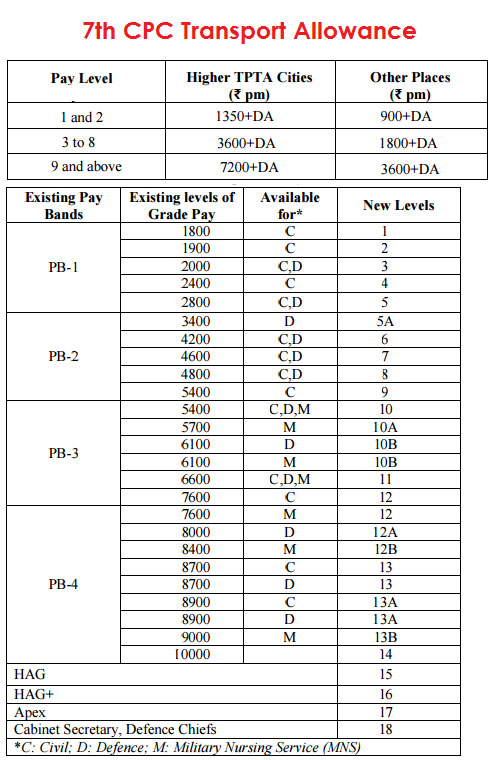

7th CPC Recommended Transport Allowance TPTA CENTRAL GOVERNMENT

https://4.bp.blogspot.com/-skEmvsNxqtM/Vk9d2W-gjSI/AAAAAAAAAek/9NEB-5oqgf0/s1600/7th-cpc-transport-allowance.jpg

DIFFERENCE BETWEEN TRAVELLING ALLOWANCE TRANSPORT ALLOWANCE AND

https://i.ytimg.com/vi/e125smkh-88/maxresdefault.jpg

https://www.pwc.com/ug/en/assets/pdf/tax-datacard-202…

Web 2020 2021 Income tax Corporations Corporation rate Rate Capital deductions www pwc ug Income Tax Resident Individuals Resident Individual monthly rate

https://thetaxman.ura.go.ug/?p=3641

Web 25 Nov 2022 nbsp 0183 32 Transport costs Cost of passage incurred by employer in respect of employee s appointment if recruited out of Uganda for employer s sole purpose only

No Changes In Transport Allowance Implemented As Per 7th CPC

7th CPC Recommended Transport Allowance TPTA CENTRAL GOVERNMENT

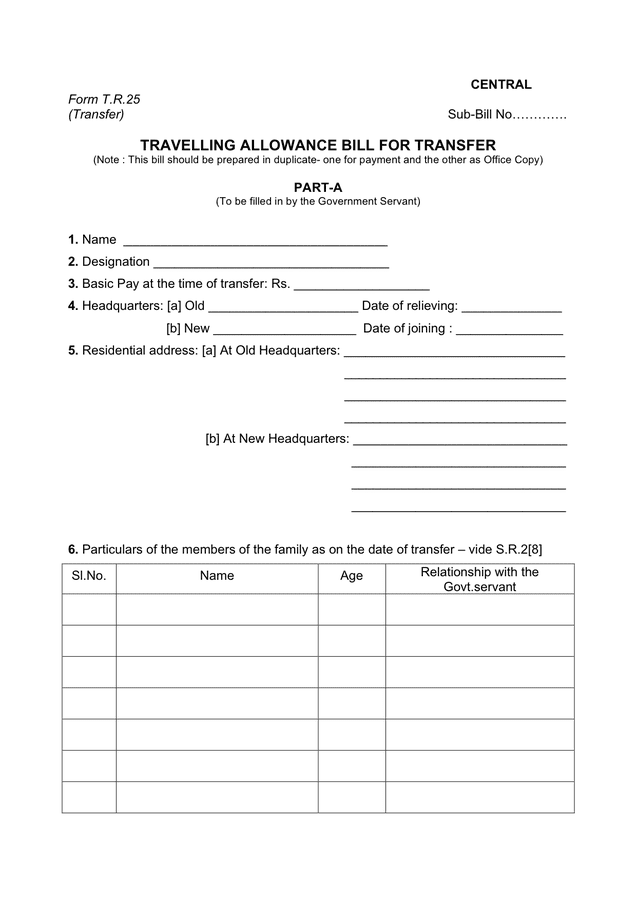

Travelling Allowance Form In Word And Pdf Formats

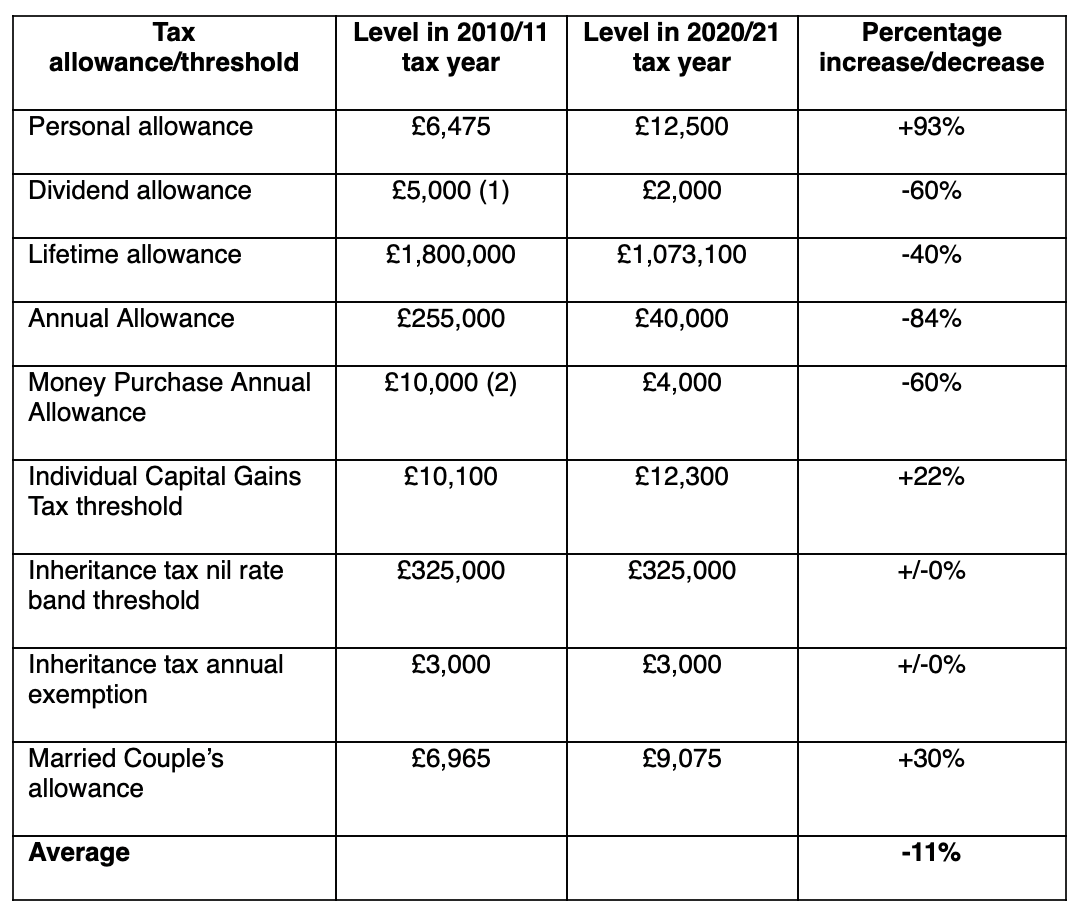

Tax Allowances Down 11 In Value Over Decade And Will Fall Further

.png)

Is Car Allowance Taxable Under IRS Rules I T E Policy I

Grant Of Transport Allowance To Central Government Employees

Grant Of Transport Allowance To Central Government Employees

Is Car Allowance Taxable Income Your Question Answered Silver Tax

Transport Allowance Zee News

Transport Allowance And Exemption For 2018 19 Legoesk

Is Transport Allowance Taxable In Uganda - Web This comprehensive encyclopedia of the law covers all parts of Uganda