Is Transport Allowance Taxable In Philippines Web 9 Nov 2023 nbsp 0183 32 Taxable Employee Benefits and Allowances De Minimis Benefits These benefits such as rice allowance uniform allowance and medical benefits are non

Web 18 Apr 2023 nbsp 0183 32 This question may arise because under Revenue Regulations RR No 2 98 as amended or the Withholding Tax Regulations compensation is defined as all remuneration for services Web 21 Sept 2022 nbsp 0183 32 Employees are entitled to a fully taxable transport allowance As a result of the withdrawal of the exemption employees are taxable for the transport allowance they receive If An Employer Pays

Is Transport Allowance Taxable In Philippines

Is Transport Allowance Taxable In Philippines

https://d6xcmfyh68wv8.cloudfront.net/learn-content/uploads/2022/12/Template-11.png

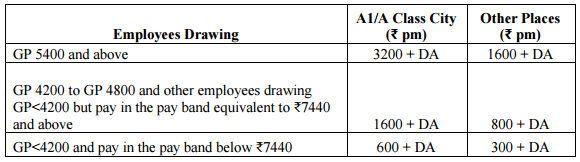

Non taxable Allowance For Transport Costs

https://lirp.cdn-website.com/md/pexels/dms3rep/multi/opt/pexels-photo-3396669-1920w.jpeg

What Compensation Is Taxable And What s Not GABOTAF

https://gabotaf.com/wp-content/uploads/2020/01/img_3738.jpg

Web If you provide more than the limitations the amount in excess of the limit would be taxable and subject to withholding tax on compensation if the recipient employee is a rank and Web 14 Juni 2022 nbsp 0183 32 Instead of giving taxable fixed transportation allowances companies may contemplate offering free shuttles to their employees who are required to return to office

Web 26 Mai 2022 nbsp 0183 32 If you work as an employee in the Philippines you will be happy to know that are accorded de minimis benefits These are a few allowances and benefits which are not subject to income tax These Web 30 Apr 2020 nbsp 0183 32 This is highlighted under Section 2 78 1 A 6 a of Revenue Regulations RR No 2 98 which provides that fixed or variable transportation representation and

Download Is Transport Allowance Taxable In Philippines

More picture related to Is Transport Allowance Taxable In Philippines

Travelling Allowance To The Officials Deployed For Election Duty

https://www.staffnews.in/wp-content/uploads/2022/09/travelling-allowance-to-the-officials-deployed-for-election-duty-claim-form.jpg

12 Non Taxable Compensation Of Government Employees 12 Non taxable

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/8def460a118dbf58656d6da484651792/thumb_1200_1553.png

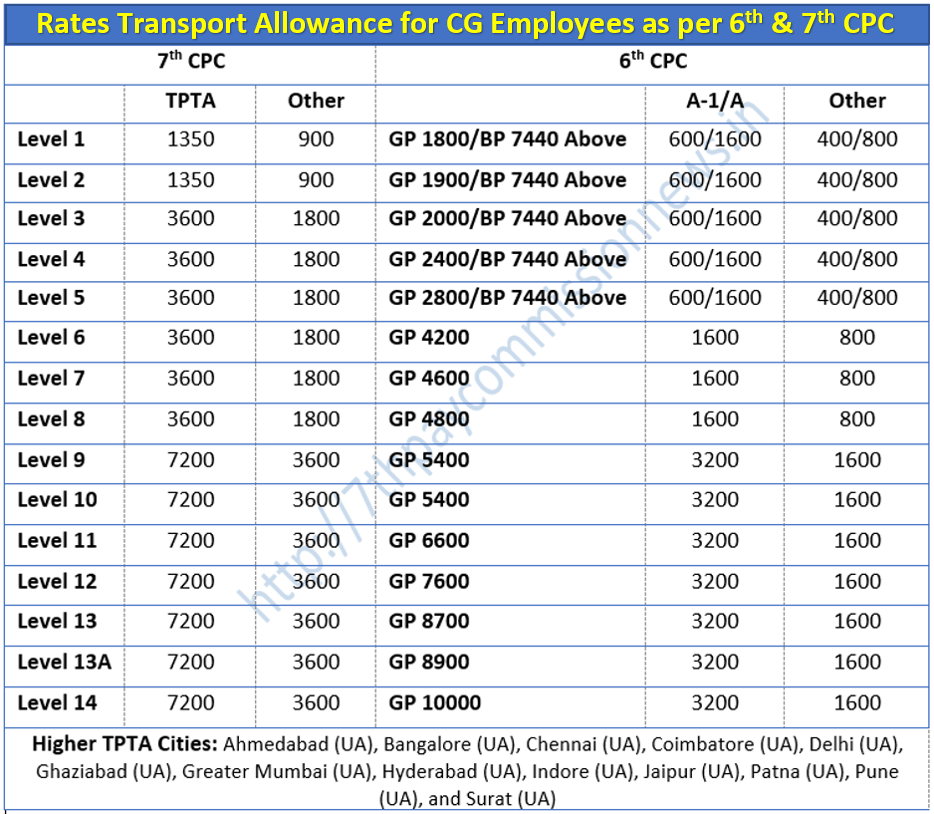

Th Pay Commission Rates Of Transport Allowance Central Government

https://7thpaycommissionnews.in/wp-content/uploads/2017/07/7th-cpc-transport-Allowance-1.png

Web 4 Mai 2017 nbsp 0183 32 If you are in HR and Payroll you probably already appreciate how daunting a subject benefits and allowances B amp As can be in the Philippines What are you allowed to pay What benefits are De Web 1 The Philippines taxes aliens whether or not resident in the Philippines only on income from sources within the Philippines The tax year 2 The tax year runs from January 1st

Web 26 M 228 rz 2022 nbsp 0183 32 Is Transportation Allowance Taxable In The Philippines Is Travelling Allowance Subject To Income Tax Is Travel Allowance Exempt From Tax How Web allowances for transportation representation entertainment and other similar items fees including director s fees paid to a director who is at the same time an employee of

The Prescribed Travel Rate Per KM Increases And The Determined Travel

https://www.nowhr.co.za/wp-content/uploads/2022/03/Determined-Rate-for-Travel-Allowance-Table-2022-2023-1024x463.png

Solved Please Note That This Is Based On Philippine Tax System Please

https://www.coursehero.com/qa/attachment/19096880/

https://www.payday.ph/insights/taxation-of-employee-benefits-and...

Web 9 Nov 2023 nbsp 0183 32 Taxable Employee Benefits and Allowances De Minimis Benefits These benefits such as rice allowance uniform allowance and medical benefits are non

https://kpmg.com/ph/en/home/insights/2023/0…

Web 18 Apr 2023 nbsp 0183 32 This question may arise because under Revenue Regulations RR No 2 98 as amended or the Withholding Tax Regulations compensation is defined as all remuneration for services

All India Association Of Inspectors And Assistant Superintendents

The Prescribed Travel Rate Per KM Increases And The Determined Travel

Carer Allowance Sa489 2022 2024 Form Fill Out And Sign Printable PDF

Is Cost Of Living Allowance Taxable In The Philippines About Philippines

Travelling Allowance Form In Word And Pdf Formats

Whether Gratuity Taxable Or Not Income Tax Calculation On Gratuity

Whether Gratuity Taxable Or Not Income Tax Calculation On Gratuity

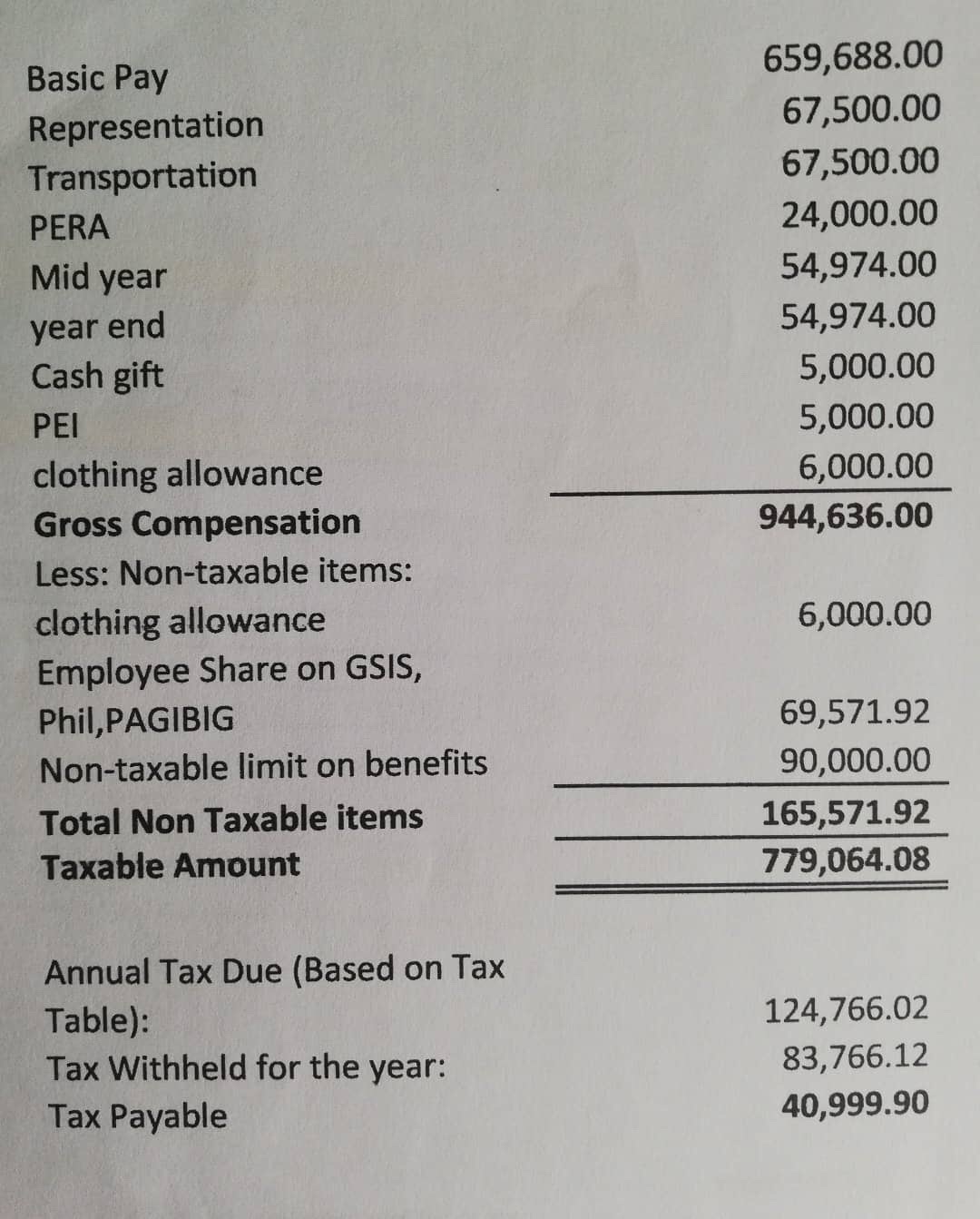

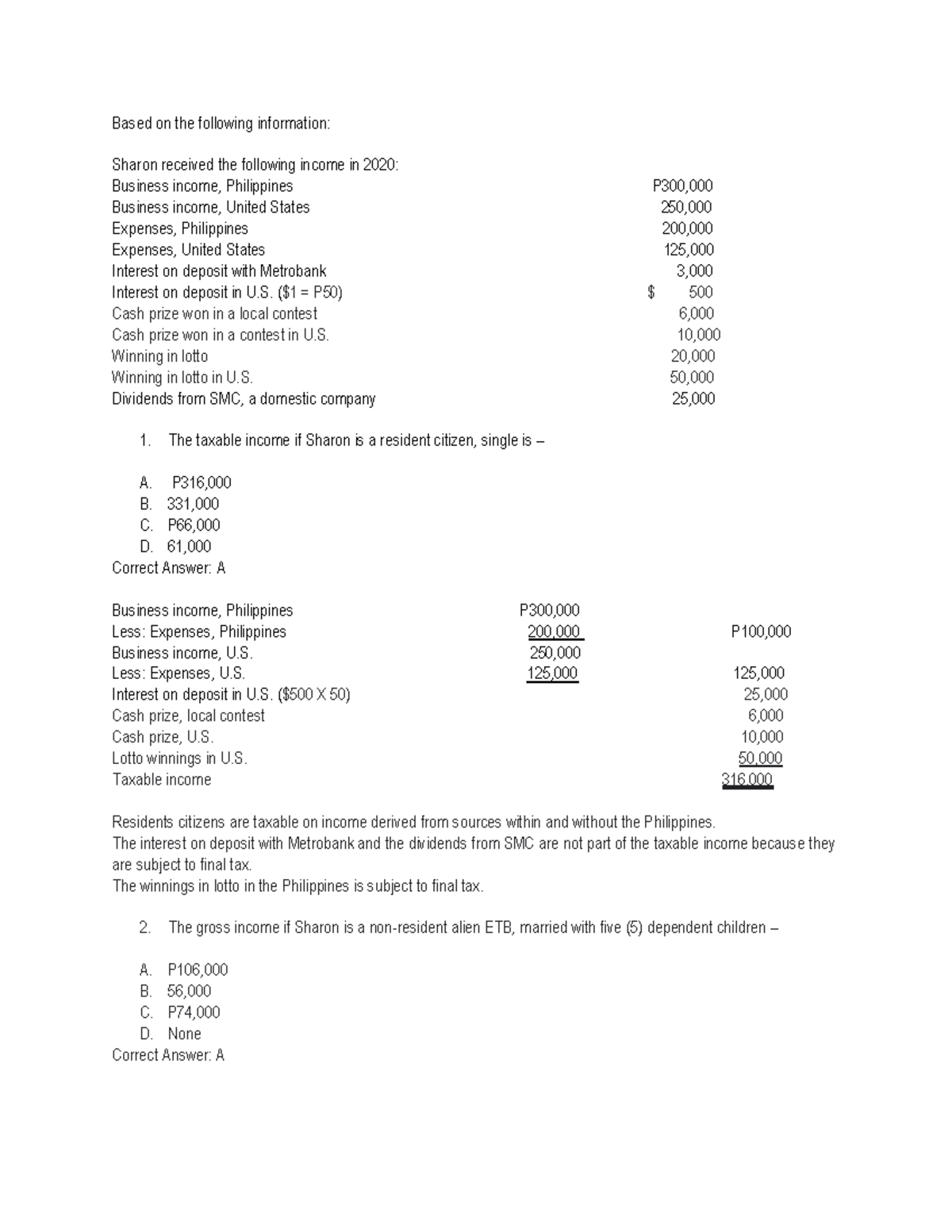

WORD Problems Taxation Mavod Based On The Following Information

TRANSPORT ALLOWANCE NOW TAXABLE SIMPLE TAX INDIA

Bookkeeping Services Overberg Employee Allowances For 2023 Tax Year

Is Transport Allowance Taxable In Philippines - Web 26 Mai 2022 nbsp 0183 32 If you work as an employee in the Philippines you will be happy to know that are accorded de minimis benefits These are a few allowances and benefits which are not subject to income tax These