Is Vhi Tax Deductible Make a claim for tax deductions if you spend more than 750 a year in order to gain or produce income Expenses you may pay for the production of income include self financed workspace home office tools for which you pay the cost yourself and purchases of books that you use for work related purposes

Tax relief on medical and health expenses is given at the standard rate of 20 However tax relief on nursing home expenses can be claimed at your highest rate of tax This means that the portion of your income which is taxable at your highest rate of tax is reduced Qualifying health expenses are for healthcare you have paid for Examples of qualifying health expenses are payment for doctor s and consultant s services routine and maternity care for women during pregnancy diagnostic procedures recommended by a practitioner services in hospitals or treatment facilities such as clinics where the

Is Vhi Tax Deductible

Is Vhi Tax Deductible

https://businesspartnermagazine.com/wp-content/uploads/2020/10/What-Does-It-Mean-When-Something-Is-Tax-Deductible.jpg

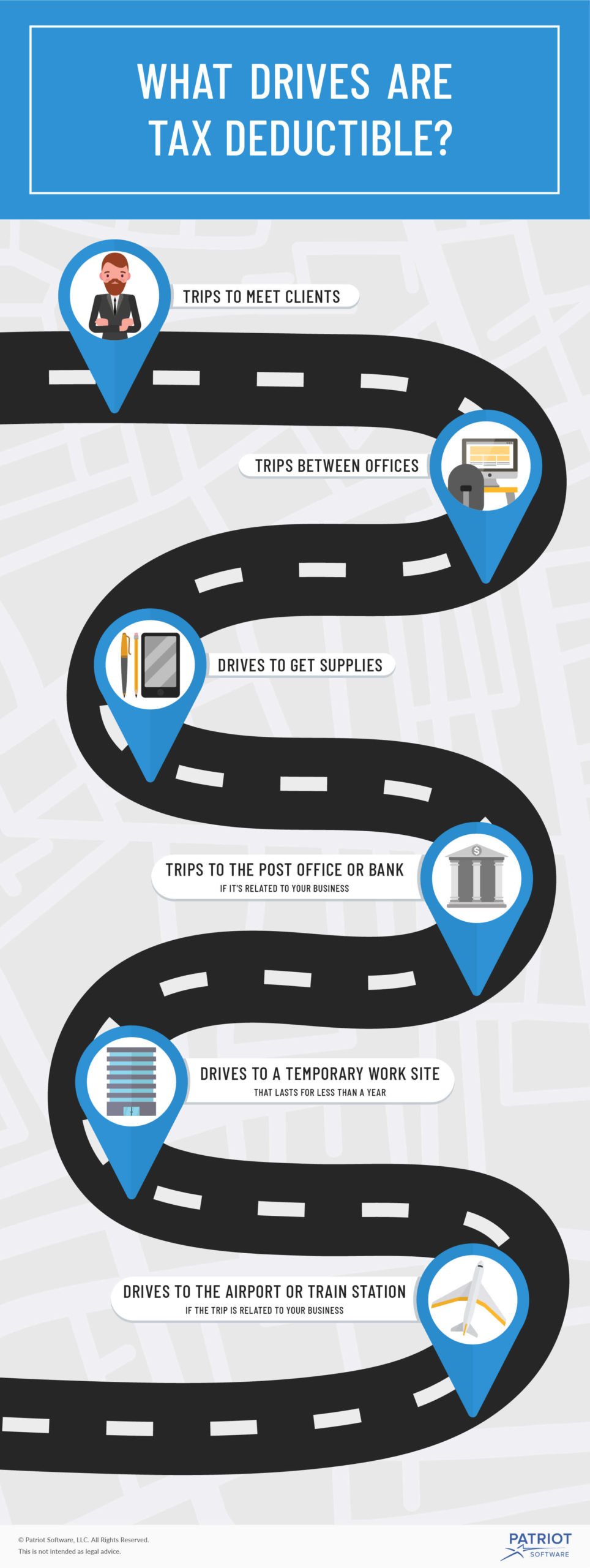

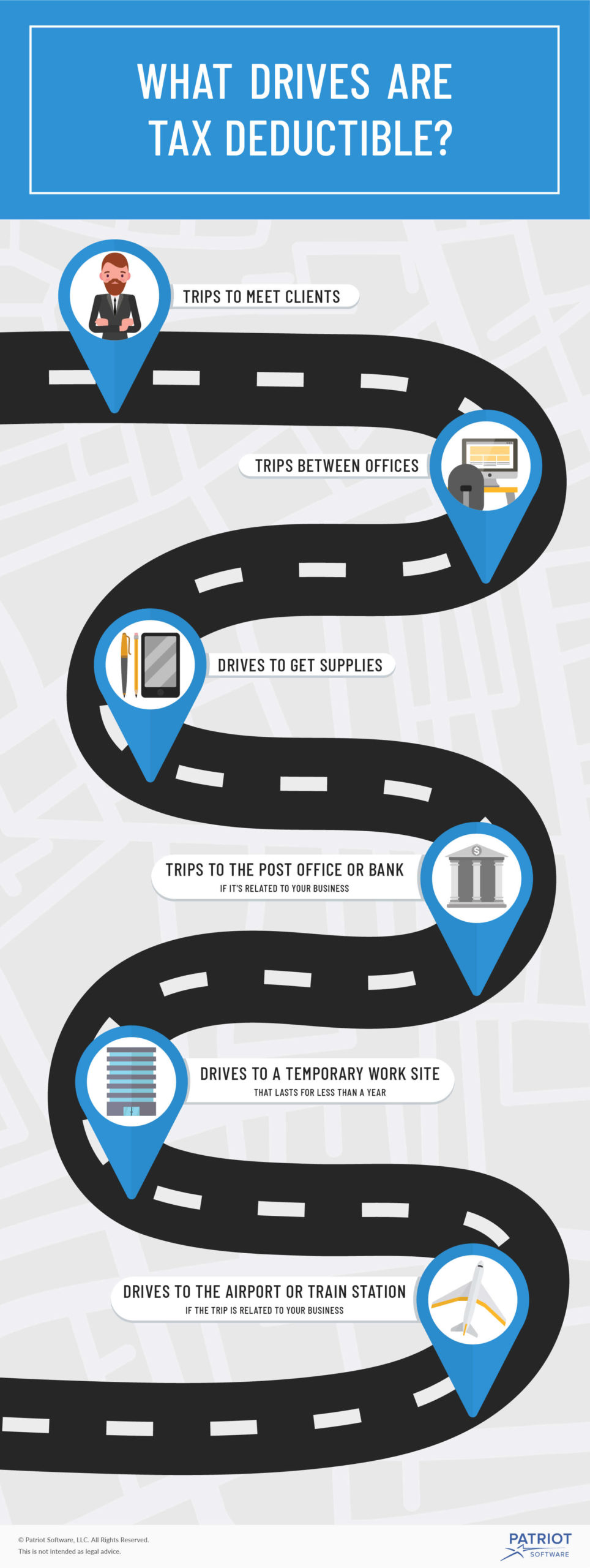

What Drives Are Tax Deductible Claiming Tax Deductions For Mileage

https://www.patriotsoftware.com/wp-content/uploads/2020/01/tax_deductable_drives_69080-01__1_-scaled.jpg

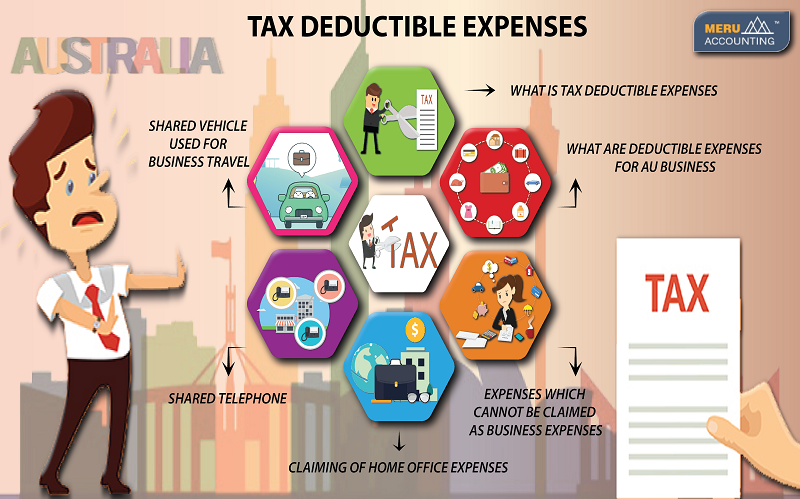

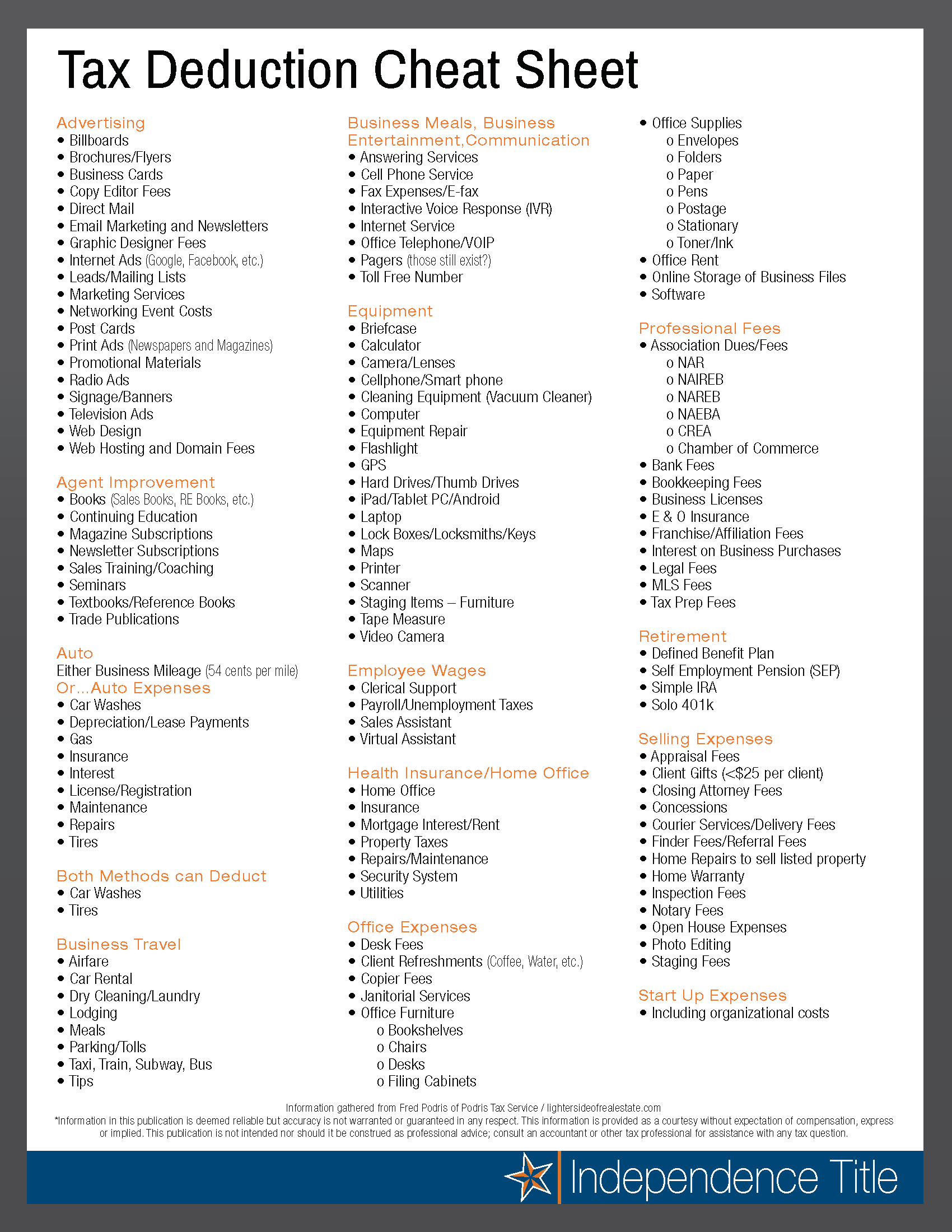

Small Business Tax Deductions Tax Deductible Business Expenses

https://www.communitytax.com/wp-content/uploads/2019/04/Small-Business-Tax-Deductions-1.png

You can pay by salary deduction direct debit annual or monthly in advance using online banking further details below or pay us directly by credit or debit card annual in advance only You will not be charged an additional surcharge on our direct debit facility You pay your employee s medical insurance policy of 800 1 000 less tax relief of 200 You must deduct Income Tax PRSI and USC on the gross amount 1 000 from your employee s pay This employee is entitled to a tax credit for the gross premium 1 000 20 in their Tax Credit Certificate

If your employer is subsidising part or all of your policy this is a non cash benefit of monetary value that you are receiving This is called Benefit in Kind BIK and is treated as taxable income by Revenue Tax is deducted from your pay by your employer based on the value of the benefit Tax relief for medical insurance premiums paid to authorised insurers is granted at source TRS by the provider of the medical insurance e g VHI Subscribers will pay a reduced premium 80 of the gross amount to the authorised medical insurer

Download Is Vhi Tax Deductible

More picture related to Is Vhi Tax Deductible

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Infographic Is My Move Tax Deductible Wheaton

http://www.wheatonworldwide.com/wp-content/uploads/2015/04/Tax-Deductible-Graphic_Wheaton.jpg

Tax Deduction Definition TaxEDU Tax Foundation

https://files.taxfoundation.org/20200714164745/Tax-Basics-How-Is-Tax-Liability-Calculated.png

You may claim tax relief in respect of the cost of certain medical expenses paid by you You cannot claim tax relief for any expenditure which has been or will be reimbursed by another body such as the VHI Quinn Healthcare Hibernian Aviva Health the Health Service Executive or other body or person Help and support on your queries relating to claims payments travel policy renewals Vhi app among others You can also find details on how to access your benefit details and ways to contact us Learn more

You generally receive tax relief for health expenses at your standard rate of tax 20 Nursing home expenses are given at your highest rate of tax up to 40 This section will explain the types of expenses that qualify Tax relief at source means that the tax credit is paid to the VHI or other company by the Revenue Commissioners on your behalf You are then charged the premium less this tax credit If you look at your VHI bill you should be able to see if you have got the tax credit

Property Expenses What s Tax Deductible In The Year Of Occurrence

https://www.crestproperty.net.au/wp-content/uploads/2018/09/Tax_Deductible_Expenses.jpg

Tax Deductible Expenses Autralian Business Tax Deduction

https://www.accountsjunction.com/australia/australia-images/Tax-deductible-expenses.png

https://www.vero.fi › en › individuals › deductions › what-can-I-deduct

Make a claim for tax deductions if you spend more than 750 a year in order to gain or produce income Expenses you may pay for the production of income include self financed workspace home office tools for which you pay the cost yourself and purchases of books that you use for work related purposes

https://www.citizensinformation.ie › en › money-and...

Tax relief on medical and health expenses is given at the standard rate of 20 However tax relief on nursing home expenses can be claimed at your highest rate of tax This means that the portion of your income which is taxable at your highest rate of tax is reduced

Are Health Insurance Premiums Tax Deductible

Property Expenses What s Tax Deductible In The Year Of Occurrence

/GettyImages-1129640389-00d4c7c7013548bf8fc2f475f25195d7.jpg)

Are FSA Contributions Tax Deductible

How To Maximize Your Charity Tax Deductible Donation WealthFit

Tax Deduction Spreadsheet Throughout Tax Deduction Cheat Sheet For Real

Tax Deductible Bricks R Us

Tax Deductible Bricks R Us

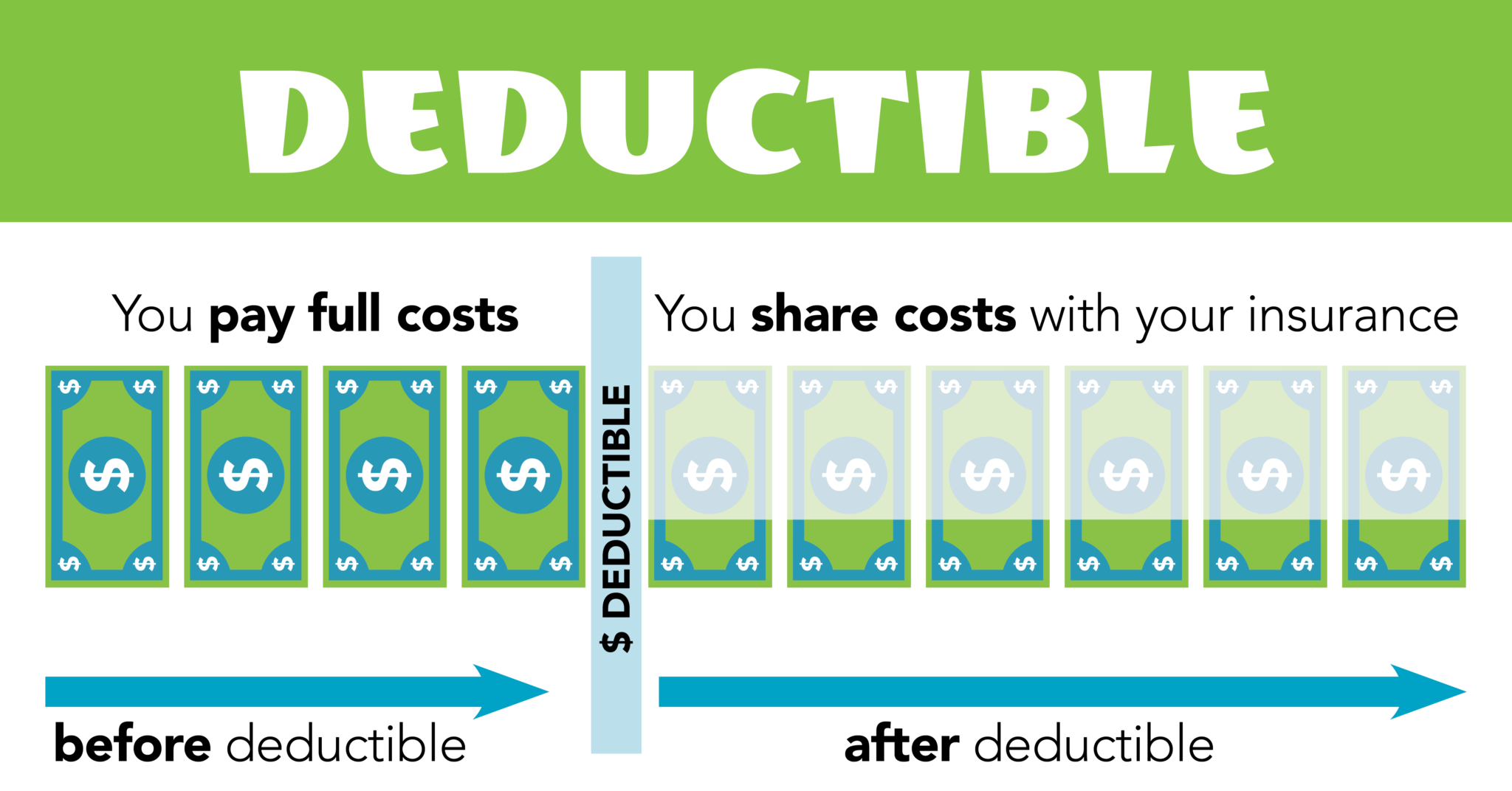

Deductibles Explained ETrustedAdvisor

Is GoFundMe Tax Deductible TL DR Accounting

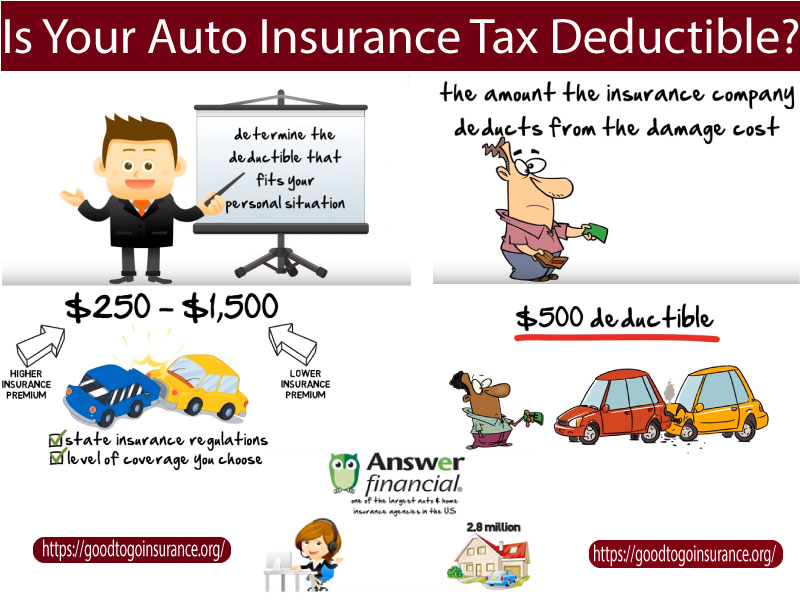

Is Your Auto Insurance Tax Deductible Answer At Good To Go Insurance

Is Vhi Tax Deductible - You can pay by salary deduction direct debit annual or monthly in advance using online banking further details below or pay us directly by credit or debit card annual in advance only You will not be charged an additional surcharge on our direct debit facility