Loan Against Property Income Tax Rebate Web Salaried individuals can avail Loan Against Property income tax benefit under this section If you re using the Loan Against Property amount to fund your new residential

Web However the tax rebate on the loan against the property will be applicable if the fund is used for building a new residential house In this case the borrower can avail of tax Web 11 janv 2023 nbsp 0183 32 On purchase of property with home loans borrowers enjoy a variety of deductions on their income tax liability These deductions against the tax could be

Loan Against Property Income Tax Rebate

Loan Against Property Income Tax Rebate

https://image.slidesharecdn.com/incometaxrebateundersection87a2017-2018-180420103021/85/income-tax-rebate-under-section-87a-2-638.jpg?cb=1666685634

What To Know About Montana s New Income And Property Tax Rebates

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA18ZJcd.img?w=1280&h=720&m=4&q=50

2021 Illinois Property Tax Rebate Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/Illinois-Property-Tax-Rebate-Form-2023-768x668.jpg

Web 19 mai 2020 nbsp 0183 32 Loan against property is a common mortgage loan that both salaried individuals and self employed businessmen avail to receive a large corpus of cash in Web 25 mai 2021 nbsp 0183 32 Here s how you can save your tax with a loan against property You can claim tax exemption from a loan against property if the loan amount is utilised for

Web 13 janv 2022 nbsp 0183 32 Broad Age Bracket Any individual between the age of 21 years to 65 years can apply for a loan against property This broad bracket encompasses a large Web 28 janv 2014 nbsp 0183 32 Tax rebate on house loan for under construction property I have purchased a flat which is about to be completed by Dec 2014 As per the law I can get

Download Loan Against Property Income Tax Rebate

More picture related to Loan Against Property Income Tax Rebate

Jacobs Van Vlierbergen Wins Wendy s High School Heisman Award

https://media.nbcchicago.com/2020/08/tlmd-cheques-gobierno-getty-archivo-1234.jpg?quality=85&strip=all&fit=2740,1541

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

https://www.practicaltaxplanning.com/ptp/wp-content/uploads/2022/06/7PY4cfZG8ZE.jpg

Property Tax Rebate New York State Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2023/02/New-York-Renters-Rebate-2023-768x685.jpg

Web 19 mai 2022 nbsp 0183 32 Loan Against Property Income Tax Rebate A Property Tax Rebate is available to property owners in Pennsylvania This program can help reduce your Web 19 oct 2015 nbsp 0183 32 You can claim the property allowance and get up to 163 1 000 a year tax free property income If you claim the property allowance you cannot claim a deduction for

Web You can claim an income tax rebate on home loan on the amount paid towards stamp duty and registration charges under section 80C of the ITA However the benefit is only Web 20 mars 2022 nbsp 0183 32 Tax Rebate On Loan Against Property If you own a property in Pennsylvania you can apply for a Property Tax Rebate This program can help reduce

Nova Scotia Gov On Twitter RT ns servicens Applications For The

https://pbs.twimg.com/media/FcigJ-UXoAAP6SS.jpg

Application For Rebate Of Property Taxes Niagara Falls Ontario

https://img.yumpu.com/48273006/1/500x640/application-for-rebate-of-property-taxes-niagara-falls-ontario-.jpg

https://www.icicibank.com/.../tax-benefits-on-loan-against-property

Web Salaried individuals can avail Loan Against Property income tax benefit under this section If you re using the Loan Against Property amount to fund your new residential

https://www.tatacapital.com/blog/loan-on-property/what-are-the-tax...

Web However the tax rebate on the loan against the property will be applicable if the fund is used for building a new residential house In this case the borrower can avail of tax

Illinois Income And Property Tax Rebates Will Be Issued Starting Monday

Nova Scotia Gov On Twitter RT ns servicens Applications For The

Tips To Obtain A Loan Against Property Without Income Proof

Over 5 1 Million Illinoisans Have Received Anticipated Income And

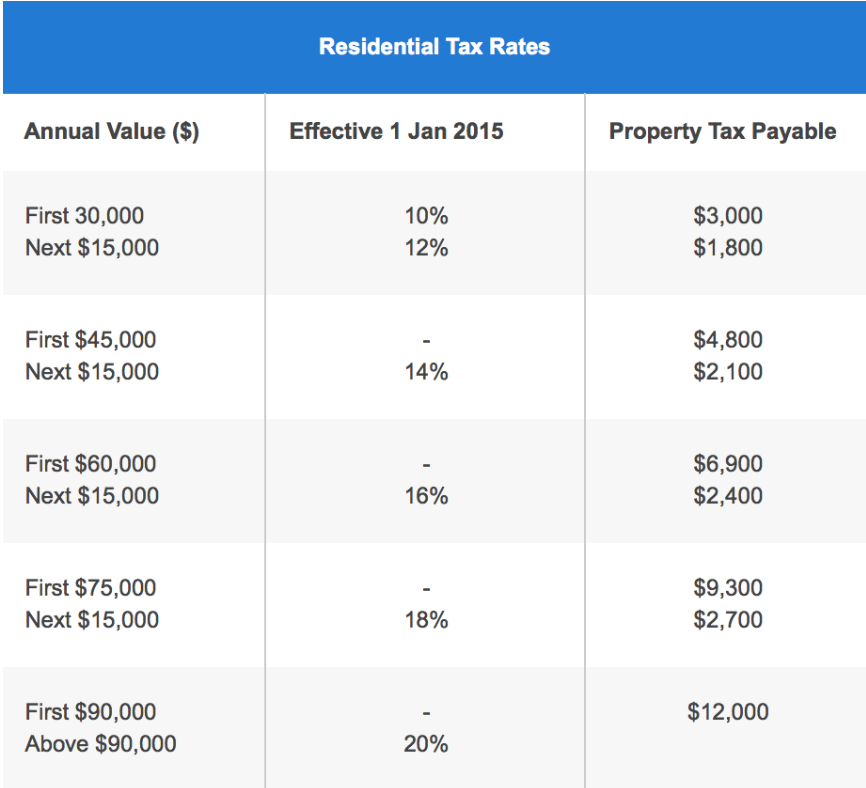

Most Residential Properties To Incur Higher Tax From Jan 1 2023

PA s Property Tax Rent Rebate Application Deadline Is Dec 31st

PA s Property Tax Rent Rebate Application Deadline Is Dec 31st

Property Tax For Homeowners In Singapore How Much To Pay Rebates

Income Tax Rebate 2023 Illinois LatestRebate

DEDUCTION UNDER SECTION 80C TO 80U PDF

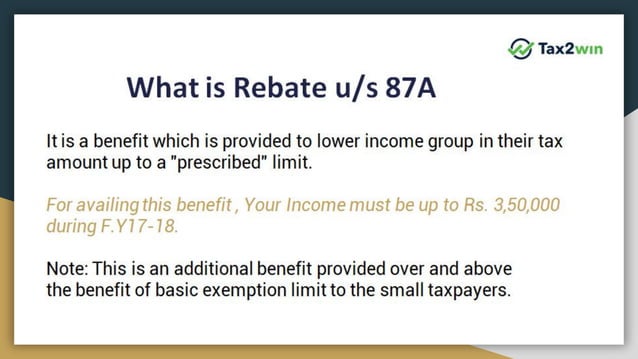

Loan Against Property Income Tax Rebate - Web 4 mars 2023 nbsp 0183 32 ITR filing Income tax exemption from long term capital gains is not available in respect of repayment of a home loan A taxpayer can claim deduction under Section