Lic Premium Exemption In Income Tax The Income Tax Act provides tax benefits if you pay the premium of a life insurance policy or a Unit Linked Insurance Plan ULIP It also provides tax exemption

Learn how to save taxes by buying a life insurance policy and claiming deduction under section 80C Also find out the conditions and implications of surrendering policy before maturity and TDS by Learn how to claim tax benefits on LIC premium payments under Section 80C of the Income Tax Act Find out the types of LIC policies the deduction limits the

Lic Premium Exemption In Income Tax

Lic Premium Exemption In Income Tax

https://i.pinimg.com/736x/a3/06/0d/a3060dc5fd0dca7fb49a71a94b1df79b.jpg

How To Calculate Standard Deduction In Income Tax Act Scripbox

https://cdn-scripbox-wordpress.scripbox.com/wp-content/uploads/2021/05/standard-deduction-income-tax.jpg

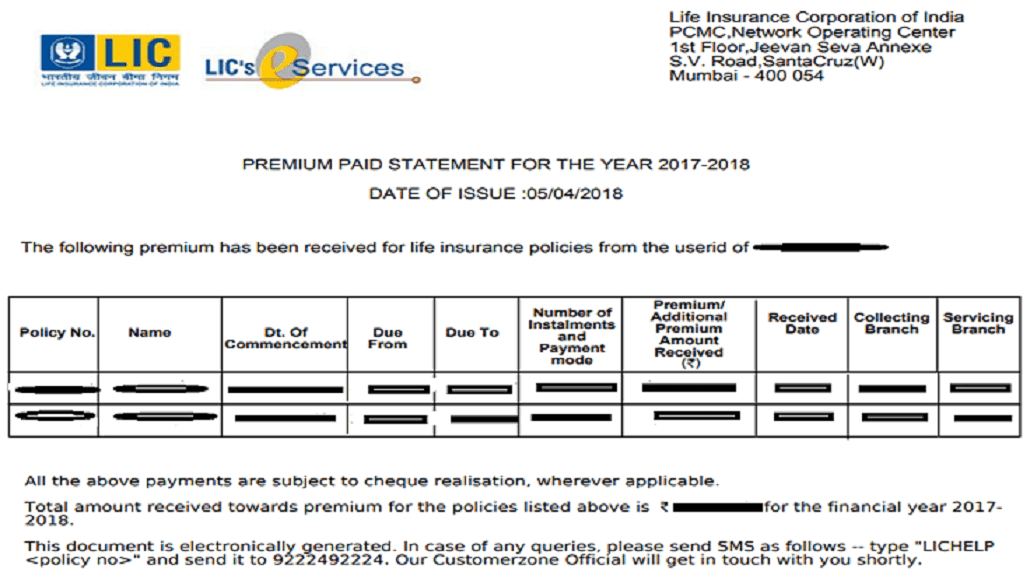

How To Download LIC Premium Paid Certificate Online For IT Returns

https://1.bp.blogspot.com/-3zy5hTwg9Tw/XiXUWba6qLI/AAAAAAAADKY/pvK8fpFJ0EERQF8kNgNagrXCpqLMtDcwgCLcBGAsYHQ/s1600/LIC%2BPremium%2BPaid%2BCertificate%2B5.png

Provisions of section 80C offer the income tax deduction whereas provisions of section 10 10D provides the income tax Learn how to claim deduction for life insurance premium under Section 80C of Income Tax Act Find out the eligibility criteria limits and conditions for different types of life

Discover the tax benefits of LIC insurance plans Maximize your savings with comprehensive policies that offer financial security and tax advantages Life insurance policies can be used as tax planning tool as premium paid on Insurance Policies is eligible for tax benefits under Section 80C of the Income Tax Act 1961 Act and Maturity Proceeds

Download Lic Premium Exemption In Income Tax

More picture related to Lic Premium Exemption In Income Tax

LIC Premium Payment Receipt 2024 How To Download From Licindia in

https://teachersbadi.in/wp-content/uploads/2021/11/LIC-Premium-Payment-Receipt.png

HRA Exemption Calculator For Income Tax Benefits Calculation And

https://educationalstuff.in/wp-content/uploads/2023/04/Tue_11_04_2023_15_27_40.png

HRA Exemption Calculator In Excel House Rent Allowance Calculation

https://fincalc-blog.in/wp-content/uploads/2021/09/hra-exemption-calculator-house-rent-allowance-to-save-income-tax-salaried-employees-video.webp

Such tax exemption continues to be available under the new tax regime Hence while you cannot claim a tax deduction for the premium payment you can continue making payments and obtain tax Is LIC premium exempt from income tax Yes the premium paid for LIC policies are exempted from income tax and can be claimed under Section 80C The deduction is

Section 80C of the Income Tax Act provides a deduction of up to Rs 1 5 lakh for the premiums paid on life insurance Deductions are available for the policy taken by yourself or in the name of your spouse Amongst the three main sections related to the tax benefits of term insurance under the Income Tax Act of 1961 section 80C states that an individual can avail of tax

LIC Navjeevan Plan From Tax Exemption To Death Insurance You Will Get

https://kalingatv.com/wp-content/uploads/2021/11/LIC-Navjeevan-Plan.jpg

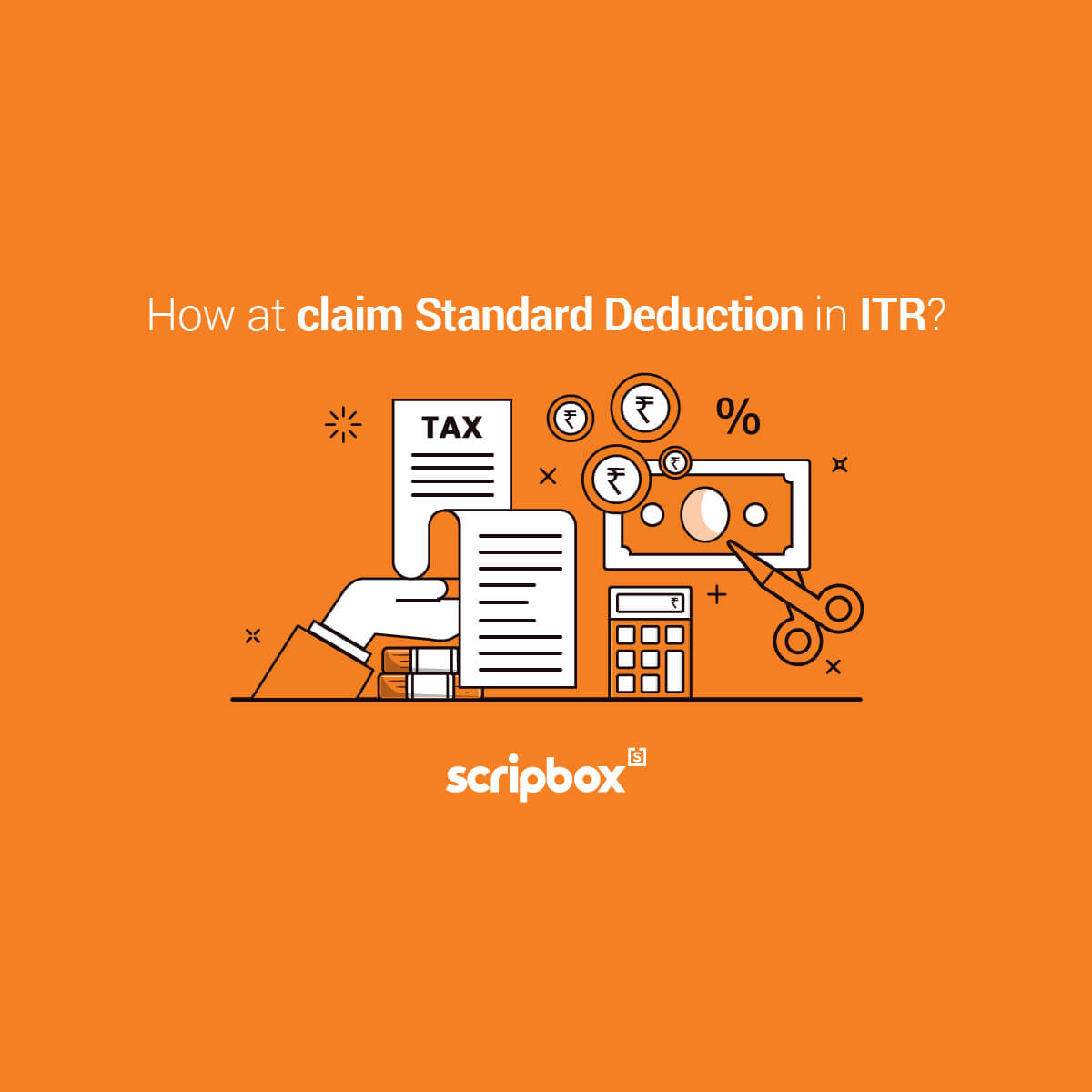

14 Individual Income Tax 14 INCOME TAX INDIVIDUAL Page 1 Of 18

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/4d966e49d5a44496b768338cc972ac91/thumb_1200_1976.png

https://news.cleartax.in/it-conditions-attached...

The Income Tax Act provides tax benefits if you pay the premium of a life insurance policy or a Unit Linked Insurance Plan ULIP It also provides tax exemption

https://taxguru.in/income-tax/section-8…

Learn how to save taxes by buying a life insurance policy and claiming deduction under section 80C Also find out the conditions and implications of surrendering policy before maturity and TDS by

2017 PAFPI Certificate of TAX Exemption Certificate Of

LIC Navjeevan Plan From Tax Exemption To Death Insurance You Will Get

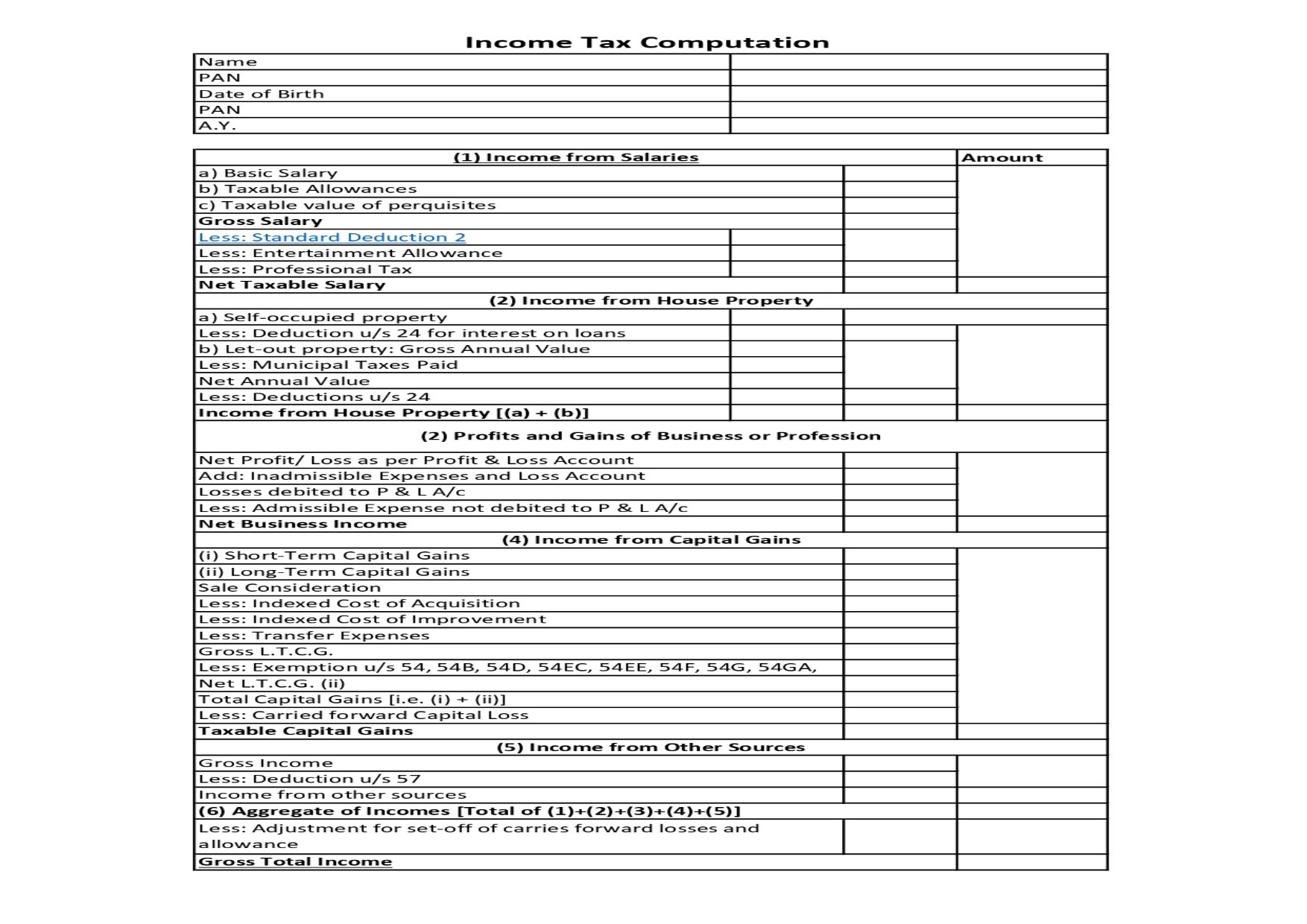

Income Tax Computation Format PDF A Comprehensive Guide

How To Use Exemptions When Filing For Chapter 13 Bankruptcy

What Is Income Tax MGC Legal

Sample Letter Exemptions Doc Template PdfFiller

Sample Letter Exemptions Doc Template PdfFiller

AFFIDAVIT IN INCOME TAX PROCEEDINGS BareLaw

LIC Bonus Rates 2022 23 Explained With Charts And Illustrations

LIC Premium Calculator For Life Insurance Term Plan Health Plans

Lic Premium Exemption In Income Tax - Learn how to claim deduction for life insurance premium under Section 80C of Income Tax Act Find out the eligibility criteria limits and conditions for different types of life